Purchasing a foreclosed property in the Philippines can be a strategic move to acquire real estate at a reduced cost. However, it’s crucial to approach this venture with thorough research and preparation to navigate potential pitfalls and maximize benefits.

Purchasing a foreclosed property in the Philippines presents a significant opportunity to acquire real estate, potentially yielding cheap houses or valuable assets below standard market rates. It can be a strategic real estate investment in the Philippines. However, navigating this path requires careful research and preparation to avoid potential pitfalls and truly benefit from the reduced cost. This guide provides essential steps for beginners.

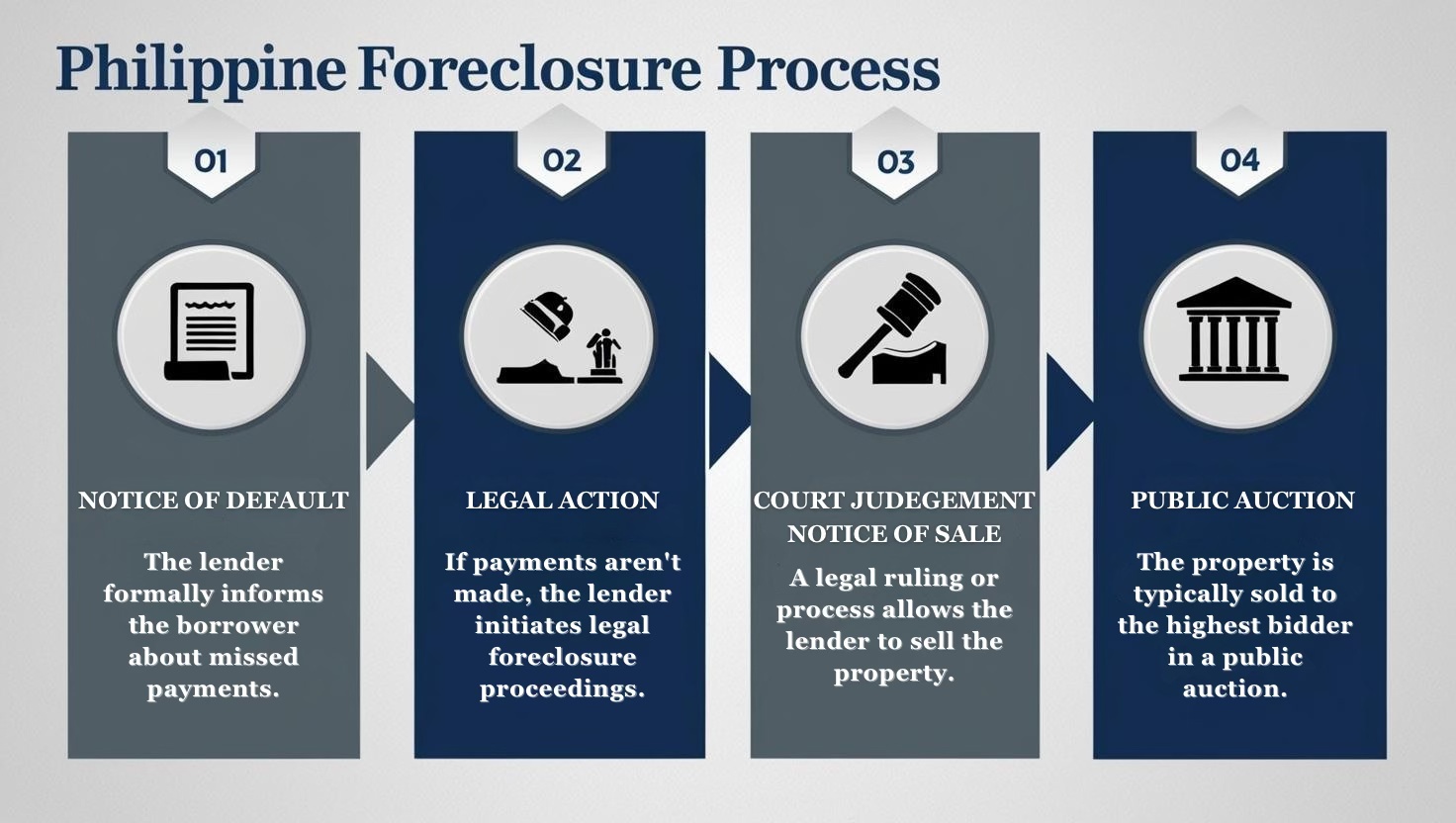

Understanding the Foreclosure Process in the Philippines

Foreclosure happens when a borrower defaults on their mortgage payments. The lender (often a bank or government entity like the Pag-IBIG Fund) reclaims the property to recover the outstanding debt. While specifics can vary, the general foreclosure process in the Philippines involves:

- Notice of Default: The lender formally informs the borrower about missed payments.

- Legal Action: If payments aren’t made, the lender initiates legal foreclosure proceedings.

- Court Judgment (for Judicial Foreclosure) / Notice of Sale (for Extrajudicial Foreclosure): A legal ruling or process allows the lender to sell the property.

- Public Auction: The property is typically sold to the highest bidder in a public auction.

Note: Procedures differ slightly between judicial and extrajudicial foreclosure, and depending on the lender (e.g., major banks like BDO, BPI, Metrobank, or government agencies like the Pag-IBIG Fund). Research the specific type of foreclosure relevant to the property you’re eyeing.

