An infographic outlining the 25 essential real estate terms every Philippine property buyer must know, highlighting the key stages of property transactions.

Most property disasters in the Philippines don’t start with scams. They start with misunderstood words. Reservation fee, title, capital gains tax, deed of sale—terms that sound routine, even harmless, yet quietly decide whether a deal protects you or bleeds you dry.

If you’ve ever felt intimidated reading contracts, unsure what you’re really paying for, or nervous signing documents you don’t fully understand, you’re not alone. The Philippine real estate process is layered with legal, financial, and government terminology that punishes guesswork and rewards clarity. One wrong assumption can mean delayed titles, unexpected taxes, or years of regret.

This guide exists for one reason: to put you in control when buying property in the Philippines. By the end, you’ll understand the real meaning behind the most critical real estate terms used in the Philippines—what they cost you, when they matter, and how they protect you. No legal fog. No sales fluff. Just the knowledge you need to buy, invest, or sell property with confidence.

Table of Contents

- Ownership & Legal Foundations: High-Risk Real Estate Terms in the Philippines

- Real Estate Taxes & Government Fees in the Philippines (What Buyers Miss)

- Financing, Loans & Payment Structures in Philippine Real Estate

- Property Types, Development Stages & Ownership Models in the Philippines

- Property Valuation, Equity & Investment Terms in the Philippine Market

- Real Estate Brokers and Developers in the Philippines: Who You’re Dealing With

- Permits, Compliance & Turnover Requirements in Philippine Real Estate

- Common Philippine Real Estate Buyer Misconceptions (That Cost Money)

- Real-Life Philippine Real Estate Scenarios: How These Terms Actually Play Out

- Key Takeaways for Buying Property in the Philippines + Your Next Smart Move

Ownership & Legal Foundations: High-Risk Real Estate Terms in the Philippines

If anything goes wrong in a Philippine real estate transaction, it almost always goes wrong here—this is the core of real estate due diligence in the Philippines. Titles, deeds, access rights, and legal authority decide one brutal question: Do you actually own what you paid for? Get these wrong and no amount of interior design—or legal optimism—will save you.

1. Title (TCT vs CCT)

Plain-English definition

A title is the government-issued document that proves legal ownership of real property. In the Philippines, ownership comes in two main forms:

TCT (Transfer Certificate of Title)

for land and house-and-lot properties

Sample Transfer Certificate of Title (TCT) for Philippine real estate ownership.

CCT (Condominium Certificate of Title)

for individual condo units

Sample Condominium Certificate of Title (CCT) illustrating ownership documentation in the Philippines.

Both are issued by the Registry of Deeds under the Torrens system.

Why this matters in the Philippines

No title, no ownership. Period. Under Philippine law, the country follows a registration-based ownership system, meaning possession, receipts, or notarized agreements don’t outweigh what’s registered with the government. Banks, courts, and buyers only recognize what’s on the title—and whose name is printed on it.

Real-world buyer mistake

A buyer pays in full for a “clean” property, only to discover later that the seller’s name was never transferred from a previous owner. The buyer has a house. They do not have ownership. Fixing it can take years.

👉 Always verify the title directly with the Registry of Deeds, not just a photocopy from the seller or broker.

👉 For condos, confirm that the CCT is already issued, not just “to be released.”

2. Deed of Absolute Sale (DOAS)

Plain-English definition

A Deed of Absolute Sale is the legal document that records the seller’s agreement to transfer ownership to the buyer in exchange for payment.

Why this matters in the Philippines

The DOAS is the backbone of title transfer—but it’s not ownership by itself. In the Philippines, a DOAS must be notarized, taxed, and registered before ownership legally changes. Miss one step and the title stays frozen in the seller’s name.

Real-world buyer mistake

Many buyers believe that once the deed is notarized, they already own the property. Months later, they discover the seller passed away or disappeared before the title transfer was completed. The result: probate court, delays, legal costs.

⚠️ Notarized ≠ Owned

Ownership only transfers after the DOAS is registered and a new title is issued in your name, as required by the Registry of Deeds.

3. Right of Way

Plain-English definition

A Right of Way is a legal right that allows access to your property through another person’s land—commonly used when a property is landlocked.

Why this matters in the Philippines

Access is everything. A property without a legally enforceable right of way may be unusable, unmortgageable, and nearly impossible to resell. Verbal agreements and “we’ve always passed here” traditions carry zero legal weight when disputes arise.

Real-world buyer mistake

A buyer purchases a cheaper lot at the back of a subdivision, assuming access is “understood.” Months later, the front lot owner blocks the path. No written, registered right of way. No access. No leverage.

👉 A right of way must be documented, clearly defined, and ideally annotated on the title.

👉 If access depends on goodwill, walk away.

