Buying a condominium in the Philippines can feel exciting—and overwhelming at the same time. With so many projects being built across Metro Manila and nearby cities, it’s easy to get drawn in by glossy brochures and tempting payment terms. But the truth is, not every condo will give you the returns or lifestyle you’re hoping for.

That’s why working with real estate professionals in the Philippines—brokers, property consultants, financial advisors, even lawyers—is such an important step. They help simplify the process, explain what to watch out for, and guide you toward smarter choices. Instead of guessing whether a property is really a good deal, you’ll have experts showing you where the opportunities and risks are.

If you’re a first-time investor or simply new to the condo market, think of professionals as your partners. Their role isn’t just to close a sale—it’s to help you make confident, well-informed decisions that protect your money and set you up for long-term success.

Why Professional Guidance Matters in Condo Investments

The Philippine condo market is full of opportunities—but it also moves quickly. Prices can shift, projects sell out fast, and not every “hot deal” delivers long-term value. Without proper guidance, it’s easy to fall into common condo investment mistakes, like overpaying for a unit, underestimating costs, or buying in an area with weak rental demand.

This is where real estate professionals in the Philippines make a major difference. They bridge the gap between what looks good on paper and what actually performs as an investment.

Here’s why their role matters:

- Rental Income Potential: In Metro Manila, average condominium rental yields range between 5–7% annually. But not every project hits that mark—units in the wrong location may only yield 3–4%. A property consultant can identify developments that attract stable renters and generate stronger cash flow.

- Capital Appreciation: Pre-selling condos in prime districts (like BGC or Ortigas) often appreciate by 6–10% annually before turnover. Professionals help you spot which developers have a proven track record of delivering projects that grow in value.

- Risk Reduction: Many first-time investors underestimate hidden expenses like condo dues (₱80–₱120 per sqm) or high vacancy rates in oversupplied areas. A trusted broker or advisor makes sure you factor these into your decision so your investment doesn’t surprise you later.

Think of professional guidance as your safety net. Instead of guessing whether a condo will give you good returns, you’ll have experts filtering the noise and pointing you toward choices that align with your goals. That means fewer risks, smarter decisions, and higher chances of long-term success.

Leveraging Local Market Intelligence

Condo prices don’t move the same way everywhere. A unit in Quezon City won’t perform like one in Makati, and a pre-selling project in Ortigas will appreciate differently than an RFO unit in BGC. Understanding these nuances is what separates smart investors from those who simply “buy and hope.”

This is where real estate professionals shine. They live and breathe local market data, and they use that insight to help you choose properties with stronger growth and rental potential.

Here’s what local expertise can reveal:

