After years of working abroad, building a life in another country, and sending hard-earned money back home, many Filipinos dream of one thing — owning a piece of land in the Philippines once again.The idea of returning to familiar streets, investing in a home for retirement, or leaving a legacy for the next generation is deeply personal. Yet when it comes time to buy property, confusion often sets in. Can you, as a dual citizen or former Filipino, legally own land? What if your spouse isn’t Filipino? And what exactly does Republic Act No. 9225, the Dual Citizenship Law, allow you to do?

These are not trivial questions. They sit at the intersection of constitutional land ownership rules and modern realities of migration. Since the enactment of RA 9225 in 2003, more than 360,000 former Filipinos have successfully reacquired their Philippine citizenship—each one eager to reconnect with their homeland through property ownership or investment opportunities. But the legal fine print can be daunting, especially for those navigating from overseas or through Philippine consulates.

This guide cuts through that complexity. You’ll learn exactly what your property ownership rights are under the Dual Citizenship Act, the limitations that still apply to certain land types, and how to legally invest in real estate as a balikbayan or returning Filipino. Whether you’re planning to buy a Tagaytay vacation home, a condo in BGC, or farmland in Batangas, this article breaks down every step — from reacquiring citizenship to securing your title — with clarity, accuracy, and expert insight.

Because owning land in the Philippines isn’t just a legal privilege. It’s a powerful way to come home.

Understanding Property Ownership for Dual Citizens

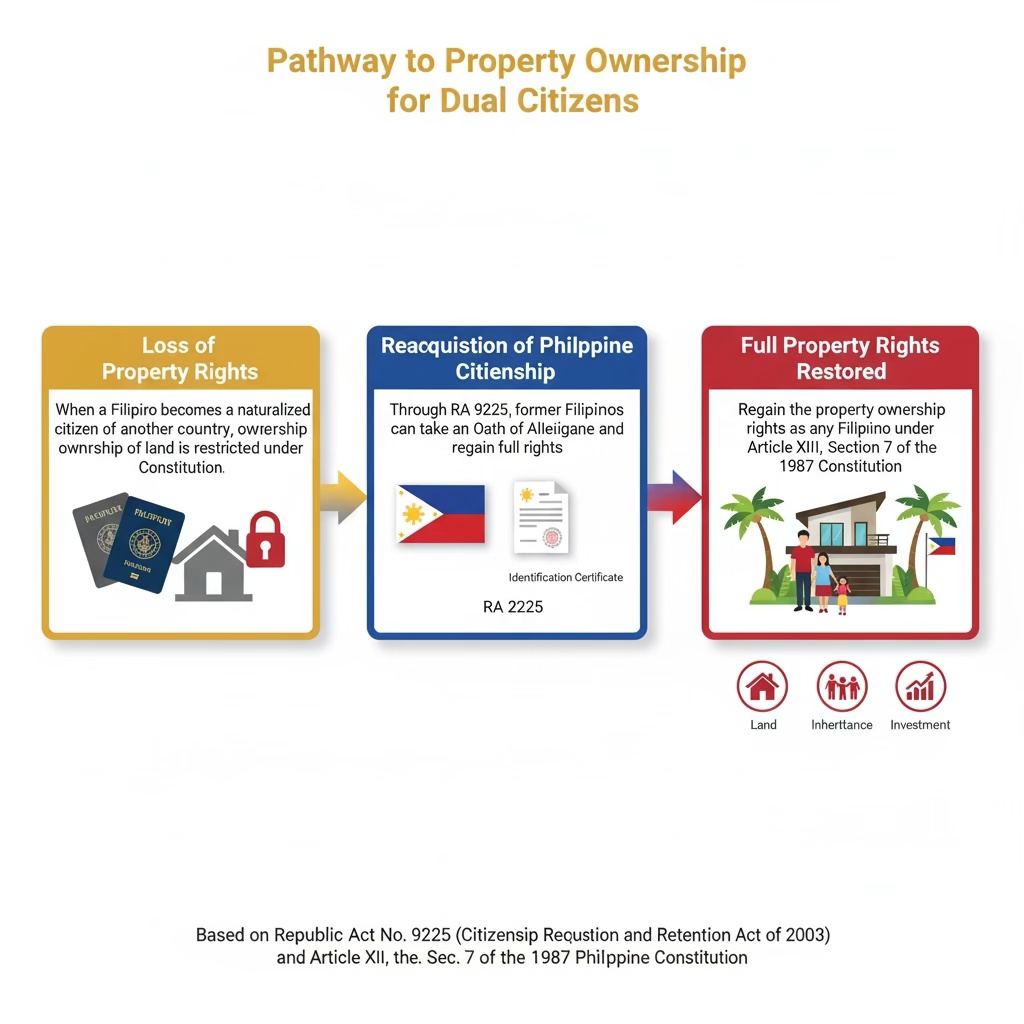

Owning land in the Philippines has always been tied to citizenship, not birthplace or sentiment. For millions of Filipinos who became naturalized citizens abroad, this reality meant losing the right to buy or own real property in the country of their birth. But with the passage of Republic Act No. 9225, better known as the Citizenship Retention and Reacquisition Act of 2003, that limitation changed — giving former Filipinos a clear legal path to reclaim what’s rightfully theirs.