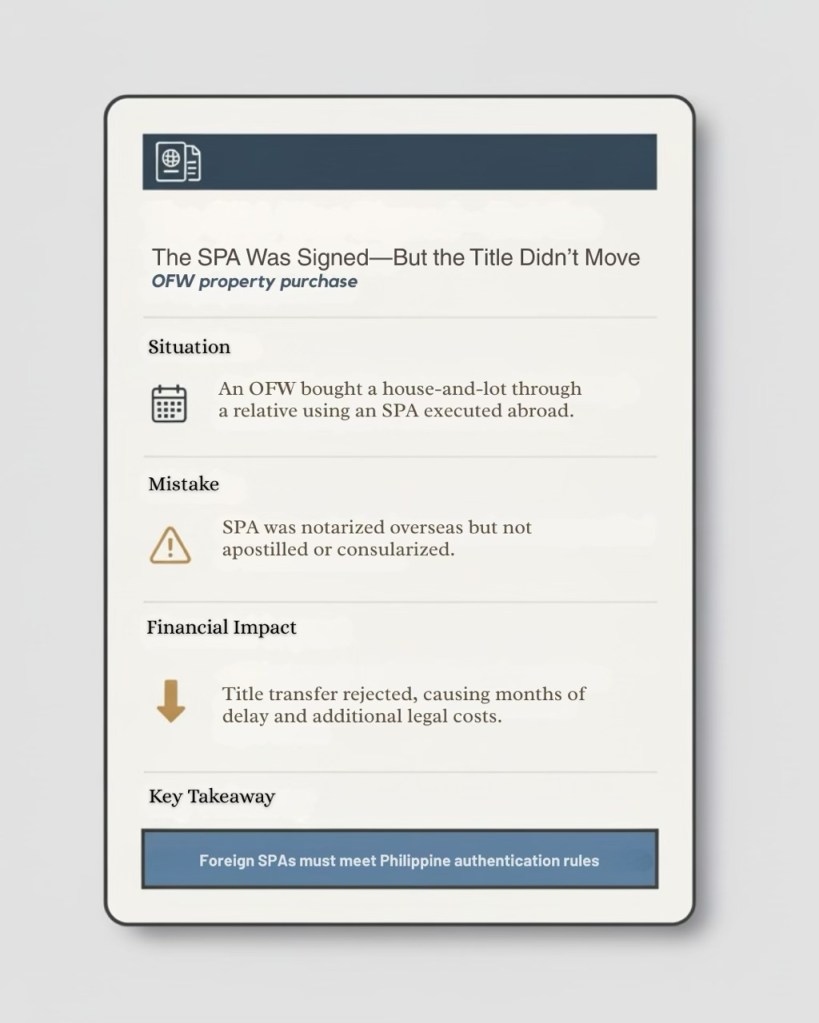

4. Special Power of Attorney (SPA)

Plain-English definition

A Special Power of Attorney (SPA) authorizes another person to act on your behalf in a specific transaction—such as signing documents, receiving payments, or transferring property.

Why this matters in the Philippines

SPAs are common for OFWs, overseas investors, or busy sellers. But Philippine real estate law is strict: the SPA must be properly executed, specific, and correctly authenticated, especially if signed abroad.

Real-world buyer mistake

A buyer transacts with someone holding an outdated or improperly notarized SPA. When the deal is challenged, the transaction is voided. The money? Hard to recover.

👉 Foreign-executed SPAs must be apostilled or consularized to be valid in the Philippines.

👉 The SPA must explicitly mention the authority to sell, buy, or sign a Deed of Sale—general wording is not enough.

Why This Section Matters More Than Any Other

👉 Pricing can be renegotiated. Layouts can be renovated. Bad locations can sometimes recover.

Bad legal foundations don’t.

👉 If you master nothing else in Philippine real estate, master these four. They don’t just protect your investment—they protect your peace of mind.

Real Estate Taxes & Government Fees in the Philippines (What Buyers Miss)

This is where deals quietly go over budget—because property taxes in the Philippines are rarely explained clearly. Not because the price was wrong—but because buyers (and sellers) underestimated taxes, timing, and government fees. In the Philippines, these charges are mandatory, non-negotiable, and unforgiving when missed. Know them cold, or pay twice.

5. Capital Gains Tax (CGT)

Plain-English definition

Capital Gains Tax is a tax on the sale of real property. In the Philippines, it’s 6% of the highest among the selling price, zonal value, or fair market value.

Why this matters in the Philippines

CGT is due within 30 days from notarization of the Deed of Sale. Miss that window and penalties pile up. Also, while CGT is customarily paid by the seller, contracts can (and often do) shift the burden.

Real-world buyer mistake

A buyer agrees to a “net of taxes” deal without understanding the numbers. After signing, the seller refuses to process the title unless the buyer shoulders CGT—an unplanned six-figure hit.

⚠️ CGT is based on value—not just price

Underdeclaring won’t save you. It will delay your title.

6. Documentary Stamp Tax (DST)

Plain-English definition

DST is a tax on legal documents. For real estate sales, it’s 1.5% of the selling price or fair market value, whichever is higher.

Why this matters in the Philippines

DST must be paid before title transfer can proceed. No DST receipt, no registration. Simple. Brutal.

Real-world buyer mistake

DST is assumed to be “small” and forgotten during budgeting. Come transfer time, the buyer scrambles for cash, delaying registration—and sometimes the entire deal.

👉 DST is often paid by the buyer, but always clarify this in writing.

7. Transfer Tax

Plain-English definition

Transfer Tax is imposed by the local government unit (LGU) where the property is located. Rates typically range from 0.5% to 0.75%.

Why this matters in the Philippines

Rates and deadlines vary by city or province. Some LGUs impose stiff penalties for late payment, even if all other taxes are settled.

Real-world buyer mistake

A buyer pays CGT and DST promptly—but delays Transfer Tax. The Registry of Deeds refuses to release the new title. Weeks turn into months.

👉 Always check the specific LGU rate and deadline. Manila is not Makati. Makati is not Cebu.

8. Property Tax (Real Property Tax / Amilyar)

Plain-English definition

Property tax, locally known as amilyar, is an annual tax based on the property’s assessed value, not its market price.

Why this matters in the Philippines

Unpaid property taxes attach to the property—not the owner. Buyers inherit unpaid balances, penalties included.

Real-world buyer mistake

A buyer skips checking tax clearances. After purchase, they discover years of unpaid amilyar blocking title transfer and resale.

👉 Ask for a current Tax Clearance before releasing final payment. No clearance, no closing.

