After nearly two years of subdued sales and cautious optimism, the mid-income condominium market in Metro Manila is roaring back to life. According to the latest market briefing from Colliers Philippines, residential take-up in the third quarter of 2025 surged by 108%, marking the highest quarterly growth in nine quarters.

Developers, eager to clear their ready-for-occupancy (RFO) inventories, are deploying some of the most aggressive pricing tactics the market has seen in years — including spot-cash discounts of up to 60%, lease-to-own options, and extended payment terms that make urban living more attainable for the mid-income segment.

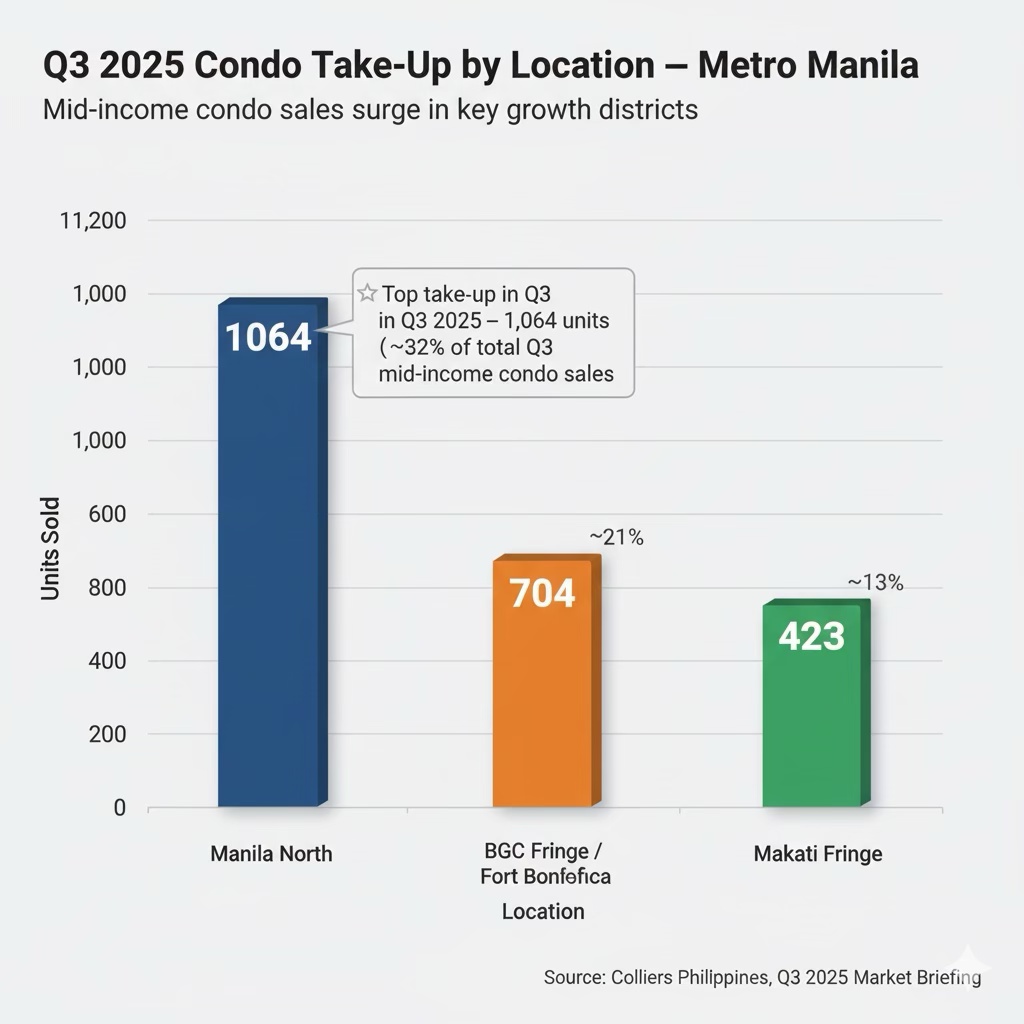

Could 2025 mark the turning point for Metro Manila’s mid-income condo market? The data certainly suggests so. From Manila North to the fringes of Makati and Bonifacio Global City, thousands of buyers are re-entering the market — driven by affordability, location convenience, and renewed confidence in long-term property values.

In this article, we’ll break down where the recovery is happening, why mid-income condos are leading the rebound, and how developers are reshaping their strategies to meet this surging demand.

The Rebound After the Dip

After two years of subdued demand and cautious developer sentiment, Metro Manila’s residential condominium market is finally finding its footing again. In its latest briefing, Colliers Philippinesreported a dramatic 108% quarter-on-quarter surge in take-up, rising from 2,800 units in Q2 2025 to 5,900 units in Q3 2025—the highest level in nine quarters.

