Purchasing a condominium in the Philippines is a significant life decision, often representing a major financial investment and a step towards stable homeownership. However, navigating the process requires careful consideration beyond just finding a property you like. This guide will walk you through the crucial factors to evaluate, helping you make an informed decision that aligns with your financial goals and lifestyle.

Let’s dive into the key elements you must consider before signing on the dotted line.

1. Location, Location, Location: Why it’s the Cornerstone of Your Condo Investment

In real estate, the mantra holds true, especially in the Philippines. A condo’s location dictates not only your daily convenience but also its potential for value appreciation.

Why Location Matters So Much:

- Accessibility & Commute: How close is the condo to your workplace, schools, family, and essential services? Consider traffic conditions during peak hours. Is it easily accessible via public transportation (LRT, MRT, buses, jeeps, or future infrastructure projects)?

- Proximity to Amenities: Are grocery stores, hospitals, banks, restaurants, parks, and entertainment options within easy reach? This significantly impacts your quality of life.

- Future Development: Research planned infrastructure projects, commercial developments, or zoning changes in the area. These can drastically increase (or sometimes decrease) property values over time.

- Neighborhood Vibe: Does the neighborhood feel safe? Is it bustling or quiet? Does it match your desired lifestyle?

🎯 Actionable Tip: Don’t just rely on online maps. Visit the location yourself at different times of the day and on various days of the week (weekday rush hour, weekend midday, evening) to get a real feel for traffic, noise levels, and the overall atmosphere. Talk to people in the neighborhood if possible.

📍Think about areas like Bonifacio Global City (BGC) in Taguig. What was once a military base has transformed into a premier mixed-use financial and lifestyle district. Early investors here saw substantial property value surges driven by strategic planning, infrastructure, and a concentration of businesses and amenities. Similarly, areas near new or expanding transport hubs often experience significant growth.

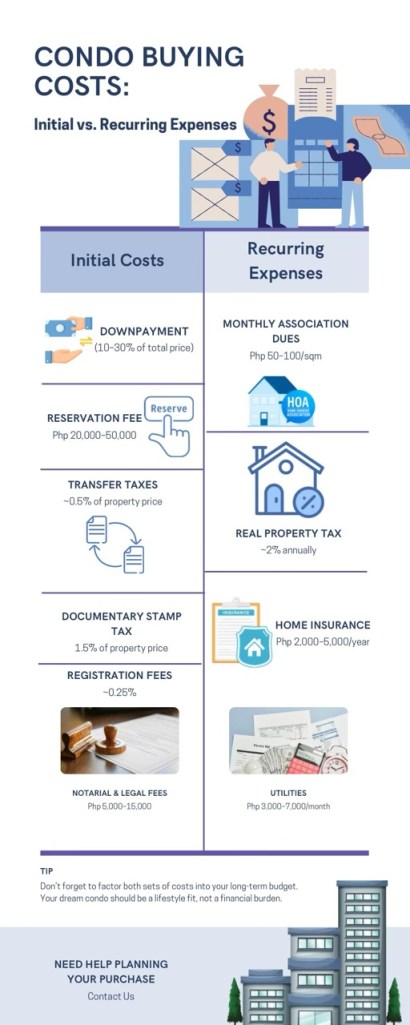

2. Understanding the True Cost of Condo Ownership: Beyond the Price Tag

Many first-time buyers focus solely on the selling price. However, there are several other significant expenses you need to factor into your budget.

