Have you ever worried about losing your hard-earned payments after missing a few months of your property installment? You’re not alone. Many Filipino homebuyers enter into real estate installment contracts—whether for a house and lot, condominium, or subdivision property—without fully understanding what legal protections are in place if things don’t go as planned.

Buying property on installment is one of the most common paths to homeownership in the Philippines. Yet, when financial difficulties arise, countless buyers assume they have no recourse and simply “forfeit” everything they’ve paid. This is one of the biggest misconceptions in the local real estate market—because the law actually protects you.

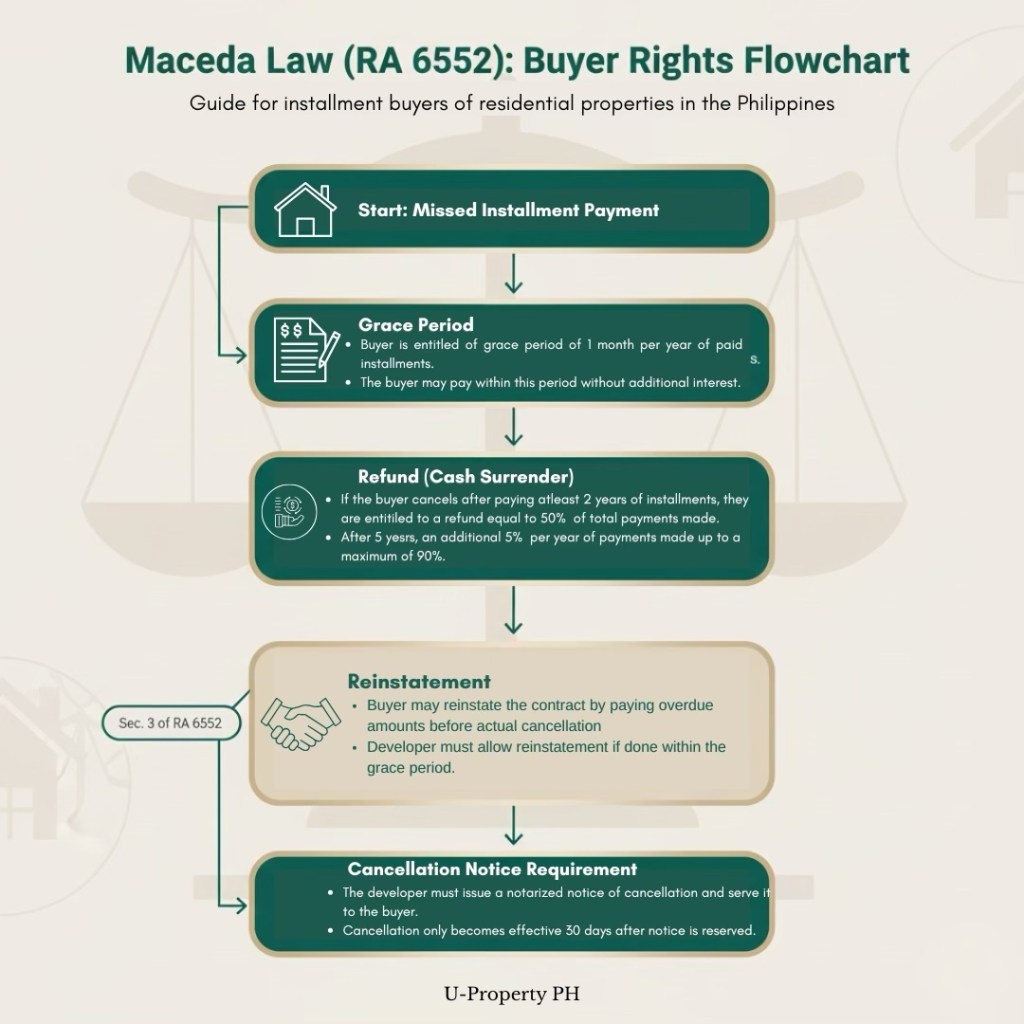

Enacted as Republic Act No. 6552, the Maceda Law safeguards buyers from unfair forfeiture of payments and sudden contract cancellations. It ensures that if you’ve paid in good faith, you’re entitled to specific rights, grace periods, and even refunds, depending on how long you’ve been paying.

