TABLE OF CONTENTS

- What is a Down Payment and Its Purpose?

- Typical Down Payment Ranges

- Factors Affecting Your Down Payment

- Financing Options to Meet Down Payment Requirements

- Why Meeting Down Payment Requirements Matters

- Planning and Budgeting for Your Down Payment

- Practical Tips for First-Time Buyers

- Real-Life Examples / Case Studies

Buying a property in Metro Manila is one of the biggest financial decisions you will make, and understanding how down payments work is important to navigating the buying process confidently. In the Philippines, a down payment is the initial cash amount a buyer pays upfront when purchasing a property, typically ranging from 10% to 30% of the property’s total price, depending on the type of property, its location, and the developer’s or bank’s requirements. For instance, a condominium in Makati may require a higher down payment than a townhouse in Pasig due to demand, market value, and urban density.

Down payments serve as more than just a fraction of the total property cost because they also a demonstration of financial commitment which is a key factor in loan approval, and a tool for reducing your overall mortgage burden. For Metro Manila buyers, where property prices are among the highest in the country, planning and budgeting for your down payment is a strategic financial preparation.

This guide will provide a clear, step-by-step overview of down payments for property buyers in Metro Manila. You will learn typical payment ranges, financing options, factors that affect the required amount, and practical strategies to save efficiently. By the end of this guide, you will be equipped to make informed decisions, budget effectively, and approach your property purchase with confidence and clarity.

What is a Down Payment and Its Purpose?

A down payment (DP) is the initial portion of a property’s total price that a buyer pays upfront before securing financing for the remaining balance. Typically expressed as a percentage of the property’s selling price—ranging from 10% to 30%—the down payment is a critical step in both house-and-lot and condominium purchases.

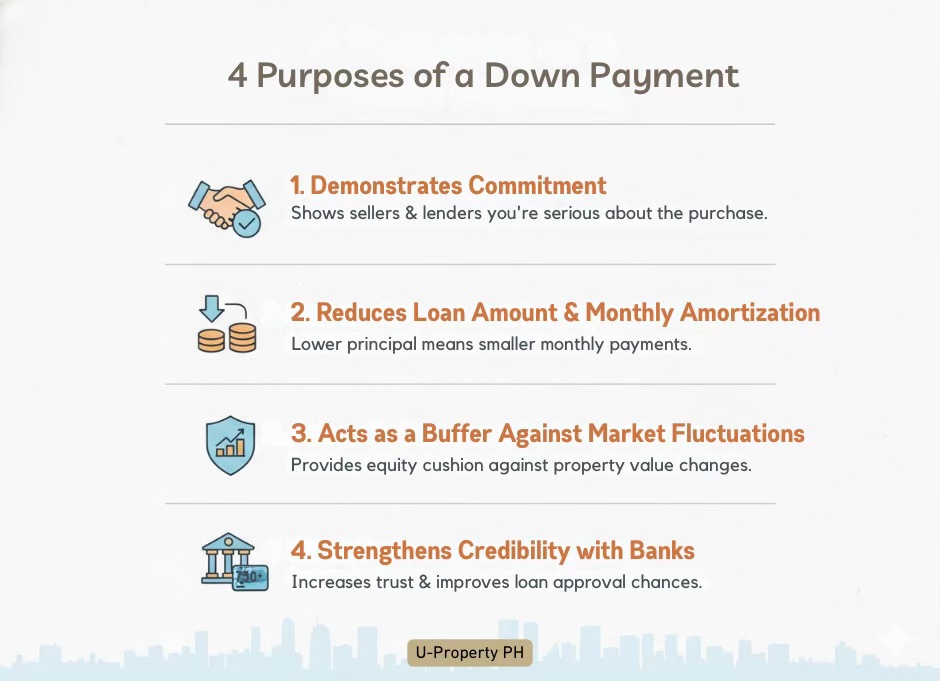

Understanding the purpose of a down payment goes beyond simply having cash on hand. It plays multiple strategic roles in a property transaction:

Demonstrates Commitment to Purchase

Paying a down payment signals to developers and lenders that you are serious and financially prepared. This is particularly important in high-demand areas like Makati, BGC, or Quezon City, where properties can move quickly.

