A contrasting view of a construction site on the left and a modern family living room on the right, showcasing the contrast from renovation to a brand new home.

- The Real Homeownership Crossroads

- The Big Question—What Problem Are You Solving?

- Assessing Your Needs (Diagnostic Checklist)

- Property Condition Audit (The Non-Negotiables)

- Renovation Path: Costs, Scope, Timelines, and ROI

- Buying a New Home: Mechanics, Advantages & Hidden Costs

- Financing Comparison (Renovation Loans vs Mortgages)

- ROI & Value-Uplift Analysis (PH Data)

- Market Timing: Seller’s vs Buyer’s Market

- Emotional & Lifestyle Factors

- Time, Convenience & Disruption

- Regulatory & Permit Checklist (Philippines-Specific)

- Risk Factors & Red Flags

- Case Studies: Real Homeowner Scenarios

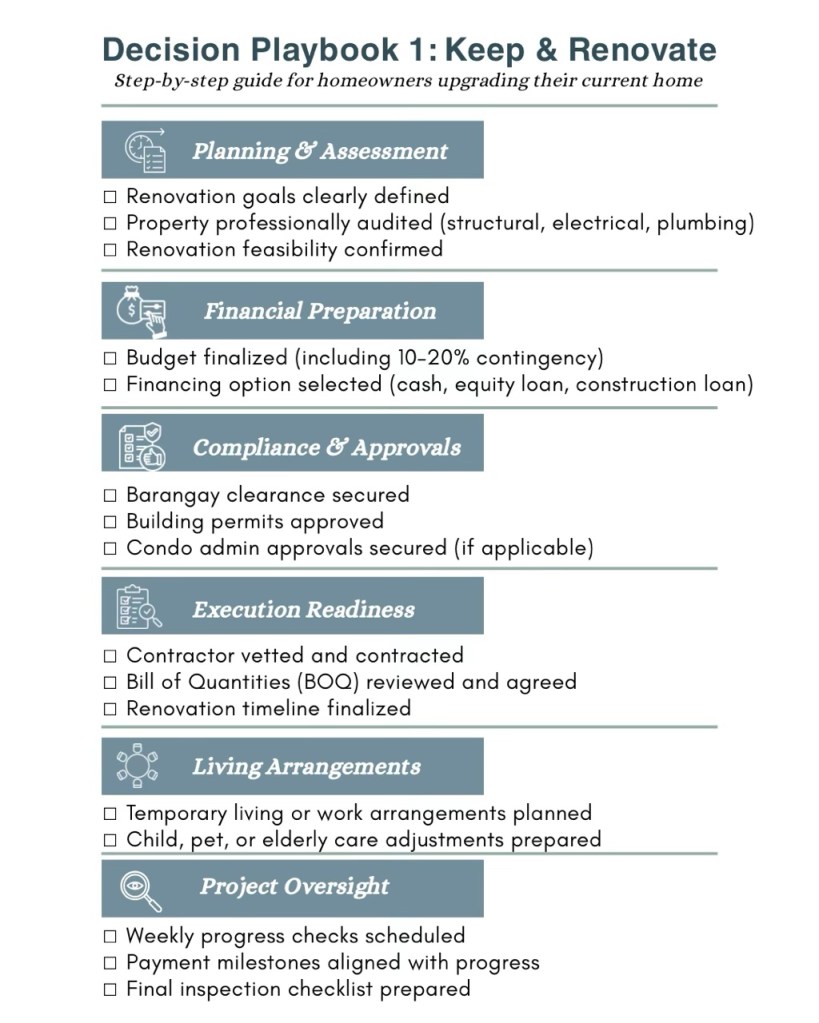

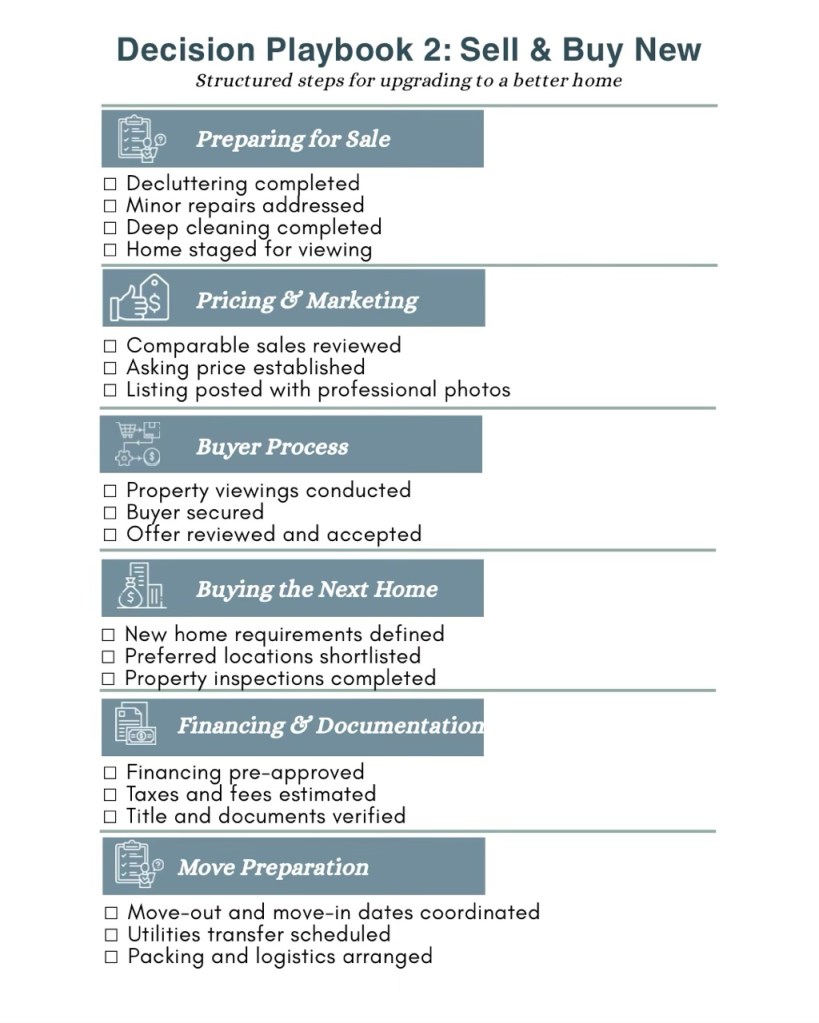

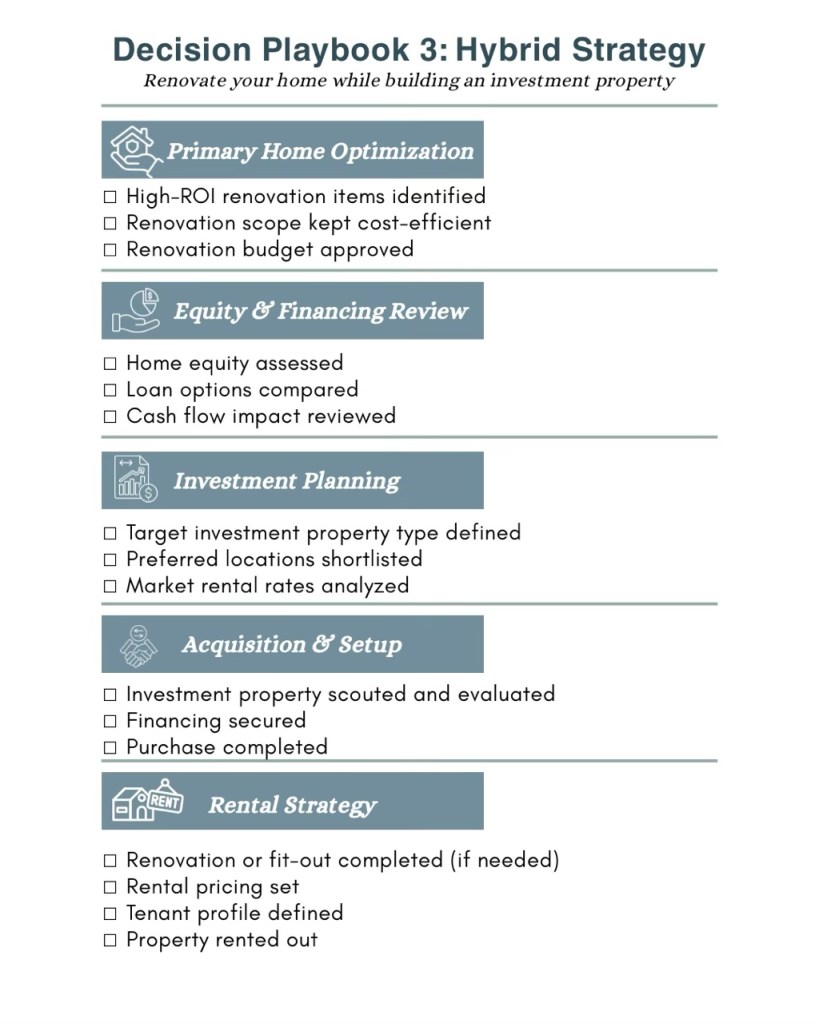

- Decision Playbooks (3 Options)

- Conclusion & CTA

The Real Homeownership Crossroads

A single question can stop even the most decisive Filipino homeowner in their tracks: Do you renovate the home you’ve grown to love, or do you start fresh somewhere new? It’s a crossroads filled with competing truths—sentimental value versus financial strategy, emotional comfort versus long-term practicality, the familiar versus the possible.

What once felt like the perfect home may now feel tight, outdated, or misaligned with the life you’re building. The kids are bigger. Work-from-home is now permanent. Your neighborhood may feel too chaotic—or too far from everything that matters. And yet the idea of walking away, especially from a community that has shaped your everyday rhythm, feels equally unsettling.

This choice goes far beyond paint swatches and Pinterest boards. It’s a strategic life decision—one that shapes your family’s next chapter, your wealth trajectory, and daily comfort for years to come. Renovating offers transformation without uprooting your routines. Buying a new home offers convenience, clarity, and a clean slate. Both paths have rewards. Both carry risks. And both require more than gut feeling.

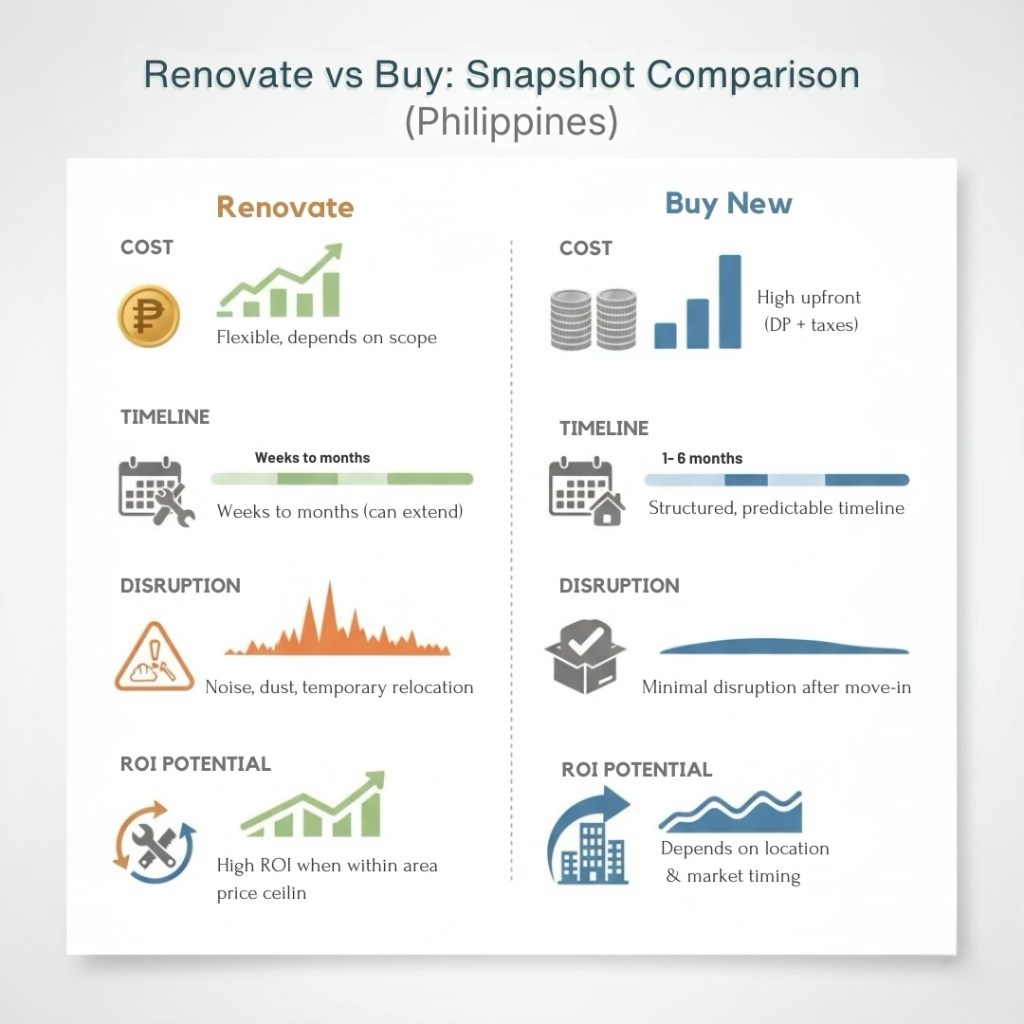

A side-by-side comparison of renovating versus buying a new home, highlighting costs, timelines, disruption levels, and ROI potential for Filipino homeowners.