This recovery marks a pivotal turnaround from the sluggish years following the pandemic, when high inflation, elevated interest rates, and buyer uncertainty dampened the mid-income segment’s performance. Now, as developers unleash bold pricing and financing schemes, the mid-income market has become the “sweet spot” of post-pandemic housing demand—balancing affordability, location accessibility, and investment potential.

The resurgence is most visible in Manila North, which saw net take-up leap from just four units in Q1 2025 to 1,064 units in Q3, signaling renewed confidence among buyers. Likewise, the Fort Bonifacio Fringe (704 units) and Makati Fringe (423 units) are proving that proximity to key business districts—without the premium price tag—is a winning formula for mid-income buyers.

Market Overview: The Numbers Behind the Comeback

The third quarter of 2025 was nothing short of a turning point for Metro Manila’s residential property sector. According to Colliers Philippines, overall condominium sales soared to 5,900 units, representing a 108% increase from the 2,800 units sold in the previous quarter — the strongest quarterly performance in over two years. This resurgence breaks a long stretch of cautious demand and signals renewed confidence in the mid-income segment, which is now driving the market’s upward momentum.

A Record-Breaking Quarter

Metro Manila’s condo market is experiencing high absorption rates, the best since 2022, thanks to demand following the pandemic. The 2025 rebound is due to affordability and smart financing. Developers are now focusing on ready-for-occupancy (RFO) units and offering flexible options for mid-income properties.

This combination of strategic pricing and revived end-user confidence has pushed quarterly take-up to its highest point in nine quarters, marking the start of what analysts believe could be a sustained recovery cycle.

Where the Action Is

The recovery isn’t evenly distributed — it’s concentrated in submarkets where value meets accessibility.

Manila North

The standout performer increased from 4 units in Q1 to 1,064 units in Q3 2025. This growth indicates rising buyer interest in Quezon City and nearby areas, where prices are lower than in central business districts, but infrastructure and connectivity are improving.

Fort Bonifacio Fringe

Ranked second with 704 units sold, areas like Uptown and Kalayaan Avenue are capturing mid-income buyers priced out of central BGC. These fringe zones offer modern living within reach of employment hubs.

Makati Fringe

With 423 units sold, demand in fringe areas such as Chino Roces and San Antonio Village underscores a growing appetite for smaller, accessible units close to Makati’s business core.

Across these districts, mid-income projects accounted for nearly all transactions, confirming that the P3 million–P8 million price band remains the market’s most active and resilient segment.

The Inventory Situation

Despite the surge in sales, unsold ready-for-occupancy inventory across Metro Manila still totals about 30,400 units, equivalent to roughly eight years of supply based on current absorption rates.

However, the composition of this inventory is shifting:

47% of RFO stock now falls under the lower- to upper-mid-income brackets, down from 59% in 2024.

The affordable segment makes up 35%, while the remainder belongs to the high-end and luxury categories.

This decline in mid-income RFO share indicates healthy absorption and market tightening, especially in developments offering competitive payment terms and strategic locations. Developers that can sustain this momentum — by keeping prices realistic and financing flexible — are likely to dominate the next growth phase of Metro Manila’s condo cycle.

Why Mid-Income Condos Are Making a Comeback

The renewed strength of the mid-income condominium market in Metro Manila isn’t a coincidence—it’s a reflection of shifting buyer power, changing urban lifestyles, and improving economic conditions. As developers recalibrate strategies to move RFO inventory, this segment is becoming the most dynamic and opportunity-rich tier in the post-pandemic real estate landscape.

Pricing Power Shifts to Buyers

In a market once dominated by premium pricing and investor-driven demand, buyers now hold the upper hand. Developers are under mounting pressure to unload thousands of ready-for-occupancy units accumulated over the past few years. The result: aggressive promotions and record-breaking discounts.

Some developers are offering spot-cash discounts as high as 40–60%, a move rarely seen before 2025. Others are introducing lease-to-own options and extended payment terms—schemes that let end-users move in immediately while spreading out payments over several years.

These incentives have restored buyer confidence and accessibility, especially among middle-income earners who were previously priced out of the market. For many, 2025 presents the best buying window in years, combining lower entry costs with strong long-term capital appreciation potential.

Lifestyle and Location Appeal

Mid-income condominiums strike the ideal balance between urban accessibility and financial practicality. They are typically located in fringe areas near major CBDs such as Makati, Bonifacio Global City, and Ortigas—offering similar convenience without the premium price tag.

These changes focus on young professionals seeking shorter commutes, families leaving rentals, and OFWs wanting stable investments and rental income. New projects like the Metro Manila Subway and North-South Commuter Railway enhance connectivity, making these mid-tier communities more attractive to buyers both locally and abroad.

What’s more, many of these properties feature modern amenities, compact yet functional layouts, and eco-conscious designs—appealing to a new generation of homeowners who value both comfort and sustainability.