9. Registration & Miscellaneous Fees

Plain-English definition

These include:

- Registry of Deeds fees

- Annotation fees

- Notarial fees

- Bank processing fees (if financed)

Why this matters in the Philippines

Individually small. Collectively painful. These fees often surface late in the process, when leverage is gone and deadlines loom.

Real-world buyer mistake

A buyer budgets for “taxes” but not for registration. The title sits unclaimed because the final fees weren’t anticipated.

👉 Registration is not optional. If the title isn’t registered, ownership hasn’t legally moved.

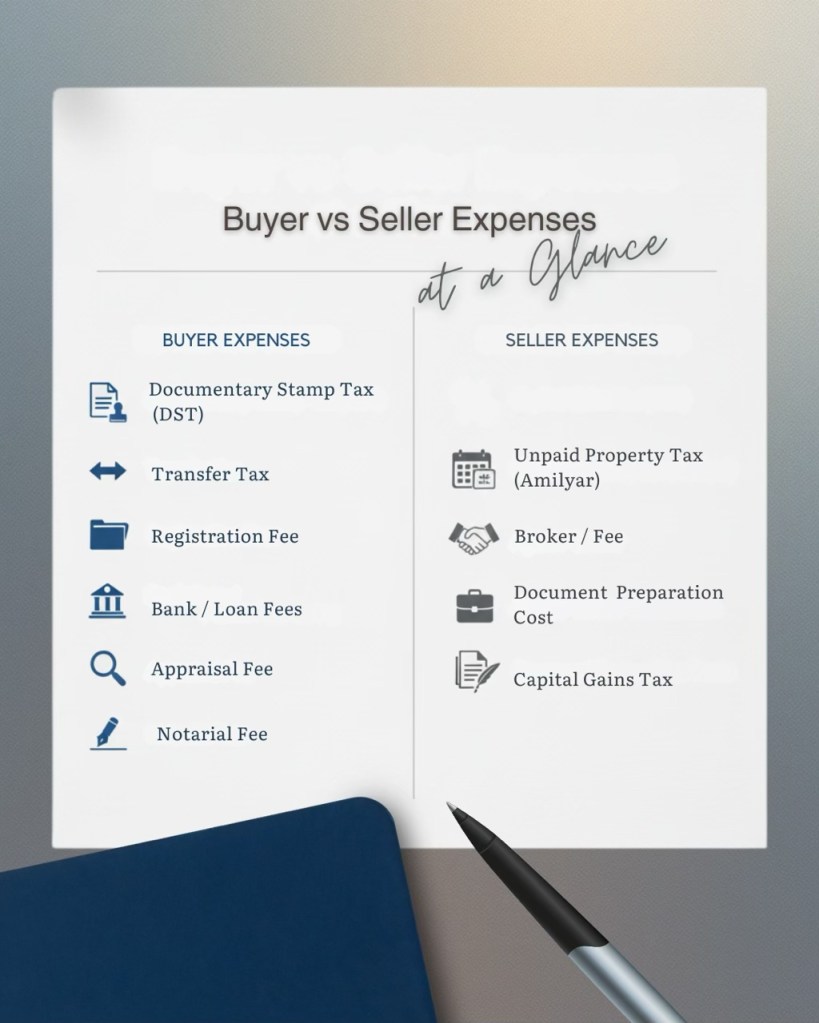

Cost Breakdown: Who Pays What (Typical PH Property Sale)

| Cost Item | Who Pays | Rate / Basis | When Paid | Common Disputes |

|---|---|---|---|---|

| Capital Gains Tax | Seller (usually) | 6% of highest value | Within 30 days of notarization | Who shoulders CGT |

| Documentary Stamp Tax | Buyer (often) | 1.5% of value | Before registration | Assumed inclusion |

| Transfer Tax | Buyer | 0.5%–0.75% | Before title transfer | LGU rate confusion |

| Property Tax (Amilyar) | Seller (arrears) | Assessed value | Annually | Unpaid back taxes |

| Registration & Misc. | Buyer | Fixed + variable | During transfer | “Hidden” late fees |

Myth-Busting: What Buyers Get Wrong

❌ “Zonal value saves me tax.”

→ The highest value wins. Always.

❌ “Seller will handle all taxes.”

→ Only if the contract says so.

❌ “I’ll pay taxes after I move in.”

→ Pay late, transfer stalls.

❌ “These are small amounts.”

→ Combined, they can hit 8–10% of the price.

A comparison chart detailing buyer and seller expenses in Philippine real estate transactions, highlighting key costs such as Documentary Stamp Tax, Transfer Tax, and Capital Gains Tax.

Taxes don’t care how excited you are about the property. They care about deadlines, documentation, and math. Master these charges, and you don’t just protect your budget—you protect the deal.

Once you know where every peso goes, the next question becomes unavoidable: how are you actually paying for all of it?

Financing decisions don’t just affect approval—they determine whether this purchase supports your life or slowly suffocates it.

Financing, Loans & Payment Structures in Philippine Real Estate

This is where emotions meet math—and math always wins. In the Philippines, most buyers don’t lose money because of interest rates alone. They lose money because they misread payment structures, underestimate long-term costs, and fall for “low monthly” illusions. Understanding these terms keeps your cash flow intact and your stress levels low.

10. Mortgage

Plain-English definition

A mortgage is a loan used to buy property, where the property itself serves as collateral. In the Philippines, mortgages are typically offered by banks or Pag-IBIG Fund.

Why this matters in the Philippines

Your lender dictates more than your interest rate. It affects your approval timeline, required income documents, loan-to-value ratio, and even resale flexibility.

