The Philippine condominium market continues to attract investors—both local and overseas Filipinos—because the demand for urban housing has never slowed down. Metro Manila alone accounts for nearly 40% of the country’s condominium stock, and according to Colliers, residential rents in central business districts are expected to rise by up to 5% annually as the economy stabilizes. Three major forces drive this resilience: the steady inflow of overseas Filipino worker (OFW) remittances, the expanding BPO workforce concentrated in urban centers, and the ongoing shift toward city-based living where access to work, schools, and lifestyle hubs outweighs suburban sprawl.

Yet, opportunity doesn’t automatically equal success. Many investors buy a unit based on location buzz or glossy brochures, only to realize later that their returns fall short of expectations. The difference between mediocre results and sustained wealth is goal alignment. Every investor—whether chasing rental yield, long-term appreciation, or portfolio diversification—must match their personal financial objectives with the right condominium strategy. Done correctly, condo investing isn’t just about owning property; it’s about turning square meters into financial momentum.

Clarifying Your Investment Goals

Before signing a condo reservation form or calculating monthly amortizations, the most critical step is defining why you’re investing. Philippine condominium markets offer different returns depending on the strategy, and mismatched goals can lead to frustration—or worse, losses.

Long-Term Wealth Building (Capital Appreciation Focus)

If your aim is to grow wealth steadily, target properties in growth corridors backed by infrastructure projects. For example, condos in Bonifacio Global City (BGC) have appreciated by over 150% in the last decade, according to Colliers, largely due to sustained office demand and lifestyle upgrades. Similarly, emerging hubs like North Caloocan (near MRT-7)or Bulacan (near the new airport) are expected to see strong appreciation once transport projects are completed. These play the long game—you’re not after immediate rental income but a property whose value compounds over years.

Short-Term Income (Rental Yield Focus)

If cash flow matters more than waiting for long-term gains, focus on rental yield hotspots. Metro Manila’s condo yields average 5–7% annually, but some segments outperform:

- Makati and Ortigas studios: popular with young professionals.

- Quezon City near universities: consistent demand from students.

- Manila Bay Area condos: high demand from POGO and expat tenants before the pandemic, now rebounding.

In these areas, occupancy rates can reach 90%+, making them ideal for investors seeking predictable income.

Portfolio Diversification (Hedging Against Inflation)

Condominiums can serve as a hedge against inflation by shifting part of your wealth into a tangible, appreciating asset. With the Philippine inflation rate averaging 5–6% in recent years, real estate helps protect purchasing power. An investor with exposure only to cash and stocks may find condos a stabilizer—especially since property historically outpaces inflation during strong growth cycles.

Lifestyle-Driven Goals (Retirement or Family Use)

Not all condo investments are purely financial. Many OFWs and high-net-worth individuals buy units as a retirement base, or as a future residence for their children studying in Manila or Cebu. In these cases, the decision blends lifestyle and investment. For instance, owning a condo in Tagaytay or Batangas beachside developments may not yield the highest ROI on paper, but it provides lifestyle returns—convenience, comfort, and security for the family.

Before choosing a condo, write down your top three financial or lifestyle goals. Ask yourself: Am I chasing income, appreciation, diversification, or personal use? Your answer will dictate where and what to buy—and just as importantly, what to avoid.

Assessing Risk Tolerance

Every condo investment carries risk—it’s just a matter of how much you’re willing, and able, to take. Understanding your risk tolerance helps you avoid mismatched strategies that lead to sleepless nights or financial strain.

High-Risk vs. Low-Risk Strategies

High-Risk, High-Reward

Buying in developing districts such as North Caloocan (MRT-7 corridor), Bulacan (New Manila International Airport), or Cavite (LRT-1 extension). These areas can deliver outsized capital appreciation once infrastructure projects are completed. However, short-term rental demand may be weak, leaving you with longer vacancy periods.

