The Philippine real estate market is booming, attracting both local and international buyers. But with growth comes risk.

Imagine this: a first-time buyer excited to purchase a studio condo in Makati finds their dream unit—pays the down payment—only to discover that the property was already sold to someone else. This scenario, known as double selling, is more common than many realize. According to the Housing and Land Use Regulatory Board (HLURB), complaints about fraudulent property sales in Metro Manila—including Makati, BGC, and Ortigas—have risen by 15% over the past three years. Alongside double selling, overpricing schemes are also rampant, leading buyers to pay up to 50% above fair market value without realizing it.

Whether you are a first-time homebuyer, an investor, or a real estate professional, understanding these scams—and learning how to protect yourself—is crucial for securing your investment and avoiding costly mistakes.

Table of Contents

What is Double Selling?

Definition:

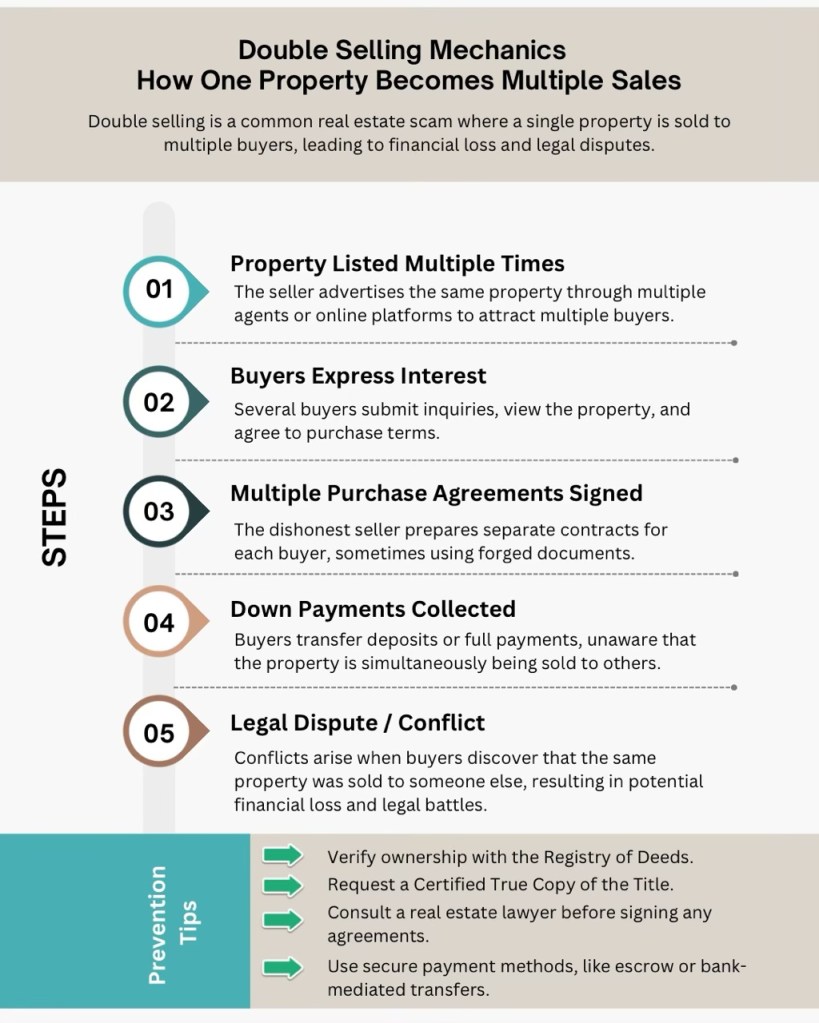

Double selling occurs when a seller illegally sells the same property to two or more buyers, often using forged contracts or misrepresented ownership documents.

How It Works:

- The property is listed through multiple agents or online platforms.

- Several buyers express interest and enter into contracts.

- The seller collects payments from more than one buyer, sometimes creating counterfeit documents or notarized-looking agreements.

Legal Context

Civil Code

Articles 1381–1382

Contracts obtained through fraud are voidable, allowing buyers to seek rescission and damages.

Revised Penal Code

Article 315

Fraudulent sale constitutes estafa, which may include imprisonment and restitution.

Practical Example:

A condo in Makati is simultaneously sold to Buyer A and Buyer B. Both pay down payments. Buyer A verifies ownership first and files a legal claim. The court may award the property to Buyer A, and Buyer B may pursue damages.

What is Overpricing?

Definition:

Overpricing happens when a property is listed above its fair market value, often to mislead buyers, inflate agent commissions, or hide ulterior motives such as money laundering.

Legal Context

While overpricing itself is not automatically illegal, it can become fraudulent if it involves misrepresentation, falsified documents, or deceptive marketing practices. HLURB monitors high-demand areas for price manipulation to ensure market transparency.

How It Works

1

Property is intentionally overpriced relative to comparable market listings.

2

Buyers are persuaded through inflated appraisals, selective data, or pressure tactics.