Reduces Loan Amount and Monthly Amortization

The higher your down payment, the smaller the remaining loan balance. This directly translates to lower monthly mortgage payments and reduced interest costs over the life of the loan.

Acts as a Buffer Against Market Fluctuations

In Metro Manila’s sometimes fast-moving property market, early commitment through a down payment can help secure a unit at a fixed price, protecting buyers from sudden price increases.

Strengthens Credibility with Banks

Banks and lending institutions assess down payment size as part of their risk evaluation. A substantial and timely DP enhances your profile as a reliable borrower, improving your chances of loan approval and access to more favorable terms.

For property buyers, recognizing these purposes is essential. A down payment is not merely an upfront cost, it is also strategic financial tool that can influence your buying power, loan terms, and long-term investment returns.

Typical Down Payment Ranges

Understanding typical down payment ranges is crucial for buyers planning to purchase property. Down payments vary depending on property type, location, and financing source, and knowing these ranges allows you to budget effectively and avoid surprises during the buying process.

Down Payment by Property Type

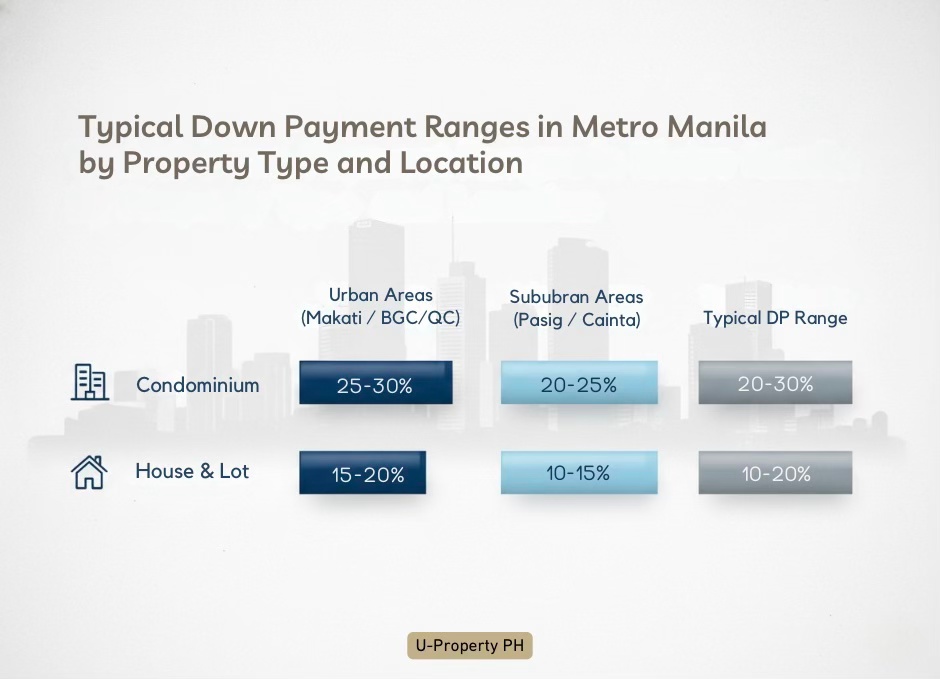

Condominiums

Condos in prime urban areas such as Makati, BGC, and Ortigas typically require 20%–30% of the total selling price as a down payment. Higher-end developments or those with premium amenities may push the DP closer to the upper limit.

Houses & Lots

Residential homes and townhouses generally require 10%–20% down payments, making them a more accessible option for first-time buyers or those with limited upfront capital.

Urban vs. Suburban Areas

Location also affects down payment requirements. In high-demand urban centers like Makati, BGC, and Quezon City, developers and banks often require larger down payments due to higher property values and strong market demand. Conversely, suburban or peri-urban areas like Pasig, Cainta, or Muntinlupa may have lower DP requirements, making them attractive for buyers seeking more budget-friendly options while still enjoying city accessibility.