Low-Risk, Steady Growth

Investing in established CBDs like Makati, BGC, or Ortigas. These areas already command strong tenant demand and historical appreciation (BGC units, for instance, appreciated ~8–10% annually in the past decade). The downside? Entry prices are higher, and rental yields may compress over time due to competition.

Personality Factors

Your personal profile plays a big role:

Risk-Averse Retirees

Often prioritize stable cash flow to supplement pensions. A 1-bedroom in Quezon City near universities can deliver consistent 5–6% rental yields with minimal surprises.

Risk-Taking Young Professionals

May be comfortable with volatility in exchange for long-term upside. They might bet on pre-selling units in Pasig or Mandaue, Cebu, banking on infrastructure-driven appreciation in the next 5–10 years.

Practical Risk Filters

To gauge your real comfort level, ask:

Liquidity

Can you afford to hold the unit if it stays vacant for 6–12 months? Vacancy risk in Metro Manila currently hovers around 15–18% (Colliers, 2024).

Financing

Are you using bank loans or in-house financing? Higher leverage amplifies both gains and losses—especially if interest rates rise (BSP policy rate is at 6.5%, affecting mortgage costs).

Exit Strategy

How fast can you resell? Prime units in BGC and Makati can sell in 3–6 months with the right pricing, while units in fringe locations may sit on the market for over a year.

If the thought of covering mortgage payments during a 12-month vacancy stresses you, lean toward established districts with proven rental demand. If you’re young, liquid, and willing to take on more risk, pre-selling in emerging growth zones might be your play.

Determining Your Investment Time Horizon

Your investment time horizon—how long you plan to hold a condo—shapes your entire strategy. A unit that works for a quick flip may not be ideal for a 10-year wealth-building plan. The Philippine market has clear patterns that show when each horizon pays off—and when it doesn’t.

Short-Term Flipping (1–3 Years)

Flipping works best in pre-selling projects, where you lock in a unit at launch prices and resell upon turnover.

When it works

In high-demand areas like BGC, Ortigas, or Cebu IT Park, pre-selling units often gain 20–40% by turnover, especially if the developer is top-tier (Ayala, Rockwell, SMDC). Example: A 30 sqm Makati pre-sell in 2017 at ₱3M resold near turnover in 2021 for ₱4.2M.

When it fails

If too many units hit the market simultaneously or if economic shocks (like COVID-19) suppress demand, flippers get stuck paying amortizations with little resale activity. Some pre-sell buyers in fringe areas saw flat or negative gains at turnover because of oversupply.

Medium-Term Holding (5–10 Years)

This horizon lets investors combine rental income with moderate appreciation.

Best for

Investors seeking balance—steady rental yields while waiting for infrastructure-driven appreciation.

Example

Condos in Quezon City near MRT-7 or Makati fringe areas (San Antonio Village). You collect 5–6% rental yields while values climb with new transit or office developments. Over a 7-year span, total returns can exceed 50% (yield + appreciation).

Hybrid strategy

Rent out the unit for cash flow, then resell once appreciation peaks.

Long-Term Buy-and-Hold (10+ Years)

Long-term plays are about compounding wealth. This works especially well in prime, land-constrained areas where property values have historically doubled or tripled.

Example

BGC condos bought in 2010 at ₱120K/sqm now sell for ₱300K–350K/sqm (Colliers, 2024). Investors who held through cycles enjoyed both strong appreciation and consistent rental demand from expats and multinationals.

Lifestyle investors

OFWs buying for eventual retirement also benefit here—short-term volatility matters less when the property is meant for future personal use and long-term asset growth.

Match your horizon with your liquidity. If you need cash in 2 years, don’t gamble on long-term appreciation plays. But if you have steady income and can wait a decade, the Philippine condo market has proven to reward patience—especially in central business districts.

Balancing Rental Income and Capital Appreciation

Every condo investor wrestles with the same question: Should I chase steady rental yields now, or hold out for bigger long-term appreciation? The answer lies in matching the property type and location to your investment objectives.

