Thinking of buying property in the Philippines? Whether you’re considering a suburban lot or a sleek condominium unit in the city, it’s crucial to understand that owning land and owning a condo are legally very different. Many first-time buyers assume that both types of ownership give them the same rights, but the reality is more nuanced—and overlooking these differences can lead to unexpected risks, fees, or legal complications.

This article will clarify the key legal distinctions between land ownership and condominium ownership, providing you with a clear understanding of what you can and cannot do with each type of property. We’ll break down ownership rights, obligations, restrictions, taxes, and practical considerations, all in the context of Philippine law.

By the end of this guide, you’ll have actionable insights to help you make informed property decisions—whether your goal is to live in your dream home, invest for long-term growth, or navigate legal complexities confidently.

Understanding Property Ownership in the Philippines

Whether you’re planning to buy your first home or invest in real estate, understanding the legal framework for property ownership in the Philippines is critical. The rules differ significantly between owning land and owning a condominium unit, affecting your rights, obligations, and long-term options.

1. Overview of Philippine Property Laws

Property ownership in the Philippines is governed by several key laws:

1987 Constitution

Only Filipino citizens or corporations with at least 60% Filipino ownership can own land. Foreigners are generally restricted but can invest in condominiums under certain conditions.

Civil Code of the Philippines

Defines the rights, responsibilities, and legal protections of property owners.

Condominium Act (RA 4726)

Governs condominium ownership, granting unit owners exclusive rights over their units and shared ownership of common areas.

Foreign Ownership Highlights:

Foreigners cannot directly own land but may lease it long-term (up to 50 years, renewable for 25 years).

In a condominium building, foreign ownership is capped at 40% of the total units.

2. Land Ownership in the Philippines

Definition:

Land ownership means holding full legal title over a piece of property, giving you broad rights to use, sell, lease, or develop it.

Key Features and Mechanics:

Ownership is evidenced by a Torrens Title, issued by the Registry of Deeds.

Transferring ownership requires a Deed of Sale, payment of Capital Gains Tax, Documentary Stamp Tax, and registration fees.

Rights of Landowners:

Full control over the land: Build, farm, or develop according to zoning laws.

Freedom to transfer: Sell, donate, or lease property.

Inheritance rights: Property can be passed to heirs under Philippine succession laws.

Legal Obligations:

Pay annual Real Property Tax (RPT) based on the assessed value.

Comply with local zoning regulations that govern land use (residential, commercial, or agricultural).

Example:

Buying a residential lot in Cavite or Cebu gives you full control to build a home, lease portions, or invest in agriculture—making it ideal for long-term property investments.

3. Condominium Ownership in the Philippines

Definition:

A condominium owner holds exclusive rights to a unit inside a building, while sharing ownership of common areas like hallways, gyms, pools, and gardens.

Key Features and Mechanics:

Ownership is evidenced by a Condominium Certificate of Title (CCT).

Unlike land, condo owners do not own the land beneath the building, only the unit and a proportional share of common areas.

Rights of Condo Owners:

Exclusive unit control: You can sell, lease, or renovate your unit (subject to building rules).

Shared access to amenities: Pools, gyms, and lounges are co-owned with other unit owners.

Voting rights in HOA: Participate in decisions affecting building management.

Legal Obligations:

Monthly HOA/association fees for maintenance, security, and utilities.

Compliance with building rules and regulations, including renovations and community conduct.

Example:

Owning a studio in Makati or BGC provides modern urban living with shared amenities and 24/7 security—but comes with HOA responsibilities and shared decision-making.

Why This Matters for Buyers and Investors

Understanding these differences helps you:

Choose the right property type based on lifestyle or investment goals.

Plan for taxes and fees accurately.

Avoid legal pitfalls related to foreign ownership, HOA rules, or zoning restrictions.

Key Legal Differences Between Land and Condominium Ownership

When deciding between buying land or a condominium unit in the Philippines, understanding the legal differences is essential. These differences affect your rights, obligations, taxes, and long-term investment potential.

1. Ownership Rights

Land Ownership:

- You hold full legal ownership of the land and any improvements on it.

- You can develop or modify the property freely, subject to zoning laws and local regulations.

- Rights include leasing, selling, or passing the property to heirs.