Variations Across Developers and Banks

Each developer and financial institution may set its own DP terms. For example:

Banks

May offer standard 20% DP with flexible installment schemes for approved borrowers.

Developers

Some may allow smaller initial payments but spread over several months prior to turnover, often used as a marketing incentive.

Special Programs

Government-backed housing loans through Pag-IBIG can also influence down payment requirements, sometimes lowering the upfront cash needed for qualified buyers.

It is essential for property buyers to compare property type, location, and financing optionsbefore committing. A clear understanding of down payment ranges ensures that your savings strategy aligns with your desired property and prevents last-minute financial strain.

Factors Affecting Your Down Payment

Several key factors determine how much you need to pay upfront when buying a property. Understanding these variables allows buyers to plan strategically, maximize financing options, and avoid unexpected hurdles.

1. Buyer Financial Profile

Your income, savings, and credit score play a central role in down payment requirements. Higher-income buyers or those with substantial savings may be able to provide a larger upfront payment, which can reduce monthly mortgage obligations. Likewise, a strong credit score improves your credibility with banks, potentially allowing for lower down payment schemes or better loan terms. Conversely, limited savings or a lower credit score may require additional time to accumulate the necessary funds.

2. Lending Institution Policies

Different lenders—banks versus in-house developer financing—set distinct down payment requirements.

Banks

Typically require 20%–30% for condos or 10%–20% for houses and lots, often with structured installment plans. Banks also evaluate your debt-to-income ratio, employment stability, and credit history.

Developers

Many offer flexible DP schemes, including staggered payments or promotional discounts. Some high-demand projects may even allow lower initial payments if you meet certain eligibility criteria.

3. Government Housing Programs

Government initiatives can significantly influence down payment amounts. Notable programs include:

Pag-IBIG Fund

Offers affordable housing loans with lower DPs, especially for first-time buyers and OFWs.

National Housing Authority (NHA) & NHMFC

Target low- to middle-income buyers, often providing subsidized or deferred down payment schemes.

These programs make property ownership more accessible and can reduce the upfront cash needed for Metro Manila buyers.

4. Property Market Trends

Finally, market conditions affect down payment requirements. In hot markets like Makati, BGC, and Ortigas, developers may demand higher DPs to secure committed buyers and manage inventory. In slower-moving areas, developers may offer lower DPs or flexible schemes to attract buyers. Monitoring local property trends ensures your down payment strategy aligns with current market realities.

The combination of personal financial readiness, lender policies, government programs, and market conditions determines the final down payment amount. Careful planning and comparison across these factors maximize your buying power and reduce financial strain.

Financing Options to Meet Down Payment Requirements

Saving for a down payment can feel challenging, especially in a competitive property market, but multiple financing options can help buyers meet this critical requirement. Understanding each option allows you to choose the most strategic path while maintaining financial stability.

1. Personal Savings

Using your own savings is the most straightforward approach. It allows full control over your funds and avoids additional interest or obligations. To make this work effectively:

- Start saving early and consistently.

- Open a dedicated savings account or short-term investment to earn interest.

- Track your progress against your target down payment.

Pros: No interest, full control, flexible timing.

Cons: Requires disciplined savings and may take longer for high-priced properties.

2. Assistance from Family or Relatives

Some buyers leverage financial help from family members, which can supplement personal savings and accelerate property acquisition. This is especially common for first-time buyers or young professionals.

Pros: Low or no interest, faster accumulation of funds.

Cons: Potential family pressure or expectations; requires clear agreements.

3. Private Loans

Private lenders or informal loans can provide quick access to funds for down payments. However, interest rates are usually higher than banks or government programs, and repayment terms can be strict.

Pros: Fast access, flexible eligibility.

Cons: Higher interest, higher financial risk, less regulation.

4. Government Programs

Government-backed initiatives significantly reduce the financial burden of down payments:

Pag-IBIG MP2 Savings Program

Allows accumulated savings to be used toward housing loan down payments.