Yield-Focused Condos

If your goal is cash flow today, prioritize units in markets with consistent tenant demand.

Student Hubs

Condos near universities like UP Diliman, Ateneo, La Salle, and UST generate 6–8% yields, driven by steady demand from students and young professionals. Small studio units often rent out within days of listing.

Business Districts

Makati and BGC studios remain highly liquid for professionals, with yields averaging 5–6% (Colliers, 2024). Vacancy rates in prime CBDs are among the lowest in Metro Manila, ensuring stable occupancy.

Expat Markets

In Rockwell, BGC High Street South, and Ayala Center Cebu, larger 2–3 bedroom units command premium rents from expats, multinational managers, and diplomats. These may offer slightly lower yields (around 4–5%), but with longer lease terms and higher tenant quality.

Appreciation-Focused Condos

If you’re willing to sacrifice immediate cash flow for long-term upside, look at areas tied to infrastructure and master-planned growth.

Upcoming Infrastructure Projects

Condos along MRT-7 (QC to Bulacan), Metro Manila Subway (Ortigas, BGC, NAIA), and the Cavite-Laguna Expressway (CALAEX) are already seeing 10–15% price jumps even before completion. Once operational, values often spike again as accessibility improves.

Master-Planned Communities

Developments like Arca South (Taguig), Vermosa (Cavite), and Nuvali (Laguna) are positioned for appreciation. Early investors capture the developer’s long-term vision as schools, malls, and offices rise around the project.

Market Conditions That Tilt the Balance

Which strategy wins depends heavily on the broader economic climate:

During low-interest environments (like 2021–2022)

Many investors chased appreciation plays, banking on cheap financing and rapid growth in pre-selling prices.

During high-inflation, high-interest cycles (like 2023–2024)

Investors shifted back to yield-focused units for immediate cash flow, since resale activity slowed and buyers became more price-sensitive.

In oversupplied condo markets

(e.g., certain fringe areas of Mandaluyong and QC)

Rental yields compress as competition rises, making appreciation plays risky unless tied to major infrastructure.

A balanced portfolio often means owning both: one yield-focused condo to generate steady income, and one appreciation-focused unit positioned in a growth corridor. This way, you cover both immediate cash flow and long-term wealth creation.

Evaluating Tax and Legal Implications

Taxes and legal costs can make or break your condo investment returns. Many first-time investors focus on the purchase price and potential rental income, but overlook the mandatory taxes, fees, and compliance costs that impact cash flow and resale value. Understanding these early saves you from nasty surprises down the road.

Rental Income Taxation

If you rent out your condo, your rental earnings are taxable in the Philippines. You have two options:

Graduated Income Tax Rates

If you’re under the regular income tax system, rental income is added to your other income and taxed progressively (from 15% to 35% under the TRAIN Law).

Optional 8% Flat Tax

For individuals earning less than ₱3 million annually, you can opt for an 8% flat tax on gross rental income (instead of graduated rates + percentage tax). This often benefits small landlords who want a simple structure and predictable tax bill.

Example

If you earn ₱25,000/month (₱300,000/year) in rent, the 8% flat tax means ₱24,000 in taxes annually—much easier to manage than navigating brackets and deductions.

Capital Gains and Transfer Taxes When Selling

When you sell your condo, the transaction triggers several taxes and fees:

Capital Gains Tax (CGT)

6% of the selling price, zonal value, or fair market value—whichever is higher.

Documentary Stamp Tax (DST)

1.5% of the selling price or zonal value.

Local Transfer Tax

Ranges from 0.5–0.75%, depending on the LGU.

Registration Fees

Based on a sliding scale (typically less than 1%).

Condo Dues and Association Fees

Condo ownership isn’t just about the mortgage. You’ll also pay monthly condo dues, which cover building maintenance, security, and amenities.

Rates vary

From as low as ₱80/sqm in mid-range projects to as high as ₱150–200/sqm in luxury developments like Rockwell or BGC premium towers.