Condominium Ownership:

- You own only the individual unit and a proportional share of the building’s common areas(e.g., hallways, pool, gym).

- Development or modifications inside your unit are allowed, but common areas are governed by the Homeowners’ Association (HOA) rules.

- Ownership is restricted by condominium law and subject to HOA management.

2. Transfer and Sale Restrictions

Land Ownership:

- Land can be sold, donated, or mortgaged, but foreigners are generally prohibited from owning land (exceptions include long-term leases).

- Ownership transfer requires Torrens Title registration and payment of taxes.

Condominium Ownership:

- Condominium units can be sold to foreign buyers, but foreign ownership per building is limited to 40% under RA 4726.

- Ownership transfer involves a Condominium Certificate of Title (CCT) and HOA approval for certain transactions.

3. Taxes and Fees

Land Ownership:

- Capital Gains Tax (6%) and Documentary Stamp Tax (1.5%) apply when selling.

- Real Property Tax (RPT) is an annual obligation based on assessed value.

Condominium Ownership:

- Same taxes apply upon sale.

- Monthly HOA/association fees are required to cover maintenance, security, and shared amenities.

4. Legal Protections

Land Ownership:

Directly protected under the Civil Code of the Philippines, including remedies for trespassing, eminent domain, or disputes.

Condominium Ownership:

Governed by RA 4726 (Condominium Act) and the building’s association bylaws, which regulate usage, repairs, and community rules.

5. Land vs. Condominium Ownership

| Feature | Land Ownership | Condominium Ownership |

|---|---|---|

| Ownership Scope | Full ownership of land and improvements | Ownership of unit + proportional share of common areas |

| Development Rights | Can freely develop subject to zoning | Limited to unit; common areas managed by HOA |

| Transfer / Sale | Easier transfer; foreigners restricted | Transfer allowed; max 40% foreign ownership per building |

| Taxes | Capital Gains Tax, Documentary Stamp Tax, RPT | Same taxes; plus monthly HOA fees |

| Legal Protection | Civil Code of the Philippines | RA 4726 + HOA bylaws |

| Examples | Residential lot in Cavite | Studio in BGC with gym and pool access |