Breakdown of Condo Costs:

| The Purchase Price | This is the base cost negotiated with the seller or developer. |

| Closing Costs & Taxes | Don’t forget these! They typically range from 4% to 8% of the property value and can include: Documentary Stamp Tax (DST) Transfer Tax Registration Fee IT Fee Miscellaneous Fees Notary Public Fee |

| Monthly Association Dues (or Condo Dues) | These are recurring fees paid to the Condominium Corporation to cover the maintenance, repair, and operation of common areas and facilities (lobby, elevators, amenities, security, garbage collection, staff salaries, etc.). These can vary significantly based on the building’s age, size, and amenities. |

| Real Property Tax (RPT) | Also known as “Amilyar,” this is an annual tax levied by the local government unit based on the assessed value of your unit and a portion of the common areas. You can often pay quarterly or annually. |

| Property Insurance | Lenders usually require fire insurance. It’s also wise to consider coverage for other risks. |

| Utilities | Electricity, water, internet, cable TV – factor in estimated monthly consumption. |

| Potential Special Assessments | Sometimes, the Condominium Corporation may levy additional fees for major repairs or unforeseen expenses (e.g., a major elevator replacement). |

| Maintenance & Repair within Your Unit | While the Condominium Corp handles common areas, you are responsible for repairs inside your unit. Budget for potential issues like plumbing leaks, appliance repairs, or renovations. |

🎯 Actionable Tip: Create a detailed budget checklist that includes all potential costs. Use online mortgage calculators (many Philippine bank websites offer these) to estimate monthly loan payments if financing. Inquire about the current and projected association dues.

📄 Resource: Check the websites of major Philippine real estate portals (Lamudi and Property24) to compare listing prices and sometimes find information on typical association dues for buildings. For property tax details, consult the website of the specific city or municipality’s Assessor’s Office where the condo is located.

3. Amenities: Enhancing Your Lifestyle (and Budget)

Condominiums often boast attractive amenities designed to enhance residents’ lifestyles. While these add value and convenience, they are also a primary contributor to higher monthly association dues.

Common Condo Amenities in the Philippines:

- Swimming Pool (Lap pool, kiddie pool)

- Gym or Fitness Center

- Function Room / Club House

- Playground or Kids’ Area

- Gardens or Landscaped Areas

- 24/7 Security & CCTV

- Concierge Services

- Parking (often sold or leased separately)

- Retail Spaces on the ground floor

Considerations:

| Do they align with your lifestyle? | If you never swim, is paying for a lavish pool area worth it? If you prefer working out outdoors, will you use the gym? |

| Are they well-maintained? | During viewings, check the condition of the amenities. Poorly maintained amenities can be a sign of issues with building management or financial health. |

| How do they impact dues? | More extensive or high-end amenities generally mean higher maintenance costs passed on to residents. |

🎯 Actionable Tip: Make a list of amenities that are “must-haves,” “nice-to-haves,” and “unnecessary” for you. Use this to help evaluate if the included amenities justify the cost.

4. Navigating Condo Rules and Regulations: Ensuring Harmonious Living

Living in a condominium involves sharing common spaces and adhering to community rules set by the Condominium Corporation and outlined in the Master Deed with Declaration of Restrictions (MDDR) and the House Rules. These rules are designed to ensure peaceful co-existence but can significantly impact your daily life.

Common Areas Covered by Rules:

- Pet Policy: Are pets allowed? If so, what are the restrictions (size, number, specific breeds)? This is a dealbreaker for many pet owners.

- Renovation Guidelines: What types of renovations are allowed? Are there restrictions on noise or working hours? Do you need permits or approvals?

- Noise Restrictions: Rules often govern noise levels, especially during certain hours.

- Use of Common Areas: Regulations on booking function rooms, using the pool or gym, guest policies, and visitor parking.

- Garbage Disposal & Recycling: Specific procedures for waste management.

- Leasing/Renting: If you plan to rent out your unit, are there minimum lease periods or requirements for tenants?

🎯 Actionable Tip: Request and thoroughly review the condominium’s House Rules and the relevant sections of the Master Deed before making an offer. Ensure these rules are compatible with your lifestyle and plans (e.g., if you plan to get a pet or rent out the unit).

5. Assessing Resale Potential and Market Dynamics: Investing for the Future

Even if you plan to live in your condo for a long time, considering its potential resale value is a smart part of the investment process. Market conditions and building factors influence how well your property retains or gains value.

Factors Influencing Resale Value:

- Location and Infrastructure: As mentioned, this is key. Areas with ongoing development, improved connectivity, and strong demand tend to appreciate more.