Pag-IBIG Housing Loans

Offer low DP requirements, particularly for first-time buyers and OFWs.

These programs make property acquisition more accessible while offering structured and secure financing.

Pros: Lower DP requirements, favorable interest rates, structured repayment.

Cons: Application processes may take longer, eligibility criteria must be met.

5. Developer/Deferred Payment Schemes

Many Metro Manila developers provide flexible payment schemes, such as installment plans or deferred payments until turnover. These promotions are common in condominiums and new residential projects.

Pros: Lower initial cash requirement, flexible schedule, promotional benefits.

Cons: May lock you into specific units or developers; total cost may be higher.

Financing Options Comparison Table

| Financing Option | Pros | Cons | Typical Eligibility/Notes |

|---|---|---|---|

| Personal Savings | Full control, no interest | Requires discipline, may take longer | Anyone with sufficient savings |

| Assistance from Family/Relatives | Fast accumulation, low/no interest | Family obligations, potential conflicts | Depends on family support |

| Private Loans | Quick access, flexible | High interest, higher financial risk | Depends on lender, income proof may be required |

| Government Programs (Pag-IBIG MP2, Housing Loan) | Lower DP, favorable terms | Application time, eligibility requirements | First-time buyers, OFWs, Pag-IBIG members |

| Developer / Deferred Payment | Low initial cash, flexible schedule | Possible higher total cost, unit restrictions | Offered by developers on select projects |

Why Meeting Down Payment Requirements Matters

Meeting your down payment (DP) obligations is more than a contractual step—it directly influences your ability to secure financing, reduce costs, and strengthen your position as a buyer. Understanding these benefits helps you approach the property purchase strategically and confidently.

1. Loan Approval Benefits

Banks and lending institutions evaluate down payments as a key measure of financial reliability. A timely and sufficient DP demonstrates your capacity to commit, increasing the likelihood of loan approval. For first-time buyers, this credibility can be crucial becausee banks prefer borrowers who show strong financial preparedness.

2. Securing Favorable Interest Rates and Terms

A higher or on-time down payment can translate into lower interest rates, reduced amortizations, and better loan-to-value ratios. In Metro Manila, where property values are high, even a 5–10% difference in DP can save buyers hundreds of thousands of pesos in interest over the life of a housing loan.

3. Negotiation Leverage During Purchase

Meeting the required down payment signals seriousness to developers and sellers, giving you leverage in negotiations. Buyers who are ready with their DP are more likely to access unit upgrades, discounts, or preferential payment schemes, especially in new condominium projects or high-demand residential areas.

4. Long-Term Financial Planning Impact

Paying the appropriate DP helps buyers plan their finances realistically. By reducing the principal loan amount, you lower monthly amortizations and create room for other expenses such as furnishing, moving costs, and emergency funds. Proper DP planning ensures your property purchase does not compromise your long-term financial stability.

