A modern studio condo featuring minimalist design, complete with a bed, desk, and ample natural light from large windows in a vibrant urban setting.

A studio condo in a prime Metro Manila location. Clean. Furnished. Priced “reasonably.”

And yet—weeks pass. Messages trickle in. Viewings go nowhere. The unit sits. Quiet. Expensive silence.

That’s not a pricing problem. That’s a targeting failure.

Most studio condo owners in the Philippines don’t lose money because their units are bad. They lose money because they’re marketing to a renter who no longer exists—or worse, one who was never their best customer to begin with. The studio condo rental market moved. Renter behavior evolved. Owner assumptions didn’t.

Here’s the uncomfortable truth: the modern studio condo renter in the Philippines is not who most owners think they are. And when you design, price, and market your unit for the wrong person, vacancy becomes inevitable—no matter how “fair” the rent looks on paper.

This guide resets the lens. You’ll see who actually rents studio condos today, why they choose them deliberately, and how aligning your unit with the right renter profile leads to clearer positioning, faster leasing, and materially stronger returns. Less guessing. More control. Better cash flow.

Once you understand who the studio renter really is, every other decision—pricing, furnishing, marketing—suddenly becomes easier.

- The Studio Renter Myth That’s Costing Owners Money

- Who Actually Rents Studio Condos Today (Philippine Market Breakdown)

- Income Reality — What Studio Renters Actually Earn

- Lifestyle Drivers Fueling Studio Demand

- Location Beats Size—Every Time

- What Studio Renters Care About (And What They Ignore)

- Why This Matters Financially to Owners

- Marketing Studios the Right Way

- Costly Studio Owner Mistakes (Red Flags)

- Philippine Case Snapshots

- Where Studio Demand Is Headed (3–5 Year Outlook)

- Strategic Takeaways for Studio Owners

- Ready to Make Your Studio Work Smarter?

The Studio Renter Myth That’s Costing Owners Money

A visual comparison of old and modern studio renters, highlighting a shift from budget-driven, temporary living to a more intentional, convenience-driven lifestyle.

For years, studio condos in the Philippines have been marketed to a single imaginary person:

young, entry-level, budget-conscious, just starting out.

That renter used to exist. Today, they’re no longer the dominant demand driver—and clinging to that stereotype is quietly eroding returns across the studio condo rental market.

The old belief: studios are “starter rentals,” so they should be cheap, generic, and flexible enough for anyone.

The current reality: studios are now deliberate lifestyle choices made by renters with purchasing power, defined routines, and zero patience for poorly positioned units.

This disconnect shows up everywhere.

Owners price conservatively “to be safe.” They furnish defensively—too basic to excite, too cluttered to function. Listings speak vaguely to “students” or “young professionals,” assuming volume will solve everything. It doesn’t. Units blend into the noise. Serious renters scroll past. Vacancy stretches.

Studios don’t underperform because they’re small.

They underperform because they’re misunderstood.

And misunderstanding the renter is the fastest way to misunderstand the market.

How the Wrong Assumptions Hurt Performance

When owners assume studio condos are only for low-budget renters, three costly things happen—almost automatically:

- Pricing anchors too low, leaving money on the table or attracting renters who negotiate aggressively.

- Furnishing decisions miss the mark, prioritizing looks over daily function—or function without intent.

- Marketing becomes generic, failing to signal value to income-stable renters who are actively willing to pay more.

None of these mistakes look dramatic in isolation. That’s the danger. They compound quietly, month after month, until owners start blaming “market conditions” instead of strategy.

Where Studio Owners Commonly Go Wrong

These patterns show up repeatedly in underperforming studio listings:

- Defaulting to “students or entry-level workers” as the target renter

- Competing primarily on price instead of positioning

- Overfurnishing to “justify” rent instead of furnishing for renter behavior

- Writing listings that describe the unit, not the lifestyle it enables

- Ignoring micro-market demand (hospital zones, CBD clusters, transit corridors)

The studio condo market in the Philippines didn’t shrink. It segmented.

Owners who haven’t adjusted are simply speaking to the wrong audience—and wondering why no one is listening.

Once this myth collapses, the real renter picture comes into focus.

Who Actually Rents Studio Condos Today (Philippine Market Breakdown)

Studio demand in the Philippines didn’t weaken.

It fractured into clearer, more predictable segments.

Owners who still imagine one generic renter miss the real picture—and misprice, mis-market, and mis-position their units as a result. What actually drives absorption today is not volume demand, but fit.

Below are the renter groups consistently leasing studio condos across Metro Manila and major urban hubs—and why they matter to you as an owner.