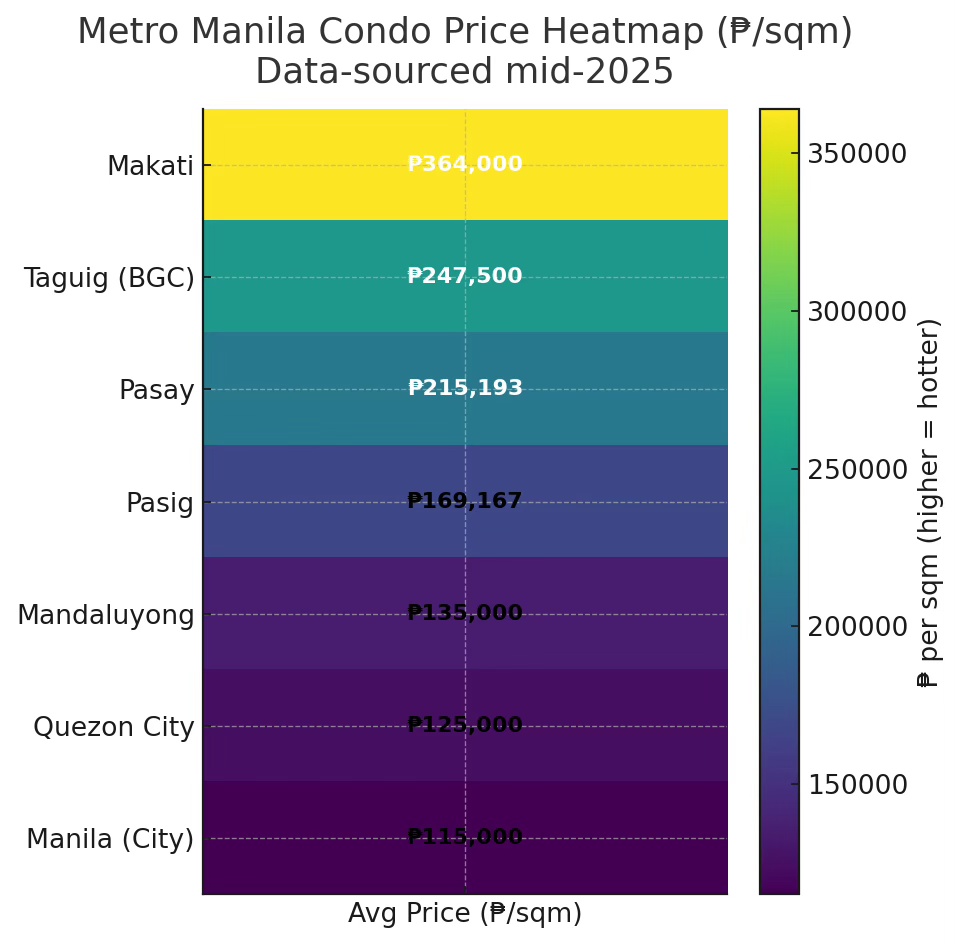

- Price per Square Meter Trends: As of 2024, Makati condos average around ₱280,000 per sqm, while Quezon City averages closer to ₱160,000–₱180,000 per sqm. Professionals help you see whether you’re paying above, below, or right at market value.

- Emerging Growth Areas: Infrastructure projects are shifting demand. For example, the completion of MRT-7 is already driving interest in Fairview and San Jose del Monte. Experts can spot these “next big” locations before prices peak.

- Pre-Selling vs. RFO Timing: Pre-selling units can be 20–30% cheaper than RFO, but they also carry risks if you don’t pick the right developer. Brokers and consultants help you evaluate which pre-selling projects are worth the wait.

- Rental Demand by Location: BGC and Makati continue to command the highest rental rates due to expat and BPO demand, while Ortigas and Quezon City are attracting young professionals looking for affordability.

💡 Beginner Tip: You don’t need to memorize all these numbers—just partner with someone who already tracks them. A good broker can tell you if a property is overpriced, undervalued, or positioned for strong rental demand.

With professional guidance, you’re not just buying a condo—you’re buying into the right market at the right time.

Property Selection with Precision

Not every condo unit is profitable. Two projects in the same city can deliver completely different returns depending on pricing, amenities, and target market. This is where expert advice helps you separate overpriced units from hidden gems and pick properties that actually support your financial goals.

How Experts Filter the Best Units

A property consultant doesn’t just look at the sticker price. They analyze:

- Price vs. Market Average: If the project is selling at ₱250,000 per sqm in an area where the average is only ₱190,000, they’ll flag it as risky unless the location or amenities justify the premium.

- Developer Track Record: Units from top developers like Ayala Land or Rockwell may hold value better than smaller players with weak after-sales service.

- Future Resale Potential: They evaluate how easy the unit will be to resell in 5–10 years based on location, layout, and project reputation.

Amenities That Drive Rental Demand

In the Philippines, renters don’t just look for four walls and a roof—they want lifestyle features. Amenities can increase both rental demand and resale appeal:

- Fitness Facilities (gym & pool): Highly attractive to young professionals and expats.

- Co-Working Spaces & Wi-Fi Lounges: Increasingly sought after by remote workers and freelancers.

- Green/Open Spaces: Parks and sky gardens add long-term desirability, especially in urban districts.

- Retail & Dining Access: Developments with malls or commercial strips on site enjoy higher occupancy.

Matching Investor Profiles to Properties

Not all investors play the same game:

- Long-Term Landlord: Best with 1BR units in stable rental markets (steady cash flow, less turnover).

- Short-Term Rental Operator (Airbnb): Studio units near business hubs or tourist spots usually outperform.

- Flippers (buy-sell investors): Pre-selling units in upcoming locations offer higher appreciation potential.

Unit ROI Potential: A Quick Comparison

| Unit Type | Average Floor Area | Typical Buyers/Renters | ROI Potential (Rental Yield + Appreciation) | Best For |

|---|---|---|---|---|

| Studio | 20–30 sqm | Students, young professionals, Airbnb guests | 6–8% if near transport hubs & BPO centers | Short-term rental, beginner investors |

| 1-Bedroom | 35–45 sqm | Couples, mid-level professionals | 5–7% with stronger long-term tenancy | Landlords seeking stable income |

| 2-Bedroom | 60–80 sqm | Families, expats | 4–6%, but stronger resale value | End-use buyers, long-term investors |

With the right consultant, you’ll not only avoid overpriced condos—you’ll also zero in on unit types and amenities that maximize profitability for your strategy.