Planning and Budgeting for Your Down Payment

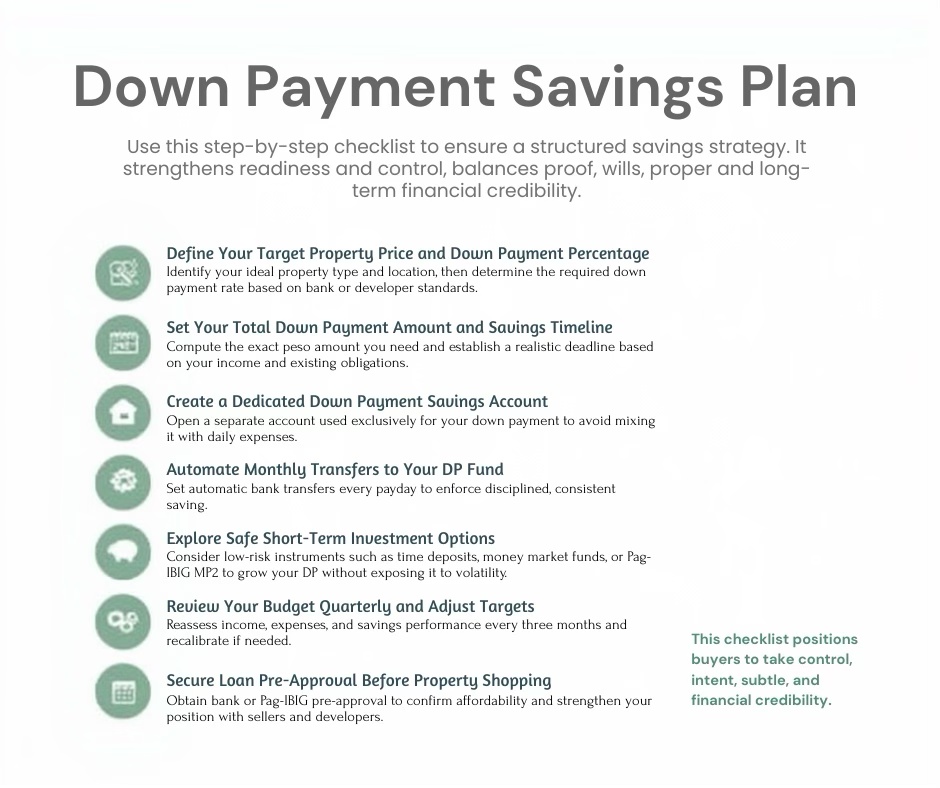

A down payment is not something you save casually. It requires deliberate planning, disciplined budgeting, and a clear financial timeline. Buyers who treat down payment preparation as a structured project are far more likely to secure their target property without financial strain.

1. Set a Realistic Savings Goal

Start by identifying your target property price and the required down payment percentage. From there:

- Compute the exact peso amount you need to save.

- Set a target timeline—12 months, 24 months, or longer.

- Break the total into monthly savings targets that are measurable and achievable.

For example, a PHP5 million condominium with a 20% down payment requires PHP1 million. Over 24 months, that means saving roughly PHP41,700 per month.

2. Budget for the Realities of Life

Property buyers face high living costs, transportation expenses, and existing financial obligations. A realistic budget must account for:

- Rent or current housing expenses

- Utilities and daily living costs

- Debt repayments and family responsibilities

Allocate a fixed percentage of your monthly income strictly for down payment savings. Treat this as a non-negotiable financial commitment, not a discretionary expense.

3. Use Smart Savings and Investment Strategies

Accelerate your savings through structured tools:

- Automatic bank transfers to a dedicated down payment account.

- Short-term investment instruments such as time deposits or Pag-IBIG MP2 to earn modest returns while preserving capital.

- Separate your down payment fund from daily spending accounts to avoid accidental use.

Consistency beats intensity. Small, regular deposits compound into purchase-ready capital.

4. Prepare for Loan Pre-Approval Early

Pre-approval strengthens your financial readiness and clarifies how much you can realistically afford. Before applying:

- Organize income documents and tax records.

- Review your credit standing and existing debts.

- Simulate monthly amortizations based on different down payment scenarios.

Pre-approval aligns your savings goal with actual bank lending limits, preventing over- or under-saving.