This guide brings sharp, data-backed clarity to the dilemma many Filipinos face today. You’ll learn how to evaluate your space needs, budget capacity, expected ROI, lifestyle goals, and the realities of the Philippine real estate market—so you can choose a path that supports, not stresses, your future. Whether you’re craving more space, dreaming of a modern layout, seeking a better neighborhood, or protecting your long-term financial health, you’ll walk away equipped to make a confident, strategic, and fully informed decision.

The Big Question—What Problem Are You Solving?

Before comparing renovation costs, mortgage options, or the latest property listings, start with the question that most homeowners skip—but shouldn’t:

What exact problem are you trying to solve?

It sounds simple. It rarely is. Many homeowners rush into calling contractors or browsing listings the moment frustration hits. A cramped kitchen. A growing family. A suffocating commute. An old home that no longer feels right. But these symptoms are not the root problem—they’re signals pointing to deeper needs.

Misdiagnose the real issue, and you risk choosing the wrong path entirely.

You might pour millions into a renovation that still doesn’t fix your lifestyle frustrations. Or you might buy a new home that solves space but ruins your commute—and your patience.

This section cuts through the noise and helps you articulate the actual driver behind your desire for change.

Clarifying Your Homeownership Goals

Every homeowner has a unique story, but motivations often fall into clear, predictable patterns. Anchoring yourself to the right motivation instantly sharpens your decision-making—because renovation and buying each solve different problems.

Below are the four dominant motivations—and the decisions they naturally push you toward.

1. Space & Functionality Needs

When your home feels cramped no matter how you rearrange it, space becomes the central issue.

Common triggers:

- Growing family needs (new baby, teens, grandparents)

- WFH demands requiring a quiet room

- Lack of storage or poor circulation

- A layout that no longer supports your routines

If space is the pain point:

- Renovate if expansion is structurally possible and aligned with your lot or condo rules.

- Buy if the existing structure is too limiting, or the cost of adding rooms outweighs long-term value.

2. Lifestyle Changes

Sometimes the issue isn’t size—it’s how the home feels and functions.

You may want:

- Better natural light or ventilation

- A modern kitchen or open-concept living

- A calmer, greener environment

- A home that reflects who you are now—not who you were 10 years ago

If lifestyle upgrade is the goal:

- Renovate if your current home can be reconfigured meaningfully.

- Buy if the lifestyle you crave requires a different property type or a different neighborhood altogether.

3. School Zones & Community Considerations

Your environment shapes your everyday life more than any single room in your house.

Common motivators:

- Desire for better school accessibility

- Need for safer or quieter communities

- Wanting a more family-oriented neighborhood

- Interest in emerging townships with parks, walkability, and amenities

If location-related needs dominate:

- Buy—because no renovation can solve a location mismatch.

- Renovate only if you’re committed to staying and schools or infrastructure still meet your long-term needs.

4. Long-Term Investment & Wealth-Building Goals

Real estate is not just shelter—it’s a financial tool. Many Filipinos consider upgrades or new home purchases primarily to strengthen future equity.

Typical motivations:

- Preparing home for resale

- Moving to a higher-appreciation area

- Buying a property with stronger rental demand

- Long-term wealth planning for the family

If investment potential is the priority:

- Renovate when improvements meaningfully raise your home’s value within neighborhood price ceilings.

- Buy when shifting to a new location unlocks better appreciation or rental ROI.

Your Decision Starter Checklist

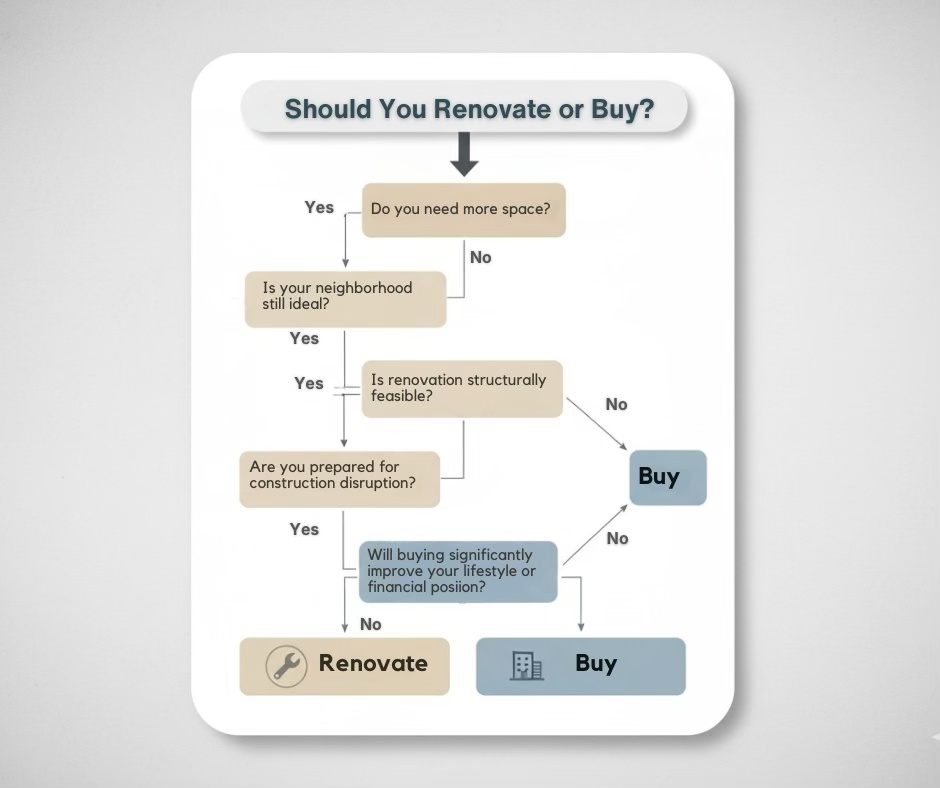

A decision flowchart illustrating the key considerations for homeowners deciding whether to renovate or buy a new home.

Use this clarity test to identify your dominant motivation. Answer each with Yes, No, or Unsure:

Answer each with Yes, No, or Unsure:

- Will your household size or needs change within 3–5 years?

- Does your current neighborhood still support your lifestyle goals?

- Are the home issues mostly fixable through layout or design?

- Is there enough structural flexibility to renovate meaningfully?

- Can you tolerate months of noise, dust, and temporary disruption?

- Would buying significantly simplify your commute or routine?

- Does your current home sit in a strong long-term appreciation zone?

- Are you financially prepared for either path (renovation or purchase)?

Quick Interpretation:

- More “Yes” for home issues = Renovation gains an edge.

- More “Yes” on lifestyle/location = Buying becomes the strategic move.

- More “Unsure” = Continue reading. The next sections will clarify what your home can—or cannot—become.

Assessing Your Needs (Diagnostic Checklist)

Choosing between renovating and buying is not just a financial puzzle—it’s a lifestyle audit. Before you compare costs, hire contractors, or shop for listings, you need absolute clarity on how well your current home serves your everyday life. This is where minor irritations reveal major truths: the breakfast rush bottleneck in your kitchen, the one shared bathroom that sparks daily conflict, or the commute that steadily drains your energy.

This section helps you evaluate the functional, spatial, and locational realities of your home—so you can determine whether renovation can solve your frustrations or if it’s time to move on.

Space Requirements

Filipino households evolve quickly. What once felt spacious can suddenly feel cramped or chaotic. Understanding your space needs today—and anticipating those in the next three to five years—is one of the most powerful predictors of whether renovation or relocation is the right path.

Growing Families

If your household is expanding, your home must evolve with it. New babies, teenagers needing privacy, or adult children returning home can stretch your space to its limits.

Signs you’re outgrowing your current home:

- Bedrooms doubling as multi-purpose zones

- Bathroom queues every morning

- Kids studying in hallways or dining areas

- Furniture rearranged every few months to “make things fit”

If vertical or horizontal expansion is possible, renovation remains a strong solution.

If your lot or condo layout is already maxed out, buying may be the only practical option

Multigenerational Living

It’s common in the Philippines for grandparents or parents to move in, requiring thoughtful space planning.

Multigenerational homes need:

- An extra bedroom or suite

- Accessibility upgrades

- More shared storage

- Additional bathrooms

Renovation works if your current layout allows structural reconfiguration.

Buying becomes wiser if accessible layout changes are impossible or structurally restricted.

Work-From-Home Requirements

WFH is here to stay—and using the dining table for Zoom meetings is not a long-term solution.

Ask yourself:

- Can a room be converted into a dedicated office?

- Does the home offer enough natural light and noise control for remote work?

- Will renovating require sacrificing essential living spaces?

If creating a functional workspace demands major reconfiguration or giving up comfort, buying a new home with a built-in office area may deliver better long-term value.

Functional & Layout Limitations

Some homes don’t fail because they’re old or small—but because they’re inefficient. Spaces can be optimized through renovation, but only within structural and architectural limits.

Circulation (Flow and Movement)

If people constantly bump into each other during busy hours, or if navigating the house requires odd detours, your layout is working against you.

- Poor circulation can usually be fixed by removing partitions or reconfiguring spaces.

- But if load-bearing walls limit movement, your home’s flow might never improve meaningfully.

Storage

Filipino families accumulate a lot—furniture, documents, appliances, balikbayan boxes.

Limited storage often signals:

- A space that’s too small

- A layout not optimized for built-ins

- Overcrowding due to lack of zoning

Renovations can solve storage issues—only if the home’s footprint allows it.

Ventilation & Natural Light

These two factors dramatically affect comfort and health. Many older homes suffer from poor airflow and dim interiors.

Renovation can improve this through:

- Window enlargement

- Better layout orientation

- Skylights or clerestory windows

But if your home’s position, structural walls, or setbacks limit improvements, buying a more naturally bright and well-ventilated home may be the superior choice.

Room Size Limitations

Tiny bedrooms, undersized kitchens, or narrow living areas restrict comfort. While combining rooms can help, structural walls and lot constraints may make true spaciousness impossible.

Ask:

“Can this home physically become the version I need?”

If the honest answer is no, renovation becomes a short-term fix—not a long-term solution.

Neighborhood Evaluation

Sometimes the home isn’t the problem—the location is. Renovation can transform spaces, but it cannot fix environmental, accessibility, or community-related issues.

Do You Still Want to Live in Your Current City or Barangay?

Neighborhood attachment is powerful—but you must assess whether it still supports your goals.

- Are you still happy with the safety and community?

- Do nearby developments add or reduce appeal?

- Will future lifestyle needs take you elsewhere?

