Nearly 4 out of 10 condo buyers in Metro Manila admit they regret their purchase within the first three years—and it’s rarely because of the paint color or the size of the unit. The problem is deeper: they bought without doing proper market research.

Condominium investing in the Philippines can be one of the most rewarding wealth-building strategies. Property values in hotspots like BGC, Makati, and Ortigas have shown steady appreciation, and rental demand continues to surge thanks to BPO workers, expats, and urban migration. But here’s the catch: the market is uneven. For every project that delivers strong returns, there’s another plagued by oversupply, high vacancies, or unsustainable fees.

That’s why market research isn’t optional—it’s the backbone of profitable condo investing. Knowing where demand is headed, which demographics are driving it, and how infrastructure projects shape values can mean the difference between a condo that pays you and one that drains you.

This guide is written with the Philippine investor in mind. We’ll break down the exact steps for analyzing local market conditions, historical trends, demographics, infrastructure, and projections—so you can buy with confidence, not guesswork.

Understanding Market Research in Condo Investing

When most people think of condo shopping, they picture open houses, glossy brochures, and hours scrolling through property portals. That’s not market research—that’s browsing. True market research in real estate is a systematic process of gathering, analyzing, and interpreting data to determine whether a condominium is positioned to deliver strong long-term returns.

Market research goes beyond asking, “Is this a nice unit?” It asks tougher, profit-driven questions:

- What are the price trends in this district over the last five years?

- How fast are similar units being absorbed in the market?

- Who exactly is renting or buying here—and is that demand sustainable?

- How do HOA fees and infrastructure projects affect net returns?

This distinction matters because casual browsing relies on impressions, while structured research relies on evidence. A sleek model unit may tempt you, but without data, you could be walking into a market already oversaturated with rentals or a community where appreciation has flatlined.

Skipping research isn’t just risky—it’s expensive. Investors who dive in blind often face:

- Missed appreciation opportunities by buying in stagnant areas instead of growth corridors like Alabang or Nuvali.

- High vacancies from choosing locations with weak rental demand, leaving units idle for months.

- Overpriced purchases where glossy marketing masked inflated valuations compared to nearby developments.

In short, market research is what separates speculation from strategy. It shifts you from buying on impulse to investing with foresight.

Study the Local Real Estate Market

Before you even consider a down payment, zoom out and study the real estate ecosystem of the area where your target condo sits. This isn’t about “liking the neighborhood” — it’s about understanding pricing, demand, and profitability dynamics that determine whether your condo investment will pay off.

Current Property Prices

The first step is knowing the baseline. What are condos actually selling for in the area? In the Philippines, reliable data can be sourced from:

- Bangko Sentral ng Pilipinas (BSP) Residential Real Estate Price Index (RREPI) – tracks nationwide condo price movements.

- Lamudi Market Reports and Property24 Trends – provide quarterly insights on average prices in Metro Manila and emerging cities.

- Developers’ disclosures – especially for pre-selling projects, which often show launch prices versus current selling prices.

Tracking prices ensures you don’t overpay and lets you spot areas where values are climbing faster than inflation.

Supply and Demand Dynamics

The Philippine condo market can shift quickly depending on supply pipelines. Always ask:

- How many projects are being launched in the same district?

- What’s the current absorption rate (how fast new units sell or rent out)?

- Are you buying into an RFO market with tight supply (higher rental potential) or a pre-selling-heavy market where oversupply risk looms?

For example, Manila’s Bay Area saw rapid condo launches from 2017–2019. Demand from offshore gaming firms initially absorbed supply, but when POGOs pulled back during the pandemic, vacancy rates spiked above 20%.

Rental Market Insights

For investors, rental yields are as important as appreciation. Some current market ranges (Colliers & Leechiu, 2024 data):

- BGC & Makati – 5–7% gross rental yields, driven by expats and corporate leases.

- Ortigas & Alabang – 4–6%, with steady demand from BPO employees and families.

- University Belts (Taft, Katipunan) – 6–8% but with higher tenant turnover.

Knowing these figures helps you project cash flow and benchmark realistic rental income.

Amenities & Lifestyle Drivers

In the Philippines, lifestyle amenities aren’t “extras”—they’re decision-drivers. Renters and buyers consistently prioritize:

- Proximity to malls and transport hubs (e.g., SM Aura, MRT stations).

- Strong security and management reputation (a non-negotiable for expats).

- Well-maintained gyms, pools, and co-working spaces, which are now standard in competitive urban condos.