Example

A 40 sqm unit at ₱120/sqm dues = ₱4,800/month, or nearly ₱60,000/year. That can wipe out a big portion of rental income if not planned for.

VAT and Other Overlooked Costs

VAT on Property Sales

Units priced over ₱3.6 million (as of TRAIN Law thresholds) are subject to 12% VAT if sold by a developer.

Withholding Tax

If you’re leasing to a corporation, they may automatically withhold and remit a portion of the rental tax on your behalf.

Notarial and legal fees

Small compared to taxes, but still add to closing costs.

Work with both a broker and a tax advisor before closing a deal. This ensures your ROI calculations include all taxes and fees, not just the purchase price and potential rental income.

Financing Options and Leverage

How you finance a condo purchase often matters just as much as the location or unit type. The right financing strategy can multiply your returns, while the wrong one can quietly eat away at your profits.

Bank Financing

Best for: Buyers who want lower interest rates and longer payment terms.

Rates & Terms: As of mid-2024, major banks like BPI, BDO, and Security Bank offer 6.5–8% annual interest on condo loans, payable up to 20 years.

Advantages

Lower monthly amortization and the ability to leverage your capital—meaning you can control a ₱6M condo with only ₱1.2M down (20%).

Watch out for

Strict credit checks and documentary requirements. Banks may reject buyers if the condo is too old or in a location flagged as high-risk.

In-House Financing

Best for: Buyers who can’t qualify for bank loans but want to secure a unit fast.

Rates & Terms: Developers typically offer 12–18% interest with shorter terms (5–10 years max).

Advantages

Easier approval, no heavy paperwork.

Watch out for

High interest eats into rental yields and ROI. Often works better as a stopgap plan until you refinance with a bank later.

PAG-IBIG Fund (HDMF)

Best for: Locals and OFWs who want the most affordable rates for long-term ownership.

Rates & Terms: Fixed rates as low as 6.25% for loans up to ₱6M, payable up to 30 years.

Advantages

Very borrower-friendly, especially for end-users and first-time investors. Longer terms lower monthly payments dramatically.

Watch out for

Limited loanable amounts for higher-value units, slower processing times compared to banks.

How Leverage Magnifies Returns—and Risks

Financing allows you to multiply ROI because you’re using other people’s money (the bank’s or PAG-IBIG’s). But the leverage sword cuts both ways.

Case Example: Cash Buyer vs. Financed Buyer

| Scenario | Cash Buyer | Financed Buyer (20% Down, 80% Loan at 7% for 20 yrs) |

|---|---|---|

| Condo Price | ₱6,000,000 | ₱6,000,000 |

| Equity Required | ₱6,000,000 | ₱1,200,000 |

| Monthly Rent (gross) | ₱30,000 | ₱30,000 |

| Net Annual Yield (after dues/tax) | ~4% (₱240,000/yr) | Debt service eats most of the yield |

| 5-Year Price Appreciation (30%)5-Year Price Appreciation (30%) | ₱1.8M gain | ₱1.8M gain |

| ROI on Equity | 30% | 150% (₱1.8M gain on ₱1.2M equity) |

Insight: The financed buyer enjoys a much higher ROI on equity because of leverage—but also carries repayment risk. If rents fall or vacancy rises, debt obligations remain fixed.

Use leverage when investing in high-demand, low-vacancy markets (like BGC, Makati, Cebu IT Park), where rental cash flow and appreciation potential are reliable. Go conservative or even cash-heavy in fringe or oversupplied areas to avoid being trapped with negative cash flow.

Location Strategy: Where to Invest in Condos in the Philippines

Real estate may be about timing, but location remains the kingmaker in condominium investing. Picking the right city—or even the right street—can be the difference between a unit that quietly bleeds cash and one that grows into a portfolio centerpiece.

Metro Manila Hotspots

Metro Manila is still the country’s largest rental market and capital appreciation engine. Despite high prices, demand continues to rise due to job concentration, infrastructure upgrades, and lifestyle appeal.