If the answer leans toward “I’ve outgrown this area,” renovation is merely cosmetic.

Commute Time

Long daily travel drains productivity and happiness. Consider:

- Would moving closer to work or school improve your quality of life significantly?

- Are traffic patterns worsening year after year?

- Does your current location still make sense for your routine?

Commute inefficiency is one of the biggest reasons Filipino families choose to buy a new home.

School Accessibility

Families with school-age children must factor in:

- Proximity to preferred schools

- Safety along travel routes

- Travel time consistency during rush hours

If your school requirements change, your location will have to change too—renovation cannot solve this.

Future Infrastructure Development

Upcoming transport lines and road projects shape both lifestyle and property value.

Examples:

- MRT-4 (Ortigas–Taytay)

- MRT-7 (QC–Bulacan)

- LRT-1 Cavite Extension

- Skyway Stage 3 ramps

- New township developments (e.g., Bulacan Airport corridor, Cavite LRT extension zones)

If your area is primed for growth, staying and renovating may boost long-term ROI.

If growth is shifting elsewhere, buying in a rising corridor may outperform any renovation you invest in today.

Needs Assessment Scoring Sheet

A table homeowners can fill out with a 1–5 score for each item:

| Category | Criteria | Score (1-5) | Notes |

|---|---|---|---|

| Space | Bedroom needs, WFH, multigenerational readiness | ||

| Layout | Circulation, storage, room size, light/ventilation | ||

| Neighborhood | Commute, safety, schools, future infra | ||

| Emotional | Attachment, community ties | ||

| Practicality | Renovation feasibility, structural limits |

Interpretation:

- High scores (4–5) → Strong reason to consider buying.

- Mid scores (2–3) → Renovation may solve the issue.

- Mixed scores → Conduct deeper assessment in the next sections.

Property Condition Audit (The Non-Negotiables)

Before you spend a single peso on renovation plans—or fall in love with the idea of buying something new—you must confront the physical realities of your current property. This step isn’t glamorous, but it’s the one that prevents six-figure mistakes, blown budgets, and heartbreak later.

A dream renovation can fall apart when hidden structural issues surface.

A “perfect” resale home can turn into a financial burden if you overlook foundation problems or outdated systems.

No matter how sentimental you feel about your home, ignoring structural red flags is the fastest way to turn your property into a liability.

This audit helps you identify what’s cosmetic, fixable, expensive, or outright dangerous—so you can make a decision grounded in truth, not wishful thinking.

Structural vs Cosmetic Issues

Not all home issues are created equal. Some can be solved with paint and tiles; others require engineers, permits, and deep pockets. Distinguish early to avoid sinking money into a property that will never meet your needs.

Roof: Your First Line of Defense

Water intrusion is one of the top deal-breakers in Philippine homes.

Warning signs include:

- Water stains or peeling paint

- Persistent leaks during the rainy season

- Sagging roof lines

- Cracked or missing tiles

Roof repairs are manageable. Full roof replacement? Not always worth it.

If your roof’s lifespan is near its end, renovation costs may escalate fast—especially for older homes where structural trusses also need reinforcement.

Foundation: The Silent Deal-Breaker

Foundational issues are rare but extremely expensive. Look for:

- Stair-step cracks on exterior walls

- Doors suddenly misaligned

- Uneven floors

- Persistent settling

If a structural engineer flags foundation problems, consider whether the home is still worth renovating.

Foundation repairs can consume 40–60% of a renovation budget—sometimes more.

Electrical System: Outdated, Overloaded, Unsafe

Older Filipino homes often retain wiring from the ‘80s or ‘90s, which cannot support today’s appliances, air-conditioners, and home office setups.

Red flags:

- Frequent breaker trips

- Warm or buzzing outlets

- Flickering lights

- Old fuse-type panel boxes

A full electrical rewiring requires wall opening, rewiring, panel upgrading, and permits.

If the electrical backbone is too old, buying a newer home may be more cost-efficient long term.

Plumbing & Water Lines: The Hidden Money Pit

Leaks are easy to fix; systemic plumbing issues are not.

Watch for:

- Very low water pressure

- Rust-colored water

- Persistent leaks

- Slow drainage

- Moisture in walls or ceilings

This alone can turn a “simple” renovation into a major overhaul.

Bottom Line:

- If issues are cosmetic → Renovation is a smart, high-ROI move.

- If issues are structural, systemic, or hidden → Buying a new home may save you from a multi-year money drain.

Flood, Soil & Environmental Risk

No renovation—no matter how beautiful—can overcome environmental risk. The Philippines’ climate and geography demand an honest evaluation of external hazards.

Barangay-Level Flood History

Before committing to renovation, verify your area’s flood track record. Visit the barangay office and ask for:

- Historical flood levels

- Areas with chronic flooding

- Drainage improvement plans

If your home floods during strong typhoons, even once every few years, renovation won’t eliminate the bigger problem.

Flood-prone properties generally suffer from:

- Lower resale value

- Higher insurance costs

- Higher long-term maintenance expenses

- Continual stress during rainy season

If flood patterns worsen annually, moving may be the safer strategic choice.

Old or Inadequate Drainage Systems

Some subdivisions have outdated drainage no longer capable of handling NCR-level monsoon rains.

Warning signs:

- Water pooling after mild rain

- Persistent moisture in ground-floor walls

- Musty odors indicating hidden dampness

Renovation cannot fix neighborhood drainage issues. If the LGU or developer does not have clear improvement plans, upgrading your home may not be worth the long-term risk.

Soil Stability & Erosion

Homes built on slopes, reclaimed land, or areas with history of settling require extra caution.

Check for:

- Cracks on exterior retaining walls

- Unusual soil movement

- Slanted floors

- Repeated settling of certain areas

If soil instability is detected, renovation may not just be expensive—it may be unsafe without significant engineering interventions.

Rule of thumb:

If the land itself is unstable, don’t renovate. Relocate.

Condo-Specific Checks

Condominiums come with unique constraints. What you want to change and what you’re allowed to change are often two very different things.

Admin Renovation Rules & Restrictions

Before dreaming of an open kitchen or full layout change, check your Condominium House Rules. Expect restrictions on:

- Wet works (bathroom, kitchen upgrades)

- Structural alterations

- Noise-generating activities

- Work hours

- Electrical load limits

- Debris disposal procedures

Some condos disallow major reconfiguration altogether. If your ideal design isn’t permitted, buying a new unit may be more practical.

Waterproofing & Leak Issues

Condo leaks are more than an inconvenience—they’re a legal and financial risk.

Check for:

- Ceiling moisture

- Wall bubbling

- Bathroom leakage

- Balcony membrane failures

If your building has a history of waterproofing failures, your renovation may not survive the next rainy season—or worse, may damage the unit below.

Pipes, Shafts& Mechanical Restrictions

Condo plumbing stacks and shafts are usually fixed. This limits you from relocating:

- Toilets

- Sinks

- Showers

- Aircon drainage routes

If your renovation goals require moving plumbing across the unit, admin approval may be impossible.

Load-Bearing Walls

Most condos use structural walls that cannot be removed. This severely limits layout transformation.

If your dream design demands major wall removal, verify feasibility with a structural engineer. The answer is usually: Not allowed.

Key takeaway:

A condo or house renovation is only as flexible as the property’s structure and environmental conditions allow.

Before investing emotionally or financially, ensure your home is not hiding a costly truth you cannot renovate your way out of.

Who This Is For

- Homeowners considering a major renovation

- Families deciding whether to stay or move

- Condo owners unsure if renovations are even allowed

- Buyers assessing older resale properties

- Anyone who wants clarity before spending a single peso

This Property Condition Audit Checklist (Philippines Edition) is a practical, step-by-step tool designed to help you evaluate your home objectively before committing time, money, or emotional energy to a major decision.

What You’ll Get

✔ A structured checklist covering structural integrity, electrical and plumbing systems, flood risk, and condo renovation rules

✔ A renovation feasibility scoring system to help you decide whether upgrading your current home makes sense

✔ A printable, PDF-ready format you can use during site inspections or professional consultations

✔ A clear framework used by experienced property professionals to assess real renovation risk

Download the Checklist

Enter your email to receive instant access to the Property Condition Audit Checklist and use it as your decision anchor before moving forward.

Renovation Path: Costs, Scope, Timelines, and ROI

Renovation has a magnetic appeal. It promises transformation—your dream kitchen, a brighter layout, an extra bedroom, or a home that finally reflects how you live today. But renovation is not just a creative exercise; it’s a financial and logistical undertaking that must be treated with the same seriousness as buying property.

This section breaks down the true scope, cost realities, timelines, and ROI potential of renovating in the Philippines, giving you a sharp, realistic framework for choosing whether improving your current yhome is a brilliant investment—or an expensive detour.

Types of Renovations

Renovations fall into tiers, each with its own cost implications, timelines, and feasibility. Knowing which category your project sits in prevents unrealistic expectations and budget shocks.

1. Light Renovations (Cosmetic Upgrade)

These beautify your home without altering its structure.

Typical Inclusions:

- Repainting interior/exterior

- Re-tiling or refinishing floors

- Replacing cabinetry or cabinet faces

- Upgrading light fixtures

- Installing new doors or hardware

Best For: Boosting livability or preparing a home for resale with minimal cost and disruption.

Timeline: 2–6 weeks

ROI: High for cost vs impact; ideal for condos and older homes needing a refresh.

2. Medium-Scale Remodels

These improve function and appearance without major structural changes.

Typical Inclusions:

- Standard kitchen remodel

- Bathroom modernization

- Upgrading windows or sliding doors

- Reconfiguring non-load-bearing walls

- Adding built-in storage

Best For: Modernizing outdated interiors and improving everyday comfort.

Timeline: 1–3 months

ROI: Strong, especially for kitchens and bathrooms.

3. Full Home Remodels

A more holistic transformation involving multiple rooms or your entire home.

Typical Inclusions:

- Major layout changes

- Full electrical and plumbing upgrades

- New flooring, ceilings, and finishes across all rooms

- Converting closed layouts into open space

Best For: Homes older than 15–20 years or those requiring complete modernization.

Timeline: 3–12 months

ROI: High—if the home is structurally sound and located in a good neighborhood.

4. Extensions or Additions

These expand your home’s footprint, vertically or horizontally.

Common Projects:

- Adding a bedroom or ensuite

- Constructing a second floor

- Extending kitchen or dining spaces

- Building outdoor living areas

This alone can turn a “simple” renovation into a major overhaul.

Best For: Growing families or multigenerational households.

Timeline: 4–10 months

ROI: Very strong in neighborhoods where extra bedrooms significantly raise resale value.

5. Structural Changes (Engineer-Heavy Projects)

These require serious planning and technical expertise.

Examples:

- Removing load-bearing walls

- Elevating ceilings

- Reinforcing foundations

- Adding beams or columns

This alone can turn a “simple” renovation into a major overhaul.

Best For: Transformative designs—but only when structurally feasible and financially justified.

Timeline: Varies widely

ROI: High risk, high reward; requires strict cost-benefit analysis.