Common Misconceptions About Property Ownership in the Philippines

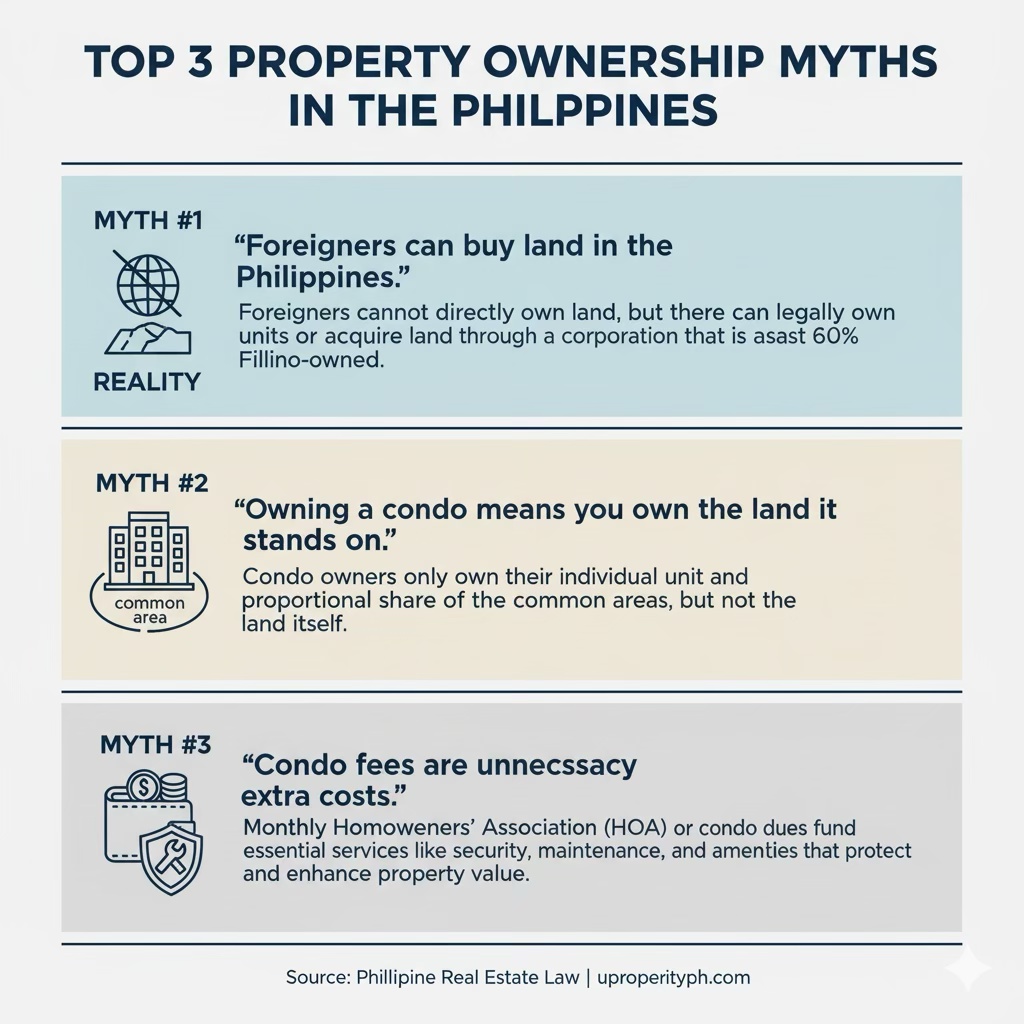

Buying property in the Philippines can be confusing, especially when navigating the differences between land ownership and condominium ownership. Many buyers make assumptions that could lead to costly mistakes. Let’s debunk some of the most common misconceptions:

1. “Buying a condo is the same as owning land.”

Reality

Condominium ownership is fundamentally different from land ownership. When you buy a condo, you only own your unit and a proportional share of common areas, not the land beneath the building. In contrast, land ownership gives you full legal rights to the property, including the ability to develop or lease it (subject to zoning and local laws).

Example

Buying a studio in BGC allows you to enjoy amenities like a pool or gym, but you cannot build an extension outside your unit. Owning a lot in Tagaytay, however, allows full construction and development freedom.

Legal Reference: Republic Act 4726 (Condominium Act) clarifies the distinction between unit ownership and land ownership.

2. “Foreigners can’t buy condos.”

Reality

Foreigners can purchase condominium units, but ownership is restricted to a maximum of 40% of the total units in a building. This rule ensures that at least 60% of the units are owned by Filipino citizens or corporations with majority Filipino ownership.

Example

A U.S. citizen can legally own a condo in Makati or Ortigas as long as the building’s total foreign-owned units do not exceed 40%.

Legal Reference: Section 8 of RA 4726 governs foreign ownership limits in condominium projects.

3. “HOA fees are optional.”

Reality

Monthly Homeowners’ Association (HOA) or condominium association fees are mandatory for all unit owners. These fees cover maintenance, security, and management of common areas. Non-payment can lead to penalties, legal action, or even the suspension of your unit’s privileges.

Example

In a condo in Makati, failing to pay your HOA fees can result in your access card being deactivated and legal claims from the homeowners’ association.

Legal Reference: Condominium bylaws, approved under RA 4726, make payment of monthly dues a legal obligation for all unit owners.

Why This Matters for Buyers

Understanding these misconceptions helps you avoid legal disputes, unplanned costs, and investment mistakes. It also ensures that your property purchase aligns with your ownership goals, lifestyle, and financial plans.

Practical Implications for Buyers and Investors

Understanding the legal differences between land and condominium ownership isn’t just academic—it directly impacts your investment decisions, lifestyle, and financial planning. Here’s how these distinctions play out in practice:

1. Choosing Property Based on Your Goals

Investment vs. Personal Residence:

Land ownership is ideal for buyers seeking long-term appreciation, development flexibility, or agricultural opportunities. A lot in Cavite, Tagaytay, or Cebu can be developed into a custom home, subdivided, or leased for income.

Condominium ownership suits those prioritizing urban convenience, modern amenities, and rental income opportunities. Condos in Makati, BGC, or Ortigas attract young professionals and expatriates, making them easier to lease short-term or long-term.