In this guide, we’ll break down what the Maceda Law is, how it works, what rights you have as a buyer, and how you can use these provisions to protect your investment.

What Is the Maceda Law (Republic Act No. 6552)?

The Maceda Law, officially known as Republic Act No. 6552, is a landmark legislation in the Philippines that protects buyers of real estate sold on installment. Enacted in 1972 and named after former Senator Ernesto Maceda, this law ensures that property buyers who have faithfully made installment payments are not unfairly deprived of their investment if they experience financial difficulties.

At its core, the Maceda Law provides fairness and security in property transactions. It recognizes that purchasing a home is often the largest financial commitment for Filipino families and that unforeseen hardships—such as job loss, illness, or emergencies—should not instantly erase years of savings and payments.

Purpose and Intent

Before RA 6552 was enacted, developers could immediately cancel installment contracts and keep all payments made by buyers after a single default. The Maceda Law changed that by requiring grace periods, refund rights, and due process before cancellation. Its goal is to balance the interests of both developers and buyers—protecting consumers from abuse while allowing developers to enforce contracts fairly.

Who and What It Covers

The law applies to the sale of residential real estate on installment, including:

- Subdivision lots

- House-and-lot packages

- Condominium units

However, it does not apply to:

- Industrial lots or commercial properties

- Rent-to-own or lease-with-option-to-buy arrangements

- Fully paid or mortgaged properties (since ownership has already transferred)

Essentially, the Maceda Law covers cases where a buyer is still paying in installments and does not yet own the property outright.

How the Maceda Law Works

Here’s how the law protects you as a buyer:

1. If you’ve paid less than two years of installments:

You are entitled to a 60-day grace period to settle unpaid installments before cancellation.

2. If you’ve paid at least two years of installments:

You have the right to:

- A one-month grace period for every year paid; and

- A refund of 50% of total payments made, plus an additional 5% per year after five years, up to a maximum of 90%.

3. Notice requirement:

The seller must serve a notarized notice of cancellation and wait 30 days after receiving the buyer’s payment or notice before officially rescinding the contract.

In short, the Maceda Law gives you breathing room and a legal pathway to recover part of your investment—protection you won’t have if you’re unaware of your rights.

Buyer’s Rights Under the Maceda Law (RA 6552)

The Maceda Law exists to protect you as a buyer from losing everything you’ve worked for when paying for property on installment. It outlines four key rights that ensure fairness between you and the developer. Knowing these rights is crucial—because the moment you default or experience financial difficulty, they determine how much protection you actually have.

1. Right to a Grace Period

Under Section 3 of RA 6552, every buyer in good standing is entitled to a grace period to catch up on missed payments:

If you’ve paid less than two years of installments:

You have 60 days from the date of default to pay the unpaid installments without any additional interest or penalty.

💡 Example: You bought a subdivision lot and have been paying for 18 months. If you miss a payment, you have 60 days to make up for it before your contract can be canceled.

If you’ve paid at least two years of installments:

You get a grace period of one month for every year of installment payments you’ve made.

💡 Example: If you’ve been paying for 5 years, you’re entitled to a 5-month grace period to settle your arrears.

During this period, the developer cannot immediately cancel your contract or resell your property. This grace period gives you a legal window to recover financially or negotiate payment adjustments.

2. Right to a Refund (Cash Surrender Value)

If you’ve paid at least two years of installments, you’re entitled to a cash surrender value (refund) if your contract is canceled.

According to Section 3(b) of the law:

- You are entitled to 50% refund of all payments made.

- After five years of payments, an additional 5% per year is added to the refund, up to a maximum of 90%.

Example Calculation:

Let’s say you’ve paid ₱2,000,000 in total over 8 years.

- First 5 years = 50% refund → ₱1,000,000

- Additional 3 years (5% × 3 = 15%) → ₱300,000

- Total refund: ₱1,300,000

This refund protects your equity — ensuring that years of diligent payments don’t vanish when financial problems arise.