Cost Ranges in the Philippine Market

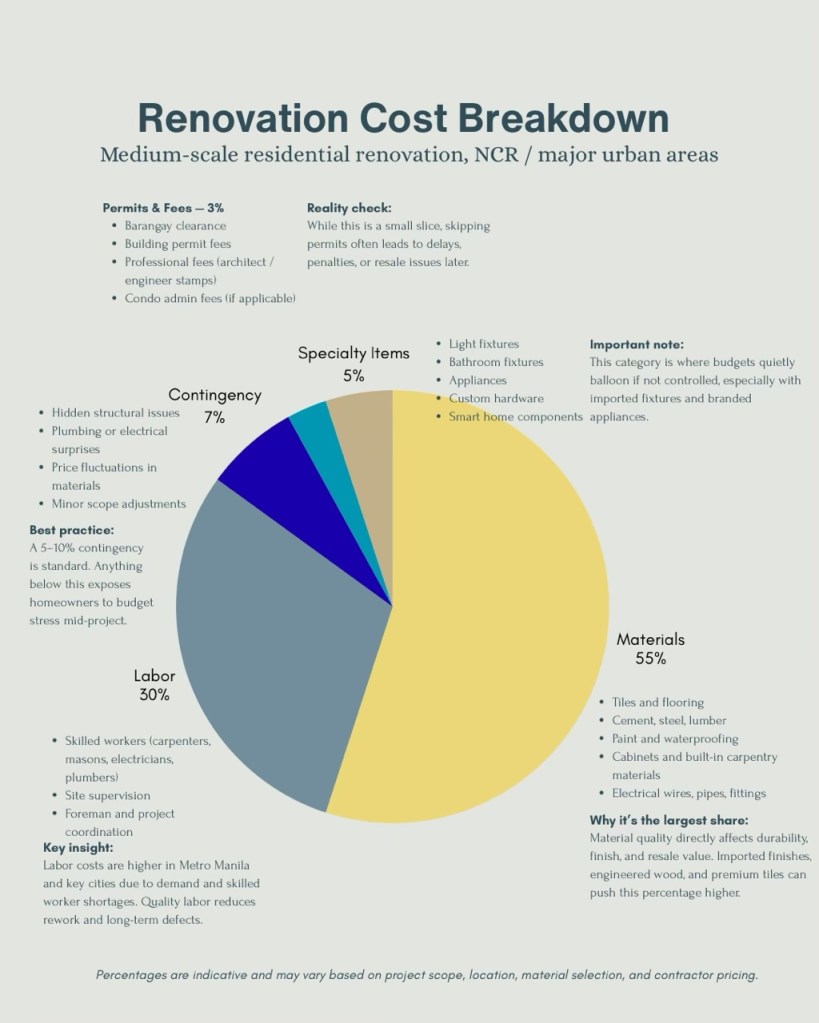

A comprehensive breakdown of renovation costs for medium-scale residential projects in major urban areas of the Philippines, highlighting materials, labor, permits, and contingency fees.

Renovation costs vary based on materials, labor rates, location, and structural complexity. Below are realistic market ranges to help you budget effectively.

Kitchen Remodel Cost (Per Square Meter)

Basic

₱25,000–₱35,000/sqm

Mid-Range

₱40,000–₱60,000/sqm

High-End

₱70,000–₱120,000/sqm

Includes: Cabinets, countertops, backsplash, plumbing relocation, electrical upgrades, appliances.

Insight: The kitchen consistently delivers one of the highest ROI percentages in Philippine homes.

Bathroom Remodel Cost

Basic

₱150,000–₱250,000

Mid-Range

₱250,000–₱400,000

High-End

₱450,000+

Driven by: Waterproofing, tiles, fixtures, plumbing changes, ventilation solutions.

Insight: A modern, hotel-style bathroom dramatically increases buyer appeal.

Extensions / Additions

Simple Expansion

₱25,000–₱40,000/sqm

Two-Storey Addition

₱35,000–₱60,000/sqm

Covers foundation work, framing, roofing, finishes, and structural engineering.

Insight: Additional bedrooms remain one of the most value-boosting upgrades in family-centric neighborhoods.

Labor vs. Materials Breakdown (Typical PH Projects)

Materials

55–70%

Labor

30–45%

Material costs escalate quickly, especially with imported tiles, engineered wood, and premium fixtures. Labor costs in NCR and Cebu are higher due to demand.

Pro Tip: Add a 10–20% contingency fund—non-negotiable for older homes where hidden issues are common.

Timeline Expectations

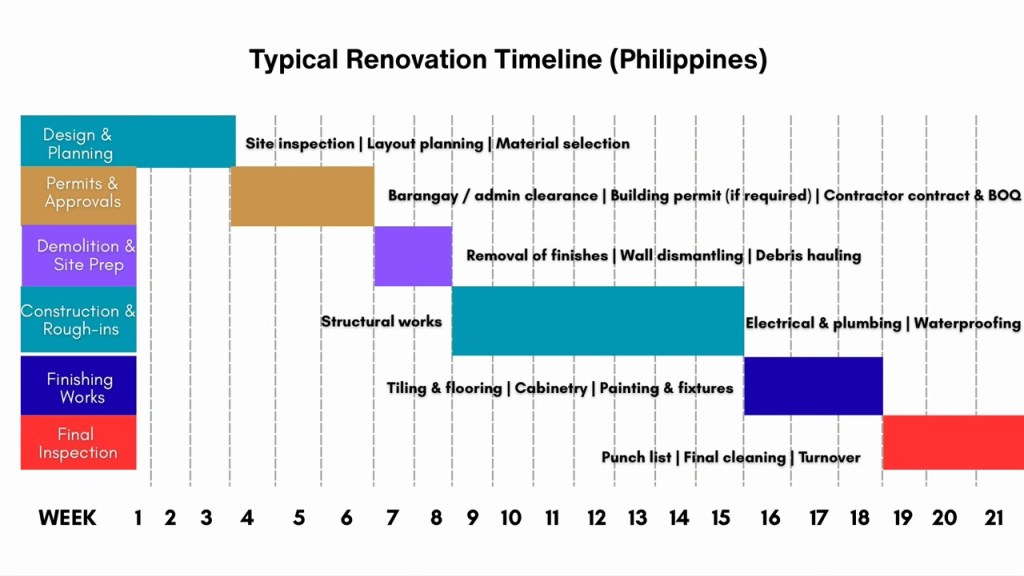

A visual flowchart outlining the typical renovation timeline in the Philippines, detailing the stages from design and planning to final inspection.

Timelines depend on project scope, contractor availability, material delivery, and weather conditions.

Typical Renovation Durations:

Light renovation

2–6 weeks

Kitchen remodel

6–10 weeks

Bathroom remodel

4–8 weeks

Full home remodel

3–12 months

Extensions/additions

4–10 months

Common Sources of Delay

Permit processing

Some LGUs take 2–8 weeks.

Material availability

Imported items often face shipping delays.

Weather

Rainy season affects concrete curing and exterior work.

Contractor workload

Skilled teams are booked months in advance.

Structural surprises

Termite damage, corroded pipes, weak beams, or mold.

Important:

Renovation timelines aren’t just about convenience—they directly affect labor costs, rental arrangements, and financial buffer requirements.

When Renovation Makes Financial Sense

Renovation becomes a powerful wealth-building tool when done strategically and aligned with neighborhood value ceilings.

High-ROI Upgrades

These upgrades consistently boost resale value and marketability:

- Kitchen remodels (top ROI generator)

- Bathroom upgrades

- Open floor plan conversions

- Additional bedrooms

- Outdoor living enhancements

- Energy efficiency upgrades (windows, ventilation, LED lighting)

These improvements pay off not only in value uplift but in everyday quality of life.

Neighborhood Value Ceiling Check

Every neighborhood has a price band based on comparable sales. No matter how beautiful your renovation is, buyers won’t pay beyond what the location can justify.

Renovation makes financial sense when:

- Your home is BELOW the neighborhood’s median value

- Improvements align with what buyers in your area want

- You plan to stay long enough to enjoy—and amortize—the upgrade

- The structural shell supports transformation without overspending

Renovation becomes financially risky when:

- Your desired upgrades exceed the ceiling price

- Surrounding homes don’t support high-end improvements

- Major repairs + remodeling would cost more than buying a better home elsewhere

- Your lot or unit has limitations that cap future appreciation

Every barangay or subdivision has a price band—your renovation should stay within it.

Renovation makes sense when:

- Your home is currently undervalued for the area

- Your planned upgrades align with buyer expectations

- You intend to stay long enough to enjoy the improvements

- The structure supports your renovation goals

Renovation becomes risky when:

- You exceed the neighborhood’s price ceiling

- Major repairs plus remodeling costs surpass the value of buying new

- Structural issues demand engineer-level intervention

- Your lot or unit has permanent limitations

Rule of Thumb:

Don’t invest ₱3M into a home in a neighborhood where selling prices cap at ₱5M–₱6M—unless your goal is long-term enjoyment, not ROI.

Buying a New Home: Mechanics, Advantages & Hidden Costs

Buying a new home hits differently. There’s a sense of reset—a chance to live in a space that finally fits your lifestyle instead of endlessly adjusting your life around the limitations of your current home. It’s cleaner, simpler, faster, and often more aligned with your long-term goals.

But the buying process in the Philippines is not as straightforward as browsing listings and submitting an offer.

It’s a series of financial, legal, and logistical checkpoints that must be understood clearly to avoid surprise costs, delays, or mismatched expectations.

This section clarifies the full mechanics of purchasing, the advantages you gain, and the hidden costs you must anticipate before committing to a new address.

Upfront Costs (What You Must Pay Before Moving In)

One of the biggest misconceptions among Filipino buyers is thinking that the only large expense is the down payment. In reality, the total upfront cost of buying a home can stretch 8–13% above the property price once taxes, bank requirements, and LGU fees are added.

Here’s the full breakdown.

1. Down Payment (DP)

Equity for pre-selling units

Usually 10–20% payable over 24–48 months

For RFO units and resale homes

10–30%

For high-end or luxury properties

20–50%

Your DP size directly impacts your monthly amortization and loan approval chances.

2. Closing Fees

Charged upon loan release or title transfer. These typically include:

- Bank processing fees

- Notarial fees

- Documentary submissions

- Registration handling fees

Typical range: ₱30,000–₱80,000 depending on the bank and loan amount.

3. Government Taxes

Documentary Stamp Tax (DST)

1.5% of the property’s selling price or zonal value—whichever is higher.

This is one of the biggest hidden costs.

Transfer Tax

0.5–0.75% depending on your city or municipality. Metro Manila LGUs tend to be on the higher end.

Registration Fee

Based on a sliding scale set by the Registry of Deeds. Typically ₱10,000–₱30,000 for mid-range properties.

4. Appraisal Cost

Most banks require a third-party appraisal to determine the loanable value.

Range: ₱3,500–₱6,000 for condos and ₱5,000–₱10,000 for houses and lots.

5. Move-In Fees (Condos/Subdivisions)

These include:

- Move-in bond

- Utility activation fees

- HOA/Condo dues

- Security and access tag fees

Range: ₱5,000–₱50,000 depending on developer/building rules.

Bottom Line:

The real upfront cost is not just the DP.

It’s DP + taxes + closing costs + appraisals + move-in fees—often adding up to hundreds of thousands on top of the base price.

Condos vs Subdivision Homes vs Townhouses

Each property type solves a different problem. You’re not just choosing a structure—you’re choosing a lifestyle, a daily rhythm, and a future resale pathway.

Below is a sharper, more realistic comparison grounded in current PH buyer patterns.

Condominiums

Best For: Young professionals, investors, downsizing couples, OFW families wanting low maintenance.

Strategic Fit: Buy a condo when your priorities revolve around convenience, rental income, or short commute times.

Advantages:

- Prime locations (BGC, Makati, Ortigas, Cebu IT Park)

- Strong rental demand

- 24/7 security

- Amenities you can’t replicate at home (pools, gyms, lounges)

- Minimal upkeep

Limitations:

- Limited expansion potential

- Smaller living spaces

- Monthly condo dues

- Strict renovation rules

Subdivision Homes (Lot+House)

Best For: Families needing space, privacy, pets, future extensions, or long-term stability.

Strategic Fit: Ideal when you want control, breathing room, and the ability to customize freely.

Advantages:

- Bigger floor areas

- Expansion flexibility

- Outdoor space for kids and pets

- Strong long-term appreciation in the right neighborhoods

Limitations:

- Higher maintenance

- Security varies by subdivision

- Commutes can be longer for suburban developments

Townhouses

Best For: Families wanting a compromise between condo convenience and house space.

Strategic Fit: Townhouses are perfect for families who need more space than a condo allows but want to stay near the city.

Advantages:

- More affordable than detached homes

- Multiple floors for privacy

- Often located near city centers

- Strong rental demand in urban areas

Limitations:

- Limited lot area

- Shared walls

- Parking constraints

- Possible HOA restrictions

Transaction Timeline

Buying a home in the Philippines follows a predictable—but often lengthy—sequence. Understanding the order helps you avoid delays and manage expectations.

