A condo with low fees can be a cash cow. One with rising HOA charges can drain your returns overnight. Many investors underestimate the power of condo fees—maintenance charges, association dues, and hidden assessments—that quietly eat into cash flow.

In the Philippines, where condo living continues to surge in areas like BGC, Makati, and Ortigas, understanding condo fees in 2025 is no longer optional. Whether labeled as maintenance fees or HOA dues, these costs directly shape your rental yield, long-term profitability, and even resale value. Ignore them, and you risk owning a property that looks good on paper but delivers disappointing returns in reality.

This guide will help you think like a professional investor. You’ll learn how to evaluate fees against rental income, spot red flags in HOA budgets, compare fee structures across developments, and calculate the true ROI of a condominium investment. By the end, you’ll know exactly when condo fees are worth paying—and when they signal trouble ahead.

What Exactly Do Condo Fees Cover? (Maintenance vs. Association Fees)

One of the most common sources of confusion for condo buyers is the difference between maintenance fees and association fees. Both are recurring costs tied to ownership, but they fund different aspects of condo living. If you don’t separate them clearly, it’s easy to misjudge how much of your money is truly going into preserving your investment versus paying for extras you may not even use.

Maintenance Fees

These cover the essentials that keep the property running day to day. Think of them as the operational backbone of the building. Typical inclusions are:

- Repairs and Upkeep – routine maintenance of hallways, elevators, roofs, plumbing, and common areas.

- Utilities for Shared Spaces – water and electricity for lobbies, corridors, and outdoor lighting.

- Security and Staffing – guards, receptionists, janitorial services, and other essential personnel.

- Landscaping and Cleanliness – gardens, walkways, and shared outdoor spaces.

Association Fees (HOA Dues)

Association fees, collected by the homeowners’ association (HOA), go beyond maintenance and focus on community management and amenities. These may include:

- Amenity Operations – pools, gyms, function rooms, and recreational areas.

- Property Management Costs – administrative staff, accounting, and legal services.

- Community Enhancements – events, programs, or beautification projects.

- Long-Term Planning – contributions to reserve funds for future renovations or upgrades.

Comparison at a Glance

| Category | Maintenance Fees | Association Fees (HOA Dues) |

|---|---|---|

| Purpose | Day-to-day operations and upkeep | Community management and lifestyle amenities |

| Covers | Repairs, utilities, cleaning, security | Amenities, management staff, long-term upgrades |

| Who Manages It | Building management | Homeowners’ Association (HOA) |

| Investor Impact | Affects operational costs and tenant satisfaction | Adds to perceived value but may not always increase ROI |

Takeaway

Maintenance fees protect your property’s value by ensuring the building remains functional and safe. Association fees, on the other hand, can either boost rental appeal (if amenities are in demand) or weigh down returns if tenants won’t pay extra for them. Smart investors look at both not just as costs, but as levers that influence ROI, tenant retention, and long-term resale value.

How Much Should Condo Fees Cost? Benchmarks and Red Flags

Condo fees vary widely depending on the development, its location, and the lifestyle it offers. Paying them isn’t inherently bad—what matters is whether the cost is reasonable compared to the property’s value and earning potential.