Where to Find Foreclosed Property Listings in the Philippines

Finding opportunities is the first step. Key sources include:

- Major Banks: Most Philippine banks have dedicated portals for their foreclosed properties (often called Acquired Assets or ROPOA – Real and Other Properties Owned or Acquired). Check the websites of banks like:

- BDO: BDO Real Estate Assets for Sale

- BPI: BPI Foreclosed Properties

- Metrobank: Metrobank Properties for Sale

- Security Bank: Security Bank Foreclosed Properties for Sale

- RCBC: RCBC Bank-Owned Properties for Sale

- PNB: PNB Foreclosed Properties

- Government Agencies:

- Pag-IBIG Fund: Pag-IBIG Fund Acquired Assets (This page lists properties for auction and negotiated sale)

- SSS (Social Security System): SSS Acquired Assets (SSS lists housing and other acquired assets available for sale here, though listings may be less frequent or comprehensive compared to Pag-IBIG)

- Property Portal: Real.ph – Foreclosed Properties (Real.ph is one example of a property portal in the Philippines with a dedicated section for foreclosed listings). Many other large portals like Lamudi also list foreclosed properties, which you can typically find using their search filters.

Evaluating Location: A Key Factor for Philippine Real Estate Investment

A property’s location is paramount to its current value and future appreciation potential. When considering buying foreclosed homes in the Philippines, assess:

- Proximity to Amenities: Accessibility to schools, hospitals, markets, malls, and public transport routes.

- Neighborhood Safety & Reputation: Research local crime statistics and community feedback. Read How to Check the Perfect Neighborhood in the Philippines: A Homebuyer’s Guide

- Future Development Plans: Quezon City Comprehensive Land Use Plan (CLUP) This page on the official Quezon City Government website provides access to their CLUP, which outlines the city’s long-term spatial strategies, development goals, land use policies, and proposed circulation networks (infrastructure). This is the type of resource where you’d find information on planned developments that could impact property value.

Crucial Due Diligence for Buying Foreclosed Homes

Thorough research is non-negotiable before committing. “As-is, where-is” is a common condition for foreclosed sales, meaning you accept the property in its current state.

Verifying the Property Title (Clean Title Check)

- Ensure the property has a “clean” title – free from unexpected claims (liens), restrictions (encumbrances), or legal issues (lis pendens). Obtain a Certified True Copy of the Title from the Registry of Deeds. Land Registration Authority Website

Investigating Property History and Occupancy

- Research past ownership. Crucially, determine if the property is vacant or still occupied. Dealing with previous owners or tenants can involve legal processes and delays. Check for unpaid real estate property taxes (Amilyar) and association dues. Understanding Property Taxes and Other Hidden Costs of Buying a Home in the Philippines

Conducting Market Value Comparison

- Compare the asking price with similar properties recently sold in the same area. This helps determine if you’re getting a fair deal, even considering potential repair costs.

Case Study: A buyer securing a bank foreclosed property discovered significant unpaid real estate taxes only after purchase, adding unexpected costs. Thorough due diligence during the checking period could have revealed this.

Why a Professional Home Inspection is Non-Negotiable

Foreclosed properties might suffer from neglect. A professional inspection is vital before finalizing your purchase, especially for bank foreclosed properties often sold “as-is”.

- Structural Integrity: Check foundation, walls, roofing for damage.

- Essential Systems: Assess electrical wiring, plumbing, and HVAC functionality.

- Pest Issues: Look for termites (anay), rodents, or other infestations.

Recommendation: Hire a licensed and reputable home inspector. Their detailed report can identify hidden problems and serve as a basis for negotiation (though negotiation room on foreclosed properties can be limited). Philinspect Property Inspection Services

Considering Energy Efficiency for Long-Term Savings

While assessing immediate repairs, consider long-term running costs.

- Appliance Age: Older air conditioners or refrigerators consume more power.

- Insulation: Check roof and wall insulation quality.

- Lighting: Outdated fixtures can be replaced with energy-saving LEDs.

Statistic: Simple habits like unplugging devices when not in use can save Filipino households significant amounts annually on electricity bills. Check Department of Energy.

Debunking Common Myths About Foreclosed Properties

- “Foreclosed Automatically Means Dirt Cheap”: While often priced below market, factor in substantial repair costs, potential legal fees, and unpaid dues.

- “All Foreclosures Are Bad Investments”: Many are excellent opportunities if you perform diligent research and understand the risks.

- “Immediate Possession After Auction”: Occupancy issues or required legal steps can delay your ability to move in or utilize the property.

Key Takeaways for Aspiring Foreclosed Property Buyers

- Research Widely: Understand the specific foreclosure process and investigate potential listings from banks and Pag-IBIG foreclosed properties.

- Inspect Thoroughly: Never skip a professional inspection to uncover hidden costs.

- Verify Everything: Conduct rigorous due diligence on the title, taxes, and occupancy status.

- Analyze Location: Evaluate the neighborhood’s long-term potential.

- Budget Realistically: Account for repairs, taxes, and potential delays beyond the purchase price.

Ready to Explore Foreclosed Properties?

Equipping yourself with knowledge is the best defense when buying foreclosed properties in the Philippines. Consult with real estate professionals familiar with foreclosures, legal advisors, and certified inspectors.

What part of buying foreclosed properties in the Philippines seems most challenging to you? Share your thoughts or questions below, or contact us for personalized advice!Contact U-Property PH

Disclaimer: This guide provides general information for informational purposes only and does not constitute legal, financial, or real estate advice. Always consult with qualified professionals before making any real estate decisions.

Leave a comment