Economic Drivers Supporting the Shift

The macroeconomic backdrop is also turning favorable. Inflation has begun to ease, employment levels are improving, and remittance inflows from OFWs remain strong, all of which bolster consumer purchasing power.

According to the Bangko Sentral ng Pilipinas (BSP), consumer confidence rose in Q3 2025, suggesting a good outlook for major purchases like homes and cars. This better sentiment is driving demand for mid-income housing, as developers are changing prices and payment options to match what buyers can afford.

In essence, the mid-income condo rebound is both cyclical and structural: cyclical in the sense that it follows economic recovery, and structural because lifestyle shifts toward urban convenience and ownership flexibility are here to stay.

Developer Strategies and Market Response

Developers are responding to the shifting tides of Metro Manila’s condo market with a mix of aggressive pricing tactics, innovative payment terms, and market-sensitive repositioning. The focus has clearly shifted from profit maximization to inventory absorption and buyer re-engagement, signaling a more pragmatic and competitive approach across the mid-income segment.

Aggressive Promotions: Redefining Affordability

To move unsold ready-for-occupancy (RFO) units, developers are going beyond the typical 5–10% discount structures. Many are now offering spot-cash discounts of up to 60%, drastically lowering barriers for qualified buyers and investors.

For those hesitant to pay everything upfront, extended amortization plans lasting up to 10 years post-turnover allow for gradual ownership without needing bank financing. Also, rent-to-own programs enable renters to buy by making monthly payments that lower the total purchase price.

These aggressive pricing moves are designed to stimulate absorption in a market still managing a substantial RFO inventory while attracting a wider pool of end-users who might otherwise delay their purchase decisions.

Developer Commentary and Market Insight

According to Joey Roi Bondoc, Research Director at Colliers Philippines, developers are “prioritizing absorption over margins” — a strategic shift acknowledging that maintaining market velocity is now more critical than holding out for premium pricing.

This sentiment shows a trend among top developers in Metro Manila, with many shifting marketing budgets to direct incentives instead of just preselling campaigns. The goal is to sell existing inventory, keep construction going, and maintain investor confidence in a changing economy.

In practical terms, this strategy not only boosts near-term cash flow but also positions developers to reset pricing baselines and launch new projects more competitively in 2026.

What This Means for Investors and End-Users

For end-users, this is arguably the most buyer-friendly market environment in years. Flexible financing and aggressive discounts mean they can secure prime locations at historically low prices — often with move-in-ready units that eliminate construction delays. Many buyers are finding that owning is now cheaper than renting, especially under lease-to-own structures.

For investors, particularly OFWs and local flippers, this is an ideal window to acquire discounted RFO or secondary units. The potential for rental yield recovery is strong, especially in fringe markets near key CBDs where demand from young professionals remains robust. As the market rebounds, investors who enter now could benefit from capital appreciation once incentives taper off and prices normalize.

Red Flags and Market Risks

Even with the rise of sustainable and mixed-use developments in Metro Manila, the market isn’t immune to potential pitfalls. Here are some key risks that buyers and investors should keep an eye on:

Oversupply Still a Concern

Despite strong housing demand, the Metro Manila condo market still carries an estimated eight-year inventory of ready-for-occupancy (RFO) units. This oversupply means developers may offer more units than the market can absorb, which can lead to longer selling cycles, slower appreciation, and tighter competition among landlords in the rental segment.

Possible Price Corrections if Economic Growth Slows

Current price stability depends heavily on the country’s economic momentum and remittance inflows. Should inflation spike or interest rates remain high, property prices—especially in mid- to high-end segments—could experience short-term corrections. Investors relying solely on capital appreciation should diversify and monitor macroeconomic indicators closely.

Developer Focus Shifting Toward Volume, Not Longevity

With many developers racing to capture the “sustainability” trend, some projects risk prioritizing sales volume over long-term structural quality and community resilience. Buyers should scrutinize build quality, after-sales management, and actual environmental certifications (BERDE, EDGE, LEED) before investing in any “green” development.

What Buyers and Investors Should Do Now

With the mid-income condominium market making a strong comeback, timing and strategy matter more than ever. Whether you’re buying a home, investing for rental yield, or planning your next project launch, here’s how to navigate this shifting market with confidence:

For Homebuyers: Find Real Value Behind the Discounts

Developers are dangling spot-cash discounts of up to 60% and extended payment schemes—but don’t be swayed by numbers alone.

Verify if discounts apply to your preferred area

Popular growth corridors like Manila North and the Makati Fringe are seeing rapid take-up, so limited inventory may reduce your bargaining power.

Look beyond the sticker price

Assess total ownership cost, including fees, upkeep, accessibility, and expected value increase. A more expensive condo in a well-connected area may offer greater long-term value than a cheaper, isolated one.

