The rise in home prices across the Philippines slowed during the second quarter, as high interest rates dampened demand for housing loans, according to the Bangko Sentral ng Pilipinas (BSP).

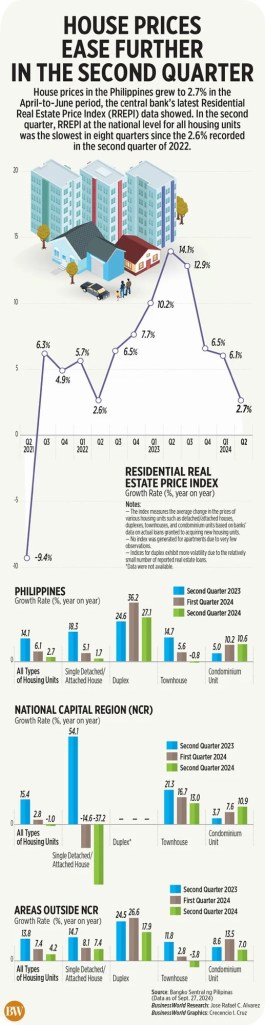

Nationwide prices of new housing units, tracked by the Residential Real Estate Price Index (RREPI), increased by 2.7% year-on-year for the period ending in June. This marked a significant slowdown from the 6.1% jump seen in the first quarter of the year.

However, on a quarter-on-quarter basis, home prices picked up slightly, growing by 1.8% compared to the 1.1% rise in the first quarter.

The RREPI, which reflects changes in prices based on bank data from actual mortgage loans for new housing units, doesn’t include pre-owned or foreclosed properties.

Condo Prices Surge, But Townhouses See Decline

Among property types, condominiums saw the largest year-on-year price increase, rising by 10.6% in Q2. Prices of single-detached/attached houses also grew, though at a more modest rate of 1.7%. Meanwhile, townhouse prices bucked the trend, dropping by 0.8%.

The slowdown in home price growth coincided with weaker demand for housing loans. The number of loans granted by banks fell 3.5% year-on-year in the second quarter, a sharp contrast to the 8.9% increase recorded in the first quarter.

On a quarter-on-quarter basis, home loans dropped by an even larger 15.1%, signaling the continued impact of the BSP’s previous interest rate hikes aimed at curbing inflation.

Inflation Eases, Loan Rates May Follow

Banks base their loan interest rates on the BSP’s policy rate, which has remained high to temper inflation by curbing demand. However, as inflation has started to cool and return to the BSP’s target range of 2% to 4%, the central bank began to ease rates, cutting the policy rate to 6.25% in August.

BSP Governor Eli Remolona Jr. has hinted at the possibility of further rate cuts later this year, signaling a potential boost for the housing market.

“The initial rate cut from the BSP, along with more reductions expected through 2025, should lead to lower mortgage rates and help revive demand for residential units across the country,” said Joey Bondoc, senior research manager at Colliers Philippines.

With lower borrowing costs on the horizon, potential homebuyers may find it more affordable to secure financing, which could spark renewed interest in the real estate market in the months ahead.

Leave a comment