Philippine Market Benchmarks

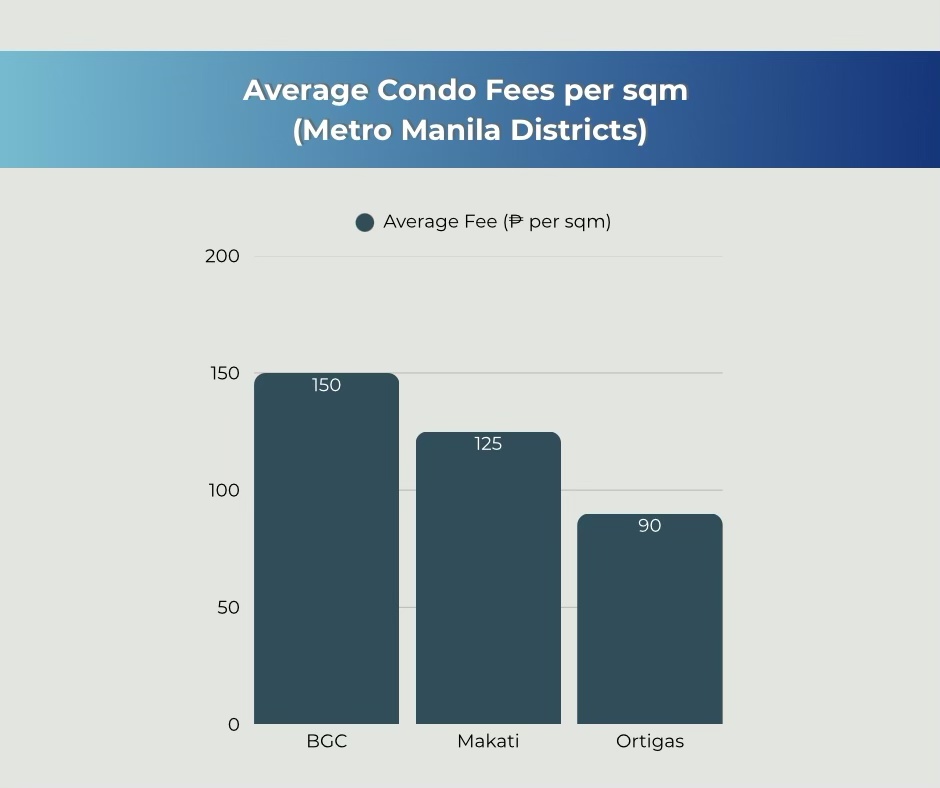

In Metro Manila, typical condo fees range between ₱50 to ₱150 per square meter per month. The rate depends on the building’s positioning in the market:

- ₱50–₱80/sqm → Common in mid-range condos, often in Mandaluyong, Quezon City, or Pasig. Basic security, limited amenities.

- ₱80–₱120/sqm → Standard for upper mid-range developments in Makati, Ortigas, or Alabang. Includes pools, gyms, and better maintenance.

- ₱120–₱150/sqm → Expected in premium or luxury projects in BGC, Rockwell, or Greenbelt. High-end amenities, concierge services, and superior security.

For example, a 50 sqm unit in BGC with fees at ₱130/sqm will cost ₱6,500 monthly in dues. That’s a material chunk of expenses, especially if rental income averages only ₱40,000–₱45,000.

Red Flags to Watch For

- Sudden Fee Hikes: Increases above 20% year-on-year suggest poor financial planning or underfunded reserves.

- Amenities Out of Sync with Fees: Paying luxury-level dues in a property with mediocre facilities is a bad sign.

- Opaque Budgeting: If the HOA cannot explain where money is going, expect future hikes or special assessments.

- High Delinquency Rate: If many owners are defaulting on dues, the financial burden eventually shifts to compliant owners.

Healthy Investor Benchmark

As a rule of thumb, condo fees should not exceed 25–30% of your gross rental income. For instance, if your unit rents for ₱40,000 per month, your total fees (maintenance + HOA dues) should ideally stay below ₱10,000–₱12,000. Anything beyond that begins to erode net yield and may make your unit less competitive in the rental market.

Takeaway

Condo fees aren’t “good” or “bad” on their own. They’re only healthy when aligned with your rental strategy. A luxury condo with ₱10,000+ monthly fees may still deliver excellent ROI if tenants are willing to pay for its amenities, while a mid-range unit with surprisingly high dues is a clear profitability trap.

Calculating the Impact on Rental Yield and ROI

Condo fees don’t just eat into monthly cash flow—they directly reshape your rental yield and long-term return on investment (ROI). Smart investors calculate both gross yield and net yield before committing to a property.