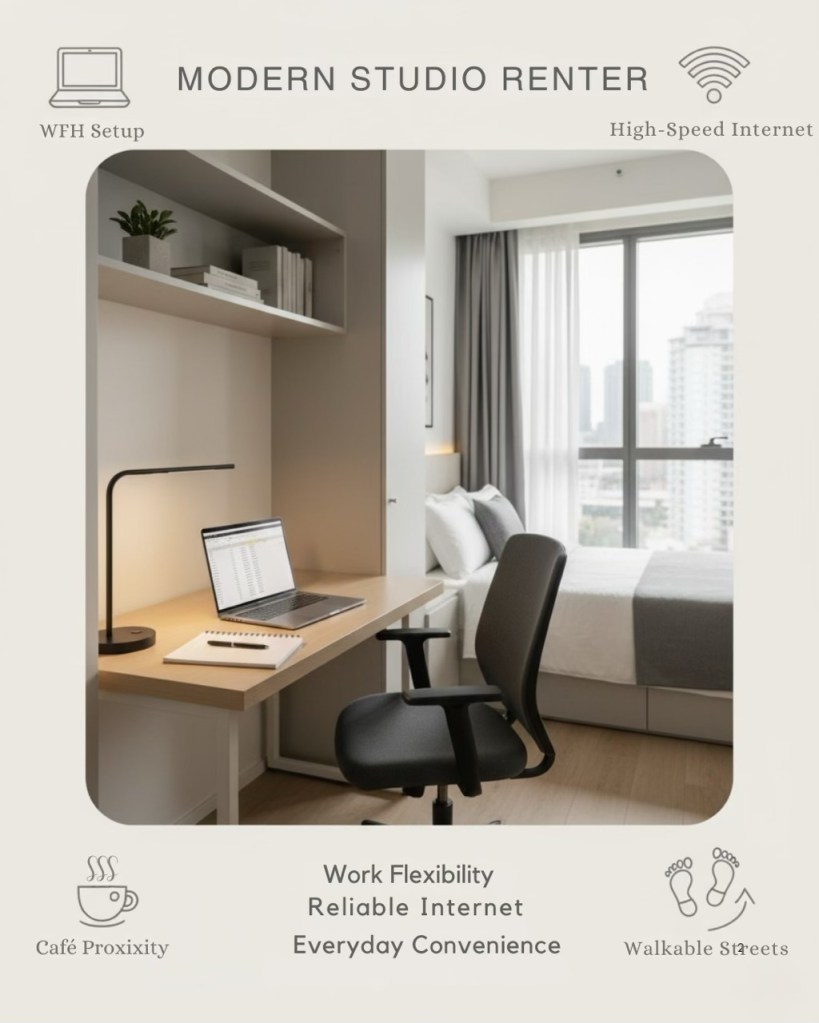

Remote & Hybrid Professionals

A modern studio designed for the intentional renter, featuring a workspace, high-speed internet, and convenient access to cafes and walkable streets.

This is no longer a niche. This is core demand in the modern studio condo rental market.

Who they are

- BPO team leads and mid-level managers

- Offshore professionals working for US, AU, and EU companies

- Freelancers, consultants, creatives, and digital specialists

They earn well. They manage their own time. And they have zero interest in paying for space they don’t use.

Why studios work for them

- Studios support a single-occupant, workstation-first lifestyle

- Lower maintenance equals more usable time and less mental clutter

- Savings from space efficiency are redirected to lifestyle—cafés, gyms, travel, flexibility

Many could afford a 1BR. They simply choose not to.

Location preferences

- BGC, Makati CBD, Ortigas Center

- QC growth nodes (Vertis North, Eastwood, UP–Katipunan fringe)

- Cebu IT Park and similar IT-centric districts

For this segment, what matters isn’t size. It’s reliable internet, walkability, and predictable quiet.

Owner implication: If your studio isn’t positioned as WFH-ready, you’re invisible to this renter—even if your rent is competitive.

Transition Renters (The Silent Majority)

A visual representation of the journey from life transition to leasing a modern studio, highlighting the evolution of living spaces.

This is the most underestimated—and most stable—studio renter group.

Who they are

- Professionals promoted or reassigned to a new city

- Individuals coming out of long-term relationships or marriages

- Buyers waiting for condo turnover or finalizing a home purchase

They don’t browse endlessly. They decide quickly.

Why studios fit perfectly

- Studios function as strategic pause housing

- No emotional attachment to size—only speed, privacy, and location

- Faster move-in, fewer decisions, lower friction during life transitions

They value optional permanence: flexibility without instability.

Lease expectations

- Typically 6–12 months

- Willing to pay slightly higher rent for:

- Furnished, turnkey units

- Flexible renewal terms

- Clean, neutral interiors

These renters are not bargain hunters. They are time buyers.

Owner implication: Flexibility and clarity outperform discounts for this segment.

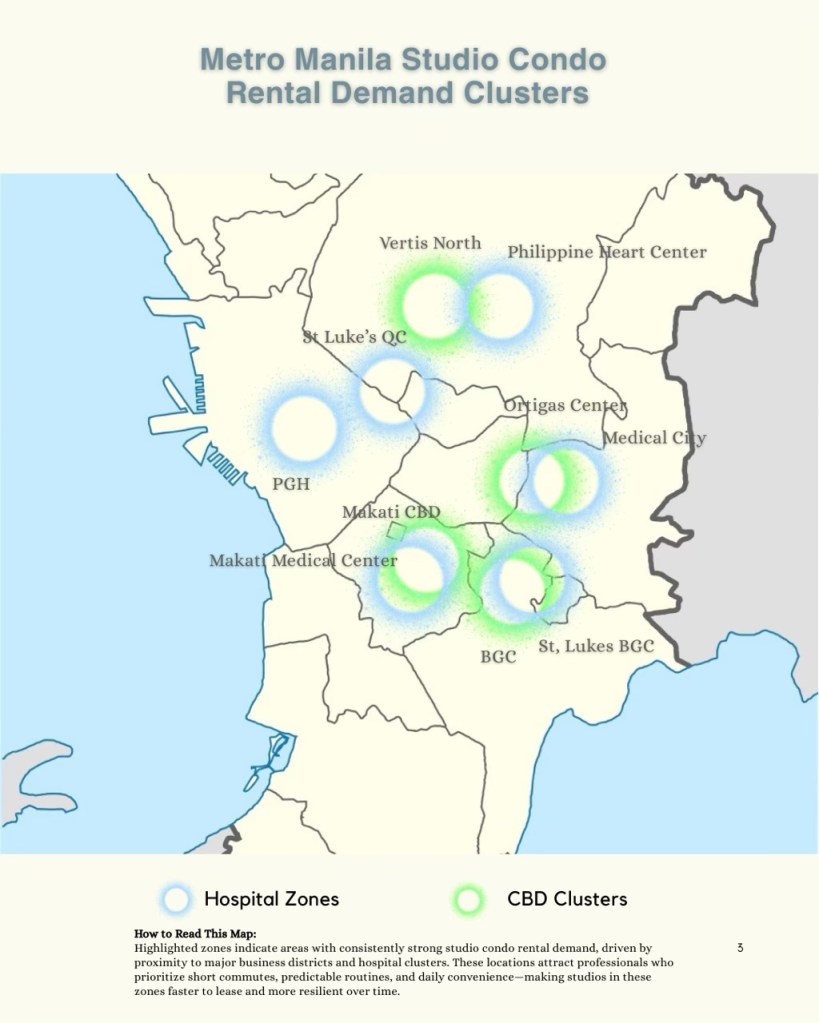

Medical & Legal Professionals

A map highlighting key rental demand clusters for studio condos in Metro Manila, indicating areas with strong demand due to proximity to business and hospital districts.