3

Financial arrangements may involve hidden fees or longer payment terms to soften the high price.

Example:

A 30-sqm studio in BGC listed at ₱8 million when similar units sell for ₱5.5–6 million. Without independent appraisal, buyers may overpay, reducing their ROI and exposing them to financial risk.

Key Differences Between Double Selling and Overpricing

| Feature | Double Selling | Overpricing |

|---|---|---|

| Intent | Obtain multiple payments fraudulently | Maximize profit or commissions |

| Legal Risk | Criminal & civil liability | Civil liability; criminal if fraud is involved |

| Impact on Buyer | Risk of losing full payment | Risk of overpaying |

| Detection | Verify ownership & title | Conduct market research & appraisal |

Warning Signs and Red Flags

When navigating the Philippine real estate market, being able to identify early warning signs of double selling or overpricing can save you significant financial loss. Here are the key indicators to watch out for, along with explanations and actionable tips:

Pressure to Sign Immediately

Sellers who insist on quick decisions without giving you time to review contracts or consult professionals may be attempting to rush a fraudulent transaction. Always take time to read documents, verify ownership, and seek legal advice before committing any payment.

Multiple Buyers Claim the Same Property

If you discover other buyers claiming to have purchased the property, it could indicate double selling. Cross-check property ownership with the Registry of Deeds and ask the seller for a Certified True Copy of the title.

Property Price Exceeds Market Averages by 30%+

Overpricing is often used to mislead buyers or inflate commissions. Compare the listed price with recent sales of similar properties in the area. If the price difference is unusually high, request an independent appraisal before proceeding.

Suspicious, Missing, or Unverifiable Title Documents

Titles that are incomplete, altered, or difficult to verify may indicate fraudulent activity. Verify the title’s authenticity with the Registry of Deeds, checking for liens, encumbrances, or prior sales.

Agent Refuses Notarized Contracts or Official Receipts

Ethical and professional agents provide proper documentation, notarized contracts, and official receipts. Reluctance or refusal to do so is a major red flag. Always insist on legally binding agreements.

Lack of Registration with HLURB or Local Housing Authorities

Properties not registered with the Housing and Land Use Regulatory Board (HLURB) or local housing offices may be illegal or unregulated. Confirm registration to ensure the property is legally recognized and that your purchase is protected under Philippine law.

Pro Tip: Combine these red flags with professional verification. If two or more red flags appear simultaneously, consider it a strong warning sign and pause any transaction until verified.

Step-by-Step Guide to Protect Yourself

Protecting yourself from double selling and overpricing starts with careful verification, research, and documentation. Following these steps helps ensure your property purchase is safe, legal, and financially sound.

Verify Ownership

Ensure the property is legally owned by the seller and free from legal issues.

- Obtain at least two Certified True Copies (CTCs) of the TCT or CCT from the Registry of Deeds.

- Check for liens, mortgages, or pending litigations on the Encumbrance Page.

- Confirm seller’s authority with a Notarized SPA or Authority to Sell if not the direct owner.

- Cross-check Real Property Taxes (RPT) and tax declarations to ensure they match the title.

Research Market Prices

Know the fair value to avoid overpaying for the property.

- Use online real estate portals, Facebook Marketplace, and broker listings for current pricing.

- Compare local market values by visiting the area and checking per sqm rates.

- Seek guidance from licensed brokers for recent sales or active listings.

- Treat 20–50% above average pricing as a red flag and request an independent appraisal.

Engage Professionals

Get expert advice to secure a safe and legitimate transaction.

- Hire a PRC-accredited broker for legal compliance and market insight.

- Consult a real estate lawyer to review contracts and spot irregularities.

- Get an independent appraisal report to validate the property’s fair market value.

Conduct Due Diligence

Double-check all property details and seller credentials.

- Inspect the property in person to verify boundaries, condition, and occupancy.

- Cross-check the seller’s IDs with the title owner’s name.

- Investigate the sale history with the Registry of Deeds or barangay.

- Verify HLURB registration and local permits for subdivisions or condos.

Document Everything

Keep a clear and complete paper trail for protection.

- Keep organized copies of titles, tax declarations, contracts, and receipts.

- Ensure all agreements are notarized and signed by both parties.

- Use email confirmations for additional traceability and evidence.

Use Escrow or Secure Payment Methods

Safeguard your money until legal transfer is complete.

- Consider bank escrow accounts to secure your payment until transfer is complete.

- Avoid paying the full amount in cash without a verified title and notarized contract.

- Opt for staggered payments tied to milestones like title verification and turnover.

Expert Insights and Market Data

Navigating the Philippine real estate market requires not just intuition, but data-driven insights. Here’s what industry experts and market trends reveal about double selling and overpricing:

Rising Double Selling Complaints

According to HLURB reports, complaints related to double selling in Metro Manila increased by 15% between 2021 and 2024, particularly in high-demand areas such as Makati, BGC, and Ortigas. Experts attribute this rise to the growth of online property listings and the high turnover in urban condominiums, which creates opportunities for unscrupulous sellers.