What Is Dual Citizenship Under Republic Act No. 9225?

Republic Act No. 9225 (RA 9225) allows natural-born Filipinos who became citizens of another country to reacquire their Philippine citizenship without renouncing their foreign one. In simpler terms, it officially recognizes that you can be both Filipino and a citizen of another country at the same time.

Once you take the Oath of Allegiance to the Republic of the Philippines and receive your Identification Certificate (IC), your rights as a Filipino — including land ownership, voting, and engaging in business — are fully restored.

RA 9225’s intent is clear: to strengthen ties between the Philippines and its global Filipino community, enabling them to participate again in the nation’s economic and cultural life.

Dual Citizenship vs. Dual Nationality: Why It Matters

The terms often get used interchangeably, but they aren’t identical.

Dual Citizenship is a legal status granted under specific laws like RA 9225, which gives you the full rights and obligations of both countries.

Dual Nationality, meanwhile, can occur automatically (by birth or parentage) and doesn’t always come with equal legal rights in both nations.

In real estate, the distinction matters. Only dual citizens who have formally reacquired Philippine citizenship under RA 9225 are recognized by Philippine law as having constitutional property rights. Merely being of Filipino descent or having dual nationality through birth does not automatically qualify you to own land.

Rights Regained After Reacquiring Philippine Citizenship

Once you’ve completed the reacquisition process, you’re treated as a full Filipino citizen once again, enjoying all rights under Philippine law. This includes:

- The right to acquire and own land or other real property in your name;

- The right to inherit real property from Filipino relatives;

- The right to invest in residential, commercial, or condominium developments; and

- Equal protection under Philippine civil and property laws.

Essentially, reacquisition restores your constitutional capacity to own land, whether as a private individual, investor, or business owner in a Filipino-controlled corporation.

The Constitutional Basis for Filipino Land Ownership

The 1987 Philippine Constitution clearly defines who can own land:

Article XII, Section 7 — “Save in cases of hereditary succession, no private lands shall be transferred or conveyed except to individuals, corporations, or associations qualified to acquire or hold lands of the public domain.”

In practice, this means only Filipino citizens or corporations that are at least 60% Filipino-ownedcan legally acquire private land. For foreign nationals — including former Filipinos who have not yet reacquired citizenship — land ownership remains prohibited.

By reacquiring your citizenship under RA 9225, you fall back within the scope of this constitutional protection, regaining the full rights of a natural-born Filipino to buy, own, and transfer real property.

Land Ownership Rights under the Dual Citizenship Act (RA 9225)

Reacquiring your Philippine citizenship under Republic Act No. 9225 isn’t just symbolic—it’s the legal key that unlocks your property ownership rights in the Philippines. Once your citizenship is restored, the law treats you as if you never lost it at all, granting the same rights as any natural-born Filipino when it comes to buying, owning, and transferring real estate.

What RA 9225 Legally Allows You to Own

Under RA 9225, natural-born Filipinos who reacquire Philippine citizenship can legally:

- Purchase residential, commercial, or industrial land in their own name;

- Own condominium units, provided that at least 60% of the condominium corporation is Filipino-owned;

- Acquire land through inheritance from Filipino relatives; and

- Invest in agricultural or rural property, subject to constitutional area limits.

In other words, once your citizenship is reinstated, your ownership capacity mirrors that of any other Filipino citizen—no restrictions, no special permits, no foreign caps.

Equal Rights as Natural-Born Filipinos

The Bureau of Immigration and Department of Justice consistently affirm that a reacquired Filipino citizen enjoys all rights and privileges of a natural-born Filipino. That includes:

- Full ownership of private land and property;

- Eligibility to register property titles under your name;

- The ability to buy and sell land freely, and

- The right to engage in real estate investment or business ventures in compliance with Philippine laws.

Simply put, reacquiring your citizenship erases the legal distinction between you and any Filipino-born citizen living in the country.

Timing Is Everything: Reacquire Before You Buy or Inherit

Here’s a critical nuance many balikbayans overlook:

You must have reacquired your Philippine citizenship before purchasing or inheriting real estate.

If you buy land before reacquiring citizenship, the transaction is invalid because, at that time, you were considered a foreign national. The Register of Deeds will not allow the transfer of property in your name unless you hold a valid Identification Certificate (IC) proving your reacquisition.