Key Formulas

Gross Yield

Net Yield

Gross yield gives a quick snapshot, while net yield reflects the real profitability after fees and costs

Worked Example: Mid-Range Condo

- Unit Price: ₱6,000,000

- Monthly Rent: ₱35,000 → ₱420,000 annual rent

- Condo Fees: ₱100/sqm for a 50 sqm unit → ₱5,000/month → ₱60,000/year

- Other Expenses (insurance, minor repairs, taxes): ₱30,000/year

Gross Yield:

420,000 ÷ 6,000,000 = 7.0%

Net Yield:

(420,000 – 60,000 – 30,000) ÷ 6,000,000 = 5.5%

A 1.5% drop might not sound dramatic, but across several years it compounds into hundreds of thousands in lost profitability.

Case Study: High Fees vs. Low Fees

| Scenario | Condo A: Premium, High Fees | Condo B: Mid-Tier, Low Fees |

|---|---|---|

| Unit Price | ₱10,000,000 | ₱6,000,000 |

| Monthly Rent | ₱60,000 | ₱30,000 |

| Condo Fees | ₱12,000/month (₱144,000/year) | ₱4,500/month (₱54,000/year) |

| Other Expenses | ₱60,000/year | ₱25,000/year |

| Annual Rent | ₱720,000 | ₱360,000 |

| Gross Yield | 7.2% | 6.0% |

| Net Yield | (720,000 – 144,000 – 60,000) ÷ 10,000,000 = 5.2% | (360,000 – 54,000 – 25,000) ÷ 6,000,000 = 4.7% |

Interpretation:

- Condo A (premium) charges very high fees, but its rental income is also higher, allowing it to maintain a healthy 5.2% net yield.

- Condo B (mid-tier) looks cheaper upfront, but after fees and expenses, its 4.7% net yieldis barely competitive.

- Lesson: High fees aren’t automatically bad if they attract premium tenants willing to pay higher rent.

Takeaway

Always run the numbers beyond gross yield. A condo with seemingly “affordable” fees might deliver weak returns if rental rates in the area are flat. Conversely, a luxury unit with steep dues could still be a star performer if its tenant base values amenities enough to pay premium rent.

Understanding Reserve Funds and Special Assessments

Not all condo fees are created equal. A big part of what determines whether your dues are sustainable lies in how the homeowners’ association (HOA) manages its reserve fund. This fund acts as the community’s “savings account” for future major repairs and replacements.

What Is a Reserve Fund?

The reserve fund is money set aside by the HOA to cover long-term expenses—things like:

- Roof replacements

- Elevator upgrades

- Major plumbing or electrical repairs

- Renovation of amenities like gyms, pools, or lobbies

Without this cushion, even routine wear and tear can lead to financial stress for both the association and individual unit owners.

Healthy Reserve Levels

Industry benchmarks suggest that reserve funds should be at least 10–40% of the annual operating budget. In the Philippines, where many developments are relatively young, some HOAs underfund reserves early on—leaving owners vulnerable as buildings age.

- 10–20% → Minimum safety buffer, common in smaller or newer projects.

- 20–30% → Comfortable for mid-range condos with predictable maintenance schedules.

- 30–40%+ → Strong financial health, typically seen in premium or well-managed developments.

Anything significantly below these thresholds should raise eyebrows.

The Risk of Special Assessments

When reserves are too low, HOAs often resort to special assessments—one-time fees charged directly to unit owners to cover unexpected expenses.

Example:

If a condo’s elevator suddenly fails and the reserve fund is insufficient, each unit owner might be required to contribute ₱50,000–₱150,000 or more in a lump sum. These surprise costs can derail your cash flow and make your investment less attractive to renters or buyers.

Warning Signs for Investors

Before buying into any condo development, review the HOA’s financials for red flags:

- Poor Reserve Disclosure – Vague or missing details on how much is in the fund.