Bonifacio Global City (BGC)

Consistently one of the strongest rental markets with yields averaging 5–6% for mid-range units. Its master-planned layout, premium office demand, and expat-heavy tenant pool make it a top choice for both short- and long-term investors.

Ortigas Center

A rising contender with lower entry costs than BGC or Makati. With the MRT-4 and Ortigas Greenways projects underway, expect stronger appreciation over the next 5–8 years.

Makati CBD

The country’s financial heart. Studio and 1BR units here remain attractive for young professionals. Capital appreciation in Legazpi and Salcedo Villages has outpaced other Makati districts due to lifestyle amenities.

Manila Bay / Entertainment City

Driven by integrated resorts and casinos, this area is seeing both gaming-driven rentals and tourism demand. However, investors must weigh flooding risks and oversupply carefully.

Growth Corridors Beyond NCR

The next wave of condo opportunities is spreading outward, fueled by infrastructure projects and decentralization of business hubs.

Cebu IT Park

The Visayas’ business and lifestyle hub. Condos here achieve rental yields of 6–7%, thanks to BPOs and the growing digital nomad community. Ongoing expansions around Cebu Business Park add to long-term upside.

Pampanga (Clark and Angeles)

With Clark International Airport expansion and New Clark City rising, Pampanga is positioning as a future central hub. Condos here are 30–40% cheaper than NCR, but values are rising quickly.

Davao City

Stable economic growth, lower crime perception, and continuous infrastructure projects (e.g., Mindanao Railway) are attracting both local and OFW investors. Rental yields hover around 5–6%, with stronger upside in lifestyle-oriented developments.

Bulacan

The New Manila International Airport (Bulacan Airport) is a game-changer. Early movers in nearby condo developments stand to benefit from long-term appreciation once the airport is operational.

Lifestyle-Driven Investments

Not all condo investments are about jobs and offices—leisure and lifestyle now drive major parts of the market. These properties thrive in the short-term rental space (Airbnb, staycations).

Tagaytay

Still one of the strongest weekend destinations for Metro Manila residents. Airbnb units here can generate occupancy rates of 60–70%, especially during holidays and summer months.

Batangas (Nasugbu, Lian, San Juan)

Beach condos and condotels benefit from growing domestic tourism and improved accessibility via CALAX and Cavite-Batangas road projects. Rental income potential here is highly seasonal but strong.

La Union & Siargao (emerging lifestyle hubs)

While smaller in condo stock, these areas attract young professionals and digital nomads, hinting at strong future demand for boutique condo developments.

Condo Investment Hotspot Comparison (Philippines, 2024–2025 Estimates)

| Location | Average Condo Price (per sqm) | Rental Yield Range | Appreciation Outlook (5–10 yrs) | Key Drivers |

|---|---|---|---|---|

| BGC (Taguig) | ₱280k–₱350k | 5–6% | High (8–10%/yr) | Premium business hub, strong expat demand, lifestyle ecosystem |

| Makati CBD | ₱220k–₱300k | 4–5% | Moderate–High (6–8%/yr) | Financial center, limited land supply, heritage CBD |

| Ortigas Center | ₱150k–₱190k | 5–6% | High (7–9%/yr) | MRT-4, Ortigas Greenways, competitive entry price |

| Manila Bay / Entertainment City | ₱180k–₱230k | 4–5% | Moderate (5–7%/yr) | Casinos, hotels, Bay reclamation projects |

| Cebu IT Park / Cebu Business Park | ₱150k–₱200k | 6–7% | High (7–9%/yr) | BPO hub, digital nomad growth, tourism recovery |

| Davao City | ₱120k–₱160k | 5–6% | Moderate–High (6–8%/yr) | Regional growth, infra projects, stable demand |

| Pampanga (Clark/Angeles) | ₱110k–₱150k | 5–6% | High (8–10%/yr) | New Clark City, Clark Airport expansion |