Banks

Faster processing, higher loan amounts, stricter approval, shorter terms

Pag-IBIG

Lower rates, longer terms (up to 30 years), income caps, slower processing

Real-world buyer mistake

A buyer stretches for a higher-priced unit assuming bank approval is guaranteed. It isn’t. Loan gets denied, reservation fee is forfeited, and the unit is lost.

👉 Get loan pre-approval before paying a reservation fee. Hope is not a financing strategy.

11. Amortization

A comparison chart detailing how early mortgage payments are split between interest and principal, illustrating the gradual shift in payment structure over a typical 30-year Philippine home loan.

Plain-English definition

Amortization is the schedule of regular payments that gradually pays off your mortgage—covering both interest and principal.

Why this matters in the Philippines

Early amortization payments are interest-heavy. You’re paying the bank first, not yourself. This matters if you plan to resell, refinance, or prepay early.

Real-world buyer mistake

A buyer sells after three years, expecting equity—only to discover most payments went to interest, not the loan balance.

⚠️ Early years build very little equity. Don’t assume “I’ve been paying for years” means profit.

12. Down Payment

Plain-English definition

A down payment is the upfront amount you pay toward the property price before financing kicks in. In the Philippines, this typically ranges from 10% to 30%.

Why this matters in the Philippines

Developers often spread down payments over long periods during pre-selling—making properties feel cheaper than they are.

Real-world buyer mistake

A buyer commits to a unit based on manageable down payments, only to panic when the balloon payment or bank amortization begins.

👉 Down payment affordability ≠ ownership affordability. Always project post-turnover monthly amortization.

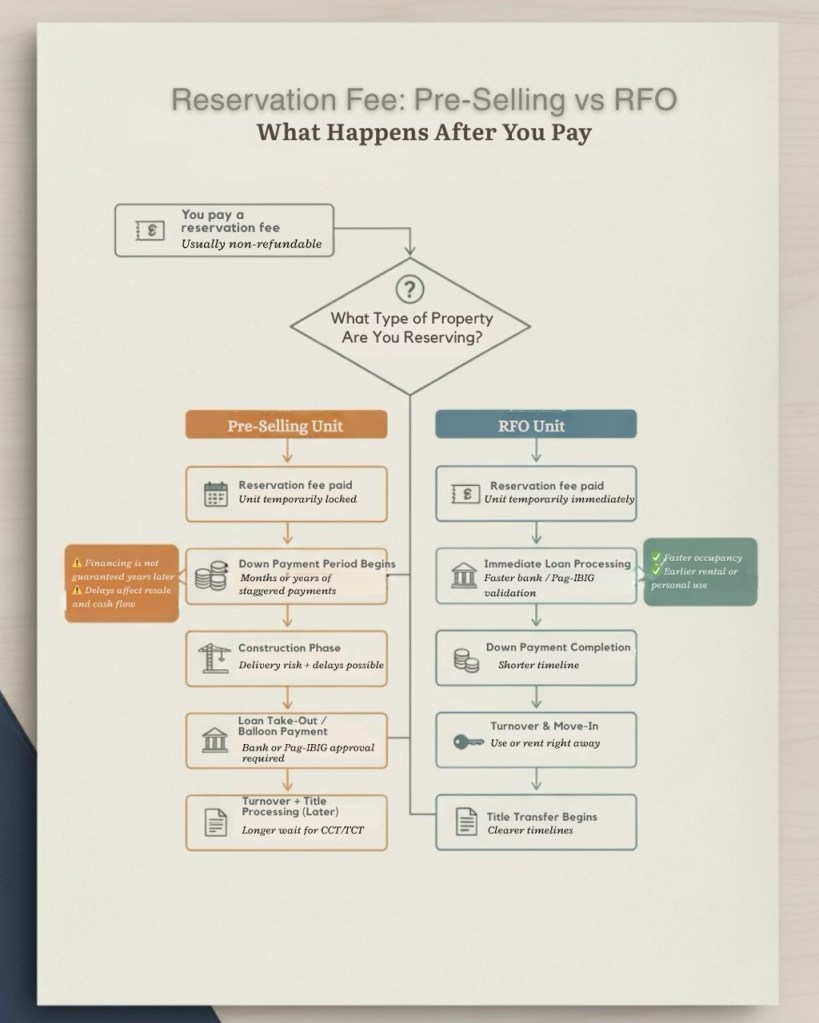

13. Reservation Fee

An infographic comparing the processes and implications of paying a reservation fee for pre-selling and ready-for-occupancy (RFO) properties in the Philippine real estate market.

Plain-English definition

A reservation fee is a payment made to temporarily lock in a unit. It’s usually non-refundable and deducted from the total price.

Plain-English definition

A reservation fee is a payment made to temporarily lock in a unit. It’s usually non-refundable and deducted from the total price.

Pre-selling

Lower upfront cost, longer wait, higher risk tolerance required

RFO (Ready-for-Occupancy)

Higher entry cost, immediate use, clearer financing

Real-world buyer mistake

A buyer reserves first, asks questions later. Financing falls through. Reservation fee is gone.

⚠️ Never pay a reservation fee without knowing:

- Total cash-out before loan release

- Financing eligibility

- Turnover timeline

14. Escrow (The Philippine Reality Check)

Plain-English definition

Escrow involves a neutral third party holding funds until transaction conditions are met.

Why this matters in the Philippines

Unlike other countries, escrow is rarely used in Philippine residential transactions. Buyers often release payments directly—raising risk.

Real-world buyer mistake

A buyer pays in full before title transfer, trusting verbal assurances. The seller delays. The buyer waits.

👉 When escrow isn’t available, control payments through milestones, not promises.