For this group, proximity isn’t a preference. It’s a requirement.

Where demand concentrates

- Hospital clusters (PGH, St. Luke’s, Makati Medical Center, The Medical City, Chong Hua)

- Law firm zones in Makati, BGC, and Ortigas

Residents, fellows, junior associates, and newly promoted professionals all share one priority: short commutes and reliable rest.

Willingness to pay

- Above-average tolerance for rent premiums

- Low sensitivity to unit size

- Zero tolerance for noise, unreliable elevators, or weak management

Furnishing priorities

- Comfortable bed and blackout curtains

- Quiet, efficient air-conditioning

- Smart storage

- Neutral, calming interiors

Flashy décor doesn’t impress them.

Function and silence do.

Owner implication: If your studio is near a hospital or CBD but marketed generically, you’re underselling its real advantage.

Project-Based & Corporate Renters

A detailed comparison of studio and 1-bedroom units outlining factors like lease flexibility, total occupancy cost, and turnover speed for short-term corporate rentals.

These renters are underrepresented in listing data—but overrepresented in performance results.

Who they are

- Consultants, auditors, engineers, and project managers

- Expat specialists on fixed-term assignments

- Corporate secondees and regional staff

They arrive with clear timelines, predictable budgets, and decision authority.

Lease length patterns

- Commonly 3–12 months

- Fast decision cycles

- Strong preference for furnished, turnkey units

Why studios outperform 1BRs here

- Lower total occupancy cost for short stays

- Faster cleaning and turnover

- Easier furnishing standardization

- Better alignment with temporary occupancy needs

For this segment, studios aren’t compromises.

They’re optimized tools.

Owner implication: Studios positioned correctly often outperform larger units on net yield in this category.

The Pattern Owners Should Notice

Across all these segments, one reality keeps repeating:

- Studios are no longer “cheap alternatives”

- They are intentional urban living solutions

- Demand is driven by convenience, control, and clarity—not budget desperation

Owners who understand this stop chasing tenants.

They start attracting the right ones.

Once this renter profile becomes clear, the next misconception collapses quickly:

income reality versus renter choice.

Income Reality — What Studio Renters Actually Earn

A detailed income-to-rent ratio chart displaying the relationship between studio rental prices and monthly income ranges in Metro Manila.

Let’s dismantle the most expensive misconception in studio investing:

Studio renters are not low-income renters by default.

In Metro Manila today, a significant portion of studio condo renters earn well above what’s required to afford larger units. They stay in studios by choice—not constraint. And pricing a unit based on imagined financial limits is how owners quietly sabotage returns.

This is not a theory. It’s a pattern repeated across the studio condo rental market in the Philippines.

What Studio Renters Actually Earn (Philippine Context)

Based on prevailing leasing behavior in CBDs and high-demand growth nodes, studio renters typically fall into these income brackets:

₱60,000–₱90,000/month

Senior BPO staff, offshore professionals, early managers, medical residents

₱90,000–₱150,000/month

Remote specialists, consultants, legal associates, experienced freelancers

₱150,000+/month

Corporate secondees, expats on fixed-term contracts, high-skill project-based professionals

These renters are not stretching themselves thin. Many could comfortably lease a 1BR—or even a modest 2BR. They simply see no functional upside to paying for space they don’t use.

This is where owner assumptions break down.

Rent-to-Income Ratios in Metro Manila (What Actually Happens)

Professionals renting studios tend to be financially disciplined. Even when they can afford more, they rarely exceed a 25–30% rent-to-income ratio.

In practical terms:

₱18,000–₱25,000/month studios

→ Comfortable for ₱60,000–₱80,000/month earners

₱26,000–₱35,000/month well-positioned, furnished studios

→ Common for ₱90,000–₱120,000/month earners

₱36,000–₱45,000+/month premium CBD studios

→ Typical among ₱150,000+ income brackets

When owners price conservatively “to be safe,” they often undercut what the market is already willing to pay for clarity, convenience, and fit.

Affordability is not the ceiling. It’s the baseline.

Why Higher-Income Renters Still Choose Studios

Affordability does not equate to a preference for larger living spaces; many studio renters opt for smaller, intentional living environments.

This is the part many owners miss—and where pricing power is lost.

Higher-income studio renters are not downgrading.

They’re optimizing.

They choose studios because:

- Location and building quality outweigh square meters

- Extra space means extra cleaning, cooling, and furnishing costs

- One-person households don’t need spatial redundancy

- Time saved on maintenance has real economic value

For many professionals, a studio near work—or near life—beats a larger unit that quietly steals time every single day.

Studios align with intentional living, not financial limitation.

The Pricing Insight Owners Need to Absorb

When you price a studio as if your renter is barely scraping by, you attract:

- Negotiation-heavy lease cycles

- Budget-stressed tenants

- Higher turnover

When you price and position a studio for income-stable professionals, you attract:

- Faster decisions

- Cleaner tenancy

- Longer, more predictable occupancy

The unit didn’t change.

The renter you’re speaking to did.

Once income reality is clear, the lifestyle logic behind studio demand becomes impossible to ignore.

Lifestyle Drivers Fueling Studio Demand

Key lifestyle benefits of modern studio living: time saved, reduced commute, building security, and lifestyle simplicity.

Studio demand isn’t being pushed by affordability alone.

It’s being pulled—hard—by how people now live, work, and value their time in dense Philippine cities where friction is expensive and convenience compounds daily.

What looks like a “small unit decision” is actually a lifestyle strategy.

Convenience Economics: The Hidden Math Renters Do Daily

Modern studio renters run quiet calculations constantly:

- Minutes lost in traffic

- Energy spent maintaining unused space

- Mental load from clutter, logistics, and friction

Studios win because they minimize all three.

Living closer to work, cafés, gyms, and essentials often costs more per square meter—but less per day lived. Renters understand that paying a premium for proximity saves money elsewhere: transport costs, food delivery, time lost to commuting, and even stress-related burnout.

Once renters experience this trade-off, they rarely reverse it.

Convenience isn’t emotional. It’s economic.