- History of Special Assessments – Indicates chronic underfunding or poor management.

- Deteriorating Amenities – Cracked tiles, peeling paint, or broken gym equipment suggest that maintenance is already being deferred.

- High Fee Increases – Sudden or frequent hikes in association dues may indicate the HOA is scrambling to cover gaps.

Takeaway

A well-funded reserve protects your investment by ensuring the building remains attractive and functional without saddling you with surprise costs. An underfunded reserve, on the other hand, is like a ticking time bomb—eventually you’ll be asked to pay for it. Always analyze reserve levels as carefully as you analyze rental yields.

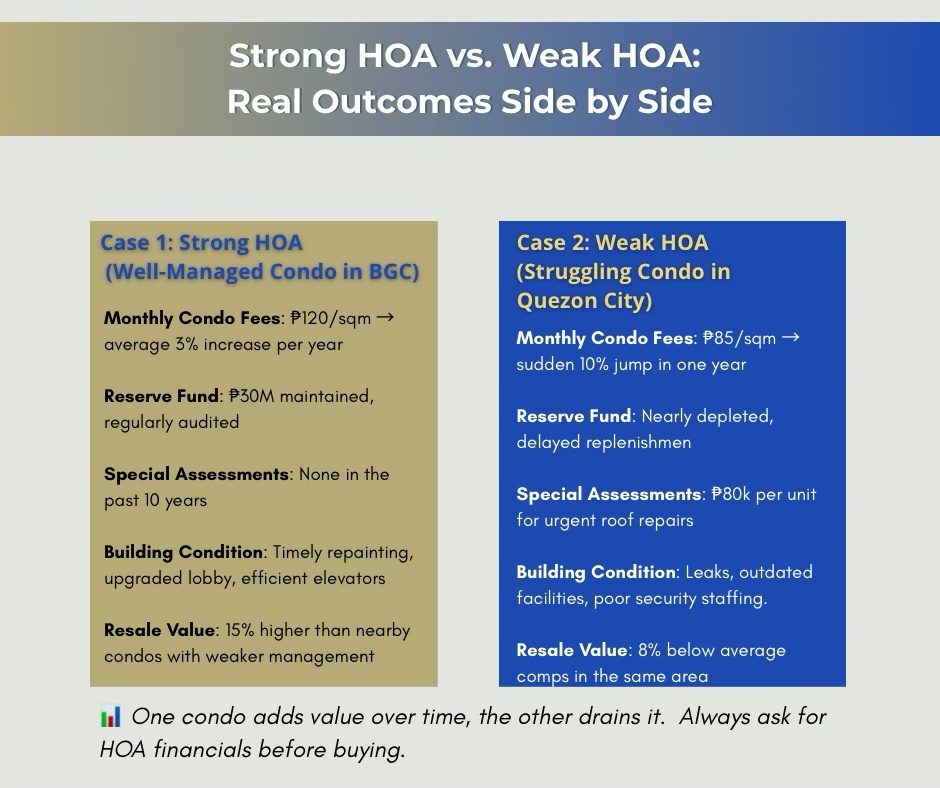

Evaluating HOA Management Quality

Many investors fixate on amenities—pools, gyms, function rooms—without asking the tougher question: who is actually running the building? In reality, the quality of the homeowners’ association (HOA) management can matter more than the amenities themselves. A poorly managed HOA can turn even a high-end condo into a financial headache.

Why Management Quality Matters

A strong management team ensures:

- Consistent maintenance → Amenities stay functional, common areas remain appealing, property values hold steady.

- Financial discipline → Association fees are fair, reserve funds are properly built, and special assessments are rare.

- Resident satisfaction → Clear communication and responsive service keep turnover low, making rentals easier and resale values stronger.

By contrast, weak management can lead to spiraling costs, deferred maintenance, and declining property values.

Red Flags to Watch For

Poorly managed HOAs often show clear warning signs:

- Lack of transparency – Financial statements are vague, inaccessible, or withheld from owners.