A condo without lifestyle pull may stagnate in value, even if the location is central.

HOA & Maintenance Fees

Homeowners’ Association (HOA) fees can quietly erode rental returns. In Metro Manila, these range from ₱70–₱120 per sqm per month in most mid-market projects, while luxury towers in BGC and Rockwell can exceed ₱150–₱200 per sqm.

Mini Case Study: BGC vs. Ortigas HOA Fees

Take a 40 sqm 1-bedroom condo:

- BGC Luxury Tower – Selling price: ₱10M. HOA at ₱180/sqm = ₱7,200/month. Average rent: ₱55,000/month. Net rental yield: ~5.7%.

- Ortigas Mid-Market Condo – Selling price: ₱6M. HOA at ₱90/sqm = ₱3,600/month. Average rent: ₱30,000/month. Net rental yield: ~6.1%.

At first glance, BGC looks stronger because of premium demand. But when factoring in HOA fees, Ortigas units can actually deliver a higher net yield percentage—despite lower absolute rent.

This shows why market research must go beyond sticker prices and glossy amenities. It’s the fine print—like fees, demand drivers, and rental absorption—that determines real profitability.

Condo Market Snapshot: BGC vs Makati vs Ortigas

| Location | Average Condo Price (₱/sqm) | Typical 1BR Rent | Gross Rental Yield | HOA Fee Range (₱/sqm/month) | Net Yield Impact |

|---|---|---|---|---|---|

| BGC | ₱250,000–₱320,000 | ₱50K–₱60K | 5–7% | ₱150–₱200 | Higher rent, but HOA fees reduce net return |

| Makati CBD | ₱220,000–₱280,000 | ₱45K–₱55K | 5–6% | ₱120–₱170 | Balanced demand from expats & corporates |

| Ortigas Center | ₱150,000–₱190,000 | ₱28K–₱35K | 6–7% | ₱80–₱100 | Lower prices & fees = stronger % yields |

💡 Key Takeaway

Don’t be blinded by prestige pricing. While BGC and Makati deliver stable demand and high rental rates, Ortigas often outperforms in net yield thanks to lower purchase prices and HOA fees. For investors, that margin can mean the difference between a condo that just “pays for itself” and one that actively grows your wealth.

Analyze Historical Data and Trends

Condo prices in the Philippines don’t move in a straight line—they move in cycles influenced by inflation, interest rates, and overall demand. Understanding where you are in the cycle can be the difference between buying at peak pricing versus entering just before the next growth wave.

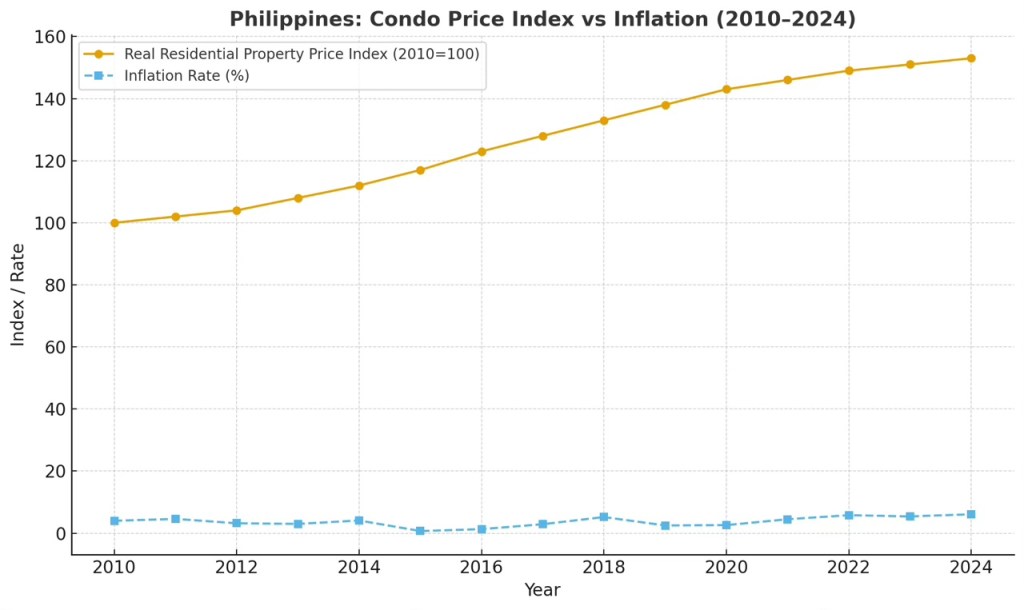

The chart above shows the Philippines Residential Property Price Index (2010 = 100)compared with average inflation rates from 2010 to 2024. Notice how:

- 2015–2019 boom: Property prices surged faster than inflation, driven by strong OFW remittances, BPO expansion, and urban condo demand.