| Bulacan (near NMIA) | ₱90k–₱120k | 4–5% | Very High (10–12%/yr). | New Manila International Airport project |

| Tagaytay | ₱100k–₱140k | 6–8% (Airbnb) | Moderate (5–7%/yr) | Staycation hotspot, proximity to NCR |

| Batangas (Nasugbu, San Juan, Lian) | ₱90k–₱130k | 7–9% (seasonal) | Moderate–High (6–8%/yr) | Beach tourism, CALAX & road expansions |

| La Union / Siargao (emerging hubs) | ₱80k–₱120k | 7–10% (Airbnb) | High but Niche (7–9%/yr) | Surf tourism, digital nomad influx |

Anchor your condo investment strategy to infrastructure projects (subways, expressways, airports). Properties within 1 km of major transport nodes typically appreciate 15–25% fasterthan the market average over a 5–10 year horizon.

Market Trends and Data to Watch

A successful condo investment isn’t just about picking the right unit—it’s about reading the market. Philippine condo investors need to monitor yields, appreciation patterns, and demand drivers to avoid costly missteps.

Current Average Rental Yields in Metro Manila

Colliers Philippines reports that as of Q2 2024, Metro Manila’s average gross rental yields for condominiums sit between 4.5% and 6%, depending on location.

BGC and Makati CBD lead the pack with yields around 5–6%, while fringe areas like Quezon City and Pasig average closer to 4–5%.

Short-term rentals (Airbnb/staycations) in areas like Tagaytay, Ortigas, and Manila Bay can push yields into the 7–9% range, but occupancy is highly seasonal.

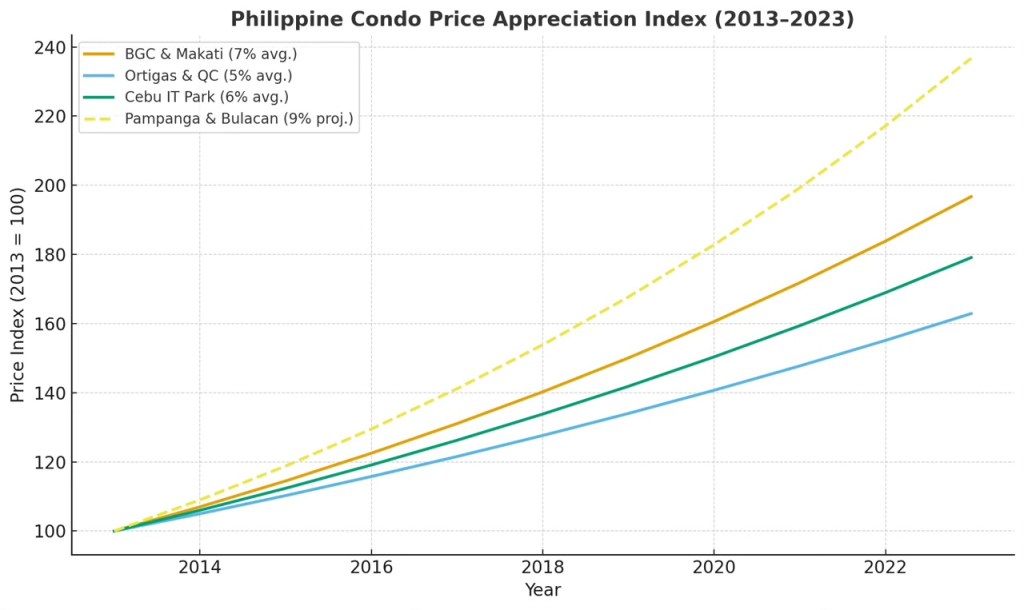

Historical Condo Appreciation Rates

According to Lamudi’s 2024 Market Report, prime condo prices in BGC and Makatihave grown by an average of 6–8% annually over the last decade.

Lifestyle markets such as Tagaytay and Cebu IT Park have recorded price hikes of 5–7% annually, showing resilience even during pandemic downturns.