⚠️ Note: The refund only applies after the contract has been properly canceled and the buyer has surrendered possession of the property.

3. Right to Reinstatement

Even after defaulting, you can reinstate your contract during the applicable grace period by paying your arrears without interest.

This means the contract remains valid as long as you catch up within the grace period. Developers are legally required to accept payment and cannot refuse reinstatement within that window.

💡 Example: You’ve missed three monthly payments on a condo you’ve been paying for 4 years. You can still keep your contract active by paying those missed installments within your 4-month grace period.

This right to reinstatement is particularly valuable for buyers recovering from temporary financial setbacks—like job transitions or emergency expenses.

4. Right to Notice Before Cancellation

Developers are prohibited from immediately canceling your contract after a default. Under the Maceda Law, a valid cancellation must follow two mandatory steps:

- Grace period must lapse (60 days or 1 month per year paid).

- The seller must serve a notarized notice of cancellation and allow an additional 30 days after receipt of that notice before rescission takes effect.

In other words, a developer can’t just declare your contract void overnight or repossess your unit without following this due process.

📜 Legal basis: Section 3(b), Republic Act No. 6552

“The actual cancellation of the contract shall take place after 30 days from receipt by the buyer of the notice of cancellation or the demand for rescission of the contract by a notarial act…”

If this notice is not served properly, the cancellation is invalid, and you may legally contest it before the DHSUD (formerly HLURB).

Summary of Buyer’s Rights

| Buyer Situation | Entitlement | Example |

|---|---|---|

| Paid less than 2 years | 60-day grace period | Buyer can pay within 60 days to avoid cancellation |

| Paid 2–5 years | 50% refund + 1-month grace per year paid | Buyer with 4 years of payment gets 4 months grace and 50% refund |

| Paid more than 5 years | 50% refund + 5% per extra year (up to 90%) | Buyer with 8 years of payment gets 65% refund |

| Upon default | Right to reinstatement | Contract remains valid if arrears are paid within grace period |

| Before cancellation | Right to 30-day notarized notice | Developer must issue proper written notice |

What the Maceda Law Does Not Cover

While the Maceda Law (RA 6552) is a powerful consumer protection tool, it’s often misunderstood. Many buyers assume it automatically applies to any real estate transaction involving payment terms — but that’s not always true. To avoid costly mistakes or false expectations, it’s important to understand the limitations and exemptions of the law.

Below are the key cases not covered under the Maceda Law:

1. Commercial and Industrial Properties

The law only applies to residential real estate — that is, properties meant for human habitation.

- It does not protect buyers of commercial spaces, office units, warehouse lots, or industrial lands.

- These are considered business transactions, and parties are expected to negotiate terms freely under general contract law, not consumer protection law.

💡 Example: If you purchase a retail unit in a commercial plaza or an industrial lot for a warehouse, you cannot invoke the Maceda Law’s grace periods or refund rights if you default.

2. Rent-to-Own, Lease-to-Own, and Pag-IBIG Financing

The Maceda Law applies strictly to installment sale contracts — meaning, ownership remains with the developer until full payment is made.

It does not apply to:

- Rent-to-own or lease-with-option-to-buy arrangements (since these are governed by lease laws, not installment sales).

- Pag-IBIG housing loans or bank-financed mortgages, where ownership transfers immediately upon sale and the buyer’s obligation becomes a loan repayment, not installment purchase.

💡 Example: If you’re paying your condo through a Pag-IBIG loan, the developer has already been paid in full by Pag-IBIG. You are now bound by your mortgage terms, not the Maceda Law.

3. Spot Cash Payments and Regular Mortgage Loans

RA 6552 only protects installment buyers, meaning payments are spread out directly to the sellerover time.

You cannot invoke the law if:

- You paid spot cash for the property (full payment at once).

- You’re under a mortgage loan with a bank or Pag-IBIG where title has been transferred to you and the debt is now between you and the lender.

💡 Example: Once you’ve taken a bank loan and received your title, defaulting on payments will trigger foreclosure laws, not the Maceda Law.