Time Over Space: The New Urban Currency

In Metro Manila, time—not space—is the scarcest asset.

Studios convert spatial efficiency into time dividends.

For single professionals:

- Less space means faster cleaning

- Smaller layouts simplify daily routines

- Fewer possessions reduce decision fatigue

A studio doesn’t feel restrictive when life happens outside the unit. It becomes a base, not a container.

This is why larger units in worse locations struggle—while smaller units in the right micro-markets lease faster and renew more often.

Security, Walkability, and Transit Access

Studio renters disproportionately value predictability and personal safety.

They gravitate toward:

- Buildings with consistent security protocols

- Walkable neighborhoods with lighting, sidewalks, and active streets

- Transit-adjacent locations that reduce dependence on private cars

In real terms, renters will willingly trade 5–10 square meters for:

- A safe walk home at night

- A five-minute commute instead of forty

- Access to daily needs without planning logistics

Studios don’t cluster where land was cheapest.

They cluster where urban life actually works.

Minimalist Living Isn’t a Trend—It’s a Response

Minimalism in Philippine cities isn’t aesthetic. It’s adaptive.

Rising costs, smaller households, delayed family formation, and mobile careers have pushed renters toward intentional ownership. Studios support that mindset naturally:

- Storage is curated, not excessive

- Furniture earns its place

- Layout efficiency matters more than décor volume

This isn’t about deprivation.

It’s about control.

For many renters, a well-designed studio feels calmer, more efficient, and more aligned with how they want to live now—not someday.

What Owners Should Read Between the Lines

Studio renters aren’t asking for “less.”

They’re asking for better alignment—with their time, routines, and priorities.

Owners who understand this stop marketing studios as compromises. They start positioning them as purpose-built urban solutions.

Once lifestyle logic is clear, one factor starts to outweigh everything else: location.

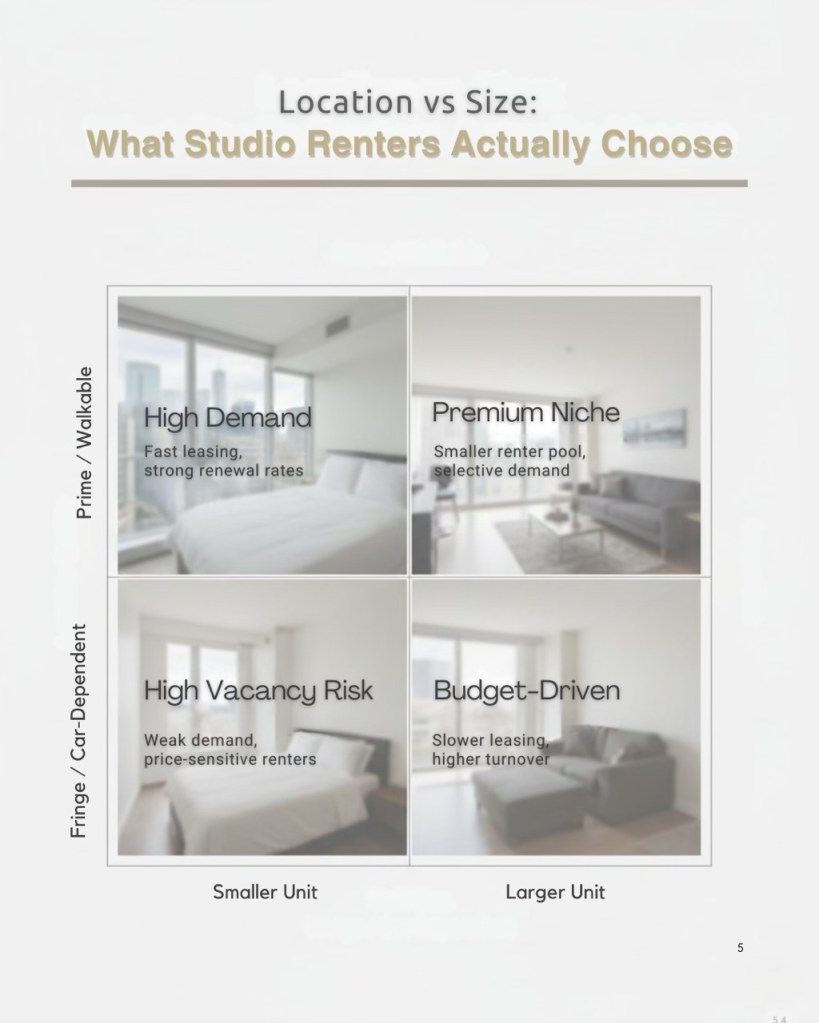

Location Beats Size—Every Time

A comparison chart illustrating the trade-offs between location and size for studio renters in urban settings.

When studios underperform, owners instinctively blame size.

The market almost never does.

In Philippine urban rental markets, location overwhelms floor area—consistently and predictably. A well-located 22-sqm studio will outperform a poorly located 35-sqm unit almost every time. Not occasionally. Systematically.

This isn’t preference. It’s behavior.

CBD vs Fringe: The Trade-Off Renters Actually Make

Studio renters don’t compare square meters in isolation. They compare daily friction.

In CBDs like BGC, Makati, and Ortigas:

- Short commutes convert directly into usable hours

- Walkability replaces transport planning

- Lighting, security, and density reduce mental load

Fringe locations offer:

- Larger units at lower rents

- Longer, less predictable commutes

- Higher dependence on cars or multi-modal transport

For studio renters, the choice is straightforward:

less space for more life outside the unit.

This is why studios command premium rents in CBDs—and why similarly sized units struggle when pushed into locations that demand long travel times or car ownership.

Transit-Oriented Demand Is Non-Negotiable

Studios perform best where mobility is effortless.

High-performing studio zones cluster around:

- MRT/LRT stations and major bus corridors

- Walkable office districts

- Mixed-use developments with daily needs on the ground level

Transit access doesn’t just widen the renter pool. It accelerates decision-making. Renters move faster when logistics are solved before they even step inside the unit.

Studios away from transit can still work—but only if they offer exceptional compensating value. Most don’t.