Cost Breakdown: Who Pays What (Typical PH Property Sale)

| Cost Item | Who Pays | Rate / Basis | When Paid | Common Disputes |

|---|---|---|---|---|

| Capital Gains Tax | Seller (usually) | 6% of highest value | Within 30 days of notarization | Who shoulders CGT |

| Documentary Stamp Tax | Buyer (often) | 1.5% of value | Before registration | Assumed inclusion |

| Transfer Tax | Buyer | 0.5%–0.75% | Before title transfer | LGU rate confusion |

| Property Tax (Amilyar) | Seller (arrears) | Assessed value | Annually | Unpaid back taxes |

| Registration & Misc. | Buyer | Fixed + variable | During transfer | “Hidden” late fees |

Why “Low Monthly” Is Not the Same as Affordable

Low monthly payments are often achieved by:

- Longer loan terms

- Higher total interest

- Smaller early equity

They feel good now. They cost more later.

Smart buyers ask:

- What’s my total interest over the loan?

- Can I afford this if rates reprice?

- Does this still work if my income dips?

Financing isn’t about chasing the lowest monthly payment. It’s about choosing a structure that won’t trap you when life changes. Control the structure—and the property starts working for you, not the other way around.

But payment structure is only half the equation.

The type of property you buy—and the stage it’s in—will determine how flexible, liquid, and forgiving that structure actually is.

Property Types, Development Stages & Ownership Models in the Philippines

Not all properties are created equal—and in the Philippines, how and when you buy often matters more than what you buy—especially in any serious condo buying guide for the Philippines. Development stage and ownership structure dictate your risk, your exit options, and your long-term returns. Ignore this section and you might end up owning something that looks great—but behaves badly as an investment.

15. Pre-Selling

An infographic illustrating the timeline of Philippine property development from pre-selling to title release, highlighting key stages like construction, turnover, and finalizing legal ownership.

Plain-English definition

Pre-selling refers to buying a property before construction is completed, sometimes before ground is even broken. Buyers commit early, often in exchange for lower prices and flexible payment terms.

Why this matters in the Philippines

Developers use pre-selling to fund construction and manage cash flow. That’s why early buyers get discounts, extended down payments, and marketing incentives.

Developer incentives explained

- Lower entry prices to secure early buyers

- Spread-out down payments to boost sales velocity

- Early commitments to satisfy bank funding requirements

Real-world buyer mistake

A buyer assumes pre-selling is always cheaper. Years later, comparable RFO units are selling at similar prices—without the wait, risk, or uncertainty.

Resale & exit implications

- Pre-selling units are harder to resell before turnover

- Profits depend heavily on location, developer credibility, and market timing

- Delays can erase projected gains

⚠️ Pre-selling rewards patience and developer discipline, not blind optimism. Always check the developer’s delivery history.

Leasehold vs Freehold

Plain-English definition

- Freehold means you own the property indefinitely.

- Leasehold means you own the right to use the property for a fixed period, typically 25–50 years, after which ownership reverts to the lessor unless renewed.

Why this matters in the Philippines

Leasehold properties are common in certain condo developments, government lands, or master-planned estates. They’re legal—but not equal to freehold in value behavior.

Real-world buyer mistake

A buyer focuses on price and ignores lease duration. Years later, resale demand softens as the remaining lease term shortens.

Resale & exit implications

- Leasehold properties often depreciate as lease expiry approaches

- Banks may be stricter or refuse financing on short remaining terms

- Inheritance and long-term holding strategies are limited

👉 Leasehold can work for short- to mid-term use, not legacy wealth. Know your timeline before you buy.

17. Condominium Ownership (RA 4726 Explained Simply)

An infographic detailing the ownership structure of condominium units in the Philippines under RA 4726, illustrating private, common, and exclusive use areas.

Plain-English definition

Under Republic Act 4726 (The Condominium Act), condo buyers own:

- Their individual unit (with a Condominium Certificate of Title or CCT)

- An undivided interest in common areas (lobbies, elevators, amenities)

Why this matters in the Philippines

You don’t own the building outright—you co-own it with everyone else. This is where condo corporations and homeowners’ associations step in.

Clarifying the condo corporation’s role

- Manages common areas and building maintenance

- Collects association dues

- Enforces house rules and usage policies

Real-world buyer mistake

A buyer treats a condo like a standalone house—renovates freely, ignores dues, or violates rules—only to face penalties or resale issues later.

Resale & exit implications

- Well-managed condos command higher resale values

- Poorly run condo corporations kill investor interest

- High delinquency rates signal future maintenance problems

⚠️ Before buying, review the condo corporation’s financial health, not just the unit layout.

Why This Section Shapes Your Outcome

👉 Pre-selling determines timing risk.

👉 Leasehold defines value longevity.

👉 Condo ownership controls collective responsibility.

👉 These aren’t technicalities. They decide whether your property is flexible, financeable, and future-proof—or locked into limitations you didn’t see coming.

👉 Understand the structure, and you stop buying blindly.

Property Valuation, Equity & Investment Terms in the Philippine Market

This is the language of real money. Not list prices. Not marketing claims. Value, equity, and appreciation determine whether a property quietly builds wealth—or just looks impressive on paper. In the Philippine market, misunderstanding these terms leads to overpaying, underperforming, and misplaced confidence.

18. Real Estate Appraisal

An infographic illustrating the disparity between appraisal value and asking price in Philippine property deals, highlighting common scenarios that affect loan approval.

Plain-English definition

A real estate appraisal is an independent, professional estimate of a property’s value, usually conducted by a licensed appraiser and required by banks before loan approval.

Why this matters in the Philippines

Banks lend based on appraised value, not your negotiated price. If the appraisal comes in low, you don’t get more money—you get a financing problem.