Actionable tip: Always verify ownership at the Registry of Deeds and request a Certified True Copy of the title before making any payment.

Overpricing Trends and Risks

Overpricing is prevalent in premium districts, inflating property costs by 40–50% above fair market value in areas like BGC, Makati, and Taguig. Market analysts warn that buyers who overpay may face reduced rental yields, longer resale periods, and lower ROI.

Actionable tip: Conduct a comparative market analysis (CMA) using recent sales data or engage an independent appraiser to determine the property’s true market value.

Legal and Professional Advice

Real estate lawyers consistently emphasize: “Never skip title verification or independent appraisal. These are the best defenses against scams.” They advise that even if a property seems legitimate, skipping due diligence can lead to costly legal battles or financial loss.

Investment Implications

Investors note that properties purchased in overvalued areas often take longer to sell and generate lower returns than expected. Long-term planning and careful market analysis are essential to avoid overpaying or entering a potentially risky investment.

Detailed Case Studies and Lessons Learned

Real-life case studies provide practical lessons on how double selling and overpricing can impact buyers and investors. Understanding these examples helps you anticipate risks and take preventive action.

Case 1: Double Selling – Quezon City Townhouse

Scenario

A two-story townhouse in Quezon City was simultaneously sold to two different buyers. Both buyers had signed contracts and made down payments.

Outcome

The court awarded ownership to the buyer who verified the title first and filed a legal claim. The second buyer was entitled to restitution of payments and damages.

Lesson & Actionable Insight

Early Title Verification: Always check the Registry of Deeds before making any payment.

Legal Guidance: Engage a licensed real estate lawyer to review contracts and advise on potential risks.

Preventive Tip: Maintain written documentation of all communications with the seller to strengthen your legal position.

Case 2: Overpricing – Taguig Condo Studio

Scenario

A 40-sqm studio in Taguig was listed at ₱9 million, whereas comparable units in the same building were selling for ₱6.5 million. An investor was initially unaware of the overpricing.

Outcome

The buyer commissioned an independent property appraisal, which revealed the fair market value. Using this data, the buyer successfully renegotiated the price to a reasonable amount, avoiding overpayment.

Lesson & Actionable Insight

Market Research: Conduct a comparative market analysis (CMA) to identify fair pricing.

Professional Appraisal: Engage a licensed appraiser, especially for high-value transactions, to validate pricing.

Investor Strategy: Avoid making decisions based solely on listing prices; rely on objective data.

Case 3: Mixed Risk – BGC Investment

Scenario

An investor was about to purchase a studio unit in BGC, only to discover through title verification that the same unit had been sold to another buyer. This case combined the risks of double selling and potential overpricing.

Outcome

Verification prevented the transaction from proceeding, saving the investor from financial loss. The investor later acquired a similar unit at a fair market price after performing proper due diligence.

Lesson & Actionable Insight

Combined Legal and Market Checks: Always verify both ownership and pricing before committing.

Use Secure Payment Methods: Consider escrow accounts or bank-mediated payments to protect funds during the verification process.

Long-Term Planning: Incorporating due diligence into your buying strategy ensures that investments are protected and profitable.

Conclusion and Key Takeaways

Navigating the Philippine real estate market safely requires awareness, preparation, and strategic action. Here are the key lessons from understanding double selling and overpricing:

Double Selling = Fraud; Overpricing = Potential Deception

Double selling is outright illegal and criminal, where a property is sold to multiple buyers simultaneously. Overpricing, while sometimes legal, can mislead buyers and reduce investment returns. Recognizing the difference is critical to protecting your finances.

Perform Thorough Due Diligence Before Committing Funds

Always take the time to research the property, verify legal documents, and analyze market data. Rushing into a purchase increases the risk of scams or overpaying.

Verify Ownership, Market Value, and Legal Documents

- Check the Registry of Deeds for title authenticity.

- Use comparative market analysis (CMA) or independent appraisal to assess fair pricing.

- Review all contracts, receipts, and permits to ensure compliance with Philippine property laws.

Knowledge, Preparation, and Verification Are Your Best Defenses

Staying informed about market trends, regulatory requirements, and common scams empowers you to make confident and secure investment decisions. Proactive verification and professional guidance are far more effective than reacting to problems after they arise.

Protect Your Investment: Take Action Today

Investing in real estate is exciting—but it comes with risks. Avoid costly mistakes by partnering with licensed real estate professionals and experienced legal advisors who can guide you through property verification, contract review, and negotiation. Protect your hard-earned money and make confident investment decisions.

Stay Informed and Empowered

Subscribe to our weekly newsletter for:

Market insights

Latest trends and property data in the Philippines

Scam alerts

Updates on double selling, overpricing, and other fraudulent practices

Investment tips

Actionable strategies to maximize ROI and secure your properties

Leave a comment