Likewise, for inheritance, your citizenship status at the time of death of the decedent matters. If you were still a foreign citizen then, you can inherit property only through hereditary succession, not by purchase or donation.

These technicalities often trip up overseas buyers, so always complete your reacquisition first—it saves you from future legal headaches and title disputes.

Joint Ownership with Non-Filipino Spouses

Dual citizens married to non-Filipino spouses often wonder: Can my spouse’s name be on the title?

Here’s how it works:

- Land ownership can only be in the Filipino spouse’s name.

- However, the non-Filipino spouse may acquire property through hereditary succession, not purchase.

- For properties acquired during marriage, conjugal or community property laws still apply—meaning the non-Filipino spouse has a right to the property’s value or proceeds, but not to the land title itself.

This setup ensures constitutional compliance while recognizing the financial partnership in a marriage. Many couples navigate this through estate planning or prenuptial agreements to protect shared investments.

Land Ownership Rights: Dual Citizen vs. Foreigner vs. Former Filipino (Without Reacquisition)

| Category | Dual Citizen (RA 9225) | Foreigner | Former Filipino (No Reacquisition) |

|---|---|---|---|

| Can own private land | ✅ Yes, same as natural-born Filipino | ❌ No | ❌ No |

| Can own condo units | ✅ Yes (if 60% Filipino-owned) | ✅ Yes (if 60% Filipino-owned) | ✅ Yes (if 60% Filipino-owned) |

| Can inherit land | ✅ Yes (full rights) | ⚠️ Only by hereditary succession | ⚠️ Only by hereditary succession |

| Can register title in own name | ✅ Yes | ❌ No | ❌ No |

| Spouse can co-own land | ⚠️ Only if spouse is Filipino | ❌ No | ❌ No |

Documentary Requirements for Reacquiring Philippine Citizenship

Before you can legally buy or inherit property in the Philippines, you must first reacquire your Philippine citizenship under Republic Act No. 9225. The process is straightforward but must be done through official channels — either at a Philippine consulate abroad or the Bureau of Immigration (BI) if you’re already in the Philippines. Think of this step as restoring your full legal identity as a Filipino, which unlocks your right to own land, invest, and register property titles under your name.

Step-by-Step Process: How to Reacquire Philippine Citizenship

1. File Your Petition for Reacquisition

Submit a Petition for Citizenship Retention and Reacquisition to the nearest Philippine Embassy or Consulate (if abroad) or the Bureau of Immigration (if in the Philippines).

You’ll need to establish that you are a natural-born Filipino who lost citizenship after naturalization in a foreign country.

2. Attend the Oath-Taking Ceremony

Once your petition is approved, you’ll be scheduled to take an Oath of Allegiance to the Republic of the Philippines. This marks the official reacquisition of your citizenship.

3. Receive Your Identification Certificate (IC)

After the oath, the consulate or BI will issue an Identification Certificate (IC) — your proof of Philippine citizenship. This document is crucial for all legal transactions, especially property ownership and land registration.

4. Apply for a Philippine Passport (Optional but Recommended)

Once you have your IC, you may apply for a Philippine passport. While not mandatory for property ownership, it simplifies identification for real estate transactions and business dealings.

Key Documents You’ll Need

Here’s what you’ll typically prepare and present:

- Completed RA 9225 Application Form

- Original and photocopy of your foreign passport

- Original and photocopy of your Philippine birth certificate (PSA-issued)

- Marriage certificate, if applicable

- Certificate of Naturalization from your adopted country

- Two valid photo IDs

- Recent photographs (passport size)

- Processing fee (varies by location)

If applying at the Bureau of Immigration, expect to submit your documents personally and appear for a biometrics capture.

Processing Timeline and Fees

Processing time varies depending on location:

- Philippine Consulate abroad: usually 2 to 4 weeks

- Bureau of Immigration (Philippines): typically 1 to 2 months

Fees range from USD 50 to USD 75 abroad, or around ₱10,000–₱12,000 if processed locally, depending on administrative charges and document requirements. Some consulates offer group oath-taking schedules, which can shorten waiting times.

Pro Tip for Property Buyers and Investors

Before you make any real estate transaction — whether buying land, signing a sale deed, or transferring a title — secure your Identification Certificate (IC) first. It serves as legal proof of your citizenship, which the Register of Deeds and real estate developers will require. Attempting to buy property before reacquisition could invalidate the transaction under Philippine law.

For returning investors or retirees, this small step ensures smooth title registration, tax compliance, and inheritance rights down the road.

Property Limitations for Former Filipinos

Even with the right to own land reinstated, reacquiring Philippine citizenship doesn’t mean unlimited ownership. The law draws clear boundaries to preserve land for Filipino nationals while giving returning citizens fair access to real estate opportunities. Understanding these limits can save you from costly legal issues and missteps during property acquisition.