1. Property Viewing & Offer Submission

You submit an Offer to Buy or reserve a unit (for pre-selling/brand-new).

2. Document Submission

Banks and developers typically require:

- Valid IDs

- Proof of income

- ITRs

- Certificate of Employment

- Marriage certificate (if applicable)

- Reservation forms

3. Bank Loan Processing & Appraisal

Banks evaluate your financial capacity and appraise the property.

Timeline: 2–4 weeks

Longer during peak seasons or for provincial properties.

4. Approval, Loan Signing & Insurance Enrollment

Most banks require:

- MRI (Mortgage Redemption Insurance)

- FGI (Fire & Geohazard Insurance)

5. Title Transfer & Documentary Processing

Handled by the developer, bank, or your broker depending on the arrangement.

Timeline: 1–3 months for condos

2–6 months for house-and-lot, especially if documents need LGU clarifications.

6. Turnover & Move-In

Once all documents and fees are settled, the developer or seller will turn over the property and grant clearance to move in.

Total Realistic Timeline:

Condos

2–5 months

House & Lot

3–6+ months

Pre-selling

2–5 years

When Buying Makes More Sense

Buying wins—hands down—when the lifestyle, safety, structural, or financial limitations of your current home can’t be fixed through renovation.

Here’s when buying becomes the superior long-term move:

1. You Need Instant Space and Functionality

No amount of rearranging or repainting will create:

- An extra bedroom

- A bigger kitchen

- A larger living area

- More bathrooms

If your current home has maxed out every square meter, buying is the only real solution.

2. Your Home Has Major Structural Issues

If your home is suffering from foundational problems, recurring leaks, severe electrical issues, or long-term moisture damage, renovation becomes a money pit, not an investment.

Buying gives you a structurally sound fresh start.

Banks and developers typically require:

- Valid IDs

- Proof of income

- ITRs

- Certificate of Employment

- Marriage certificate (if applicable)

- Reservation forms

3. Your Lifestyle Demands a Different Environment

The most powerful reasons to move include:

- School access

- Shorter commute

- Healthier surroundings

- Better security

- More walkable communities

- Access to new infrastructure

These are benefits no renovation can replicate.

4. Your Long-Term Financial Goals Favor a New Location

Buying makes strategic sense when:

- A different area offers stronger appreciation

- You want to enter a fast-growing township

- You plan to build a rental portfolio

- Your current home is capped by neighborhood price ceilings

Renovation vs Buying — Cost & Timeline Comparison

Buying wins—hands down—when the lifestyle, safety, structural, or financial limitations of your current home can’t be fixed through renovation.Here’s when buying becomes the superior long-term move:

| Category | Renovation | Buying a New Home |

|---|---|---|

| Upfront Cost | Flexible; depends on scope | High; 20 + down payment |

| Timeline | Weeks to months | 6 weeks – 6 months |

| Disruption | High (dust, noise, temporary relocation) | Low to moderate |

| Control | Full design freedom | Limited (especially condos) |

| ROI Potential | High if strategic | Depends on location & market |

| Complexity | Permits, contractors, construction risks | Financing, taxes, title transfer |

| Ideal For | Homeowners who love their location | Families needing instant change |

Financing Comparison (Renovation Loans vs Mortgages)

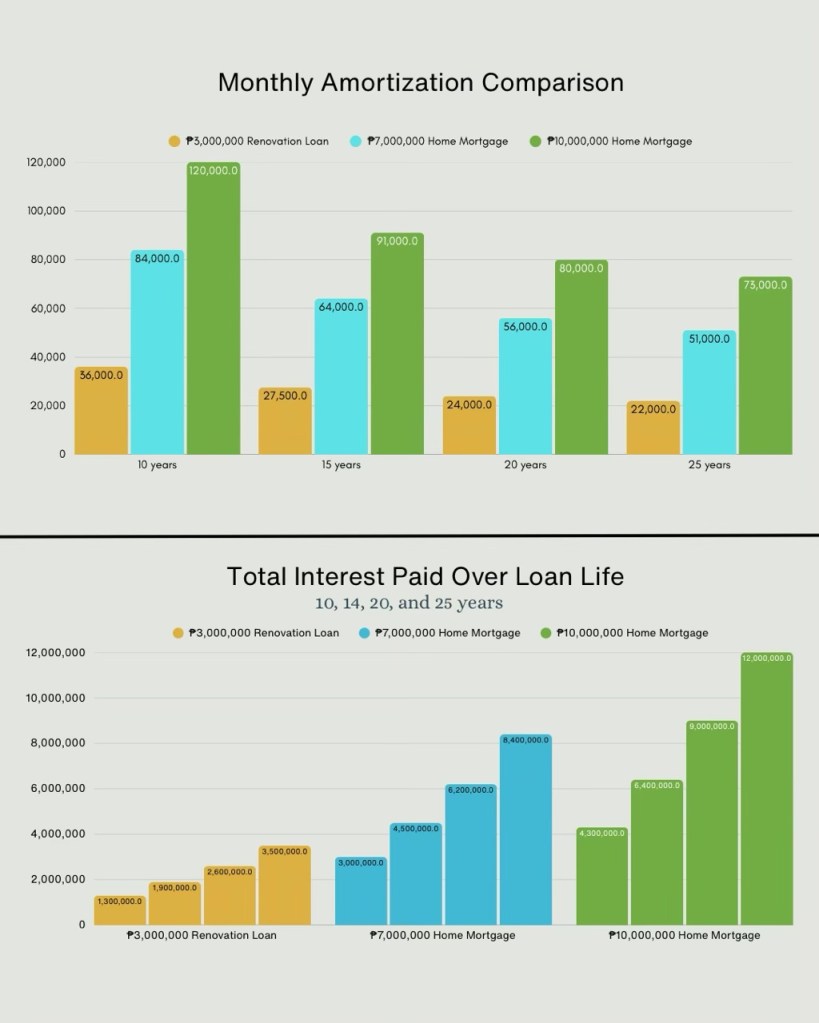

A flowchart comparing monthly amortization for different renovation loans and home mortgages in the Philippines, highlighting financial implications over various loan terms.

Buying may look expensive. Renovating may look flexible. But the truth is far less obvious: your financing strategy—not the project itself—determines whether you thrive or struggle financially.

Homeowners often compare renovation and buying based on upfront cost alone, but the smarter benchmark is cash flow durability, risk exposure, and total cost over time.

This section breaks down the financing tools available in the Philippines, the loan-to-value rules that quietly shape your options, and the cash flow scenarios that reveal which path is truly sustainable for your household.

PH Bank Options (Your Financing Tools, Decoded)

Philippine banks offer three major loan types that directly influence your renovate-vs-buy decision. Each one has its own rhythm—requirements, release schedules, constraints, and best-use scenarios.

1. Home Loan Refinancing

A refinancing loan replaces your existing mortgage with a new one—often with better terms or a higher principal.

Best when:

- Your home has appreciated in value

- You want lower interest rates

- You’re restructuring your monthly obligations

- You want to free up cash for a renovation without taking a separate loan

Advantages:

- Lower monthly amortization (in many cases)

- Access to equity you’ve built over the years

- Allows consolidation of high-interest debts

- Strong leverage tool for major upgrades

Risks:

Since your home serves as collateral, missed payments can lead to foreclosure.

This is a powerful tool—but best used with disciplined cash flow management.

2. Home Equity Loan (HEL)

Think of this as unlocking your home’s financial “stored value.”

Banks let you borrow against the equity you’ve built.

Best for:

- Mid to large-scale renovations

- Second-floor additions

- Kitchen + bathroom overhauls

- Upgrading older homes for resale or rental

Advantages:

- Higher loan amounts compared to personal loans

- Lower interest rates (secured loan)

- Flexible use of funds (not tied to specific construction milestones)

Watch out for:

- Processing timelines (typically 30–60 days)

- Appraisal results that may limit the loanable amount

Refinancing is the quiet workhorse of renovation financing—especially when you want more liquidity without selling your home.

3. Construction Loans

For homeowners planning major structural upgrades or ground-up rebuilds, a construction loan releases funds in tranches, aligned with project milestones.

Best for:

- Extensions or additional floors

- Full-home remodels

- Structural overhauls

- Rebuilding older homes while retaining the lot value

Advantages:

- Designed specifically for phased construction

- Ensures funds match real project progress

- Banks often require architect/engineer plans—adding a layer of oversight

Limitations:

- More documentation

- Slower approval timeline

- Requires tight coordination with your contractor

Construction loans shine when you’re doing a heavy transformation, but they demand discipline and professional planning.

Loan-to-Value (LTV) Rules

Banks in the Philippines don’t simply lend based on need—they lend based on the property’s value and risk profile.

This is where many homeowners discover the limits of their financing options.

Typical LTV Ratios in PH Banks

House & Lot

80–90%

Condominiums

70–80%

Vacant Lots

60–70%

Renovation / Construction

70–80% of the completed value

Notice the pattern:

Banks lend less for condos, even less for vacant lots, and are strict about renovation loans because the property must justify the increased value.

What affects your LTV?

- Income stability

- Credit history

- Debt-to-income ratio

- Age and condition of the property

- Developer reputation (for condos)

- Flood risk and location

- Market saturation in the area

LTV isn’t just a bank rule—it‘s a decision-making compass.

A low LTV approval often signals a deeper truth: your plan may not be financially sustainable without more equity.

Cash Flow Scenarios

This is where the renovate-vs-buy debate becomes brutally clear.

Monthly cash flow determines not just affordability—but lifestyle stability.

1. Using Home Equity to Fund Major Renovations

If your home has appreciated significantly (common in NCR, Cebu, Davao, and Iloilo), a HEL or refinancing loan unlocks liquidity you already own.

Example:

Home current value: ₱8,000,000

Existing loan balance: ₱5,000,000

Equity: ₱3,000,000

A bank may lend ₱1.5M–₱2.4M for renovation depending on LTV rules.

This is ideal when:

- Your home is in a strong neighborhood

- Renovation boosts value beyond the loan amount

- You want to upgrade without draining savings

- You’re planning a resale in the next 3–7 years

With equity financing, your home becomes both your shelter and your capital engine.

2. Monthly Amortization Comparison: Renovate vs Buy

The monthly impact of your decision often matters more than the total cost.

If You Buy a New Home:

- Higher principal = higher amortization

- Longer financing terms

- But the home is move-in ready

- Little to no disruption

Predictable but heavier.

If You Renovate:

- Lower monthly loan payments (typically)

- But you absorb hidden costs:

- Temporary relocation

- Contingencies

- Material delays

- Change orders

- Project management drains time and energy

Lighter monthly payments, but heavier lifestyle disruption.

Smart Homeowner’s Test:

Ask:

“Which option preserves my cash flow while improving my long-term wealth?”

Many are shocked to discover:

A renovation that looks cheaper can end up costing more—financially and mentally—because of unpredictable expenses.

A home purchase that looks expensive can actually offer more stability thanks to consistent amortization and minimal disruption.

Cash flow is the real battlefield—not the sticker price.

ROI & Value-Uplift Analysis (PH Data)

Renovation is often framed as an emotional decision—“I want a nicer kitchen,” “I want a more modern home.” But the smartest homeowners think like investors. They ask one thing:

“If I pour money into this home, will it grow my wealth—or stall it?”

This section answers that question with real Philippine market behavior, renovation ROI trends, and value-uplift insights drawn from actual buyer psychology across Metro Manila, Cebu, Davao, Iloilo, and rising provincial cities.

Some upgrades elevate value instantly. Others sink money into changes the market will never reward. Knowing the difference is what separates strategic renovators from homeowners who “over-upgrade” and trap themselves financially.