Ortigas and Quezon City have seen slightly slower but steady growth at 4–6% annually, boosted by infrastructure like the MRT-7 and MRT-4 projects.

Emerging areas like Pampanga and Bulacan are projected to outpace Metro Manila in percentage growth, with analysts forecasting 8–10% annual appreciation once the New Clark City and New Manila International Airport become operational.

Vacancy Rates and Rental Demand Drivers

Colliers notes that Metro Manila’s vacancy rate dropped to 15% in early 2024, down from 17% in 2022, signaling a gradual recovery in rental demand.

Student housing demand remains strong near university hubs in Manila, Quezon City, and Cebu, where smaller studio-type condos consistently achieve high occupancy.

BPO employment growth (over 1.7M Filipinos employed in the sector as of 2024) continues to drive demand in BGC, Makati, Ortigas, and Cebu IT Park.

The rise of digital nomads and hybrid workers is also fueling demand in lifestyle-oriented locations such as La Union, Siargao, and Tagaytay, where short-term rentals dominate.

Returning OFWs and expatriates have pushed rental demand upward in premium markets like BGC, Makati, and Rockwell.

Keep your eye on the Philippine Property Price Index (PPI) published by the BSP. It’s a useful macro-indicator showing if condo prices are growing sustainably or if a slowdown is brewing.

Note: Data modeled using historical appreciation ranges reported by Colliers Philippines, Lamudi Market Reports, and regional outlooks from Santos Knight Frank. Figures represent average compounded growth rates (2013–2023) and projections for emerging areas such as Pampanga and Bulacan. For baseline comparison, all indices were set at 100 in 2013. Actual returns may vary depending on project, developer, and market conditions.

Here’s a chart showing Philippine condo price appreciation trends (2013–2023) across key markets:

- BGC & Makati: Steady 7% annual growth, reflecting prime CBD demand.

- Ortigas & Quezon City: More modest 5% growth, but supported by ongoing infra projects.

- Cebu IT Park: Solid 6% growth, driven by BPO expansion and tourism.

- Pampanga & Bulacan: Projected to outpace NCR with 9% growth tied to New Clark City and NMIA.

Common Mistakes to Avoid

Even seasoned investors can fall into traps when buying condominiums in the Philippines. These mistakes don’t just trim returns—they can sink an otherwise solid investment.

1. Overestimating Rental Demand

Many buyers assume that just because a condo is in a “hot area,” tenants will always be lining up. The reality is more nuanced:

Oversupply Risk

In 2024, Colliers noted that Metro Manila had a 15% vacancy rate across condos, meaning 1 in 7 units sat empty. Certain pockets in Makati and Manila Bay have even higher vacancy due to rapid new project launches.

Tenant Segmentation

A studio near Ateneo may be great for students, but it won’t attract expats. A 2BR in BGC may appeal to corporate leases, but not solo professionals. Matching unit type to tenant demand is crucial.

Pro Tip

Check actual occupancy rates and rental comps in the building or area before buying. Platforms like Lamudi or Rentpad give real market data, not brochure promises.

2. Ignoring Condo Dues and Hidden Costs

It’s easy to focus only on loan amortization and forget the ongoing costs that eat into yield.

Condo Dues

Typically range from ₱80–₱150 per sqm per month. For a 40 sqm unit, that’s ₱3,200–₱6,000 monthly—a chunk of your rental income gone. Premium projects (Rockwell, BGC luxury towers) can go as high as ₱200/sqm.

Taxes and Fees

Don’t forget 12% VAT (if applicable), 5% withholding tax on rentals for corporate tenants, and annual real property tax.

Repairs & Vacancy Loss

Even new units need repainting, appliance replacements, or occasional months with zero tenants. Budget at least 5–10% of rental income for these.

Pro Tip

Always compute your net yield, not just gross rental income. A “6% yield” can quickly shrink to 3–4% once dues and taxes are factored in.