1. Residential Land Ownership: Urban and Rural Limits

Former Filipinos who have reacquired citizenship under Republic Act No. 9225 may own residential property within defined caps:

Urban Areas

Up to 1,000 square meters of residential land.

Rural Areas

Up to one (1) hectare of land.

These limits are per individual, meaning you and your spouse (if both are eligible Filipinos) can each own separate parcels up to these maximums. For those planning to build a vacation home, retirement residence, or ancestral house, these allocations are often more than sufficient.

2. Commercial Land: Ownership Through a Filipino Corporation

While former Filipinos can invest in commercial ventures, direct ownership of commercial land remains restricted. The Philippine Constitution reserves such ownership to entities that are at least 60% Filipino-owned.

- You may, however, form or invest in a corporation that meets this Filipino ownership threshold.

- As a dual citizen, you can participate as a shareholder or business owner within this corporate framework, allowing you to engage in commercial real estate legally and strategically.

This pathway is common among balikbayans who want to establish businesses such as resorts, restaurants, or rental developments.

3. Agricultural Land: Still Protected Under the Constitution

Agricultural land is a sensitive category in Philippine property law. Even as a dual citizen, constitutional restrictions apply—land devoted to farming remains limited to Filipino citizens and cannot exceed the caps set by law.

- The Comprehensive Agrarian Reform Law and Article XII, Section 3 of the Constitution safeguard agricultural lands for Filipino farmers and prevent speculative acquisition.

- If your investment interest leans toward agritourism or farm estates, ensure the land classification aligns with your intended use and that ownership complies with current regulations.

4. Condominium Ownership: Up to 40% in Foreign-Owned Developments

For many former Filipinos, condominium units are the most convenient and flexible option. You can fully own a condo unit, provided that foreign ownership in the entire project does not exceed 40%.

- This makes condos particularly attractive for balikbayans who want low-maintenance, urban living in prime areas like BGC, Makati, or Cebu IT Park.

- Condo ownership also simplifies property management when residing abroad, as developers often provide leasing and maintenance services.

Property Ownership Limits for Former Filipinos

| Property Type | Allowable Size/Share | Ownership Condition | Legal Basis |

|---|---|---|---|

| Residential (Urban) | Up to 1,000 sqm | Individual ownership allowed | BP 185 |

| Residential (Rural) | Up to 1 hectare | Individual ownership allowed | BP 185 |

| Commercial Land | None (directly) | Only via 60% Filipino-owned corporation | Philippine Constitution, Art. XII |

| Agricultural Land | Restricted | Must comply with constitutional limits | Art. XII, Sec. 3 |

| Condominium | Up to 40% in project | Allowed if 60% Filipino-owned | Condominium Act (RA 4726) |

These boundaries ensure that returning Filipinos enjoy property rights comparable to natural-born citizens—balanced with national safeguards on land ownership. Before finalizing any transaction, always verify zoning classifications, title status, and your citizenship documentation to ensure compliance with Philippine property laws.