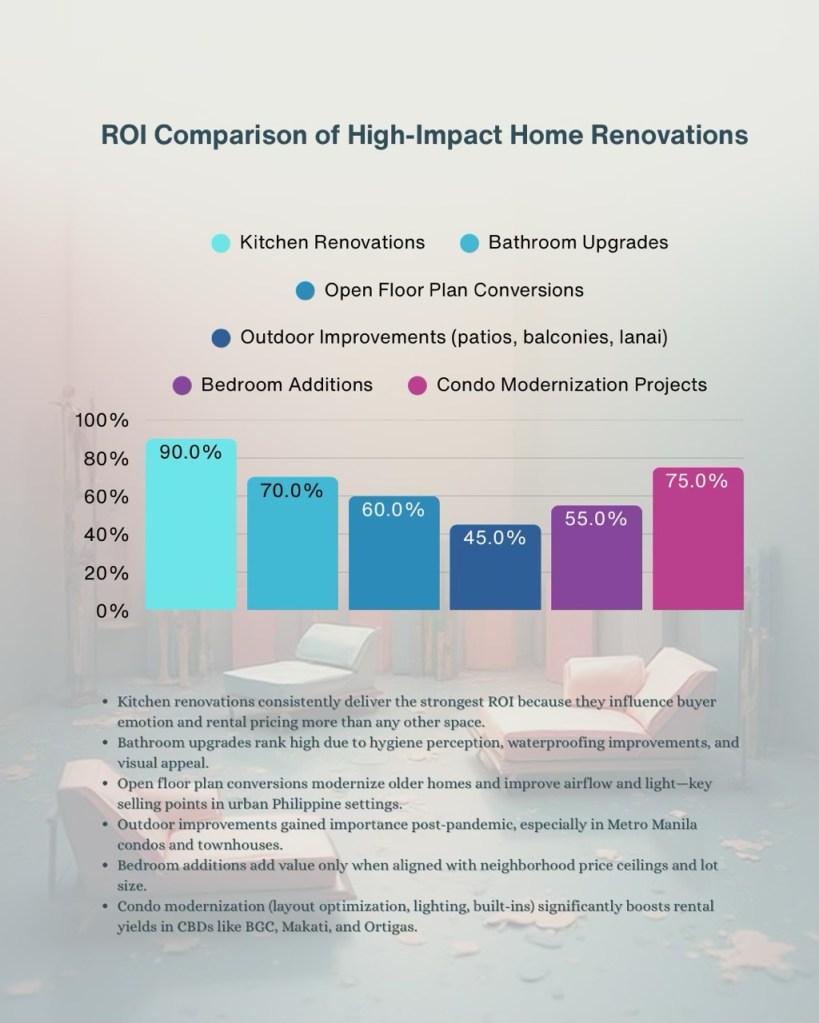

Renovations with the Strongest ROI

A bar graph illustrating the ROI comparison of various high-impact home renovations, showcasing kitchen renovations leading with 90% ROI, followed by bathroom upgrades at 70%, and outdoor improvements at 60%.

Only a handful of improvements consistently outperform in the Philippine market—because they strike the perfect balance between function, emotion, and market demand.

These upgrades shine whether you plan to resell, rent, or simply elevate your long-term equity.

1. Kitchen Renovations (ROI: 60%–120%) — The Philippine Power Move

In Filipino households, the kitchen is not just a workspace—it’s a social hub. Buyers immediately judge the home’s modernity, maintenance level, and overall appeal based on this single room.

High-impact upgrades:

- Quartz/granite countertops

- Modular cabinetry

- Modern backsplash designs

- Improved task + ambient lighting

- Efficient layout reconfiguration

- Better appliance integration

Why it works:

A modern kitchen upgrades the perceived value of the entire home. In many PH listings, buyers rank the kitchen as a top deal-maker or deal-breaker—even more than total floor area.

2. Bathroom Upgrades (ROI: 50%–90%) — The Silent Value Booster

Bathrooms affect both emotional comfort and resale desirability. A fresh, hotel-style bathroom instantly signals “well-maintained” and “move-in ready.”

High-impact upgrades:

- Walk-in showers with glass enclosures

- High-quality tiles

- Proper waterproofing (critical in PH climate)

- Modern fixtures

- Improved ventilation

Why it works:

Bathroom renovations remove one of the biggest buyer fears: hidden plumbing issues. It also dramatically improves day-to-day living quality.

3. Open Floor Plan Conversions (ROI: 40%–80%) — The Modern Filipino Preference

Older homes in the PH often suffer from compartmentalized layouts. Opening key non-load-bearing walls transforms light, airflow, and usability.

Value-added outcomes:

- Bigger visual space

- Better circulation

- Flexible furniture arrangement

- Improved natural ventilation (vital in a tropical climate)

Why it works:

Filipino families increasingly favor airy, social layouts inspired by condo-style living. When done correctly, this upgrade makes an older home feel instantly contemporary.

4. Outdoor & Semi-Outdoor Upgrades (ROI: 30%–60%) — A Post-Pandemic Essential

Demand for usable outdoor spaces skyrocketed after 2020 and remains consistently high today—especially in locations where families seek greenery or relaxation zones.

Strong performers:

- Covered patios/lanai extensions

- Decks

- Garden enhancements

- Balcony makeovers

- Outdoor lighting + ventilation upgrades

Why it works:

In cities like QC, Antipolo, Cebu, Iloilo, and Davao, homes with functional outdoor areas command higher prices and faster sales.

When ROI Drops

Not all renovations pay off. Some even destroy value—even when they look beautiful.

These are the pitfalls that Filipino homeowners and investors repeatedly fall into:

1. Overbuilding Beyond the Neighborhood Price Band

Every barangay, subdivision, or condo cluster has a “price ceiling.”

Once you exceed what buyers in that area are willing to pay, your ROI evaporates.

Examples:

- A ₱2M gourmet kitchen in a ₱4–5M subdivision

- Adding luxury finishes in a mid-market neighborhood

- Building a second floor when surrounding homes are single-level

- High-end interiors in aging, low-demand condos

Rule of Thumb:

Stay within 10–15% of the neighborhood’s median resale price unless you’re holding the property long-term.

2. Highly Customized Interiors

Filipino buyers tend to avoid niche designs that feel “personalized.”

They want neutral, clean, and flexible spaces—not themed interiors that lock them into your preferences.

Low-ROI upgrades include:

- Industrial lofts in suburban homes

- Strong patterned tiles that quickly feel dated

- Built-ins that reduce adaptability

- Converting bedrooms into hobby rooms or walk-in closets

- Bold color palettes that limit staging

Buyers are emotional but also practical: if they can’t imagine themselves living there, value perception drops instantly.

Buy-and-Upgrade Strategy for Investors

Investors are a different breed. They don’t just renovate—they renovate with purpose.

A strategic renovation can transform a good property into a high-performing asset.

This strategy is especially potent in rental-heavy districts like:

- BGC

- Makati

- Ortigas

- Mandaluyong

- Cebu IT Park

- Davao City Center

- Iloilo Business Park

Rental Uplift After Renovation (Actual PH Market Behavior)

Typical Uplift:

- Standard units → Renovated units: +10%–25% rent

- Premium renovated units (hotel-inspired): +30%–50% rent

- Fully furnished designer units: premium tenants (expats, executives) pay significantly more

Why this strategy works:

- Tenants pay for convenience and aesthetics

- Renovated units reduce maintenance calls

- Units lease faster, reducing vacancy periods

- Higher rent offsets renovation costs quickly

Best Upgrades for Rental ROI

- Modern kitchenette with modular cabinetry

- Fresh bathroom with new fixtures

- Smart storage solutions

- Neutral, timeless design

- Improved lighting & ventilation

- Clean, clutter-free layout

These upgrades elevate perceived value dramatically without overspending.

Investor Advantage:

Older or undervalued condos can be purchased low, renovated affordably, and repositioned as premium rentals—outperforming newly built units priced at peak market rates.

This is one of the most powerful wealth-building strategies in PH real estate today.

Market Timing: Seller’s vs Buyer’s Market

Even the smartest renovation plan or the most attractive new home can become a poor financial move if done at the wrong moment. Timing isn’t just a bonus strategy in real estate—it’s a multiplier. Buy during the wrong cycle, and you overpay. Renovate during the wrong cycle, and you miss out on market gains. Choose right, and the market works for you.

Understanding whether the Philippines is leaning toward a seller’s market or buyer’s market equips you with the advantage most homeowners never bother to develop. This is where homeowners graduate into strategic decision-makers.

Before choosing whether to renovate or buy, learn how to read the signals that seasoned investors monitor obsessively.

Indicators to Watch

Markets don’t change overnight. They leave patterns—clues that reveal whether you should sit still, renovate, or strike quickly and buy. Watch these three indicators the way investors watch interest rates and inflation.

1. Inventory Levels (Supply)

Supply defines the battlefield.

It shows whether buyers or sellers currently hold the power.

Low inventory (lean supply) → Seller’s Market

Homes sell fast, choices are limited, and prices climb. Renovating becomes more logical because finding a better home—at a fair price—grows harder.

High inventory (oversupply) → Buyer’s Market

This signals weak demand and motivated sellers. Buying becomes more attractive—especially for homeowners aiming for bigger homes, better locations, or newer communities.

Why this matters to homeowners:

If supply in your target area is tight—BGC, Makati, Mandaluyong, QC—it’s harder to find a replacement home without paying a premium. Renovation becomes the strategic choice.

If supply balloons (common in fringe condo markets or emerging townships), buying can become more financially advantageous than upgrading your existing home.

2. DOM (Days on Market)

DOM reveals market appetite.

Short DOM → Homes are selling fast

Demand exceeds supply. Competition heats up. Renovation becomes safer if buying means bidding wars or inflated prices.

Long DOM → Homes sit for weeks or months

This signals weak demand and motivated sellers. Buying becomes more attractive—especially for homeowners aiming for bigger homes, better locations, or newer communities.

Rule of thumb:

If you notice properties in your area selling in under 30 days, brace for competition.

If listings linger past 60–90 days, buyers are in the driver’s seat.

3. Interest Rate Movements

In the Philippines, the Bangko Sentral ng Pilipinas (BSP) directly shapes buyer power.

Even a 1% shift in mortgage rates can alter affordability by hundreds of thousands over a loan’s lifetime.

When Rates Are Low:

- Monthly amortizations become easier

- Loan approvals increase

- Developers offer aggressive promos

Buying becomes extremely attractive.

This is when many homeowners choose to upgrade instead of renovate.

When Rates Are High:

- Borrowing power drops

- Monthly amortizations spike

- Buyers adopt a wait-and-see stance

Renovation becomes the smart, controlled financial move—you improve your lifestyle without taking on a more expensive mortgage.

Investor insight:

Monitor BSP announcements and bank rate adjustments quarterly. Market sentiment often flips within weeks of a rate change.

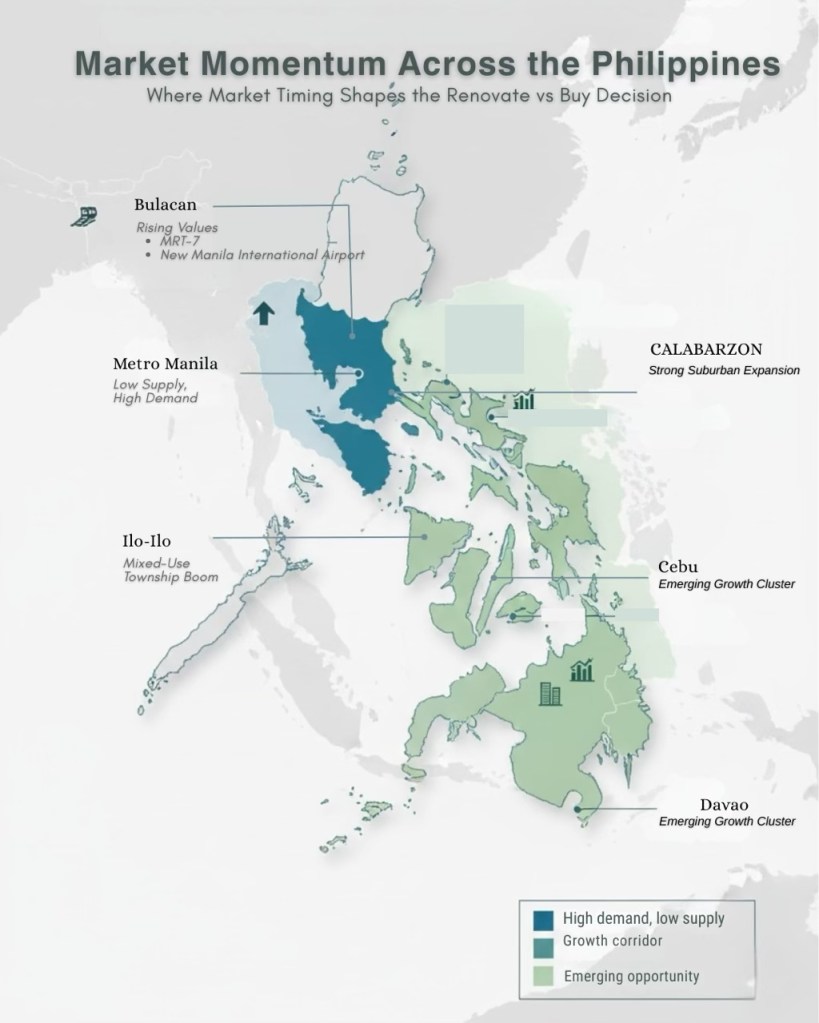

Metro Manila vs Provincial Market Differences

A detailed map illustrating market momentum across the Philippines, highlighting regions with high demand, low supply, and emerging growth clusters affecting housing decisions.