- Building Age and Maintenance: Older buildings can depreciate, but well-maintained ones in prime locations can hold value or even appreciate. Assess the overall condition and management of the building.

- Developer Reputation: Properties built by reputable developers with a track record of quality construction and timely project completion tend to have better resale value and command higher prices.

- Market Demand: What is the demand for condos in that specific area? Are there many new developments? Is the rental market strong (indicating potential for passive income or attracting future buyers)?

- Unit Condition & Upgrades: The state of your specific unit and any improvements you’ve made will impact its appeal to buyers.

📍 Condominiums in established central business districts like Makati City have historically shown strong resilience and appreciation in value due to sustained demand from businesses and residents, coupled with continuous infrastructure improvements and limited land supply.

6. Common Pitfalls First-Time Condo Buyers Should Avoid

Being aware of common mistakes can save you time, money, and stress.

| Common Pitfalls | How to Avoid |

|---|---|

| Overlooking the Total Costs: Focusing only on the list price and not budgeting for taxes, fees, dues, and other expenses. | Create a comprehensive budget checklist covering all potential costs mentioned in Section 2. |

| Neglecting Loan Pre-Approval: Not securing financing early can lead to delays, losing out on a desired unit, or discovering you can’t borrow as much as you thought. | Get pre-approved for a home loan by a bank before you start seriously looking. This clarifies your budget and makes you a more attractive buyer. |

| Ignoring Developer Reputation: Buying from a developer with a history of delays, construction issues, or poor management can lead to significant problems down the line. | Research the developer’s past projects, read reviews, check their track record with relevant government agencies (like the Department of Human Settlements and Urban Development – DHSUD, formerly HLURB), and talk to owners in their completed buildings if possible. |

| Underestimating Maintenance Fees: Failing to budget adequately for monthly association dues can strain your finances. | Get the exact amount of current dues and ask about any planned increases or special assessments. Factor this into your monthly housing budget. |

| Disregarding Resale Value: Buying solely based on current needs without considering future marketability can make it harder to sell later. | Evaluate the factors affecting resale potential (Section 5) and choose a property with good long-term prospects. |

| Skipping the Inspection: For pre-owned units, not having a professional inspection can leave you unaware of costly underlying issues. For new units, don’t neglect your punch list during turnover. | Hire a qualified inspector for resale units. For new units, be meticulous during the turnover inspection and document all defects. |

7. Useful Tools and Resources

Beyond the general advice, leverage available tools and professionals:

- Real Estate Portals: Websites like Lamudi.com.ph, Property24.com.ph, and FazWaz.ph are useful for Browse listings, comparing prices, and getting a feel for the market in different areas.

- Bank Websites: Use their online mortgage calculators and learn about loan requirements.

- Local Government Unit (LGU) Websites: Check the Assessor’s Office for property tax information and the Planning and Development Office for zoning or future infrastructure plans.

- Department of Human Settlements and Urban Development (DHSUD): Verify the developer’s license to sell and check for any complaints against them.

- Real Estate Professionals: Agents and brokers can provide invaluable local market knowledge, help you find properties, negotiate, and guide you through the complex paperwork.

Conclusion: Your Journey to Informed Condo Ownership

Buying a condominium in the Philippines is a significant investment that requires thorough due diligence. By carefully evaluating the location, understanding the true costs of ownership, assessing how amenities fit your lifestyle, reviewing the building’s rules, considering its resale potential, and being aware of common pitfalls, you equip yourself to make a smart and informed decision.

This process isn’t just about finding a place to live; it’s about securing an asset that can grow in value and provide a comfortable living environment for years to come.

Ready to take the next step?

Consult with a licensed and reputable real estate professional who specializes in the areas you are considering. They can provide personalized guidance.

Start exploring properties on trusted real estate portals armed with your newfound knowledge!

Investing wisely in a Philippine condominium can be incredibly rewarding. Happy house hunting!

Leave a comment