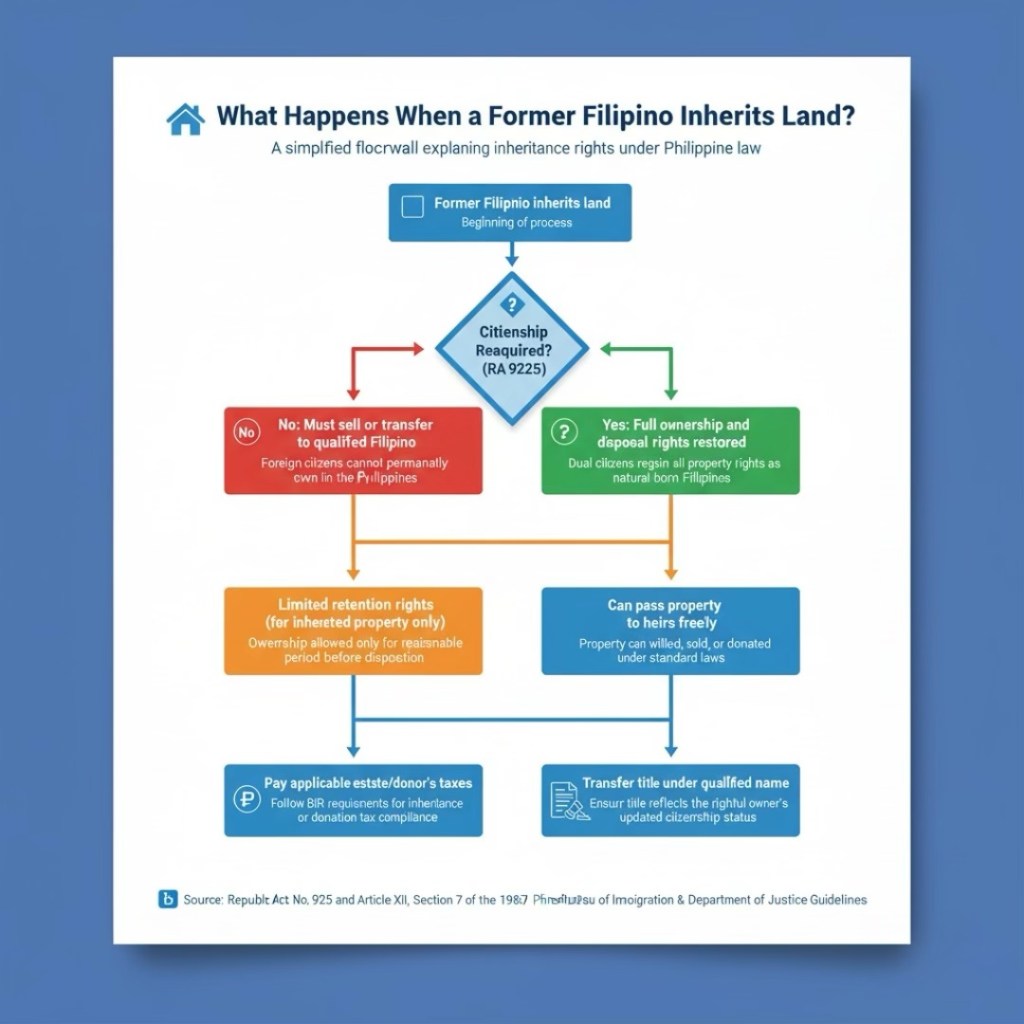

Inheritance vs. Purchase Rights

Many former Filipinos assume they lose all property rights once they give up their citizenship. That’s not entirely true—but it’s also not as simple as it sounds. Inheritance is treated differently from property purchase under Philippine law, and knowing the distinction can prevent serious legal complications for you or your heirs later on.

1. Inheritance Rights Even Without Reacquiring Citizenship

Even if you’ve become a foreign citizen, you can still inherit land in the Philippines through hereditary succession, whether by will or by operation of law.

- The 1987 Constitution protects the right of a Filipino’s legal heirs—regardless of nationality—to receive property as inheritance.

- However, this applies only when the property is inherited, not purchased.

- This means a former Filipino can inherit land from Filipino relatives even without reacquiring citizenship.

In short: You can inherit, but you can’t buy unless you regain your Filipino citizenship.

2. Limitations on Disposition for Foreign Citizens

While a foreign citizen may inherit land, they cannot retain indefinite ownership. The law allows inheritance but restricts continued possession of real estate by non-Filipinos.

- A foreign heir must sell or transfer the inherited property to a qualified Filipino within a “reasonable period.”

- Retaining ownership long-term may lead to complications with land registration and potential government forfeiture.

- This rule exists to preserve national control over land while respecting family succession rights.

If you plan to pass property to your children abroad, it’s crucial to understand whether they hold Filipino citizenship—or whether you should reacquire yours before succession to simplify estate distribution.

3. How Dual Citizenship Restores Full Inheritance Rights

Reacquiring citizenship under Republic Act No. 9225 (RA 9225) eliminates these gray areas completely. Once you’ve taken the Oath of Allegiance and obtained your Identification Certificate (IC), you’re again recognized as a Filipino citizen under the law.

- You regain the right to both inherit and purchase land without restriction.

- You can retain ownership indefinitely, pass it to your heirs, and even purchase new properties as any natural-born Filipino would.

- This restored legal status gives peace of mind to balikbayans planning to build family estates, retire in the Philippines, or secure generational assets.

Dual citizenship bridges that emotional and legal gap—allowing you to reclaim not only your heritage but also your rightful property rights.

4. Tax Implications for Estate and Property Transfer

Inheritance comes with financial obligations. Understanding these early prevents delays and penalties when transferring titles.

- Estate Tax: Payable before property transfer, currently at 6% of the net estate value, based on Republic Act No. 10963 (TRAIN Law).

- Donor’s Tax: If property is transferred as a gift, a 6% donor’s tax applies.

- Capital Gains Tax (CGT): When the property is sold by the estate or heirs, a 6% CGT on the sale price or fair market value applies.

- Documentary Stamp Tax and Transfer Fees also apply during registration with the Registry of Deeds.

While reacquiring citizenship doesn’t exempt you from taxes, it simplifies estate settlement and ensures your name can be registered as a qualified owner without additional legal hurdles.

How to Invest in Real Estate as a Balikbayan

For many balikbayans, buying property in the Philippines is more than a financial decision—it’s an emotional homecoming. It’s the chance to turn years of hard work abroad into something tangible: a home that anchors your family, your memories, and your future. But smart investing requires more than sentiment—it demands strategy, legal clarity, and a keen sense of where opportunities are growing.