4. No Developer Buy-Back Obligation

Another common misconception: the Maceda Law does not require developers to buy back your property after cancellation.

- The law only mandates that you receive your cash surrender value (refund) if eligible.

- Once the contract is canceled and refund settled, the developer is free to resell the property to another buyer.

💡 Example: If you cancel your installment contract after paying for 6 years, you may receive your refund (50% + 10%), but the developer is not obliged to repurchase or reassign your old unit to you later.

Summary: When the Maceda Law Does Not Apply

| Situation | Covered by RA 6552? | Explanation |

|---|---|---|

| Buying a residential condo or house on installment | ✅ Yes | Law applies — buyer entitled to grace period and refund |

| Buying a commercial unit or industrial lot | ❌ No | Business transaction, not residential |

| Paying via Pag-IBIG or bank mortgage | ❌ No | Ownership already transferred; governed by loan contract |

| Rent-to-own or lease-with-option-to-buy | ❌ No | Considered a lease, not a sale on installment |

| Spot cash payment | ❌ No | No installment sale relationship |

| Buyer wants the developer to buy back canceled property | ❌ No | Only refund applies; no repurchase obligation |

How to Compute Your Refund or Grace Period Under the Maceda Law

Understanding how much you can recover—or how long you’re protected—under the Maceda Law (RA 6552) is essential for any buyer paying in installments. Let’s break it down step-by-step.

Step 1: Know When You Qualify for a Refund

You’re entitled to a cash surrender value (refund) if you’ve paid at least two years of installmentsand your contract is canceled. The refund is based on the total amount you’ve already paid (not including penalties or interest).

Step 2: Apply the Refund Formula

Here’s the official computation under Section 3(b) of the Maceda Law:

Refund = (Total Payments × 50%) + (Additional 5% × Each Year After 5 Years)

Maximum refund: 90% of total payments.

This means that after 5 years of paying, you get a 50% refund, and for every additional year, you add 5%.

Step 3: Example Computation

Let’s use a realistic example.

- Total payments made: ₱2,000,000

- Number of years paid: 8 years

Step 1: 50% refund after 5 years = ₱2,000,000 × 50% = ₱1,000,000

Step 2: Additional 5% per year for 3 more years = 15%

Step 3: ₱2,000,000 × 65% = ₱1,300,000 refund

✅ Your refund: ₱1.3 million

✅ Your protection period before cancellation: 60 days (grace period)

Step 4: Grace Period Before Cancellation

If you’ve paid less than two years, you don’t yet qualify for a refund—but you’re still entitled to a 60-day grace period from the date of default before the seller can cancel the contract.

If you’ve paid two years or more, your grace period extends by one month for every year of payment made—which allows you to pay missed installments and reinstate your contract.

Example:

If you’ve paid for 6 years, your grace period is 6 months.

Common Violations and Red Flags to Watch Out For

While the Maceda Law (RA 6552) is designed to protect installment buyers, not all developers and sellers follow the rules. Being aware of these common violations can help you safeguard your investment and act quickly when your rights are being undermined.

1. Developers Failing to Issue a Notarized Notice Before Cancellation

Under the Maceda Law, a notarized notice of cancellation must be properly delivered to the buyer through a notarial act—not just an email, text, or unverified letter.

Many developers skip this step, assuming verbal communication or a simple demand letter is enough.

👉 Why this matters:

Without a notarized notice, the cancellation is not legally valid. This means your contract remains in force, and you still have the right to settle your arrears within the grace period or contest the cancellation.

📝 What you can do:

Always ask for a copy of the notarized notice and check if it was properly acknowledged by a notary public. If not, the cancellation has no legal effect.

2. Misrepresentation That Buyers “Lose Everything” After Default

A common scare tactic used by unscrupulous sellers is telling buyers that once they default, they automatically lose all payments made.

This is false—if you’ve paid for at least two years, you are entitled to a cash surrender value (refund)as provided under Section 3(b) of the Maceda Law.

👉 Why this matters:

Many buyers walk away from their investment due to misinformation. Understanding that you have a right to a refund and grace period can save you hundreds of thousands of pesos.