👉 Market value reflects what buyers are willing to pay

👉 Appraised value reflects what lenders are willing to risk

In hot Philippine locations, these two numbers often diverge.

Real-world buyer mistake

A buyer agrees to a premium price in a “hot” district, assuming the bank will follow. The appraisal falls short. The buyer must either add cash or walk away—after already paying fees.

⚠️ Asking price does not equal appraised value. Banks don’t buy into hype.

19. Capital Appreciation

An infographic illustrating the long-term appreciation trends of property values in the Philippines, highlighting a conservative model over a 10-year holding period.

Plain-English definition

Capital appreciation is the increase in a property’s value over time—the difference between your purchase price and its future market value.

Why this matters in the Philippines

Appreciation here is uneven and location-driven. Not all cities rise at the same pace, and not all condos appreciate at all.

Common appreciation drivers

- Infrastructure projects (rail lines, highways)

- Employment hubs and business districts

- Supply constraints in prime areas

Appreciation myths in PH cities

- ❌ “All condos go up in value”

- ❌ “New launches always appreciate”

- ❌ “Price increases equal profit”

Real-world buyer mistake

An investor buys pre-selling assuming automatic appreciation. Years later, resale prices barely exceed launch prices—after taxes, fees, and holding costs, returns are negative.

👉 Appreciation is earned, not guaranteed. Location quality beats launch hype every time.

20. Real Estate Equity

Plain-English definition

Real estate equity is the difference between your property’s current value and your outstanding loan balance.

Why this matters in the Philippines

Equity grows through:

- Property appreciation

- Loan principal reduction through amortization

But early in the loan, equity builds slowly.

Equity growth over time

- Early years: interest-heavy payments, minimal equity

- Mid-term: balance shifts, equity accelerates

- Long-term: appreciation + lower loan = leverage

Real-world buyer mistake

A property owner assumes years of payments equal strong equity—only to discover refinancing or selling yields far less cash than expected.

⚠️ Equity is not your total payments. It’s what’s left after the bank gets paid.

Why Investors Think Differently

👉 Smart investors don’t ask, “Is the price fair?”

They ask:

- Can this appraise cleanly?

- Where does equity come from—growth or payments?

- What assumptions am I making about appreciation?

👉 When you understand valuation language, you stop chasing projections and start measuring reality.

Real estate wealth isn’t built on optimism. It’s built on understanding how value actually works in the Philippine market—and acting accordingly.

Even the best numbers fail in the wrong hands.

The people guiding your transaction—brokers and developers—often determine whether projected value becomes reality or stays theoretical.

Real Estate Brokers and Developers in the Philippines: Who You’re Dealing With

In Philippine real estate, the property matters—but the people matter more. A clean title can still turn into a nightmare if the wrong hands guide the deal. Understanding who does what—and who is legally accountable—separates protected buyers from exposed ones.

21. Real Estate Broker

Understanding the key differences between licensed real estate brokers and sales agents in the Philippines is crucial for buyers.

Plain-English definition

A real estate broker is a licensed professional authorized to facilitate property transactions for a fee. In the Philippines, brokers must be licensed by the Professional Regulation Commission (PRC)under the Real Estate Service Act (RESA Law).

Why this matters in the Philippines

Developers control:

- Construction quality

- Turnover timelines

- Title issuance

- Long-term property value

Buying from the wrong developer is like buying a brand with no warranty.

PRC licensing explained

- Brokers pass a national licensure exam

- Licenses must be renewed and are publicly verifiable

- Brokers carry legal accountability for transactions they handle

Real-world buyer mistake

A buyer transacts through an unlicensed “agent” offering a better deal. When problems arise, there’s no regulatory body to hold accountable—and no professional liability.

⚠️ Always ask for the broker’s PRC license number. Legit brokers don’t get offended. They get respected.

22. Real Estate Developer

A checklist for evaluating developer track records in Philippine real estate, highlighting key areas to verify before purchasing.

Plain-English definition

A real estate developer acquires land, plans projects, secures permits, and delivers residential or commercial developments to the market.

Why this matters in the Philippines

Only PRC-licensed brokers can legally:

- Represent buyers or sellers

- Advertise properties professionally

- Receive commissions for real estate transactions

Everyone else is either working under a broker or operating illegally.

Developer Tiering (Investor Reality Check)

Tier 1 Developers

👉 Strong balance sheets

👉 Consistent delivery track record

👉 Better resale value and bank confidence

Tier 2 Developers

👉 Solid but selective track records

👉 Project-dependent reliability

👉 Moderate resale performance

Boutique Developers

👉 Smaller scale, niche concepts

👉 Higher upside and higher risk

👉 Due diligence is non-negotiable

Real-world buyer mistake

A buyer is swayed by glossy renderings and aggressive promos, ignoring the developer’s past delays or unresolved buyer complaints.

👉 A beautiful showroom doesn’t compensate for a poor delivery history.

Marketing Red Flags Buyers Commonly Ignore

- “Guaranteed appreciation” claims

- Vague turnover timelines

- Heavy reliance on celebrity endorsements

- Pressure to reserve “before price increases”

- Missing License to Sell (LTS) disclosures

⚠️ If urgency replaces clarity, step back. Real value doesn’t need a countdown timer.

Why This Section Protects You

Properties don’t fail on paper. People fail in execution.

When you understand who is legally responsible—and who just looks confident—you reduce risk, protect your capital, and dramatically improve your buying experience.

Choose professionals, not personalities.

Permits, Compliance & Turnover Requirements in Philippine Real Estate

This is the unglamorous part of real estate—the paperwork, permits, and monthly dues no one brags about. Yet these documents quietly decide whether a bank approves your loan, whether you can legally live in the property, and whether future buyers will line up or walk away.