1. Choose the Right Investment Type: Condo, Townhouse, or House-and-Lot

Balikbayans enjoy a range of property options, each catering to different goals and lifestyles:

Condominiums

Ideal for those who value convenience, security, and location. Dual citizens can fully own condo units as long as Filipino ownership in the development remains above 60%. Perfect for rental income or city living in places like BGC, Ortigas, and Makati.

Townhouses

Offer the comfort of a home with the security of a gated community. Many developments in Quezon City, Parañaque, and Cebu provide flexible financing and modern amenities attractive to returning families.

House-and-Lot Units

Ideal for long-term living or retirement. Dual citizens can own land freely, making this option popular in scenic areas like Tagaytay, Batangas, and Davao.

2. Use Remittances or Local Bank Accounts for Payment

Many balikbayans fund their property purchases through remittances or Philippine-based bank accounts. Developers and banks often accommodate overseas clients with flexible arrangements:

- Set up a joint account with a trusted relative in the Philippines to streamline payments.

- Use bank-to-developer remittance channels for secure transactions.

- Keep all proof of remittance and receipts for documentation—these may be required during title transfer or tax clearance.

Tip: Check the Bangko Sentral ng Pilipinas (BSP)-accredited remittance partners to ensure your funds are processed legally and efficiently.

3. Explore Financing Options for Dual Citizens

Reacquiring your Philippine citizenship opens access to local housing loans, often at lower interest rates than foreign banks.

Local Banks

BDO, BPI, Metrobank, and Security Bank offer housing loans tailored for OFWs and dual citizens, with tenors of up to 20 years.

Pag-IBIG Fund

If you’ve maintained contributions, you can avail of affordable housing loans with minimal requirements.

Foreign Banks and Credit Unions

Some overseas lenders also provide real estate financing for Philippine properties, but may require higher equity and legal verification.

Before committing, compare loan rates, foreign exchange risks, and prepayment penalties. A local mortgage consultant or real estate broker can help you find the most favorable terms.

4. Conduct Due Diligence and Seek Legal Assistance

Buying property remotely has become easier—but it still demands caution. Protect your investment by verifying every document and transaction step.

- Confirm title authenticity through the Registry of Deeds and ensure it’s free from liens or encumbrances.

- Validate the developer’s track record and license to sell (via HLURB or DHSUD).

- Execute a Special Power of Attorney (SPA) if someone will represent you during the purchase.

- Engage a Philippine-based lawyer or licensed broker familiar with transactions involving dual citizens and balikbayans.

The cost of due diligence is minimal compared to the losses from a fraudulent or invalid sale.

5. Discover Prime Property Locations for Balikbayans

Dual citizens and balikbayans often prefer areas that balance lifestyle appeal with strong investment potential:

- Tagaytay: Perfect for vacation homes and retirement properties, offering cool weather and steady rental demand.

- Metro Manila (BGC, Makati, Ortigas): High-value urban condos ideal for rental income or business proximity.

- Cebu City: A top destination for condo investments with strong BPO and tourism growth.

- Davao City: Known for safety, modern infrastructure, and emerging mixed-use communities.

- Batangas and Laguna: Great for suburban living or long-term family homes near industrial and business hubs.

Each region offers distinct market dynamics, so choose based on your investment goal—capital appreciation, rental yield, or personal use.

Common Pitfalls and Legal Red Flags Every Balikbayan Should Avoid

Reconnecting with your homeland through real estate is a powerful decision—but it’s also one of the most legally sensitive. Many balikbayans and dual citizens fall prey to costly mistakes because of misplaced trust, outdated assumptions, or incomplete paperwork. Understanding these common pitfalls can save you from financial loss, emotional stress, and years of legal battles.

1. Buying Land While Still a Foreign Citizen

This is one of the most serious and common missteps. Foreigners are constitutionally prohibited from owning land in the Philippines, except through hereditary succession or corporate ownership structures (with at least 60% Filipino ownership).

If you purchase land before reacquiring your Philippine citizenship, the transaction can be declared void and without legal effect, meaning you lose ownership even if full payment was made. Always complete your citizenship reacquisition under RA 9225 before signing any Deed of Sale or ownership transfer documents.

Pro Tip: Never “reserve” land under your foreign name with the intention of transferring it later—courts view this as circumvention of constitutional law.

2. Relying on Relatives to Hold Land “In Trust”

A widespread and risky practice among overseas Filipinos is buying land under a relative’s name—often with a verbal agreement that the property “really belongs” to the buyer. This trust arrangement is not legally enforceable in most cases, especially if there’s no written proof of beneficial ownership.