Maximizing ROI Through Expert Negotiation and Management

Buying a condo in the Philippines isn’t just about the list price—it’s about how well you negotiate and structure the deal. This is where a real estate professional can literally save you hundreds of thousands of pesos while also making sure you don’t get blindsided by hidden costs.

Negotiating Condo Purchases in the Philippines

Developers often leave room for negotiation, especially during pre-selling stages. With the help of an experienced broker:

- Discounts of 2–10% are common, depending on the unit, developer, and timing of your purchase. For a ₱5M condo, that could mean savings of ₱100,000–₱500,000.

- Developer Promos: Brokers are the first to know about limited-time promos like waived reservation fees, free appliances, or extended payment terms.

- Buyer Leverage: If you’re paying spot cash or buying multiple units, professionals know how to use that leverage for deeper discounts.

Breaking Down Closing Costs in the Philippines

Many first-time buyers underestimate the “extras” that come after the purchase price. A professional ensures you’re financially prepared:

- Documentary Stamp Tax (DST): 1.5% of the selling price or zonal value.

- Transfer Tax: 0.5–0.75% depending on the LGU.

- Registration Fee: Around 0.25% of property value.

- Homeowners’ Association (HOA) or Condo Dues: Typically ₱80–₱120 per sqm monthly.

- Miscellaneous Developer Fees: Move-in charges, utility deposits, etc.

👉 For a ₱5M condo, closing costs usually total 5–6% (₱250,000–₱300,000). Knowing this upfront helps you budget realistically.

Case Example: How Negotiation Boosts ROI

Imagine purchasing a ₱5M pre-selling unit:

- With no negotiation, you’d pay the full ₱5M + ~₱280k closing costs.

- With professional negotiation, you secure a 5% discount (₱250k savings) and waived reservation fees.

- Net effect: You start your investment ₱300k ahead—a significant cushion that improves both rental yield and resale ROI.

Beyond Purchase: Ongoing Management

Even after the sale, professionals add value through:

- Advising on rental pricing strategy to balance occupancy with yield.

- Connecting you with property management services for hassle-free leasing.

- Guiding you on exit timing (when to resell for maximum capital gains).

When done right, negotiation isn’t just about shaving off a few pesos—it’s about compounding returns from day one and setting up a smoother investment journey.

Legal and Financial Safeguards

Condo investing in the Philippines isn’t just about picking the right unit—it’s about making sure your purchase is legally secure and financially sustainable. Skipping this step is how buyers end up with nightmare stories: stalled projects, unclear titles, or loan rejections. With professional guidance, you’ll know exactly what to check before signing anything.

Legal Must-Knows for Condo Buyers

- Contracts and Reservation Agreements: Always review terms carefully. Developers include timelines, penalties for late payments, and turnover conditions—details you can’t afford to miss.

- Condo Declarations & HOA Rules: These documents outline how you can use your unit, rules on renovations, and monthly association dues. Understanding them prevents conflicts later.

- Title Verification: For RFO units, confirm that the property has a clean Condominium Certificate of Title (CCT). For pre-selling, check that the project is registered with the HLURB/Department of Human Settlements and Urban Development (DHSUD).

Financing Options for Condo Purchases in the Philippines

Choosing the right financing path affects both your cash flow and long-term ROI. Common routes include:

- Bank Financing: Offers competitive interest rates (typically 6–8% fixed for 1–5 years), but approval depends on income documents and credit history.

- Pag-IBIG Housing Loan: More accessible for employed and OFWs, with lower rates (as low as 5.75%) and longer repayment terms up to 30 years.

- In-House Financing: Provided directly by the developer, usually with higher interest (10–12%) but fewer requirements—ideal for buyers who can’t qualify with banks.

Common Legal Pitfalls in Pre-Selling Condos

- Non-DHSUD Registered Projects: If a project isn’t registered, your purchase isn’t legally protected.

- Delayed Turnovers: Some developers miss target completion dates by years. Check track records before committing.

- Hidden Charges: Beyond monthly amortizations, be ready for move-in fees, utility deposits, and association dues that aren’t always disclosed upfront.

- Forfeiture Risks: Missing payments during pre-selling can lead to forfeited reservations and lost investment.

Condo Buying Process: Legal & Financial Flow

Step 1: Reservation

- Pay the reservation fee to lock in your chosen unit.

- Keep the official receipt and reservation agreement.

➡️

Step 2: Contract Signing

- Review the Contract to Sell (CTS) for pre-selling units or Deed of Sale for RFO units.