Real estate in the Philippines is not one unified market—it’s a mosaic of micro-markets. Metro Manila behaves differently from Cebu, Davao, Iloilo, or Baguio. Understanding these contrasts helps you make smarter, region-specific decisions.

Metro Manila (NCR): The High-Demand, Low-Supply Battlefield

Metro Manila’s premium zones—BGC, Makati, Ortigas, Rockwell, Mandaluyong—are structurally supply-constrained. Meanwhile, many condo clusters suffer from oversupply due to rapid vertical development.

Characteristics:

- High demand in core CBDs

- Strong appreciation in locations with upcoming transport lines (MRT-4, MRT-7, LRT-1 Extension)

- High renovation costs due to labor + materials

- Competitive rental markets

- Price ceilings are tighter in older neighborhoods

Implication:

If you live in a well-located NCR home with good bones, renovation can deliver exceptional ROI because buying a similar property nearby costs significantly more.

But if you’re considering moving to a newer condo or house in NCR, be prepared for:

- Higher cash-out

- More competition

- Possibly inflated prices

For many NCR homeowners, staying put and renovating is often the more financially sensible path—unless you’re relocating for lifestyle reasons (schools, commute, amenities)

Provincial Markets: The Space-Rich, Value-Rich Alternative

Strong growth cities—Cebu, Davao, Iloilo, Bacolod, Cagayan de Oro—offer more breathing room, bigger land, and more bang-for-buck compared to NCR.

Characteristics:

- Affordable lot prices

- Flexible renovation potential due to larger land sizes

- Steady appreciation from township developments (Megaworld, Ayala, Filinvest)

- Less intense competition compared to NCR

- Better cost-to-value ratio for house-and-lot purchases

Implication:

Buying often becomes the dominant strategy.

Why? Because the jump from renovating a small, aging NCR home to owning a modern, spacious provincial property is often financially attainable—and lifestyle-changing.

Urban–Suburban Migration Trends (The New Filipino Playbook)

More Filipino families are migrating outward toward areas like:

- Cavite

- Laguna

- Bulacan

- Rizal

Driving forces:

- Larger homes

- Greener surroundings

- Better air quality

- Major upcoming roads/railways (CALAX, MRT-7, NLEX-SLEX Connector, New Manila Airport)

Implication:

Relocating to a suburban home often yields a stronger long-term value uplift than renovating a cramped NCR property.

For families craving space or a cleaner environment, buying—not renovating—often becomes the winning move.

Emotional & Lifestyle Factors

Money influences real estate decisions, but emotion often decides them. Your home isn’t just concrete and rebar—it’s the keeper of your identity, your routines, your memories. It has heard your private victories, your arguments, your laughter echoing down hallways. It has shaped your days without you even noticing.

That’s why the renovate-versus-move dilemma cuts deeper than spreadsheets or property appraisals. You’re not only deciding where to live. You’re deciding how you want to live.

And that’s where the emotional stakes reveal themselves.

This section guides you through the personal, psychological, and lifestyle forces that silently influence your decision—forces powerful enough to override even the most logical financial analysis.

Sentimental Attachment

A decision flowchart illustrating the key considerations for homeowners deciding whether to renovate or buy a new home.

Some homeowners stay because leaving feels like losing a chapter of their life. And that’s completely valid.

Sentimental attachment is one of the strongest forces in Philippine homeownership.

You know the feeling: The corner of the living room where birthdays happened. The kitchen where Nanay taught you her signature recipes. The hallway with pencil marks recording your kids’ growth spurts. The neighbors who turned into extended family.

When these memories anchor you to your home, renovation becomes more than a project—it’s a way to honor the life you’ve built while shaping the next version of it.

Renovation becomes a strong choice when:

- Your roots in the community run deep

- You value consistency, routine, and familiarity

- The home carries family history worth preserving

- The thought of starting over feels unnecessarily disruptive

But sentimentality, powerful as it is, cannot fix:

- Unsafe structures

- Dysfunctional layouts

- Frequent flooding

- Condo limitations

- Poor location fit

Emotional loyalty must be balanced with practicality

Memories vs New Beginnings

Some homeowners feel an equal but opposite pull—the desire for reinvention.

A new home isn’t just a change of address.

It’s a reset button.

It allows you to:

- Shed the “old habits” and patterns tied to your current environment

- Shift into a new lifestyle—walkable communities, modern layouts, healthier surroundings

- Access better schools, safer barangays, or more dynamic neighborhoods

- Redefine your space to match who you are now, not who you were a decade ago

If your life has evolved beyond what your home can reflect, moving becomes more than a transaction—it becomes a personal upgrade.

Ask yourself:

“Am I staying because I still love this home, or because I’m afraid of the transition?”

“Does my home support the life I want next?”

The right answer often emerges from these questions—not from financial logic alone.

Psychological Costs: Living Through Chaos vs The Stress of Moving

Every choice has friction.

Renovating and moving both bring their own brand of chaos—just in different forms.

Understanding which type of disruption you’re more comfortable handling is one of the most underrated factors in the decision-making process.

Renovation Stress: Controlled Chaos Inside Your Own Space

Renovation comes with predictable discomforts, but they hit right at home, where stress already feels amplified.

Expect:

- Packing decades of belongings

- Clearing out sentimental items

- Finding reliable movers

- Utility transfers (internet, water, electricity)

- Adjusting to new routines, new routes, and new community dynamics

- Helping kids transition to new environments

- Leaving behind emotional landmarks

Moving is a cleaner, faster disruption—but often more emotionally complex.

Some homeowners love the “fresh start energy.”

Others find the detachment difficult, even when the new home is objectively better.

Which Stress Fits Your Life Better?

The real question isn’t whether renovation or moving is “less stressful”—because both have friction points.

The smarter question is:

“Which stress aligns with my personality, lifestyle, and future vision?”

Choose Renovation If:

✔ You’re deeply attached to your neighborhood

✔ Your home has structural potential

✔ You’re prepared to live with temporary chaos

✔ Customization excites you

✔ You value continuity over reinvention

Implication:

Buying often becomes the dominant strategy.

Why? Because the jump from renovating a small, aging NCR home to owning a modern, spacious provincial property is often financially attainable—and lifestyle-changing.

Urban–Suburban Migration Trends (The New Filipino Playbook)

Driving forces:

- Larger homes

- Greener surroundings

- Better air quality

- Major upcoming roads/railways (CALAX, MRT-7, NLEX-SLEX Connector, New Manila Airport)

Choose Moving If:

✔ You’re craving reinvention or modern living

✔ Your current neighborhood no longer fits your goals

✔ You need instant change and predictable timelines

✔ Your home is structurally or geographically limiting

✔ You want a lifestyle upgrade that renovation cannot deliver

There’s no universal right choice—only the one that best aligns with who you’re becoming.

Time, Convenience & Disruption

Every homeowner dreams of a smooth, headache-free upgrade—whether through renovation or a move. But the truth is simple: one path disrupts your life now, the other disrupts your life later. Time and convenience become major deciding factors, often tipping the scale even when budgets and emotional attachments are balanced.

Most homeowners spend months comparing costs, layouts, and neighborhoods—but overlook the actual lived experience of each path. Renovating disrupts your life now. Moving disrupts your life later.

The question is simple but powerful:

“Which disruption matches the capacity of my household—and my sanity?”

If your lifestyle cannot absorb chaos, renovation becomes costly—even if the budget looks reasonable. If your household cannot handle the emotional upheaval of moving, relocation becomes heavier than expected.

This section shows the real-world consequences of each option—not the polished version contractors or developers share, but the lived reality Filipino families actually face.

Reality of Living Through Renovations

A detailed flowchart illustrating the timeline and disruption levels involved in living through a home renovation, highlighting the phases from design to finishing.

Renovations transform homes, yes—but they also transform your routine, your energy levels, and your mental bandwidth. Even the best-planned upgrades come with noise, dust, delays, and ongoing micro-decisions that can feel endless.

Most homeowners underestimate the intensity of the process until they’re in the middle of it. Here’s what truly happens inside a home under renovation:

Dust That Defies Physics

No matter how many plastic sheets you tape or how often workers clean, dust multiplies.

It floats into closets, settles on your bed, invades kitchen cabinets, and coats electronics.

For households with:

- babies

- elderly parents

- pets

- asthma or allergy concerns

…dust becomes a genuine quality-of-life issue.

Noise That Interrupts Everything

Expect:

- Drills screeching

- Hammers pounding

- Tile cutters buzzing

- Workers shouting measurements back and forth

If you:

- Work from home

- Attend online classes

- Care for toddlers

- Work night shifts

…renovation can feel like a daily battle.

Losing Access to Essential Rooms

Depending on the project, you may temporarily lose:

- The kitchen (forcing takeout or portable cooking)

- A bathroom (meaning lines, shared schedules, inconvenience)

- The living room (your decompression space)

- A bedroom (turning your home into a giant puzzle)

A house under construction isn’t a sanctuary—it’s a maze.

Temporary Relocations

For medium to major renovations, many families end up leaving temporarily, even if they didn’t plan to. Costs accumulate quickly:

- Short-term rentals

- Storage for furniture

- Transportation logistics

- Budget for eating out

This often becomes the hidden “surprise cost” of renovation.

Decision Fatigue Is Real

Every tile, faucet, grout color, cabinet handle, switch location, and lighting angle requires your input.

If you hesitate, timelines slip.

If you rush choices, you regret them later.

Renovation is not just a construction project—it’s a 6-month mental chess game.

Unpredictable Delays (Always Factor This In)

Even with a great contractor, delays can strike from:

- Permit processing backlogs

- Out-of-stock materials

- Rain disrupting exterior works

- Hidden structural discoveries

- Labor shortages

- Admin restrictions (for condos)

Your “6-week plan” can quietly stretch into 10–14 weeks or more.

Renovation truth:

You gain personalization and continuity—but you pay for it through weeks or months of lifestyle disruption.

Buying for Convenience

Buying a new home doesn’t just offer a fresh start—it offers relief. No noise, no dust, no workers stepping over your kids’ toys, no timeline extensions. Instead, you get structure, predictability, and immediate usability.

For many Filipino families, especially those with tight schedules, young kids, or demanding careers, the convenience factor becomes the deciding force—not the budget.

Immediate Usability: The Greatest Advantage

Once turnover is done and utilities are active, you can:

- cook in a functioning kitchen

- sleep in a ready bedroom

- work without noise

- live without dust

There’s no “waiting phase.” You’re fully operational from day one.

No Downtime to Your Lifestyle

Your daily rhythm stays intact.

You don’t lose rooms.

Your kids maintain routines.

You keep your productivity.

Your weekends remain yours.