Lifestyle Considerations:

Landowners enjoy more privacy and control, while condo owners benefit from community living, security, and shared facilities.

2. Risk Considerations

Land Ownership Risks:

- Disputes over property boundaries or title irregularities can arise if due diligence is not performed.

- Zoning changes or eminent domain claims may affect development plans.

Condominium Ownership Risks:

- Conflicts with Homeowners’ Associations (HOAs) or other unit owners over rules, renovations, or shared expenses can occur.

- Changes in HOA policies may increase fees or restrict unit use.

Tip:

Always perform title verification, due diligence, and review HOA bylaws before purchasing.

3. Financing Differences

Land Ownership Financing:

- Banks may require larger down payments for raw land, and interest rates may be slightly higher compared to condo loans.

- Long-term development plans may require additional financing for construction or subdivision.

Condominium Ownership Financing:

- Condo units often qualify for standard home loans with lower interest rates, especially in established developments.

- Monthly amortization may include HOA dues if the bank considers it part of recurring costs.

Example:

Buying a studio in BGC may have a more straightforward loan process, while purchasing a residential lot in Cavite may require separate financing for construction or land improvements.

Why This Matters

Understanding these practical implications ensures that your property purchase:

Matches your financial goals and lifestyle preferences.

Minimizes legal or financial risks.

Aligns with your long-term investment or residency plans.

Expert Insights and Market Trends

The Philippine real estate market continues to evolve, and understanding current trends is essential for buyers, investors, and property professionals. Let’s explore key insights for condominium and land ownership.

1. Condo Market Growth in Metro Manila vs. Land Development in Suburban Areas

Metro Manila Condominiums:

- Condo developments continue to expand in business districts like Makati, BGC, Ortigas, and Quezon City.

- Driven by urbanization, rising demand from young professionals, OFWs, and expatriates, and proximity to workplaces, malls, and transport hubs.

- Average annual price appreciation in prime locations ranges from 5–8%, making condos attractive for rental income and investment.

Suburban Land Development:

- Cities and provinces such as Cavite, Batangas, Laguna, and Cebu are seeing increased residential lot and housing developments.

- Growth is driven by affordable land prices, infrastructure projects (e.g., new highways, expressways), and lifestyle relocation trends.

- Suburban land investments often yield higher long-term appreciation, especially when near future transport corridors or economic hubs.

Insight:

Buyers seeking immediate rental income may prefer condos, while those aiming for long-term capital growth or building a custom property may consider suburban land.

2. Legal Cases and Precedents Illustrating Property Disputes

Land Ownership Disputes:

Cases of boundary conflicts, fraudulent titles, or informal settlements illustrate the importance of thorough title verification and due diligence.

- Example: In G.R. No. 36078 the Court reaffirmed that fraudulently obtained titles can be set aside, even under the Torrens system.

Condominium Disputes:

Common issues involve HOA fee enforcement, renovation rules, or common area usage.

- Example: In G.R. No. 163196 (1st Marbella Condominium Association, Inc. vs. Gatmaytan, 2008) the Supreme Court acknowledged the power of the condominium association to assert a lien for unpaid dues.

Takeaway:

Legal precedents underscore the necessity of checking titles, reviewing bylaws, and understanding your rights and obligations before buying any property.

3. Government Incentives and Programs Affecting Property Ownership

Home Development Mutual Fund (Pag-IBIG) Programs:

Offers affordable home loans for land, house-and-lot, and condominium purchases, including special financing rates for first-time buyers.

Infrastructure and Development Projects:

Projects like Metro Manila Skyways, new expressways, and railway expansions increase land and condo values in adjacent areas.

Tax Incentives for Real Estate Investments:

Under certain conditions, first-time homebuyers may qualify for exemptions on Capital Gains Tax or Documentary Stamp Tax when purchasing primary residences.

Insight:

Staying updated on government programs and infrastructure plans can help buyers maximize investment potential and take advantage of legal incentives.

Case Studies and Real-Life Examples

Learning from real-life scenarios can help buyers and investors understand the practical implicationsof land versus condominium ownership in the Philippines.

Case Study 1: Purchasing Land in Tagaytay

Scenario:

Maria, a first-time buyer, purchased a 500-square-meter lot in Tagaytay intending to build a vacation home. She wanted a property with scenic views, privacy, and potential for long-term appreciation.