- Frequent fee hikes – Sudden increases suggest poor forecasting or mismanagement of reserves.

- Poor communication – Residents struggle to get clear answers, updates are irregular, and complaints go unresolved.

- High turnover in management companies – Constantly changing administrators indicates instability.

Due Diligence Checklist for Investors

Before buying, go beyond the glossy brochures and do a management health check:

- Review Financial Reports

- Ask for the latest audited financial statements.

- Look for healthy reserves (20–30% of annual budget) and consistent collection of dues.

- Attend HOA Meetings

- Many HOAs allow prospective buyers to sit in.

- You’ll quickly see whether the board is proactive or reactive, professional or disorganized.

- Talk to Residents

- Current owners will give you candid feedback on response times, fairness of fees, and management style.

- Ask: “How often do fees increase?” or “Have there been any surprise assessments?”

- Check Delinquency Rate on Dues

- A high delinquency rate (10% or more) signals weak enforcement and financial instability.

- This can affect the HOA’s ability to fund operations and reserves, potentially shifting the burden to compliant owners.

Takeaway

Amenities impress renters on day one. Management quality determines whether those amenities—and your investment returns—are sustainable for the next ten years. A condo with a mediocre gym but excellent HOA oversight will often outperform a flashy development with chaotic management.

Who Really Benefits from High Association Fees?

Not all association fees are created equal. While investors instinctively prefer lower dues, there are cases where paying premium fees actually amplifies returns—provided the property aligns with the right tenant base.

When Paying Premium Fees Makes Sense

High fees can be justified if they directly support amenities and services that attract premium-paying renters or wealthier buyers:

- Luxury Condominiums – Developments in BGC, Makati, or Ortigas often charge ₱120–₱150 per sqm in monthly dues, but in return provide concierge services, resort-style pools, high-end gyms, and 24/7 security. These amenities appeal to executives and HNWIs who won’t blink at higher rents.

- Expat-Dense Rental Markets – Foreign tenants, especially those with housing allowances, prioritize convenience and lifestyle. They’ll happily pay ₱20,000 more in rent for a unit in a well-managed, amenity-rich development where association fees are steeper.

- Properties With Scarcity Value – A Rockwell development, for instance, may charge high dues, but its reputation for lifestyle exclusivity allows landlords to command higher occupancy rates and resale premiums.

In short, if the tenant profile values comfort, status, and convenience, high fees are not a liability—they’re part of the property’s competitive edge.

When to Avoid High Fees

On the flip side, excessive dues can cripple cash flow if the property caters to budget-sensitive markets:

- Mid-Market Condos – Tenants here typically have strict rental caps (e.g., ₱15k–₱20k per month in Mandaluyong or Pasig). If association dues push monthly carrying costs too high, investors won’t be able to charge competitive rent.

- Student-Centric Units – Near universities (Taft, Katipunan), renters are price-sensitive. High fees won’t translate into higher rent, making yields collapse.

- Emerging Cities with Low Rent Ceilings – In cities where market rents are still developing (e.g., parts of Cavite or Bulacan), premium dues won’t be justified because tenants don’t have the budget to pay for “resort-style” extras.

Here, high fees eat directly into ROI without any rental upside.

Investor Tip: Match Tenant Profile with Amenity Demand

Your decision should always hinge on the tenant profile you plan to target:

- Executives / Expats → Premium fees can be leveraged into higher rents and faster leasing.

- Young Professionals / Students → Keep fees modest; they’ll prioritize affordability over rooftop pools.

- Families → Moderate fees tied to functional amenities (playgrounds, security, parking) often strike the right balance.

Smart investors don’t just ask, “How much are the fees?” They ask, “Do these fees translate into value my tenant will pay for?”

Frequently Asked Questions About Condo Association Fees in the Philippines

Are condo fees tax deductible in the Philippines?