- 2020 pandemic dip: Growth slowed as leasing softened and investors held back.

- 2022–2024 rebound: Rising inflation pushed costs higher, but condos began recovering in tandem with the return of office workers, hybrid setups, and foreign buyers.

Pro Tip: Reading the Market Cycle

📉

Correction/Dip

Market cools, rents soften. Best time to buy low.

📈

Early Upswing

Prices stabilize, rents recover. Ideal entry point.

🔺

Growth Phase

Demand and prices rise together. Strong yields.

📊

Peak Phase

Prices outpace rents. Yields compress, risk higher.

Smart investors don’t chase peaks—they position themselves during corrections or early rebounds, when competition is low but upside is high.

Demographic and Economic Factors Driving Condo Demand

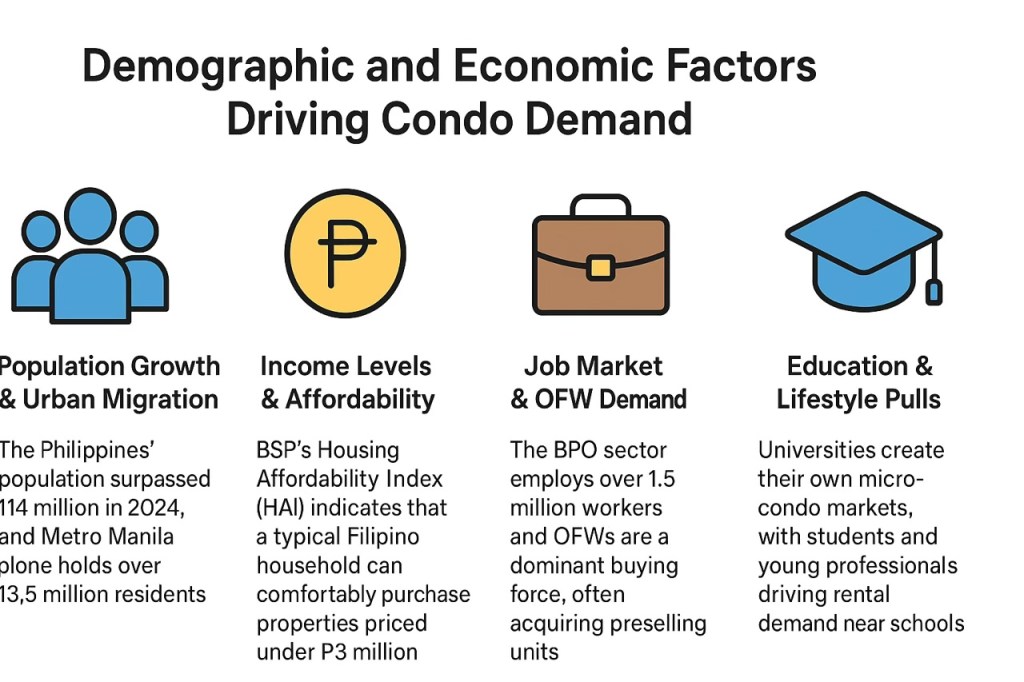

Real estate isn’t just about buildings—it’s about people. Who lives in a condo, who can afford it, and why they choose it all stem from demographic and economic realities. In the Philippines, several powerful trends are shaping condo profitability.

Population Growth & Urban Migration

The Philippines’ population surpassed 114 million in 2024 (PSA data), and Metro Manila alone holds over 13.5 million residents. Urban migration remains strong as young professionals and families flock to economic growth corridors like Metro Manila and CALABARZON. This relentless inflow sustains demand for mid- to high-rise housing, especially in land-scarce cities such as Makati, Taguig, and Pasig. For investors, this means steady tenant pools and long-term resale potential in urban cores.

Income Levels & Affordability

The middle class is expanding, but affordability remains a pressure point. BSP’s Housing Affordability Index (HAI) indicates that a typical Filipino household can only comfortably purchase properties priced under ₱3 million. This drives strong absorption of studio and 1-bedroom condos in the ₱2–5M range, where developers tailor projects for first-time buyers and young families. On the flip side, luxury investors—both local elites and foreign buyers—focus on high-end developments in BGC, Rockwell, and Ortigas, where exclusivity and capital appreciation outweigh affordability concerns.