📝 What you can do:

Request a written computation of your refund and verify it against the Maceda Law formula. You can also seek help from the HLURB (now DHSUD) or your legal counsel to validate the figures.

3. Lack of Refund Documentation or Delayed Processing

Even after a valid cancellation, some developers delay or refuse to release refunds, citing “processing time” or “internal approval.” Others issue vague promises without written timelines.

👉 Why this matters:

Delays can stretch for months—or even years—leaving buyers financially stranded. Refunds must be processed within 30 days from the date of cancellation, as stated in the law.

📝 What you can do:

Always document your communication in writing. If delays persist, file a complaint with DHSUD for enforcement and proper penalties.

4. “Greenwashed” or Falsely Compliant Developers Using Legal Loopholes

Some developers market themselves as “Maceda Law–compliant” or “buyer-friendly,” but embed clauses in their contracts that quietly waive your rights—for instance, treating your payments as “rent” instead of installments.

👉 Why this matters:

These deceptive clauses can invalidate your rights under the law, making it look like you forfeited your refund or ownership claim voluntarily.

📝 What you can do:

Before signing any contract, review the fine print with a licensed broker or lawyer. Be wary of phrases like “buyer agrees to forfeit all payments” or “installments shall be treated as rent.”

How to Protect Yourself and Assert Your Rights

Knowing your rights under the Maceda Law (RA 6552) is one thing — asserting them effectively is another. Here’s how you can safeguard your investment and strengthen your legal standing as a property buyer paying in installments.

1. Always Request a Copy of the Contract and Official Receipts

Never rely solely on verbal agreements or sales brochures. Insist on receiving:

- A complete copy of your Contract to Sell or Deed of Conditional Sale.

- Official receipts for every payment you make — reservation fee, down payment, monthly amortization, and miscellaneous charges.

👉 Why this matters:

These documents prove that you are a legitimate buyer under an installment arrangement, which is crucial in asserting your rights to a refund, grace period, or reinstatement under the Maceda Law.

Without these, the developer can more easily dispute your claims or misclassify your payments as non-refundable.

2. Ensure Your Contract Is Notarized and Clearly States It’s an Installment Sale

A notarized contract gives your transaction legal weight and ensures it’s publicly recognized.

Make sure your document explicitly identifies the sale as an installment sale — not a lease or “rent-to-own” agreement — since only installment sales are covered by the Maceda Law.

👉 Why this matters:

Unscrupulous sellers sometimes disguise installment contracts as leases to circumvent buyer protections.

If your contract isn’t notarized or misclassified, you may lose your legal basis to demand refunds or grace periods.

📝 Tip: Have your contract reviewed by a licensed broker or lawyer before signing. It’s a small investment that can prevent major financial loss later.

3. In Case of Dispute, File a Complaint with the DHSUD (Formerly HLURB)

If a developer refuses to honor your rights — such as denying your refund, canceling your contract without notice, or withholding documents — you can file a formal complaint with the Department of Human Settlements and Urban Development (DHSUD).

- Prepare your contract, payment receipts, and any communication with the developer.

- Draft a clear complaint letter outlining the violation.

- Submit it to the DHSUD Regional Office covering your project’s location.

🕒 Timeline: DHSUD usually conducts a mediation first before proceeding to adjudication. This process ensures both parties get a fair hearing before penalties or restitution are ordered.

4. Seek Help from a Licensed Real Estate Broker or Property Lawyer

Licensed real estate professionals are trained to recognize unfair contract terms, missing documents, and procedural violations.

They can also assist you in filing complaints, negotiating with developers, or computing your rightful refund.

👉 Why this matters:

Developers often have legal teams — and you should too. Having professional representation helps level the playing field and protects you from intimidation or misinformation.

💡 Tip: Keep all correspondence, payment proofs, and official documents neatly filed — physical or digital.

In case a developer unlawfully cancels your contract or misrepresents your account, these records will serve as your strongest legal defense and proof of compliance.