For individual investors leasing out a condo, association dues are generally not deductible for personal income tax. However, if you are registered as a business or professional taxpayer and your condo is treated as part of your business assets, then dues may be claimed as an ordinary and necessary business expense. Developers and corporate lessors often deduct these, but individual landlords rarely do. It’s best to consult a tax advisor for proper compliance.

Can HOA or condo fees be negotiated?

Condo association dues are typically non-negotiable because they’re set by the homeowners’ association (HOA) or condo corporation and applied equally to all unit owners. What can sometimes be negotiated is how fees are paid—for example, quarterly or annually instead of monthly. Developers may also offer temporary subsidies for new buyers, but once the condo corporation takes over, fees are standardized.

What happens if I don’t pay condo fees in the Philippines?

Failure to pay association dues can lead to interest penalties, legal demand letters, and suspension of condo privileges (use of amenities, parking rights, guest access). In extreme cases, the HOA or condo corporation may even file a lien against the property or pursue collection through legal action. For landlords, unpaid dues can disrupt tenant relations, as some HOAs may restrict elevator or common-area access until fees are settled.

Do condo fees increase every year?

Not always—but expect periodic increases. Association dues can rise when:

- Operating expenses (security, utilities, staff salaries) go up.

- Major repairs or replacements (roofing, elevators, repainting) are needed.

- Inflation impacts service contracts or utility rates.

Some condos in Metro Manila keep dues stable for years, but in older or underfunded developments, increases can be more frequent. Always check the condo’s financial statements and reserve fund health before buying.

Actionable Investor Checklist: Condo Fees Due Diligence

Before signing that reservation agreement, run through this quick but powerful checklist. It can save you from owning a condo that bleeds your cash flow dry:

🔲 Compare fees across 3–5 properties.

Don’t just look at the unit price—line up monthly association dues across similar condos in BGC, Makati, Ortigas, or Quezon City. A difference of ₱30–₱50 per sqm may sound small but can add up to thousands monthly, directly hitting your yield.

🔲 Calculate the fee-to-rent ratio.

Divide the monthly condo fee by the projected monthly rent. If fees eat up more than 10–15% of rental income, that’s a red flag for investors aiming for stable cash flow.

🔲 Review the HOA reserve fund health.

Ask for the condo corporation’s financial statements. A healthy reserve fund means they can cover big-ticket repairs (roofing, elevators, repainting) without sudden fee hikes. A weak fund usually signals special assessments down the road.

🔲 Ask about the history of special assessments.

Has the HOA imposed extra charges in the past five years? If yes, for what reasons? Frequent assessments show poor financial planning and can spook both owners and tenants.

🔲 Match fees with your tenant profile.

High association dues are more acceptable in luxury condos where expats or executives expect premium amenities. For mid-market condos, steep fees can scare away tenants who are price-sensitive. Align the fee level with your ideal tenant’s budget and lifestyle.

📌 Pro Tip: Put this checklist on your phone or print it out. Use it during site visits and HOA meetings—it’s the quickest way to separate profitable condos from financial traps.

Smart Investors Don’t Fear Fees—They Master Them

Condo fees get a bad rap. Many buyers treat them as an unavoidable nuisance, but seasoned investors know better. These charges aren’t just expenses—they’re part of a bigger investment strategy. Well-structured association dues ensure that elevators run smoothly, lobbies stay pristine, and amenities remain tenant magnets. In other words, fees safeguard the livability—and marketability—of your property.

The real danger isn’t the existence of condo fees. It’s the mismanagement behind them. A strong, transparent homeowners’ association can protect and even grow your asset’s long-term value. But a poorly run one? It can quietly drain your returns through sudden fee hikes, endless assessments, and declining property conditions that scare away tenants and buyers.

Smart investors don’t shy away from fees—they analyze, compare, and factor them into every ROI calculation. That’s how you stay ahead of the market, avoid costly surprises, and make your condo portfolio work for you, not against you.

Leave a comment