Process and Insights:

- Conducted title verification at the Registry of Deeds to ensure a clean Torrens title.

- Consulted with a local surveyor and legal counsel to confirm boundaries and zoning restrictions.

- Purchased through a bank-assisted land loan, planning future construction financing separately.

Lessons Learned:

- Land ownership requires careful due diligence to avoid boundary disputes or title issues.

- Buyers have full control over development, but responsibilities for taxes, permits, and infrastructure fall entirely on them.

- Long-term appreciation can be significant if the property is near upcoming transport or infrastructure projects.

Case Study 2: Investing in a Condo in BGC

Scenario:

John, an OFW investor, purchased a studio condo in Bonifacio Global City for rental income. His goal was steady cash flow and convenient urban living for tenants.

Process and Insights:

- Verified the Condominium Certificate of Title (CCT) and checked that foreign ownership limits were respected.

- Reviewed the HOA bylaws to understand rules on renovations, rental, and fees.

- Partnered with a property management company to handle tenants and maintenance.

Lessons Learned:

- Condo ownership offers immediate rental potential with minimal maintenance responsibilities compared to land development.

- Buyers must comply with HOA rules and monthly fees, which affect cash flow and investment planning.

- Legal protections under RA 4726 ensure owners’ rights over units and common areas but require active engagement with the HOA.

Key Takeaways from Both Scenarios

Land:

Greater control, higher development responsibility, long-term capital gains potential.

Condo:

Easier urban investment, shared responsibilities, quicker rental income but subject to HOA rules.

Actionable Advice:

Always perform title checks, review legal obligations, and consider lifestyle or investment goals before purchasing.

Conclusion / Key Takeaways

Choosing between land ownership and condominium ownership in the Philippines is more than a matter of preference—it’s a decision with significant legal, financial, and lifestyle implications.

1. Summary of Key Differences

| Aspect | Land Ownership | Condominium Ownership |

|---|---|---|

| Ownership Rights | Full control over land and improvements | Exclusive rights to the unit + shared ownership of common areas |

| Legal Obligations | Real Property Tax, compliance with zoning laws | HOA fees, adherence to association bylaws |

| Transfer & Sale | Easier to sell or lease; foreign ownership restricted | Transfer allowed with foreign ownership limits (max 40% per building) |

| Risks | Title disputes, zoning changes, development responsibilities | HOA conflicts, fee increases, restrictions on renovations or use |

2. Practical Advice for Buyers

Before making a purchase, consider the following:

Lifestyle Alignment:

Do you prefer urban living with amenities or the freedom of owning landin a suburban or rural area?

Investment Goals:

Are you looking for short-term rental income, or long-term appreciation and development opportunities?

Legal Comfort Level:

Are you confident navigating HOA rules and condo regulations, or do you want full control over your property?

3. Final Thoughts

By understanding these differences, you can make a well-informed decision that aligns with your financial goals, legal considerations, and lifestyle needs. Both land and condominium ownership offer unique opportunities—your choice depends on how you weigh control, convenience, risk, and investment potential.

Take the Next Step with Confidence

Buying property in the Philippines—whether a land lot or a condominium unit—involves important legal, financial, and lifestyle considerations. To make the best decision:

1. Consult Licensed Professionals

Work with a licensed real estate broker or lawyer to ensure your purchase is fully compliant with Philippine law. They can help you:

Verify titles and ownership documents

Review Condominium Association bylaws

Navigate taxes, fees, and foreign ownership restrictions

2. Explore Properties That Match Your Goals

Whether you’re looking for a suburban lot for a dream home or a condo in Metro Manila for rental income, our team can guide you to listings that fit your budget, lifestyle, and investment objectives.

Tip: Provide details such as preferred location, size, and property type when reaching out for faster and more personalized recommendations.

3. Contact Us For Free Consultations

Your message has been sent

To simplify your decision-making process, our free consultation can help you with the:

- Key differences between land and condo ownership

- Legal and financial considerations

- Due diligence steps before purchase

- Tips for first-time buyers and investors

Contact us now and make informed property decisions with confidence.

Leave a comment