Case Studies: How Buyers Benefited from the Maceda Law

Real stories bring the Maceda Law (RA 6552) to life. These are examples of how ordinary Filipinos protected their hard-earned investments — and how knowing their rights made all the difference.

1. Ana’s Refund Story: Recovering ₱400,000 from a Canceled Condo Purchase

When Ana, a first-time condo buyer from Quezon City, lost her job during the pandemic, she fell behind on three monthly payments.

After paying for five years, she thought her ₱400,000 in equity was gone for good.

Fortunately, her real estate broker advised her about the Maceda Law’s refund provision.

Since she had paid for more than two years, Ana was legally entitled to a 50% cash surrender valueof her total payments — a sum she successfully claimed after filing with the developer’s customer relations office.

💡 Lesson: Even if your contract is canceled, you may still be entitled to a partial refund — especially if you’ve paid two years or more.

2. Mark and Liza’s Grace Period: Saving Their Cavite Home

Mark and Liza, a young couple from Imus, Cavite, faced financial strain when Mark’s business slowed down. They had paid for six years but missed two payments in a row.

Their developer issued a Notice of Cancellation, but it was served too early — without observing the required 60-day grace period and proper notice.

With help from a DHSUD regional office, they were able to reinstate their contract by paying the arrears within their 6-month grace entitlement (one month for each year paid). Their property was saved from cancellation.

💡 Lesson: Developers cannot immediately cancel an installment contract. The Maceda Law requires a written notice, a grace period, and a fair chance for reinstatement.

3. Overseas Filipino Worker’s Story: Legal Aid Leads to ₱1 Million Refund

An OFW nurse in Dubai purchased a house-and-lot in Laguna in 2014. After seven years, she could no longer continue payments due to rising costs. The developer refused a refund, claiming her payments were forfeited.

She sought help from a real estate lawyer who cited the Maceda Law’s 65% refund entitlement(50% + 5% per year beyond five years).

After mediation through DHSUD, the developer released ₱1 million in refund within six months.

💡 Lesson: Even if a developer initially refuses, you can enforce your refund rights with proper documentation and legal support.

According to the Department of Human Settlements and Urban Development (DHSUD), most refund-related complaints are settled amicably once buyers cite RA 6552, proving how vital awareness is.

In many cases, developers comply voluntarily once they realize the buyer understands their legal rights.

Expert Insights and Legal Context

The Maceda Law (Republic Act No. 6552) remains one of the most powerful consumer protection measures for real estate buyers in the Philippines. Beyond its financial safeguards, it sets a legal precedent that balances developer rights with the buyer’s right to equity, fairness, and due process.

Government Reaffirmation of Buyer Protection

According to the Department of Human Settlements and Urban Development (DHSUD), the Maceda Law ensures that buyers under installment arrangements are protected from arbitrary cancellation and total forfeiture of payments.

In an official DHSUD statement, the agency reminds developers that:

“The buyer is entitled to a refund or cash surrender value equivalent to fifty percent of total payments made, and no cancellation shall be valid without proper notice and grace period as required by law.”

This directive is consistent with the government’s push to promote responsible property development and ethical collection practices within the housing sector.

Supreme Court Cases Interpreting RA 6552

Filinvest Land, Inc. v. Zafra-Orbe (G.R. No. 203990, February 12, 2020)

The Supreme Court ruled that a mere demand letter is not sufficient to cancel an installment sale. Under Section 3(b) of the Maceda Law (RA 6552), a notice of cancellation or demand for rescission must be made through a notarial act, and actual cancellation only becomes effective 30 days after the buyer receives such notice.

Active Realty & Development, Inc. (G.R. No. 141205)

The Supreme Court held that a developer’s cancellation of an installment contract is invalid if done without first fulfilling RA 6552’s procedural safeguards — notably the requirement to refund the buyer (cash surrender value) and observe the statute’s notice and grace period rules.

G.R. No. 189145 (2013)

The Supreme Court clarified that the protections of the Maceda Law extend to conditional sales of real estate. Under this case, even if a contract is labeled “conditional sale,” RA 6552’s rules on grace periods, cancellation notice (notarial act), and refund rights still apply when the buyer defaults.