Job Market & OFW Demand

The Philippines’ job market adds another layer. The BPO sector employs over 1.5 million workers and continues to expand outside of Metro Manila into hubs like Clark and Cebu, fueling condo demand near business districts. Overseas Filipino Workers (OFWs), who remit over $36 billion annually (BSP, 2023), remain a dominant buying force, often acquiring preselling units as investment vehicles or retirement homes. Expats tied to multinational companies also shape demand for premium rentals, particularly in Makati and BGC.

Education & Lifestyle Pulls

Universities create their own micro-condo markets. Taft Avenue, Katipunan, España, and University Belt zones thrive on student renters seeking safe, convenient housing near schools like Ateneo, La Salle, and UST. These units may not command luxury rates, but they guarantee consistent rental income and high turnover. Lifestyle also plays a role: young professionals gravitate toward condos near malls, co-working hubs, and transport links, where convenience defines value.

Infrastructure and Development Projects: The Real Drivers of Value

In the Philippines, smart investors don’t just watch infrastructure—they bet on it. Infrastructure changes the game for condos: it transforms distant neighborhoods into booming communities. Let’s dive into the projects turning value into wealth.

Transport Projects Rewriting Access

- Skyway Extension (Sucat to Alabang, 2011): Opened in 2011, this extension dramatically cut travel times and triggered noticeable uplifts in land and condo values near Alabang. It’s not just about efficiency—it’s about investor psychology: better access seals deals.

- Upcoming Game-Changers

- North–South Commuter Railway (NSCR) – With a station planned in Alabang by late 2026–27, this rail corridor will redefine accessibility and tenant draw.

- LRT Extensions, MRT-7, CALAX – These additional transit arteries will expand the commuter belt, making previously fringe areas prime living zones.

Urban Fabric: Corridor Growth & New Hubs

- Ortigas–BGC Link Road has essentially welded two of Metro Manila’s power centers together, merging demand and real estate momentum along the corridor.

- Beyond the capital, Clark Global City and Nuvali are growing into vibrant, self-contained hubs where jobs, homes, and retail converge—future-first areas investors should watch.

Neighborhood Conveniences That Sell

Connectivity isn’t everything—services matter, too. On-the-ground amenities like malls, hospitals, universities, and parks create invisible utility that boosts condo marketability. Vintage or outlying developments get second chances when schools or medical centers come knocking.

Case Study: Alabang — Skyway + Amenities

Alabang’s transformation isn’t a myth. Post-Skyway, convenience soared and rentals followed—in large part due to added amenities and smoother commutes. Here are some key data points:

- Condo Supply Surge: From 5,660 units in 2023 to a projected 8,440 by 2026—a near 45% jump.

- Unit Pricing: Mid-range condos are trading between ₱130,000–₱180,000/sqm, while luxury listings near Filinvest City and Town Center hit the ₱180k–₱200k/sqm range.

This growth isn’t hypothetical—it’s plotted on the map and logged in data. Infrastructure attracts development, which attracts demand.

Investor’s Mindset Shift: Follow the infrastructure pipeline—not just what’s built, but what’s planned. A condo isn’t just a unit—it’s an investment riding that infrastructure wave.

The Projects Shaping Tomorrow’s Condo Market

🚆

North–South Commuter Railway

Completion: 2026–27

Impact: Cuts hours off travel; Alabang gains a major station.

🛣️

CALAX (Cavite–Laguna Expressway)

Completion: Ongoing (sections by 2025–26)

Impact: Seamless Cavite–Laguna connectivity; boosts CALABARZON demand.

🚊

MRT-7 & LRT Extensions

Completion: 2025–26

Impact: Expands commuter belt; new catchment for mid-tier condos.

🌆

Ortigas–BGC Link Road

Completion: Open

Impact: Fuses two CBDs; corridor properties rising fast.

Competition and Comparative Analysis

Even the best condo in a prime location can underperform if the surrounding market is oversaturated or if investors fail to position their property correctly. A disciplined approach to competition analysis protects returns and ensures your unit stands out in a crowded marketplace.

Comparable Properties (Comps)

Benchmarking is the backbone of smart real estate investing.

- Pricing Benchmarks – Compare asking and transacted prices of nearby condos within the same class (luxury, mid-market, or affordable). For example, a 35 sqm studio in Makati priced at ₱7.5M should be weighed against similar developments like Jazz Residences or The Rise, adjusting for location premium and amenities.