Even well-intentioned family members can change their minds, pass away, or face legal disputes that put your property at risk. In the eyes of the law, the person whose name appears on the title is the legal owner—regardless of who paid for it.

Expert Insight: If you must involve family, execute a proper legal trust deed or corporate structure reviewed by a real estate lawyer.

3. Unverified Titles or Fake TCTs (Transfer Certificates of Title)

Fake or tampered land titles remain one of the most common property scams in the Philippines. Sophisticated forgeries can look convincing—even with QR codes and seals. Always conduct a title verification through the Registry of Deeds or Land Registration Authority (LRA).

You can verify by:

- Requesting a Certified True Copy (CTC) from the Registry of Deeds.

- Checking the Lot and Plan numbers for consistency with tax declarations.

- Consulting a licensed real estate broker or lawyer for due diligence.

Tip: Avoid deals where the seller “can’t produce the title right now” or claims it’s “with the bank.” Legitimate sellers can always provide verifiable documents.

4. Scams Targeting Overseas Buyers

Fraudsters know balikbayans often transact remotely and rely on online listings or relatives. Common scams include:

- Fake listings using stolen photos or non-existent properties.

- Bogus brokers or agents with no PRC license.

- Double selling, where a property is sold to multiple buyers simultaneously.

- Advance fee scams, where the scammer disappears after receiving a “reservation” payment.

Always verify a seller’s legitimacy through the Professional Regulation Commission (PRC) or DHSUD, and never send money without a notarized document or formal contract.

Smart Practice: Work only with licensed real estate brokers and verified developers—ask for their PRC ID and accreditation number.

Best Practices and Expert Tips for Dual Citizens and Balikbayans

Owning property in the Philippines as a dual citizen or former Filipino can be deeply rewarding—but only if you approach it with discipline, documentation, and due diligence. The difference between a smooth transaction and a nightmare often comes down to simple, consistent best practices that professionals live by.

1. Work Only with Licensed Brokers and Accredited Developers

Your first line of defense against fraud is choosing the right people to work with. Always verify the credentials of your real estate broker and developer:

- Brokers must be licensed by the Professional Regulation Commission (PRC) and display their PRC license number on all marketing materials.

- Developers should be accredited by the Department of Human Settlements and Urban Development (DHSUD) and hold a valid License to Sell (LTS) for every project.

You can confirm these details through the PRC or DHSUD websites. Partnering with legitimate professionals not only protects your money—it ensures the property complies with zoning laws, building codes, and ownership restrictions under Philippine law.

Pro Tip: Ask for the broker’s LTS number and project accreditation letter before making any payment or signing a reservation agreement.

2. Verify Titles with the Registry of Deeds

Never rely solely on photocopies or scanned documents. Before paying any amount, verify the Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT) directly from the Registry of Deeds.

- Request a Certified True Copy (CTC) to confirm authenticity and check for encumbrances or liens.

- Cross-check details with tax declarations and lot plans from the city or municipal assessor’s office.

- Avoid properties that have discrepancies between the title and actual use, such as agricultural land advertised as residential.

A ten-minute verification can save you years of litigation.

3. Consult a Real Estate Lawyer Before Signing Any Contract

Even legitimate transactions can hide complex legal nuances—especially when involving dual citizenship, estate inheritance, or corporate ownership structures. Before signing a Deed of Sale, Contract to Sell, or Special Power of Attorney (SPA), have it reviewed by a licensed real estate attorney.

A lawyer ensures that:

- Ownership transfers comply with the Philippine Constitution and Civil Code.

- Taxes (capital gains, documentary stamp, and transfer tax) are computed properly.

- You’re not unknowingly waiving rights or accepting risky clauses.

Expert Insight: The minimal legal fee for review is nothing compared to the potential cost of an invalid or contested sale.

4. Keep Your Dual-Citizenship Documents Updated

Your Oath of Allegiance, Identification Certificate (IC), and Philippine passport are your legal keys to property ownership in the Philippines. Make sure these documents remain valid and up to date—especially when entering into any legal transaction.

If your citizenship status lapses or becomes unclear, your ownership rights may be questioned during registration or inheritance proceedings. Always notify your broker, lawyer, and notary of your dual-citizen status and present original copies when required.

Practical Tip: Store digital backups of all citizenship and property documents in encrypted cloud storage for easy access while abroad.

5. Consider Estate Planning Early—Especially If You Have Heirs Abroad

Passing property to the next generation can get complicated if your heirs reside overseas or hold foreign citizenship. To avoid future disputes or tax burdens:

- Create a last will and testament that’s valid under both Philippine and foreign jurisdictions.

- Work with a lawyer experienced in cross-border estate planning.

- Consider establishing a family corporation or trust to streamline succession and minimize taxes.

Estate planning isn’t just about assets—it’s about preserving family harmony and ensuring your property legacy remains intact.