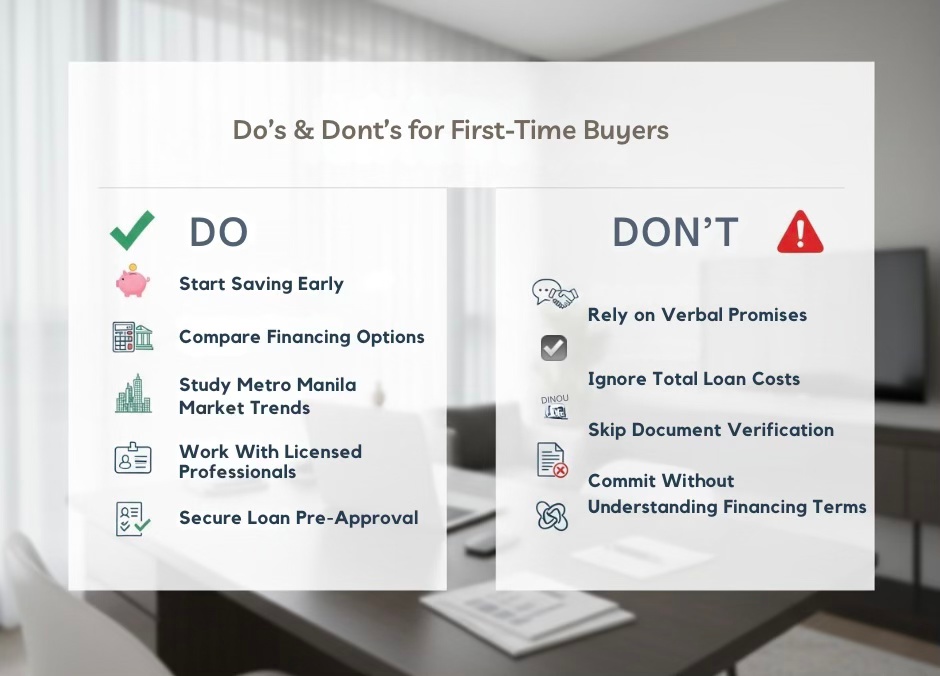

Practical Tips for First-Time Buyers

First-time property buyers face a steep learning curve. The market moves fast, financing rules are strict, and mistakes are expensive. The buyers who succeed are not the most aggressive—they are the most prepared. These practical strategies will help you enter the market with control and confidence.

1. Start Early and Set Clear Milestones

Begin preparing your down payment well before you start property hunting. Set concrete milestones such as:

- First 10% of your target down payment saved

- Completion of your first year of consistent savings

- Target date for loan pre-approval

Early preparation expands your options and reduces the pressure to accept unfavorable terms later.

2. Explore All Financing Avenues

Do not rely on a single financing source. Compare:

- Bank housing loans

- Pag-IBIG housing programs

- Developer in-house financing and deferred payment schemes

Each option carries different down payment requirements, interest rates, and approval standards. The best buyers evaluate these side by side before committing.

3. Research Property Market Trends

Study price trends, supply levels, and demand patterns in your target locations. Markets like Makati, BGC, and Ortigas behave very differently from Pasig, Cainta, or Parañaque. Understanding timing, price movement, and project pipelines allows you to:

- Identify good entry points

- Avoid overpriced developments

- Negotiate from an informed position

Market knowledge is leverage.

4. Work with Professional Real Estate Agents

A qualified real estate broker protects you from pricing errors, documentation risks, and poor project selection. In Metro Manila, where developers and offers vary widely, professional guidance often saves more money than it costs. Choose agents who:

- Are licensed and experienced

- Specialize in your target location or property type

- Can explain financing, taxes, and turnover processes clearly

5. Get Mortgage Pre-Approval Early

Pre-approval clarifies your real purchasing power before you commit to any unit. It helps you:

- Confirm how much you can borrow

- Avoid shopping beyond your budget

- Strengthen your credibility with developers and sellers

Buyers with pre-approval move faster and negotiate better.

Real-Life Examples / Case Studies

Real-world scenarios provide clarity that formulas and percentages cannot. These case studies reflect common buyer profiles and show how disciplined planning, the right financing strategy, and timely decisions turn intention into ownership.

Example 1: First-Time Buyer in Quezon City

A 28-year-old professional working in Eastwood targeted a PHP3.5 million condominium in Quezon City. With a required 20% down payment (PHP700,000), the buyer set a 24-month savings plan.

Key actions:

- Opened a dedicated down payment account and automated monthly savings.

- Used a time deposit to earn modest interest while preserving capital.

- Secured bank pre-approval six months before unit reservation.

Outcome:

The buyer completed the full down payment on schedule and qualified for a competitive bank housing loan, reducing long-term interest costs and securing the unit before prices increased.

Example 2: OFW Saving for a Makati Condominium

An overseas Filipino worker (OFW) planned to invest in a PHP6 million pre-selling condominium in Makati. The developer required a 25% down payment (PHP1.5 million) payable over 30 months.