Ignore this section and you don’t just risk inconvenience. You risk illiquidity.

23. Building Permit

Plain-English definition

A building permit is an approval issued by the local government authorizing construction, renovation, or structural modification of a property.

Why this matters in the Philippines

Banks, LGUs, and future buyers care deeply about permits. Unpermitted structures are treated as non-existent in the eyes of lenders and assessors.

Real-world buyer mistake

A buyer purchases a house with extensions built “over the years.” Later, the bank excludes those improvements from the appraisal—or rejects the loan entirely.

⚠️ If it wasn’t permitted, it might as well not exist. Always verify approved plans and permits.

24. Occupancy Permit (Certificate of Occupancy)

Plain-English definition

An occupancy permit certifies that a building is safe, compliant, and suitable for use. It’s issued after final inspection by the local government.

Why this matters in the Philippines

No occupancy permit, no legal occupancy. Banks often require this document before releasing loan proceeds or approving take-out financing.

Real-world buyer mistake

A buyer moves into a unit during “soft turnover,” assuming everything is complete. Years later, the absence of an occupancy permit delays resale or refinancing.

👉 Turnover keys ≠ legal occupancy. Always confirm the Certificate of Occupancy exists.

25. Homeowners Association (HOA) Dues

Plain-English definition

HOA dues are recurring fees collected to maintain common areas, amenities, security, and building operations.

Why this matters in the Philippines

HOA dues directly affect:

- Property condition

- Tenant satisfaction

- Resale value

Underfunded associations lead to deteriorating buildings—and falling prices.

Real-world buyer mistake

A buyer chooses the lowest HOA dues available, only to face special assessments later due to poor maintenance planning.

⚠️ Low dues aren’t always good news. Healthy HOAs plan, collect, and maintain consistently.

Why Compliance Drives Value

Loan Approval

👉 Banks demand clean permits and occupancy documents

Legal Occupancy

👉 Protects you from enforcement actions and penalties

Resale Strength

👉 Buyers pay premiums for compliant, well-managed properties

Compliance doesn’t just protect you—it preserves liquidity.

What to Request at Turnover

A checklist detailing essential documents to secure during property turnover in the Philippines, including building permits and occupancy certificates.

Where Your HOA Dues Really Go

A pie chart illustrating the typical allocation of association dues in a Philippine condominium, detailing expenses for security, utilities, maintenance, and amenities.

A well-run property isn’t accidental. It’s permitted, compliant, and properly managed. Get this right, and your property remains bankable, livable, and sellable—long after the excitement fades.

Common Philippine Real Estate Buyer Misconceptions (That Cost Money)

These beliefs sound harmless. They’re repeated casually by friends, relatives, even “experienced” buyers. Yet they are responsible for some of the most expensive mistakes in Philippine real estate. Let’s kill them cleanly.

❌ “Notarized means I own it.”

✅ Reality: Notarization only confirms signatures. Ownership changes only after registration and issuance of a new title by the Registry of Deeds. Until then, the seller is still the legal owner.

👉 Costly outcome: Buyers pay in full, then get stuck waiting years for a title that never moves.

❌ “Zonal value saves tax.”

✅ Reality: Taxes are computed using the highest among selling price, zonal value, or fair market value. The lowest number never wins.

👉 Costly outcome: Underdeclared deals trigger reassessment, penalties, and stalled title transfers.

❌ “Pre-selling is always cheaper.”

✅ Reality: Pre-selling can be cheaper—but only when appreciation outpaces delays, fees, and holding costs. Many don’t.

👉 Costly outcome: Buyers wait years, then discover RFO units are selling at similar prices—without the risk.

❌ “Banks fix title issues.”

✅ Reality: Banks don’t fix problems. They avoid them. Any title defect can kill loan approval instantly.

👉 Costly outcome: Buyers lose units after paying reservation fees because financing collapses.

The Pattern Behind These Mistakes

Each myth assumes someone else will absorb the risk.

In Philippine real estate, you always absorb it.

If a belief sounds comforting, double-check it. If it sounds too simple, it probably is.

Real-Life Philippine Real Estate Scenarios: How These Terms Actually Play Out

Real estate terminology only becomes powerful when you see what it does in actual transactions. These short scenarios mirror what happens every day in the Philippine market—quiet decisions, small assumptions, and very real consequences.

Scenario 1: The First-Time Condo Buyer in Quezon City

The situation

A young professional buys a pre-selling studio in QC. The monthly down payment looks manageable. The unit feels like a win.

What went wrong

👉 The buyer focused on the reservation fee and monthly DP—but never projected the bank amortization after turnover. When the loan starts, the monthly payment jumps by nearly 40%.

Outcome

👉 The buyer struggles, rents out the unit below expectations, and loses cash flow.

Lesson learned

Low monthly today doesn’t mean affordable tomorrow. Always compute post-turnover amortization.

Scenario 2: The OFW Buyer Using a Special Power of Attorney (SPA)

The situation

An OFW purchases a house-and-lot through a trusted relative using an SPA executed abroad.

What went wrong

👉 The SPA was notarized overseas—but not apostilled or consularized. When it’s time to transfer the title, the Registry of Deeds rejects the documents.

Outcome

👉 The deal is delayed for months. Additional legal costs follow. Stress multiplies across time zones.

Lesson learned

Foreign-executed SPAs must meet Philippine authentication rules—or they’re useless.