- Double-check payment schedules, penalties, and turnover conditions.

➡️

Step 3: Title Verification

- Pre-selling: Confirm DHSUD registration.

- RFO: Verify the Condominium Certificate of Title (CCT) is clean and transferable.

Step 4: Choose Financing Option

- Bank Financing: Competitive rates, stricter requirements.

- Pag-IBIG: Accessible, longer terms, lower interest.

- In-House Financing: Flexible, but higher interest.

➡️

Step 5: Loan Approval

- Submit income documents, IDs, and developer requirements.

- Get official loan approval and release of funds.

➡️

Step 6: Turnover & HOA Compliance

- Pay move-in fees, utility deposits, and association dues.

- Sign the HOA membership agreement.

- Receive keys and start unit inspections.

💡 Beginner Tip: Always consult with a real estate broker or lawyer in the Philippines before signing contracts, especially for pre-selling units. The small legal fee is worth the peace of mind.

Risk Mitigation Strategies in Condo Investments

Every investment carries risks, and condominiums in the Philippines are no exception. The good news? With the right strategies—and guidance from professionals—you can reduce risks and protect your cash flow.

Reducing Vacancy Risks

A condo without tenants means zero income but continued expenses. To avoid long gaps in occupancy:

- Diversify rental strategies: Many investors mix long-term leases with short-term Airbnb stays to capture different markets. In Metro Manila, Airbnb hosts report 20–30% higher monthly income when occupancy rates are managed properly.

- Hire a property manager: For a 5–10% fee of monthly rent, managers handle marketing, tenant screening, and day-to-day concerns—helping you avoid costly vacancy periods.

- Location-first approach: Properties near transport hubs, BPO offices, or universities consistently attract renters faster than units in purely residential areas.

Reviewing HOA Fee Structures

Homeowners’ Association (HOA) fees can make or break condo profitability. In Metro Manila, fees range from ₱80 to ₱150 per sqm monthly. That means a 40 sqm unit can cost ₱3,200–₱6,000 monthly just in dues.

- Professionals help you analyze whether fees are justified by amenities, maintenance quality, and location.

- Always compare HOA fees to the expected rental income—if dues eat up more than 15–20% of gross rent, profitability will be tight.

Navigating Market Downturns

Condo values don’t always go up. During the pandemic, average Metro Manila condo prices dipped by 13% in 2020 (BSP data). Professionals can help you:

- Hold through downturns by adjusting rental strategies (e.g., offering rent discounts or flexible terms).

- Protect cash flow by setting aside reserves equal to at least 3–6 months of expenses.

- Diversify your portfolio—some investors balance Metro Manila condos with provincial properties where land values may be more resilient.

💡 Beginner Tip: Always run your condo numbers with two scenarios: one at 100% occupancy and another with at least 15–20% vacancy built in. If the investment still works under stress, it’s safer to pursue.

Maximizing Returns with Expert Support

Condo investing isn’t just about buying at the right price—it’s about making your property work harder for you month after month. With professional guidance, you can maximize condo rental income in the Philippines while setting yourself up for long-term capital growth.

1. Setting Competitive Rental Rates

Pricing your condo correctly is the difference between a unit that stays vacant and one that generates steady cash flow.

- Professionals track market benchmarks (e.g., Makati studios average ₱20k–₱25k/month, while Quezon City units range from ₱12k–₱18k).

- They use comparative listings to avoid underpricing (losing money) or overpricing (scaring off tenants).

- Data-driven rent setting ensures you cover HOA dues, loan amortizations, and still post a profit.

2. Marketing for Occupancy

Even the best-priced unit won’t rent itself. Today’s renters shop online first, and experts know where to place your listing for maximum exposure:

- Facebook Marketplace & Groups – Highly active for budget-conscious renters.

- Lamudi, DotProperty, Property24 – Strong for long-term leases and professional tenants.

- Airbnb – Ideal for units near business districts, malls, and tourist spots; can yield 20–30% higher monthly returns if occupancy is well managed.

- Professionals also invest in professional photos, virtual tours, and ad targeting—tools that dramatically cut vacancy periods.

3. Tenant Screening to Protect Property

A bad tenant costs more than a few weeks of vacancy. They can delay payments, damage property, or trigger legal disputes. Real estate managers minimize these risks through:

- Background & income verification – Ensuring tenants can afford rent.

- Reference checks – Speaking with previous landlords.

- Clear lease agreements – Covering deposits, payment deadlines, and penalties.