Micro-Markets That Consistently Absorb Studios

Certain locations continue to absorb studios regardless of broader market noise:

University belts

Not just students—faculty, graduate researchers, visiting lecturers, and administrative professionals who value proximity and quiet.

Hospital zones

Residents, fellows, nurses, and allied professionals with erratic schedules and zero tolerance for long commutes.

Office clusters

CBDs, IT parks, and consulting hubs where proximity directly improves daily quality of life.

These renters prioritize predictability. Studios near these nodes integrate seamlessly into their routines.

Why Studios Fail in the Wrong Location

Studios struggle when:

- The neighborhood requires a car

- Amenities are fragmented or distant

- Security feels uncertain

- The unit becomes a place you only sleep in—and rush out of

In these environments, renters start asking the question studios can’t survive:

“If I’m already commuting this far, why not get a bigger unit?”

Once that question enters the equation, the studio loses—regardless of furnishing or price.

The Owner Reality Check

Studios are unforgiving assets.

They don’t hide location weaknesses behind extra bedrooms or flexible layouts. In the right micro-market, studios lease fast, renew well, and command strong rent-to-size ratios. In the wrong one, they sit—no matter how nicely furnished or competitively priced.

Size is negotiable.

Location is not.

What Studio Renters Care About (And What They Ignore)

An informative chart highlighting what studio renters value, including reliable fiber internet and smart storage, alongside common spending pitfalls like oversized furniture and unnecessary décor.

This is where many studio owners quietly lose money.

Not on rent discounts.

On furniture, features, and upgrades that look impressive—but deliver zero rental return.

Studio renters are ruthlessly practical. Their space is small by design, which means everything inside the unit must earn its place. Anything that compromises function, comfort, or calm becomes a liability—not a perk.

What Studio Renters Care Deeply About

These factors directly affect leasing speed, renewal likelihood, and rent tolerance.

Internet reliability

For remote professionals and corporate renters, unstable internet isn’t an inconvenience—it’s a deal-breaker. Clear fiber availability, consistent signal strength, and router-ready layouts immediately separate viable studios from non-starters.

Noise control

Studios amplify sound. Hallway noise, street traffic, thin walls, or mechanical hums become unbearable much faster in small spaces. Renters will pay more for:

- Quieter floors

- Better window sealing

- Calm, well-managed buildings

Storage efficiency

Square meters matter less than how intelligently they’re used. Vertical shelving, under-bed storage, built-ins, and clean layouts outperform larger but inefficient units. Order equals ease—and ease rents.

Building management quality

Elevator reliability, security enforcement, maintenance response, and rule consistency matter more in studios because renters are often single occupants. A poorly managed building instantly drags down perceived unit value—no matter how polished the interior looks.

Owner insight: In studios, the building rents the unit as much as the furniture does.

What Studio Renters Care Very Little About

These are classic high-cost, low-impact owner mistakes.

Oversized sofas

They consume floor area, restrict movement, and signal poor layout planning. Renters prefer compact, modular seating—or none at all.

Excess décor

Wall art, throw pillows, ornaments—these don’t rent studios. They clutter them. Studios lease faster when renters can mentally project their own routines into the space.

Rarely used amenities

Pools, lounges, and function rooms look good on brochures but rarely justify higher rent if the renter won’t realistically use them. Studios win on daily utility, not aspirational extras.

The Furnishing Rule Studio Owners Should Adopt

Before spending on anything, ask one question:

Does this reduce friction or increase rent tolerance?

If it doesn’t:

- Improve daily comfort

- Save time

- Or make the unit easier to live in

…it probably doesn’t increase rent or reduce vacancy.

Studios reward intentional investment, not decorative spending.

Why This Matters Financially to Owners

A visual representation illustrating the sequential process of how effective studio strategies translate into increased returns through targeting, positioning, pricing, and lease speed.

Everything discussed so far—renter psychology, lifestyle choices, location sensitivity—collapses into one unavoidable outcome: money.

Studios don’t succeed or fail emotionally.

They succeed or fail financially based on how accurately you align the unit with the renter who’s actually willing to pay.

When alignment is right, studios feel easy. When it’s wrong, the bleed is quiet—and relentless.

Vacancy Risk: The Cost of Misalignment

Vacancy is rarely bad luck. It’s a diagnostic signal.

When a studio is marketed to the wrong renter:

- Inquiries come in, but conversions don’t

- Viewings happen, but decisions stall

- “I’ll think about it” becomes the default response

Each extra vacant month costs more than lost rent. It compounds:

- Mortgage or opportunity cost

- Association dues

- Utilities and upkeep

- Wear from repeated viewings

In Metro Manila, a 30-day delay on a ₱30,000/month studio quietly wipes out the impact of multiple annual rent increases.

The unit didn’t fail.

The message did.

Pricing Power: Where Studios Quietly Win

Pricing power doesn’t come from being the cheapest listing.

It comes from being the clearest fit.

Well-positioned studios routinely:

- Lease at rents comparable to poorly positioned 1BRs

- Outperform larger units on net yield due to faster turnover

- Experience fewer renegotiations at renewal

When renters feel the unit fits their routine, price resistance drops. They stop comparing square meters. They compare friction.

This is where many owners get uncomfortable—but the numbers are consistent:

- Larger units in the wrong location sit longer

- Smaller, well-targeted studios stabilize faster

Speed is a form of profit.

Furnishing ROI: Spend With Intent or Don’t Spend at All

Studios magnify bad spending decisions.

Every peso spent should answer one question:

Does this reduce vacancy or increase rent tolerance?

High-ROI studio investments:

- Reliable internet infrastructure

- Noise mitigation

- Smart storage solutions

- Durable, neutral furnishings

Low-ROI investments:

- Decorative upgrades without functional value

- Oversized furniture

- Amenity-based rent justification

Owners who overspend to “justify” rent often do the opposite—they narrow the renter pool and slow leasing.

Studios reward precision, not generosity.

The Financial Chain Reaction Owners Should Internalize

Targeting determines positioning.

Positioning determines pricing power.

Pricing power determines lease speed.

Lease speed determines returns.

Break the chain at any point, and performance collapses.

Marketing Studios the Right Way

Studio rental mockup copy before the upgrade is applied.