Buying preserves your mental and physical bandwidth. Renovation consumes it.:

Predictable Timeline (A Gift in Itself)

While real estate transactions require documents and clearances, the sequence is stable:

- Offer

- Loan approval

- Title transfer

- Move-in

Compared to renovation—where every week brings a new surprise—buying feels structured, finite, and far easier to manage.

A Clean Slate with No Micro-Decisions

Moving into a new home means:

- No choosing tiles

- No debating paint

- No supervising workers

- No unexpected repairs mid-project

You focus on settling in—not on supervising a construction site.

For many families, especially dual-income households, this alone outweighs renovation benefits.

Regulatory & Permit Checklist (Philippines-Specific)

In the Philippines, no renovation or property upgrade should begin without understanding the regulatory landscape. Permits and clearances may feel bureaucratic, but they are the backbone of legal, safe, and future-proof construction. Skipping them is not a shortcut—it’s a financial and legal landmine.

Whether you’re renovating a house, updating a condo unit, or preparing a property for resale, compliance ensures your project isn’t delayed, penalized, or—worst-case—demolished. This checklist breaks down exactly what Filipino homeowners need to secure and why each requirement matters.

For Houses

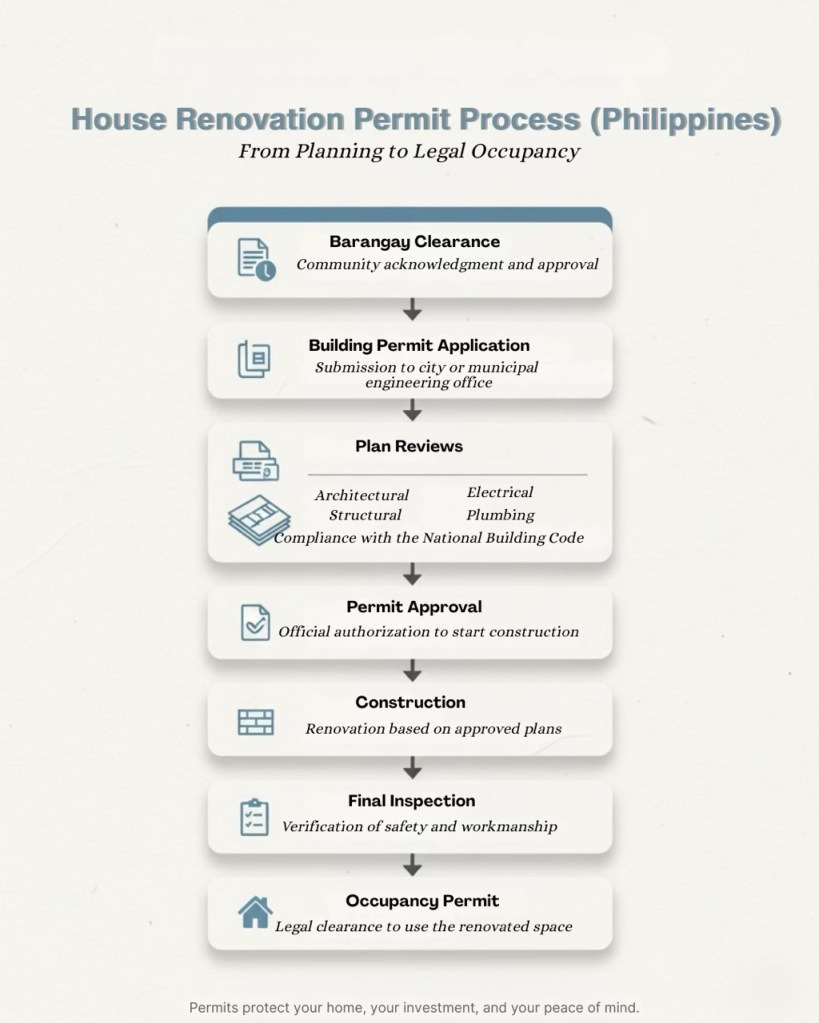

A detailed flowchart outlining the house renovation permit process in the Philippines, illustrating the steps from barangay clearance to legal occupancy.

Renovating a house in the Philippines requires full coordination with local government offices, licensed professionals, and compliance with the National Building Code. Even “simple” changes may require permits, depending on the LGU.

Below is your step-by-step legal map.

1. Barangay Clearance — The Gatekeeper Document

Everything starts here.

Before your city or municipal engineering office accepts your building permit application, the barangay must first sign off.

Barangay clearance establishes:

- That your construction is known to the barangay

- That your project won’t disrupt peace and order

- That your contractor and workers are registered

- That road or pathway usage (if any) is allowed

Without barangay clearance, there is no permit application.

Expert tip: Barangays often require a site visit. Factor this into your timeline.

2. Building Permit — The Heart of Legal Renovation

The building permit ensures your plan complies with the National Building Code of the Philippines (PD 1096). This protects you from structural failure, fire hazards, drainage issues, and non-compliance penalties.

You will typically submit:

- Architectural plans

- Structural plans

- Electrical plans

- Sanitary/plumbing plans

- Mechanical plans (if applicable)

- PRC licenses & PTR numbers of all professionals

- Barangay clearance

- Estimated project cost (for fee computation)

Why this matters:

- Banks may not approve refinancing without it

- Insurers can deny claims on unapproved improvements

- Buyers often require it before closing a sale

- LGUs can penalize occupancy without clearance

Projects that MAY NOT require a permit:

- Repainting

- Minor repairs

- Small-scale cosmetic updates

(Always confirm with your LGU—interpretations vary.)

Expert warning: Illegal builds—even minor ones—can cause problems during resale or bank appraisal. Many buyers back out once they hear “walang permit.”

3. Occupancy Permit — Your Post-Construction Clearance

Once renovations are complete, the LGU will inspect to ensure the work matches the approved plans and is safe to occupy.

You must secure the Certificate of Occupancy if your project involved:

- Extensions

- Major structural changes

- Conversion of rooms

- Any work requiring a building permit

Projects that ALWAYS require a building permit:

✔ Extensions

✔ Structural modifications

✔ Wall demolitions or new partitions (for most LGUs)

✔ Major plumbing changes

✔ Electrical rewiring

✔ Roof alterations

✔ Adding new floors or mezzanines

Skipping this step can haunt you years later.

4. DPWH Requirements — The Silent Deal-Breaker for Some Homes

If your property is near:

- A national road

- A creek, canal, or waterway

- A slope or unstable embankment

- A flood control easement

You may need DPWH clearance.

This ensures your renovation does not encroach on government property or compromise public safety.

Common triggers:

- Front setbacks on national roads

- Construction near drainage easements

- Building on sloped or erosion-prone terrain

Non-compliance consequences:

- “Notice of Violation” from DPWH

- Demolition of the affected structure

- Difficulty selling the property later

DPWH rules are strict—and LGUs enforce them heavily.

For Condominiums

A flowchart detailing the condominium renovation approval process, highlighting the essential steps from admin consultation to clearance for completion.

Unlike houses, condo units operate under tight structural, electrical, and plumbing constraints. Even aesthetic upgrades must align with admin rules to protect the building, its systems, and neighboring units.

1. Admin Approval — The Non-Negotiable First Step

Before buying a single tile, submit your renovation proposal to the condo administration.

Admins check for:

- Noise control

- Wet works limitations

- Plumbing restrictions

- Structural safety

- Impact on common areas

- Approved renovation timelines

Even minor upgrades like repainting often require notification.

Failure to secure approval leads to:

- Fines

- Forced stoppage

- Potential legal escalation if damage occurs

- Additional inspection fees

Condo management has the final say—no exceptions.

2. Architect/Engineer Stamped Plans — Your Safety & Liability Shield

Condominiums share systems across units. That means plumbing lines, drainage pipes, electrical conduits, and slab strength must be respected

Admins typically require professionally stamped plans for:

- Electrical revisions

- Plumbing relocations

- Wall removals

- HVAC or aircon drain rerouting

- Any work affecting fire safety

Why this protects YOU:

If a leak occurs downstairs or a power issue emerges later, your stamped plans serve as proof of compliance and due diligence.

.

3. Work Hours, Debris Disposal & Access Rules

Condominium boards enforce strict logistical rules to minimize disruption.

Common policies include:

- Weekday-only work (e.g., 9 AM–5 PM)

- Prohibition of noisy works during lunch or early mornings

- Required debris bags or chute usage

- Limitations on wet works

- List of accredited contractors

- Visitor IDs for workers

- Freight elevator reservations

Violations often result in:

- Penalties

- Work stoppage

- Additional deposits or withholding of renovation bonds

These restrictions directly affect your renovation timeline—especially for larger upgrades.

Why These Permits Matter (Beyond Compliance)

Unlike houses, condo units operate under tight structural, electrical, and plumbing constraints. Even aesthetic upgrades must align with admin rules to protect the building, its systems, and neighboring units.

Filipino homeowners often underestimate how deeply permits affect:

- Resale value

- Appraisal results

- Insurance claims

- Loan approvals

- Buyer confidence

- Legal protection

A property with complete documentation sells faster, refinances easier, and faces fewer risks during ownership. A property with illegal modifications? It becomes a negotiation battlefield—or a liability.

Permits are not paperwork. They are financial armor.

Risk Factors & Red Flags

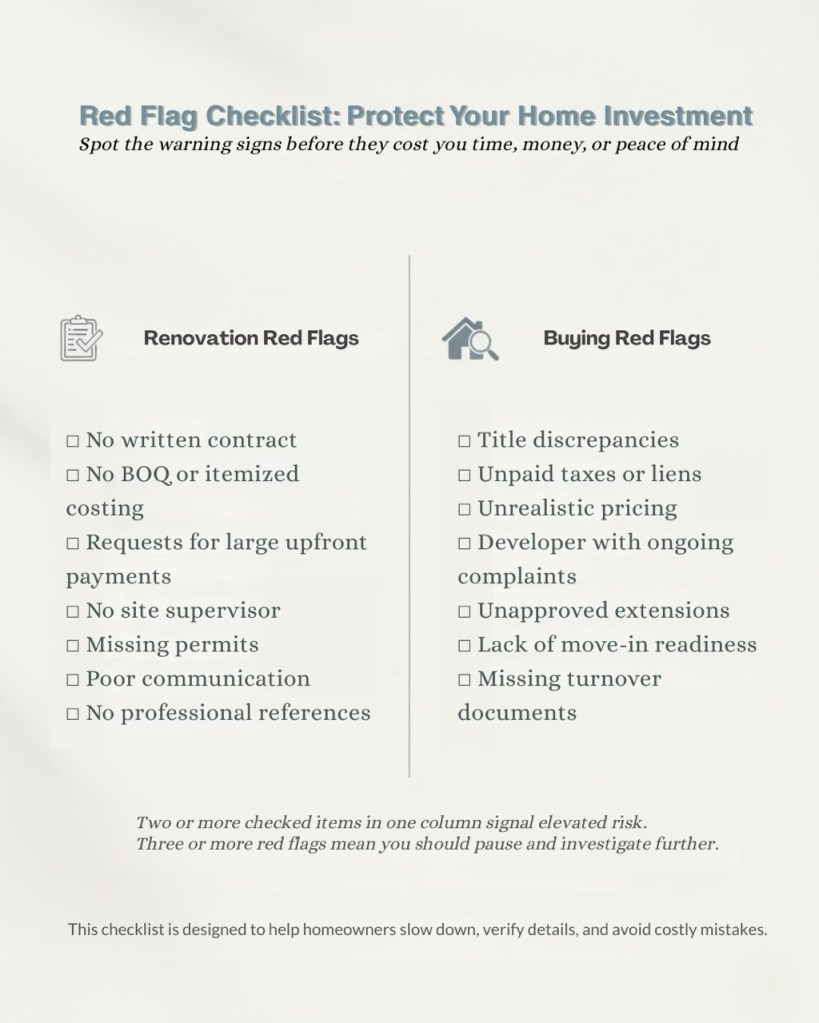

A comprehensive checklist highlighting red flags to watch for when renovating or buying a home, designed to help homeowners protect their investments.