Key Insight: These rulings highlight the consistent judicial stance that developers must act in good faith and comply with the procedural safeguards set by the Maceda Law.

Expert Legal Commentary

“The Maceda Law prevents unfair forfeiture by recognizing the buyer’s partial ownership interest in the property. It balances business practicality with the social justice intent of protecting Filipino homebuyers.”

Maceda Law vs. Recto Law: What’s the Difference?

While both the Maceda Law and the Recto Law protect buyers who purchase property through installment payments, they apply to different types of transactions and offer different remedies.

Let’s break it down clearly:

1. Maceda Law (RA 6552)

Applies to:

- Real estate sales on installment basis (residential lots, condos, houses).

Main protections:

- Grace period to pay missed installments.

- Refund (cash surrender value) after at least 2 years of payment.

- Proper cancellation process required (written notice + grace period).

- Applies only to residential properties, not commercial or industrial.

Goal: Protect buyers of real estate who pay over time from losing everything due to default.

Example:

You bought a condo unit payable over 10 years, but you default after 5 years. Under the Maceda Law, you’re entitled to 50% refund of your total payments and a 60-day grace period before cancellation.

2. Recto Law (Article 1484 of the Civil Code)

Applies to:

- Sale of personal property (movable items) payable in installments — such as cars, appliances, or furniture.

Main protections:

- Seller can choose only one of three remedies:

- Exact fulfillment (collect payment).

- Cancel the sale (take back the item).

- Foreclose the chattel mortgage (if one exists).

- Prevents double recovery — the seller cannot repossess the item and still demand full payment.

Goal: Prevent sellers from unfairly profiting by repossessing and reselling goods multiple times.

Example:

You bought a car through installment. After missing several payments, the dealer repossesses it. Under the Recto Law, they cannot demand the remaining balance once the car is taken back.

Quick Comparison

| Feature | Maceda Law (RA 6552) | Recto Law (Art. 1484) |

|---|---|---|

| Applies to | Real estate (residential properties) | Movable property (cars, appliances, etc.) |

| Buyer’s Protection | Refunds and grace period | Limits seller’s remedies |

| Minimum Years to Qualify | 2 years (for refund rights) | Not required |

| Type of Contract | Installment sale of real property | Installment sale of personal property |

| Main Purpose | Protect homebuyers from total forfeiture | Prevent sellers from double recovery |

💡 Key Takeaway

Both laws promote fairness in installment sales, but in different contexts.

- Maceda Law → Homebuyers’ protection

- Recto Law → Consumer goods protection

If you’re buying a house, condo, or lot, it’s the Maceda Law that shields your payments and ensures due process — not the Recto Law.

Conclusion & Key Takeaways

The Maceda Law (Republic Act No. 6552) is more than just a piece of legislation — it’s your safety net as a Filipino homebuyer. It ensures you don’t lose your investment overnight simply because of temporary financial setbacks.

If you’ve been paying in installments, remember:

- You have a grace period before any contract cancellation can take effect.

- You’re entitled to a refund (cash surrender value) once you’ve paid at least two years.

- You must receive a written notice of cancellation — developers cannot unilaterally forfeit your payments.

- You can reinstate your contract within your grace period by settling overdue amounts.

In short, the Maceda Law gives you time, fairness, and protection — but only if you know how to invoke your rights. Awareness is your best defense against unfair practices.

Final Thoughts

For buyers, this law is a reminder that due diligence doesn’t stop after signing. Know what’s written in your contract, track your payments, and keep all receipts and communications with your developer.

For brokers and real estate professionals, being well-versed in RA 6552 isn’t just about compliance — it’s about earning client trust and ensuring ethical transactions in the industry.

If you’re planning to buy or sell a property under installment terms, work only with licensed real estate professionals who understand the Maceda Law and its implications.

- Consult a property lawyer if you’re facing cancellation or refund issues.

- Explore listings and developers compliant with RA 6552 to safeguard your investment.

- Reach out today for guidance on finding properties or brokers that uphold your buyer rights.

Leave a comment