Smart Investor Tip: Philippine estate taxes can reach up to 6% of net estate value, so proactive planning significantly reduces your heirs’ financial burden.

Real Stories from Balikbayans Who Came Home to Invest

Behind every property title lies a story of return, belonging, and perseverance. For many dual citizens and former Filipinos, buying property in the Philippines isn’t just a financial decision—it’s an act of coming home. These real-life stories show how reacquiring citizenship under Republic Act No. 9225 (RA 9225) opened the door for balikbayans to rebuild their roots and invest in their future.

Maria’s Story: From Canadian Nurse to Cavite Homeowner

After two decades in Toronto, Maria Dela Cruz, a registered nurse, dreamed of spending her retirement somewhere warm, peaceful, and familiar. She had been sending money back home for years but never dared buy land—until she discovered she could reacquire her Philippine citizenship under RA 9225.

With guidance from the Philippine Consulate in Toronto, she took her Oath of Allegiance, received her Identification Certificate, and was soon recognized as a dual citizen. Within six months, Maria bought a 240-square-meter house and lot in Cavite, near Tagaytay’s cool ridges.

“It felt surreal,” Maria shared. “I wasn’t just investing in property—I was reclaiming a part of who I am.”

Today, she splits her time between Canada and the Philippines, managing her property through a trusted local broker while preparing for full retirement back home.

David and Liza’s Story: A Balikbayan Couple’s Condo in BGC

When David and Liza, both IT professionals working in Singapore, decided to diversify their savings, they looked toward real estate in the Philippines. The couple wanted a condo unit in Bonifacio Global City (BGC)—a neighborhood that matched their lifestyle: urban, vibrant, and future-ready.

At first, they were unsure if they were allowed to buy, since both had become Singaporean citizens. After consulting with a real estate lawyer, they learned that reacquiring Philippine citizenship under RA 9225 would fully restore their rights to own real property.

They completed the process through the Philippine Embassy in Singapore and purchased a 38-square-meter studio unit in a pre-selling BGC development under their Filipino names. Financing was made easier through a local bank loan, available only to citizens and dual nationals.

“We wanted a home that represented progress,” Liza said. “BGC was a symbol of what the Philippines has become—and what we wanted to come back to.”

Their investment has appreciated significantly since purchase, and they plan to lease it out until they return for good.

Lessons from Their Journeys

These stories highlight key insights every balikbayan should remember:

- Reacquiring citizenship unlocks full ownership rights—without it, your investment options remain limited.

- Professional guidance matters. Both Maria and the couple worked with licensed brokers and legal experts, ensuring their transactions were legitimate.

- Lifestyle alignment is crucial. They didn’t just buy property; they chose locations that fit their long-term goals and emotional connection to home.

For every balikbayan, property ownership is more than paperwork—it’s the fulfillment of a promise to return.

Their investment has appreciated significantly since purchase, and they plan to lease it out until they return for good.

Key Takeaways

- Former Filipinos can own land again — but only after formally reacquiring Philippine citizenship under Republic Act No. 9225 (the Dual Citizenship Law). Until then, ownership rights are limited.

- Property ownership limits apply:

- Residential land: up to 1,000 sqm in urban areas or 1 hectare in rural areas.

- Commercial land: only through a corporation that’s at least 60% Filipino-owned.

- Condominium units: foreigners may own up to 40% of a condo project’s total units.

- Reacquiring citizenship unlocks full rights, including the ability to buy, inherit, or sell real estate freely—just like any natural-born Filipino.

- Inherited land remains valid ownership, even without reacquisition, but a foreigner cannot keep it indefinitely. It must be sold or transferred to qualified heirs unless citizenship is restored.

- Key documents to secure: Oath of Allegiance, Identification Certificate, and a valid Philippine passport or dual citizenship ID. These are required before executing property purchases or transfers.

- Avoid legal pitfalls: Never buy land while still a foreign citizen, rely on verbal arrangements with relatives, or skip title verification. Scammers frequently target overseas Filipinos.

- Partner with professionals: Work only with licensed real estate brokers, accredited developers, and property lawyers to ensure clean transactions and secure ownership.

- Plan ahead for your legacy: Dual citizens can pass properties seamlessly to heirs, but early estate planning avoids complications for beneficiaries abroad.

Thinking of investing in property as a dual citizen—or planning your return home with a smart real estate move? Don’t leave your dreams on paper. Whether you’re eyeing a retirement haven in Tagaytay, a condo in BGC, or a vacation home in Cebu, we can help you make it happen—securely, legally, and profitably.

✨ Let’s talk about your plans. Message us today to schedule a consultation or book a personalized property tour with a licensed real estate professional who understands both your goals and the process for dual citizens.

📩 Start your investment journey with confidence—your future home in the Philippines is closer than you think.

Leave a comment