Studio rental mockup copy after the upgrade is applied.

Most studio listings don’t fail because the unit is unattractive.

They fail because the marketing tries to appeal to everyone—and convinces no one.

Studios demand precision marketing. The right message doesn’t just attract attention; it pre-qualifies the renter who already feels aligned before they ever schedule a viewing.

Listing Copy: Stop Describing the Unit. Start Signaling the Fit

Generic listings read like inventory.

Effective studio listings read like solutions.

Instead of leading with:

- Square meters

- Furniture lists

- Amenity dumps

Lead with use-case clarity.

High-performing studio listings:

- Signal lifestyle outcomes (“walk to work,” “quiet floor,” “WFH-ready”)

- Imply the renter profile without naming it outright

- Emphasize friction removal (commute, setup time, daily maintenance)

The goal isn’t more inquiries.

It’s better ones.

When renters recognize themselves in the copy, price resistance drops before the viewing even happens.

Photo Priorities: Function Over Flair

Studio photos must answer one silent renter question:

“Will this work for my daily life?”

What to prioritize:

- Clear layout flow (sleep, work, movement)

- Natural light at usable times of day

- Storage solutions and visual breathing space

- Window orientation, privacy cues, and noise buffers

What to avoid:

- Aggressive wide-angle distortion

- Decorative clutter

- Amenity photos that don’t affect daily routines

Studios lease faster when photos reduce uncertainty—not when they try to impress.

Platform Strategy: Match the Medium to the Renter

Different studio renters search differently. Relying on one channel is a self-inflicted bottleneck.

Property portals

Best for corporate renters and relocation-driven tenants. These renters filter hard and decide fast.

Facebook Marketplace & niche groups

Effective for remote professionals and transition renters—especially with lifestyle-forward copy and clean visuals.

Broker networks

Still highly effective for medical professionals, legal associates, and project-based renters who value speed and discretion.

The mistake isn’t using multiple platforms.

The mistake is using the same message everywhere.

Language That Converts Today’s Renter

Modern studio renters respond to:

- Clarity

- Confidence

- Specificity

They ignore:

- Sales hype

- Generic superlatives

- Amenity overload

Effective language frames the studio as:

- Easy

- Predictable

- Purpose-built

Not as a compromise.

Not as a “great deal.”

But as a smart decision.

When renters feel the unit was designed for them—not merely available to them—leasing friction disappears.

The Quiet Advantage of Getting Marketing Right

Good studio marketing doesn’t just lease units faster.

It filters out bad-fit tenants before they inquire.

That saves:

- Time

- Negotiation fatigue

- Future turnover risk

And that’s where real performance lives.

Costly Studio Owner Mistakes (Red Flags)

Key mistakes studio owners make that can lead to financial loss.

Studios rarely underperform because of one catastrophic decision.

They fail through small, reasonable choices that quietly compound into long vacancies, weak pricing power, and constant frustration.

When alignment is right, studios feel easy. When it’s wrong, the bleed is quiet—and relentless.

These are the red flags that separate studios that struggle from studios that stay consistently leased.

Targeting Students by Default

This is the most common—and most limiting—assumption studio owners make.

Students are not the dominant studio renter in most CBDs and growth nodes. When owners default to them, they unintentionally:

- Underprice units unnecessarily

- Normalize high turnover

- Design layouts around short-term occupancy

Worse, marketing explicitly to students repels income-stable professionals who associate student-heavy properties with noise, instability, or lax management—even if those fears aren’t always accurate.

Studios positioned for professionals will still attract students organically.

Studios positioned only for students repel almost everyone else.

Competing Only on Price

Price competition is a race studios are structurally bad at winning.

When owners drop rent instead of fixing positioning:

- Inquiries increase, but renter quality declines

- Negotiations multiply

- Renewals weaken

Studios perform best when rent reflects clarity of fit, not desperation. Renters who feel the unit matches their lifestyle argue less and stay longer. Renters who come for discounts leave the moment a cheaper option appears.

Lower rent doesn’t guarantee faster leasing.

Better targeting does.

Ignoring Building Reputation

Studios amplify building problems.

Elevator delays, weak security, inconsistent enforcement, and poor maintenance might be tolerated in larger family units. In studios, they become deal-breakers. Single occupants notice everything.

Owners often focus inward—on furniture, paint, décor—while ignoring the first thing many renters research:

- Building management quality

- Security consistency

- Resident profile

A well-furnished studio inside a poorly managed building still underperforms. Every time.

Overfurnishing to “Justify” Rent

It isn’t unlucky. It’s misaligned.

Studios don’t forgive strategic drift. They reward focus.

Owners add:

- Oversized sofas

- Extra cabinets

- Decorative clutter

Philippine Case Snapshots

Theory persuades. Outcomes convince.

Below are three Philippine studio scenarios drawn from repeatable market patterns, not edge cases. Different locations. Different renter segments. Same takeaway: small strategic shifts outperform big cosmetic changes.

Case 1: BGC Studio Repositioned

A repositioned studio condo in Bonifacio Global City, emphasizing remote work readiness and a lifestyle-focused approach.

Location: Bonifacio Global City

Unit: 28 sqm studio

Problem: Prolonged vacancy despite “competitive” rent

What was happening

The unit sat vacant for over a month. The owner assumed demand was soft and prepared to discount.

What was wrong

- Marketed as a “great deal for young professionals”

- Amenity-heavy listing with no daily-use clarity

- Photos highlighted décor, not layout or work setup

What changed

- Repositioned toward remote and hybrid professionals

- Copy emphasized walkability, quiet floor, and WFH readiness

- Photos refocused on desk space, daylight, and storage flow

Outcome

- Rent: ₱38,000/month (unchanged)

- Vacancy: Cut from 32 days to 7 days

- Tenant: Offshore professional, 12-month lease

Insight: The unit didn’t need a lower price. It needed a clearer message.

Case 2: QC Hospital-Area Studio

A detailed overview of a studio condo in Quezon City, highlighting revised rent and strategic changes to attract medical professionals.

Location: Near a major Quezon City hospital

Unit: 24 sqm studio

Problem: Frequent turnover and short stays

What was happening

Despite below-market rent, the unit cycled through tenants quickly.