4. Knowing When to Sell for Capital Appreciation

Sometimes, the smartest move isn’t holding forever—it’s selling at the peak.

- Historical data shows condos in BGC and Makati appreciated 6–8% annually pre-pandemic (Colliers PH).

- Professionals watch infrastructure developments (e.g., MRT expansions, airport projects) that can trigger future price jumps.

- Having an exit strategy—whether flipping after 5 years or holding until maturity—keeps your ROI aligned with your financial goals.

4 Ways Experts Boost Your Condo ROI

1. Set the Right Rental Rate

- Benchmark against market averages (e.g., Makati studios: ₱20k–₱25k/month).

- Avoid underpricing or overpricing mistakes.

2. Market Effectively

- Facebook Marketplace & Groups for quick reach.

- Lamudi, DotProperty, Property24 for long-term leases.

- Airbnb for higher short-term returns (20–30% more if well-managed).

3. Screen Tenants Carefully

- Verify income and employment.

- Check references from past landlords.

- Use clear lease agreements to prevent disputes.

4. Time Your Exit for Capital Gains

- Monitor appreciation (BGC/Makati historically 6–8% annually).

- Watch for infrastructure-driven value surges.

- Have a clear exit plan—flip, hold, or diversify.

💡 Beginner Tip: ROI isn’t just about rental income—it’s about the full picture: purchase price, financing cost, HOA fees, and eventual resale value. Professionals help you balance all these moving parts.

Staying Ahead of Condo Market Trends in the Philippines 2025

Condo investing doesn’t stop once you’ve bought a unit. The real winners are those who adapt their strategies based on condo market trends in the Philippines 2025. Professional advisors keep you updated on the shifts shaping demand, ensuring you don’t just buy a condo—you grow an investment portfolio that stays relevant.

Macro Demand Drivers: BPO Workforce & OFW Remittances

Two pillars continue to fuel condo demand in the Philippines:

- BPO Workforce Housing Demand: With over 1.5 million Filipinos employed in the IT-BPM sector (IBPAP, 2024), the need for housing near business districts in Makati, BGC, and Ortigas remains strong. Many prefer renting over commuting long distances, which stabilizes rental yields.

- OFW Remittances & Real Estate: The Bangko Sentral ng Pilipinas (BSP) reported OFW remittances reached $36.1 billion in 2024, a significant portion of which flows into housing investments. This keeps condo pre-selling projects moving, even when local demand softens.

Lifestyle Shifts: Co-Living, Airbnb, and Short-Term Rentals

The traditional “buy-to-rent long-term” model is evolving:

- Co-Living Spaces: Young professionals are embracing smaller, shared living spaces with flexible leases. This trend benefits studio and 1BR investors in central locations.

- Airbnb Condo Philippines: Short-term rentals are booming in Makati, BGC, and Cebu, where nightly rates often outperform traditional leases. According to AirDNA, occupancy in Metro Manila short-term rentals averaged 65–70% in 2024, with hosts earning 20–30% more monthly than long-term landlords.

- Hybrid Leasing Models: Some investors combine long-term tenants with short-term sublets to balance stability and high returns.

Adapting Strategy with Professional Guidance

Trends shift quickly. What worked five years ago may underperform today. Professionals help you:

- Spot hotspots before they peak—for example, areas along the MRT-7 corridor are emerging as future rental hubs.

- Adjust unit use—pivoting from long-term leasing to Airbnb during tourist surges or festival seasons.

- Time investments—knowing when to buy in pre-selling stage versus when to exit at maturity for capital gains.

💡 Beginner Tip: Following trends doesn’t mean chasing hype. It means aligning your condo strategy with real demand drivers—and that’s where professional insights make the difference.

Conclusion: Condo Investment Success in the Philippines Starts with Expert Guidance

Achieving condo investment success in the Philippines isn’t about chasing hype or leaving your hard-earned capital to chance. The investors who thrive are those who pair opportunity with strategy—and that strategy almost always begins with real estate expert consultation.

A seasoned property advisor in the Philippines can help you navigate hidden costs, spot undervalued units, evaluate rental income potential, and align your purchase with long-term market trends. With the right guidance, what looks like just another condo listing becomes a well-calculated investment move.

Your next step is clear: don’t go it alone. Success in this market is not about luck—it’s about informed decisions, timing, and expert insight.

👉 Ready to explore profitable condo opportunities? Work with a trusted property professional today and secure your investment edge. Book a consultation with UPropertyPH.

Leave a reply to Maximizing Real Estate Returns: A Deep Dive into Resale Potential and Market Dynamics – U-Property PH Cancel reply