Purchasing a home is a significant milestone that requires careful financial planning. To navigate this complex process, utilizing a mortgage calculator can be invaluable in understanding your potential financial commitments.

Understanding Mortgage Calculators

A mortgage calculator is an online tool designed to estimate your monthly mortgage payments and the total cost over the life of the loan. By inputting details such as loan amount, interest rate, loan term, and down payment, you can gain insights into how these variables influence your financial obligations. For instance, the BDO Home Loan Calculator offers a user-friendly interface to compute potential loan packages.

Practical Examples

Consider you’re contemplating a mortgage of ₱3,000,000. Using a mortgage calculator, you can experiment with different interest rates and loan terms to observe their impact on monthly payments. A 30-year fixed-rate mortgage may yield lower monthly payments compared to a 15-year term, but it results in paying more interest over time. Tools like the PNB Mortgage Calculator can assist in visualizing these differences.

Common Mistakes to Avoid

When utilizing mortgage calculators, be mindful of the following pitfalls:

- Overlooking Additional Costs: Many calculators focus solely on principal and interest, neglecting expenses like property taxes, homeowner’s insurance, and mortgage insurance. These can significantly affect your monthly payments.

- Inputting Inaccurate Information: Ensure all data entered is precise. Misrepresenting your income, expenses, or loan details can lead to misleading results.

- Ignoring Different Mortgage Types: Various mortgage options exist, such as fixed-rate and adjustable-rate mortgages. Not considering these can result in choosing a less suitable loan for your situation.

Diverse Scenarios

Mortgage calculators are versatile tools applicable to various financial situations:

- First-Time Homebuyers: Assess affordability and understand the financial commitment involved.

- Refinancing Homeowners: Evaluate potential savings by comparing current loans with new terms.

- Investment Properties: Analyze profitability by estimating mortgage expenses against potential rental income.

Real-Life Scenario

Consider Juan, a prospective homeowner in the Philippines:

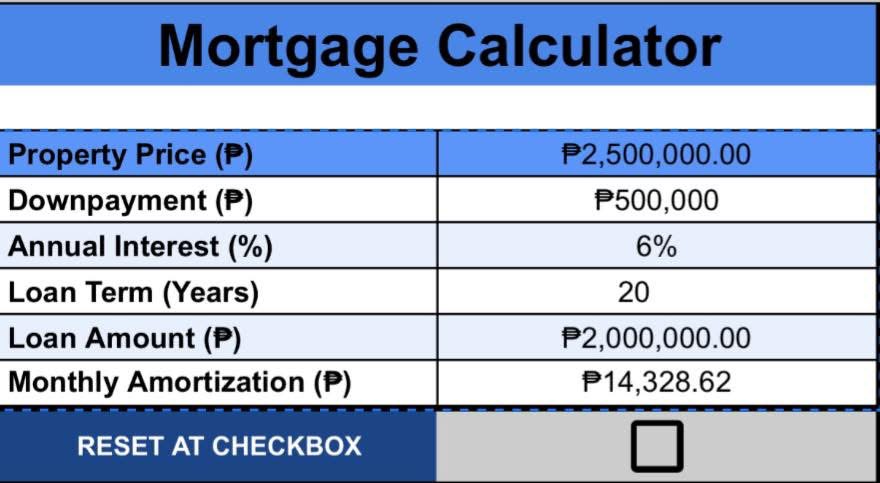

- Scenario: Juan plans to buy a house priced at ₱2,500,000 with a 20% down payment.

- Calculation: Using a mortgage calculator, he inputs a loan amount of ₱2,000,000 (after down payment), a 6% interest rate, and a 20-year term.

- Outcome: The calculator estimates his monthly payment at approximately ₱14,328, helping Juan assess affordability.

Conclusion

Integrating mortgage calculators into your home-buying process empowers you to make informed financial decisions. By accurately inputting data and considering all associated costs, you can better prepare for the responsibilities of homeownership. Explore tools like the Pag-IBIG Housing Loan Affordability Calculator to begin your journey toward owning your dream home.

Have you used a mortgage calculator in your home-buying journey? Share your experiences or questions in the comments below to help others navigate this crucial step.

Leave a comment