For Investors: Follow the Momentum, Not the Noise

The data shows where demand is heading—Manila North, Fort Bonifacio Fringe, and Makati Fringe. These areas recorded the strongest take-up in Q3 2025.

Target submarkets with rising absorption rates. These zones offer faster resale potential and solid rentability.

Use flexible payment options. Lease-to-own or longer payment plans help you keep cash flow steady while securing units in popular areas.

For Developers: Play the Long Game

Competition in the mid-income bracket is heating up, but sustainable differentiation will determine who thrives.

Monitor demand absorption rates before launching new towers. Data-driven timing helps avoid adding to the oversupply.

Invest in unique, lifestyle-driven amenities. Think co-working spaces, pocket gardens, solar-ready rooftops, and smart home features—the kind of extras that mid-income buyers now actively seek.

Expert Insights & Forecast

The mid-income condominium segment isn’t just bouncing back—it’s shaping up to be the main engine of Metro Manila’s residential market recovery heading into 2026. According to Colliers Philippines, the rebound will likely continue as long as developers sustain flexible financing and affordability-driven incentives, such as rent-to-own schemes, stretched payment terms, and large spot-cash discounts that make RFO units more attainable.

2026 Outlook: Sustained Demand Under Practical Pricing

Colliers projects that the mid-income market will maintain strong take-up through 2026, particularly if inflation remains moderate and the Bangko Sentral ng Pilipinas (BSP) begins rate cuts to stimulate borrowing. Developers are expected to keep pushing creative promos, bridging the affordability gap for first-time homebuyers and OFW families seeking end-use properties.

“Affordability and flexible terms will remain the twin anchors of residential demand,” Colliers noted, emphasizing that the post-pandemic buyer now values payment comfort over premium branding.

Preselling Launches Poised for Recovery

Property analysts view the mid-income bracket as the strongest and most expandable segment in next year’s preselling cycle. After a few quarters of low activity, developers are becoming more confident, concentrating on mid-priced vertical projects in important fringe areas like North Manila, Fort Bonifacio Fringe, and Quezon City.

These locations balance price accessibility, future infrastructure access, and urban proximity, making them ideal for preselling units aimed at long-term investors and upgraders.

Urbanization and Infrastructure: The Catalysts Ahead

The market revival matches the current infrastructure growth in Metro Manila. Key projects like the MRT-7, North–South Commuter Railway (NSCR), and Metro Manila Subway will change where people want to live, cut travel times, and make northern and eastern areas more appealing.

These transit-oriented zones are now seen as the next hotspots for mid-income condo development, as accessibility becomes the new currency of property value.

Key Takeaway:

If developers continue prioritizing affordability, accessibility, and sustainability, 2026 could mark the beginning of a longer mid-income market upcycle—one defined not by luxury, but by livable, connected, and financially sensible urban housing.

Conclusion & Key Takeaways

The mid-income condominium market has officially reclaimed its momentum—emerging as the revival engine of Metro Manila’s residential sector. Colliers Philippines’ latest data paints a clear picture: demand is roaring back, inventories are shrinking, and developers are racing to capture a wave of practical yet motivated buyers.

With sales up by 108% in Q3 2025 and North Manila, Fort Bonifacio Fringe, and Makati Fringeleading take-up, it’s evident that value-driven buyers are shaping the new normal of real estate recovery. The shift toward affordable payment terms, rent-to-own deals, and 50–60% spot-cash discounts underscores a more accessible and buyer-friendly market landscape.

For investors and end-users alike, now is a pivotal window. Prices are competitive, developers are flexible, and market confidence is rebuilding. Waiting too long could mean missing the sweet spot between price opportunity and capital appreciation potential.

📌 Key Takeaways:

Mid-income condos are driving the recovery

they accounted for most transactions across Metro Manila’s top-performing zones.

Developers are adapting fast

using aggressive pricing, rent-to-own schemes, and flexible terms to clear RFO inventory.

Market timing matters

with eight years’ worth of supply shrinking, the next 12–18 months could define early-mover gains.

Infrastructure is the multiplier

projects like MRT-7 and the Metro Manila Subway are reorienting the map of condo value.

Looking to take advantage of current developer discounts?

Now is the perfect time to explore mid-income condominiums in Manila North and the BGC Fringe, where flexible payment options, rent-to-own schemes, and discounts of up to 60% on spot-cash deals are reshaping the market.

📍 Start your search today.

Visit upropertyph.com or connect with our team to discover Metro Manila’s most promising mid-income investments before prices climb again.

At U-Property PH, our real estate experts can help you:

- Identify high-value, mid-income condos in growth-ready districts

- Compare developer promos and financing options

- Schedule personalized property viewings or virtual tours

- Get insider market insights before you commit

Leave a comment