- Size & Layout Efficiency – Smaller but well-designed units often command higher rent per sqm than larger, inefficient layouts. Investors should calculate price per sqm and rent per sqm to spot undervalued options.

- Amenity Packages – Pools, gyms, co-working spaces, and green areas can justify a higher rent. Benchmark not only the presence but also the quality and upkeep of amenities when comparing properties.

Vacancy Rates & Rental Competition

A condo may look attractive on paper but struggle in practice if vacancy rates are high.

- Oversupply Indicators – Too many new launches in one micro-market (e.g., Manila’s pre-pandemic condo boom) can lead to softening rents and longer vacancy periods.

- Rental Listings Monitoring – Checking the volume of units for rent on platforms like Lamudi or FB Marketplace gives a quick read on demand-supply dynamics. If units in a tower linger unleased for 3+ months, that’s a red flag.

- Tenant Profile Matching – A student-heavy market differs drastically from an expat-focused district. A mismatch between unit type and tenant profile (e.g., luxury loft in a student zone) results in higher vacancy risk.

Positioning Your Investment

Smart investors don’t just buy a unit; they buy an edge.

- Differentiation by Design – A furnished, professionally staged unit with smart-home upgrades can command a rent premium of 10–15% compared to a bare unit in the same building.

- Niche Targeting – Instead of competing broadly, tailor your property to a segment: digital nomads seeking fast internet and co-working setups, or corporate renters preferring long-term contracts with parking included.

- Pricing Strategy – Underpricing slightly at launch (e.g., ₱1,000 less than market average) can reduce vacancy, attract stable tenants, and secure renewals—often outperforming units priced aggressively but vacant for months.

💡 Pro Tip

“Treat every condo like it’s entering a competition. The winners aren’t always the cheapest—they’re the ones that offer the best value story to the right tenants.”

Expert Insights and Professional Guidance

Numbers can tell you part of the story, but real clarity comes from professionals who live and breathe the property market. Tapping into their expertise transforms scattered data points into a decision-making framework you can actually trust.

Real Estate Brokers & Licensed Appraisers

Brokers bring ground-level intelligence—what’s selling, what’s sitting, and why. A licensed appraiser, on the other hand, provides an objective valuation that cuts through developer hype or emotional bias. Together, they anchor your decisions to reality, ensuring you don’t overpay in a hot market or undersell during a lull.

Banks & Financial Analysts

Banks aren’t just lenders—they’re risk assessors. When they tighten or loosen mortgage terms, they’re signaling how confident they are in market stability. Analysts provide an even wider lens, tracking interest rates, inflation trends, and lending standards that directly affect affordability. Investors who align with these signals position themselves ahead of shifts in financing conditions.

Developers’ Reputation

Not all square meters are created equal. A unit built by an established player like Ayala Land or Rockwell often carries a premium—but that premium buys trust, consistent quality, and resale value. By contrast, newer or lesser-known developers may offer lower entry prices, but with higher uncertainty around delivery, amenities, or long-term upkeep. Track record isn’t just history—it’s a risk indicator.

⚡ Pro Tip: Choosing the Right Advisor

Look beyond sales talk. A trustworthy advisor should meet three criteria:

Credentials

Licensed by PRC or accredited by recognized institutions.

Transparency

Willing to show you both the pros and cons of a deal.

Alignment

Puts your goals—whether rental yield, capital appreciation, or legacy building—above their commission.

When you assemble the right team of experts, you aren’t just buying property. You’re buying foresight, risk protection, and a clear edge in a crowded market.

Monitor Market Projections and Economic Outlook

A condo investment isn’t made in isolation—it moves in step with the wider economy and the forces shaping demand across Metro Manila. Savvy investors keep their eyes on both industry-specific forecasts and broader economic signals.

Industry Reports

Reputable sources like Colliers International, Leechiu Property Consultants, Santos Knight Frank, and Lamudi publish quarterly and annual market updates. These aren’t just academic documents—they provide vacancy rates, rental trends, absorption levels, and pipeline supply data. By scanning these reports, you gain a macro view of where the market is headed and how your chosen property stacks up against the competition.

Macro-Economic Drivers

Key economic levers—interest rates, inflation, and peso-dollar exchange movements—directly shape investor behavior and affordability. A high-interest environment may soften buying power but fuel rental demand as households delay ownership. Inflation influences construction costs and, in turn, property prices. Peso depreciation can trigger increased demand from OFWs converting foreign currency into local real estate investments. Each of these forces affects your return timeline.