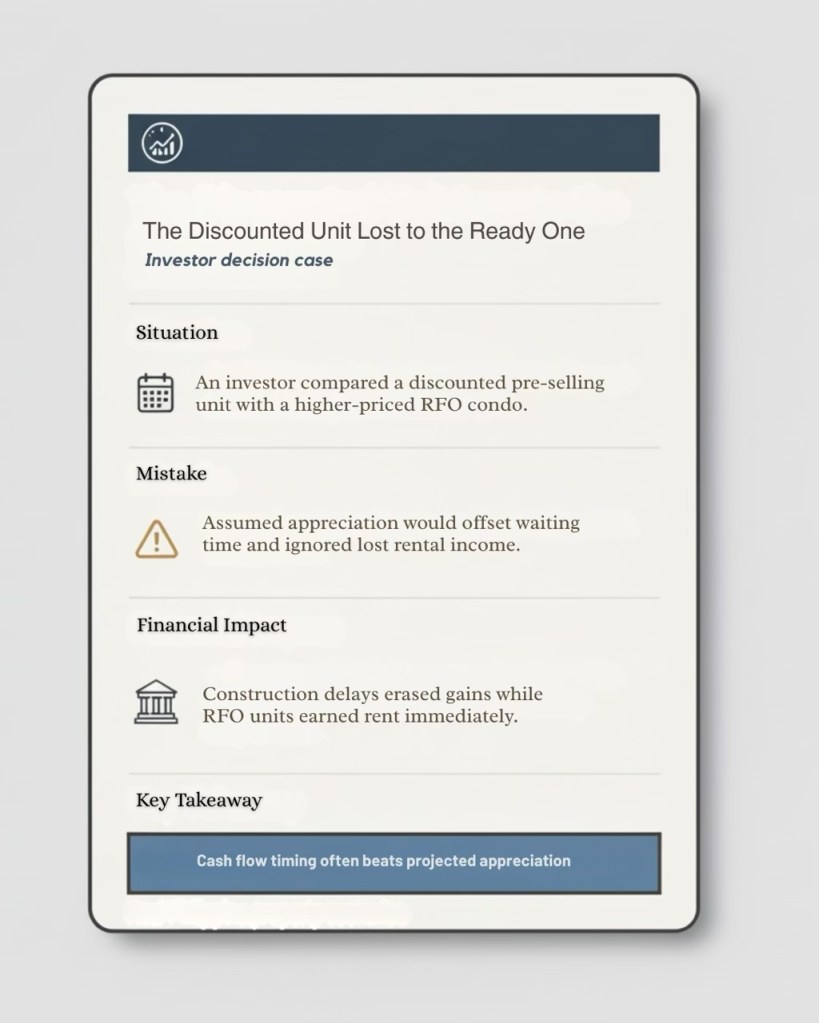

Scenario 3: The Investor Choosing Pre-Selling vs RFO

The situation

An investor compares a discounted pre-selling unit with a slightly more expensive RFO condo in the same area.

What went wrong

👉 The investor assumes appreciation will offset the wait. Construction delays push turnover back two years. Rental income is lost.

Outcome

👉 The RFO unit—despite a higher price—earns rent immediately and outperforms the pre-selling unit in net returns.

Lesson learned

Timing matters. Cash flow today can beat projected appreciation tomorrow.

Scenario 4: The Seller Shocked by Total Taxes

The situation

A homeowner sells a property expecting to walk away with the full selling price minus a small tax.

What went wrong

👉 Capital gains tax, DST, transfer tax allocations, and unpaid property taxes weren’t factored in.

Outcome

👉 Net proceeds shrink dramatically. The seller scrambles to cover shortfalls just to close the deal.

Lesson learned

Taxes don’t negotiate. Always compute net proceeds, not just selling price.

Why These Scenarios Matter

None of these people were reckless. They were uninformed.

Philippine real estate doesn’t punish intent—it punishes assumptions.

Understand the terms, and these stories become cautionary tales instead of personal experiences.

Key Takeaways for Buying Property in the Philippines + Your Next Smart Move

Knowledge is only useful if it changes what you do before money leaves your hands. This final section is your filter—use it every time you’re about to reserve, sign, or transfer funds in a Philippine property transaction.

Read This Before You Pay, Sign, or Commit

Before You Pay Anything

- Verify the title status directly with the Registry of Deeds

- Confirm your loan eligibility (bank or Pag-IBIG) in writing

- Understand whether the reservation fee is refundable—most aren’t

- Check if taxes or arrears are attached to the property

Before You Sign Anything

- Confirm who shoulders CGT, DST, and transfer taxes

- Ensure the Deed of Sale, SPA, and permits are properly executed

- Validate developer credentials and License to Sell (for condos)

- Make sure timelines—turnover, title transfer, loan release—are explicit

Before You Finalize Your Budget

- Add 8–10% for taxes, registration, and closing costs

- Project post-turnover amortization, not just down payments

- Factor in HOA dues, property tax, and maintenance

- Calculate net proceeds, not just selling price (for sellers)

📥 Free Resource: “Before You Sign Anything” Checklist

Suggested Visual:

📥 Downloadable checklist block

This one-page checklist summarizes the exact documents, numbers, and questions you must review before committing to any Philippine property deal. It’s the same framework professionals use to avoid delays, disputes, and expensive surprises.

This checklist is designed for anyone navigating the Philippine real estate process for the first time—or correcting a costly second attempt.

🤝 Need a Second Set of Eyes?

If you’re buying, selling, or investing and want clarity—not sales pressure—a short consultation can save you months of stress and six figures in mistakes.

👉 [Book a Property Review Call]

🔗 Continue Learning (Recommended Guides)

These guides go deeper into the topics you just learned—when you’re ready.

Real estate rewards preparation, not confidence.

Slow down. Verify. Ask better questions.

Then sign—with certainty.

Leave a comment