Key actions:

- Allocated a fixed portion of monthly remittances to a Pag-IBIG MP2 account.

- Took advantage of the developer’s deferred payment scheme.

- Coordinated early with a local bank for loan pre-qualification.

Outcome:

By combining structured savings with a flexible developer scheme, the OFW completed the down payment without disrupting family remittances and secured a high-demand unit with strong rental potential.

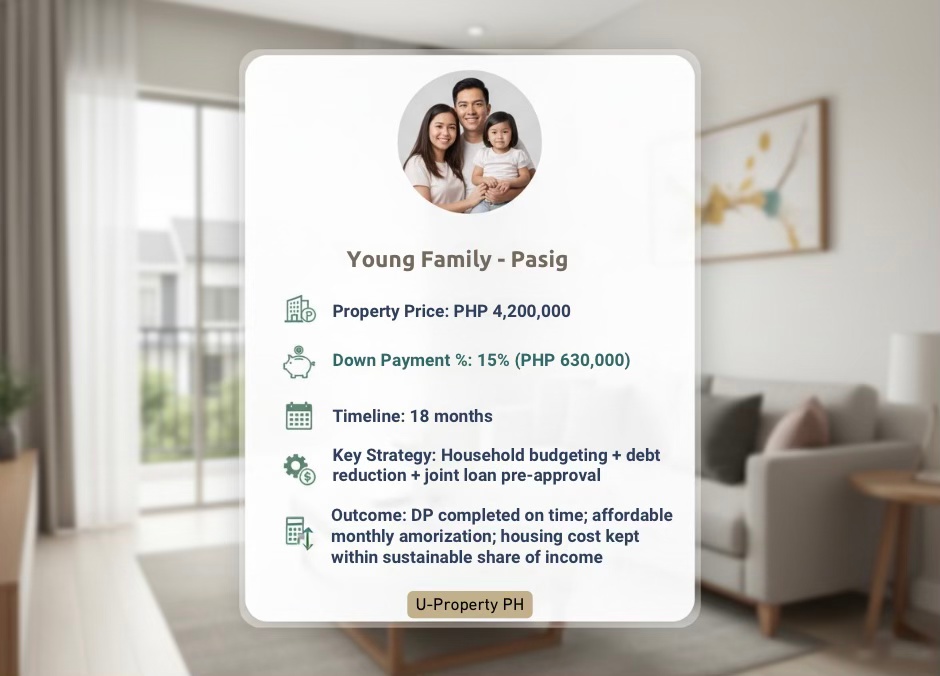

Example 3: Young Family Purchasing a Townhouse in Pasig

An overseas Filipino worker (OFW) planned to invest in a PHP6 million pre-selling condominium in Makati. The developer required a 25% down payment (PHP1.5 million) payable over 30 months.

Key actions:

- Created a household budget separating living expenses and DP savings.

- Reduced short-term debts to improve loan eligibility.

- Obtained joint loan pre-approval before selecting the unit.

Outcome:

The family met the full down payment within 18 months and secured affordable monthly amortizations, keeping their housing cost within a sustainable share of household income.

A down payment is not a simple entry fee—it is the foundation of your entire homeownership or investment strategy. Buyers who understand how down payments work, plan their savings deliberately, and budget with discipline position themselves for smoother transactions, stronger loan approvals, and long-term financial stability.

From knowing the right down payment range, to selecting the best financing option, to preparing for pre-approval, every step you take before signing a contract directly affects your future cash flow and investment returns. In a market where mistakes are costly and timing matters, preparation is your most valuable asset.

Now is the right time to act.

Consult a real estate professional, review your financing options, and begin your loan pre-approval process today. The earlier you prepare, the stronger your negotiating position—and the faster you move from planning to ownership.

Start Your Property Journey Today

Plan your down payment. Secure the right home. Avoid costly mistakes.

Leave a reply to 23 Must-Know Real Estate Terminologies in the Philippines for Effective Property Buying – U-Property PH Cancel reply