What was wrong

- Generic listing aimed at “students or employees”

- No emphasis on proximity or noise control

- Furnishings favored style over rest and function

What changed

- Targeted medical residents and allied professionals

- Copy highlighted 5-minute walk, quiet hours, blackout curtains

- Furnishings simplified to support sleep and recovery

Outcome

- Rent: Increased from ₱17,000 to ₱20,000/month

- Vacancy: Stabilized with consecutive 12-month renewals

- Tenant: Medical resident

Insight: Stability increased when the unit matched the renter’s routine.

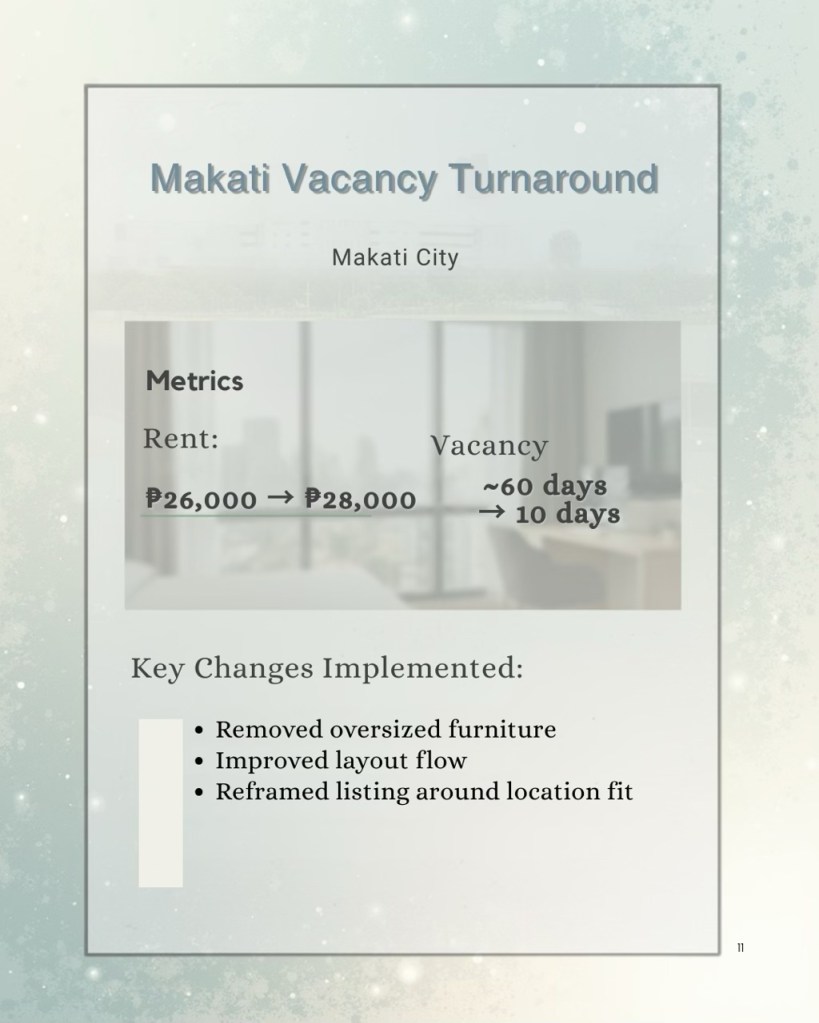

Case 3: Makati Vacancy Turnaround

Overview of the successful turnaround for a studio unit in Makati City, highlighting key metrics and improvements.

Location: Makati fringe, near office clusters

Unit: Studio unit

Problem: Nearly two months vacant

What was happening

The owner blamed competition from nearby 1BR units.

What was wrong

- Competing on price against larger units

- Oversized furniture choking usable space

- Listing copy framed the unit as “smaller but cheaper”

What changed

- Removed unnecessary furniture to open the layout

- Reframed the unit as a strategic base near offices and transit

- Updated photos to emphasize flow and simplicity

Outcome

- Rent: ₱28,000/month (up from ₱26,000)

- Vacancy: Filled in 10 days

- Tenant: Consultant on a 6-month project lease

Insight: Studios lose when compared on size. They win when positioned on fit.

What These Cases Have in Common

- No major renovations

- No aggressive discounting

- No reliance on timing luck

Just clear renter alignment, sharper messaging, and disciplined execution.

Studios don’t need reinvention.

They need repositioning.