3. Buying Based on Hype Instead of Fundamentals

The Philippines has seen waves of hype-driven condo buying—from “Bay Area boom” to “airbnb-ready units” to “pre-selling flip opportunities.” Chasing the buzz often leads to regret.

Reality Check

Some condo hotspots like Manila Bay were overbuilt, leading to stagnant prices despite flashy launches. Investors who bought purely on marketing hype saw little to no appreciation.

If the main selling point is hype (“soon-to-rise” projects, celebrity endorsements, or unrealistic rental guarantees), step back and re-check the fundamentals.

Fundamentals First

- Always evaluate:

- Location demand drivers (jobs, schools, transport)

- Supply pipeline (are 5 new towers launching nearby?)

- Exit strategy (is there secondary market liquidity?)

Avoiding these three mistakes—overestimating demand, underestimating costs, and buying on hype—can often matter more than picking the “perfect” location. Smart investors succeed less by finding unicorns and more by sidestepping traps.

Reviewing and Adjusting Your Goals

Buying a condo isn’t a one-time decision—it’s an ongoing investment that requires regular tuning. The most successful investors treat their units like a business: measured, reviewed, and adjusted as the market shifts.

How to Track Performance

You can’t improve what you don’t measure. Set clear performance indicators and check them annually:

Rental Yield (%)

Compute net yield (after condo dues, taxes, and maintenance). For Metro Manila, healthy yields range 4–6% for mid-market units and 5–7% for well-located studios. If your unit is below 3%, something is off—either with pricing, management, or demand.

Annual Appreciation

Compare your condo’s current fair market value against its purchase price. BSP data shows condo prices in Metro Manila grew 5.9% year-on-year as of Q4 2024, but pockets like BGC and Cebu often outpace the average.

Cash Flow Stability

Track vacancy months. If your unit is empty for more than 2 months a year, your returns are eroding.

When to Pivot Focus

Your original strategy doesn’t have to be permanent. Market cycles may demand a shift:

From Rental Income to Capital Gains

If property values in your area surge (e.g., Pampanga condos rose 10–12% in anticipation of NMIA), it may be smarter to sell and realize capital gains instead of holding for mediocre rental yields.

From Holding to Reinvesting

Rising interest rates or a softening rental market may push you to liquidate a condo and redirect capital into another city or asset class.

From Short-Term to Long-Term Leasing

In areas where Airbnb regulation tightens (like Makati condos with stricter HOA rules), pivoting to stable long-term tenants avoids vacancy headaches.

Importance of Annual Portfolio Review

Think of your condo as part of a living portfolio that must evolve with the Philippine economy:

Macro Trends

Monitor BSP rate changes, infrastructure projects, and OFW remittance flows—all major drivers of condo demand.

Comparative Performance

Benchmark against similar units. If other 1BRs in your building rent 20% higher, you’re leaving money on the table.

Exit Strategies

At least once a year, ask yourself: If I sold today, would the proceeds better serve me elsewhere? If yes, it’s time to consider divestment.

Set an annual “property health check” every January—review rental yields, appreciation, and expenses side by side. Treat it like a financial check-up that keeps your investment aligned with your goals.

Conclusion: Align, Act, Adjust

Condo investing in the Philippines isn’t about gambling on hype or luck—it’s about clarity, discipline, and adaptation. The investors who thrive are those who treat their units like businesses: setting clear goals, tracking performance, and adjusting strategy when the market shifts.

Opportunities are everywhere. From BGC’s corporate leasing boom to Cebu’s resilient IT hub rentals, to Pampanga’s surge with the New Manila International Airport, the landscape is dynamic. But only those who align their investment approach with real data and long-term goals consistently win.

👉 Ready to sharpen your condo investment strategy?

- Schedule a free strategy consultation to review your goals and match them with the right properties.

- Join our investor mailing list for quarterly market updates, insider reports, and curated listings before they hit the market.

Take the guesswork out of condo investing. Let UPropertyPH help you align your vision with profitable action.

Leave a comment