Short-term vs. Long-term Forecasts

Don’t mistake volatility for weakness. Short-term disruptions (e.g., global oil price spikes, policy changes) can rattle confidence, but the long-term fundamentals—urban migration, BPO expansion, infrastructure development—remain strong drivers of sustained growth. Smart investors look at both horizons: ride out the bumps while positioning for structural trends that will keep values rising.

Snapshot Forecast ⚡

According to recent industry projections, Metro Manila condo rents are expected to rise 5–7% annually through 2026, fueled largely by BPO sector growth, the return of expat professionals, and limited new project completions. This combination of rising demand and tight supply creates an environment where well-located units—especially in CBDs like Makati, BGC, and Ortigas—are likely to outperform.

Case Study: Choosing Between a BGC Studio and an Alabang 2-Bedroom

Let’s imagine two investors evaluating their options:

Investor A – The BGC Studio Buyer

- Property: 25 sqm studio in Bonifacio Global City

- Purchase Price: ₱6.5M (₱260,000/sqm)

- Target Market: Young professionals, expats on short-term contracts

- Rental Yield: Around 5–6% per year, thanks to steady rental demand and high occupancy

- Risks: Smaller unit size limits appreciation beyond a certain ceiling; competition among studios is intense

Investor B – The Alabang 2-Bedroom Buyer

- Property: 65 sqm 2BR unit in Alabang business district

- Purchase Price: ₱8M (₱123,000/sqm)

- Target Market: Families, OFWs returning home, corporate tenants from nearby Filinvest City

- Rental Yield: 4–5% per year, but with potential for stronger long-term appreciation due to larger unit type and lower entry price per sqm

- Risks: Vacancy risk if targeting the wrong tenant pool, slower short-term turnover compared to BGC

Outcome of Research:

- If Investor A prioritizes liquidity and fast rental turnover, the BGC studio is the smarter play.

- If Investor B values long-term capital appreciation and family-oriented tenants, the Alabang 2BR provides better stability.

👉 The lesson: research reveals that “best” is relative. The winning condo depends not just on market trends, but also on your investment horizon, target tenant profile, and risk tolerance.

Common Mistakes Condo Investors Should Avoid

Even seasoned investors sometimes stumble when buying a condo. The difference between a profitable unit and a financial headache often comes down to avoiding these four traps:

1. Buying Based on Hype Alone

Many rush into pre-selling launches because of flashy marketing or the “fear of missing out.” But hype doesn’t guarantee returns. A project may take years to complete, and not all deliver the projected value once built. The key is to ask: Is this location’s demand proven, or is it just buzz?

2. Ignoring HOA Fees and Taxes

Condo ownership doesn’t end with the purchase price. Monthly condo dues, real property tax, and even parking fees can quietly eat into rental yield. Investors who skip this math often end up with “negative cash flow” despite strong rental income. Always project net returns, not just gross rent.

3. Overestimating Rental Demand

Many assume “If I buy in Makati or BGC, tenants will line up.” Reality check: the condo market is competitive. Tenants today compare amenities, location, and even unit interiors before signing. Overconfidence leads to extended vacancies—sometimes months without rental income. Back up assumptions with market data, not gut feel.

4. Relying Only on Developer Marketing

Developers highlight the dream, not the fine print. Brochures rarely mention future supply in the area, neighborhood issues, or how many similar units are being sold simultaneously. Relying solely on their materials is like buying stocks based only on the company’s ad campaign. Supplement their info with independent research, competitor analysis, and on-the-ground visits.

👉 The bottom line: successful condo investing isn’t about following the crowd—it’s about cutting through the noise and running the numbers with clear-eyed discipline.

📥 Download Your Free Condo Investment Checklist

Don’t rely on gut feel. Serious investors use frameworks—this one keeps you from missing red flags and helps you spot opportunities others overlook.

✅ Must questions before buying

✅ Simple financial formulas to calculate true ROI

✅ Developer and project vetting guide

✅ Tenant demand and competition checklist

👉 Get your free printable PDF copy now. Enter your email below and receive instant access to the Smart Investor’s Condo Research Checklist.

Invest with clarity. Avoid costly mistakes. Build a portfolio that works for you, not against you.

Leave a reply to Condominium Investment in the Philippines: How to Choose the Ideal Property – U-Property PH Cancel reply