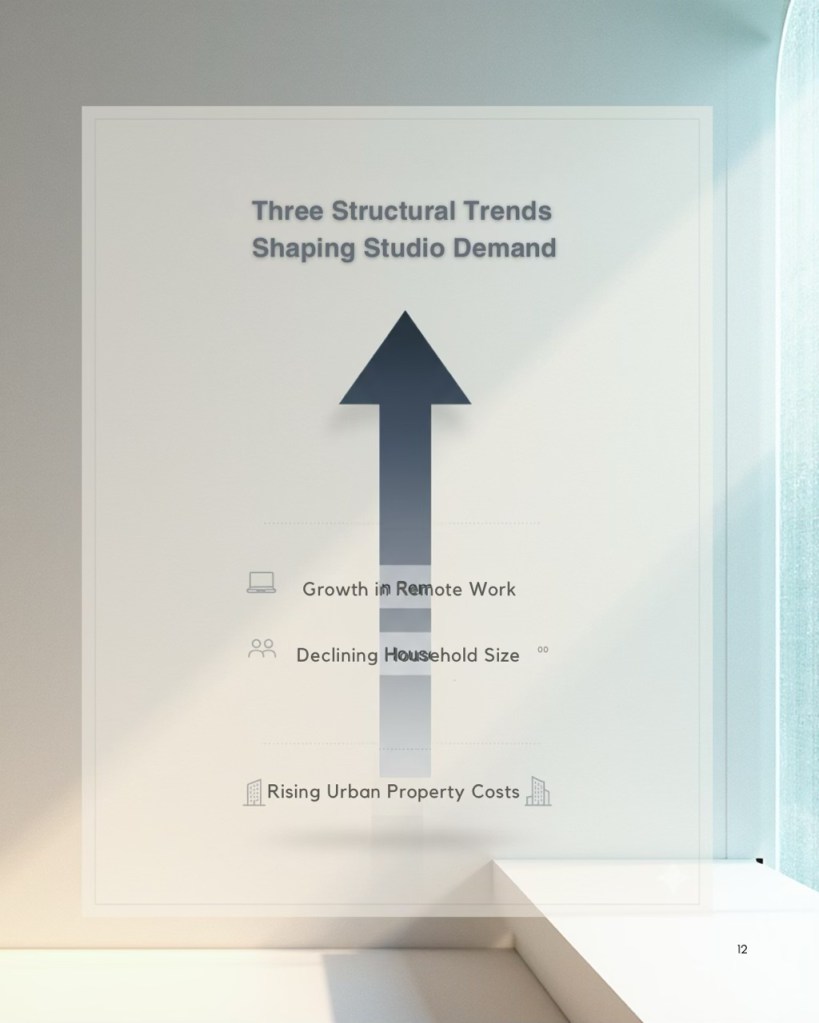

Where Studio Demand Is Headed (3–5 Year Outlook)

Key trends transforming studio rental demand: growth in remote work, declining household size, and rising urban property costs.

Studio demand isn’t a short-term reaction to market noise.

It’s the logical outcome of structural shifts that are already locked in.

Over the next three to five years, these forces won’t reverse. They’ll compound.

Owners who prepare early will experience smoother leasing and stronger pricing power. Owners who don’t will keep adjusting late—and wondering why results lag.

Remote Work Isn’t Reversing—It’s Normalizing

The Philippines has firmly established itself as a global remote-work and offshore talent hub. What started as a contingency has matured into standard operating reality.

What this means for studio condos:

- More income-stable, location-flexible renters

- Higher demand for WFH-ready layouts

- Greater tolerance for premium rents tied to reliability and convenience

Remote professionals don’t want more space. They want control over their day.

Studios deliver that efficiently—when positioned correctly.

Smaller Households Are Becoming the Norm

Delayed marriage, later family formation, and continued urban migration are shrinking average household sizes in Metro Manila and regional CBDs.

This directly favors:

- Single-occupant units

- Flexible, low-commitment housing

- Studios positioned as viable long-term homes—not temporary stopgaps

Studios aligned with professional lifestyles are already seeing longer average tenancy. This trend will accelerate.

Rising Land and Condo Prices Reinforce Efficiency

As land values rise and development costs increase, developers respond predictably:

- Smaller unit sizes

- Higher per-square-meter pricing

- Greater emphasis on location and mixed-use access

Studios aren’t shrinking because demand is weak.

They’re shrinking because efficiency is becoming non-negotiable.

For owners holding well-located studios, this creates a quiet advantage: replacement supply becomes more expensive, while demand remains resilient.

What Studio Owners Should Future-Proof Now

The next winners won’t be the cheapest listings.

They’ll be the least frictional ones.

Smart future-proofing focuses on:

- Internet infrastructure that supports remote work

- Layouts that balance work, rest, and movement

- Neutral, timeless interiors that age well

- Positioning that speaks to professionals—not transient renters

Studios that feel intentional today will feel necessary tomorrow.

The Strategic Outlook

Studios are no longer entry-level rentals.

They’re urban efficiency assets.

Owners who treat them that way will experience steadier occupancy, stronger pricing discipline, and fewer surprises as the market evolves.

Strategic Takeaways for Studio Owners

This isn’t a market you “wait out.” It’s a market you read correctly.

Studios didn’t suddenly become harder to rent. They became easier to misunderstand. Owners still operating on outdated assumptions feel squeezed. Owners who adjusted their lens are quietly outperforming—without working harder or discounting more.

Here’s what actually matters.

Studios Are No Longer “Starter Rentals”

The idea that studios are entry-level housing is obsolete.

Today’s studio renter is intentional, income-stable, and selective. They aren’t renting studios because they can’t afford more. They’re renting them because studios fit how they live now.

When you position a studio as temporary or budget-driven, you attract renters who behave that way—short stays, constant negotiation, higher turnover.

When you position it as purpose-built urban living, you attract renters who pay on time, renew, and respect the unit.

The story you tell determines the tenant you get.

Positioning Beats Size—Every Single Time

Square meters don’t lease units. Fit does.

A clearly positioned studio in the right micro-market will outperform a larger unit that’s vaguely marketed almost every time. Renters don’t compare floor plans in isolation. They compare friction—commute time, noise, convenience, and daily ease.

Owners who obsess over size miss the lever that actually moves demand.

Rising Land and Condo Prices Reinforce Efficiency

Studios reward owners who:

- Understand who they’re really renting to

- Invest only in high-ROI improvements

- Market with clarity instead of volume

These owners lease faster, negotiate less, and experience longer, more predictable tenancies.

Those who don’t adapt keep adjusting price—and wondering why nothing changes.

The Bottom Line

Studios are not forgiving assets. But they are highly predictable ones.

Read the renter correctly. Position the unit precisely. And the numbers follow.

Ready to Make Your Studio Work Smarter?

If your studio has ever:

- Sat longer than it should

- Attracted plenty of inquiries but few serious decisions

- Needed discounts just to move

…it’s not a market problem.

It’s a strategy gap.

Before you change the rent again—or add another piece of furniture—pause and reassess who your unit is actually built for and whether your current positioning speaks to today’s renter reality.

Get a Clear Studio Strategy—Without the Sales Pressure

You don’t need another generic listing tweak.

You need an outside, objective view that looks at what really drives performance:

- Renter fit and targeting accuracy

- Location and micro-market dynamics

- Pricing logic and rent tolerance

- Furnishing ROI (what’s helping vs what’s hurting)

- Marketing clarity across platforms

That’s exactly what a focused studio audit or short strategy call is designed to do.

Two Simple Ways to Start

Download the Studio Performance Checklist

A concise, owner-ready checklist that most people complete in under 10 minutes—and immediately see what’s holding their unit back.

Request a Short Strategy Consultation

A no-pressure conversation to realign your studio for faster leasing, cleaner tenancy, and stronger long-term returns.

Leave a comment