This Week’s Key Moves

(Nov 9–16, 2025)

Leasing took command of the market — calm, decisive, and the only reliable grown-up in a quarter ruled by high rates and selective buyers. It kept developer earnings stable while presales absorbed the pressure of expensive mortgages. Malls held steady, hospitality stayed lively, and the office sector split into two different universes. Meanwhile, BSP’s unflinching rate stance tightened affordability, and VisMin players outperformed with quiet consistency. The story beneath the week is simple: cashflow protects; location dominates.

Here’s the real action — the signals that matter more than the noise:

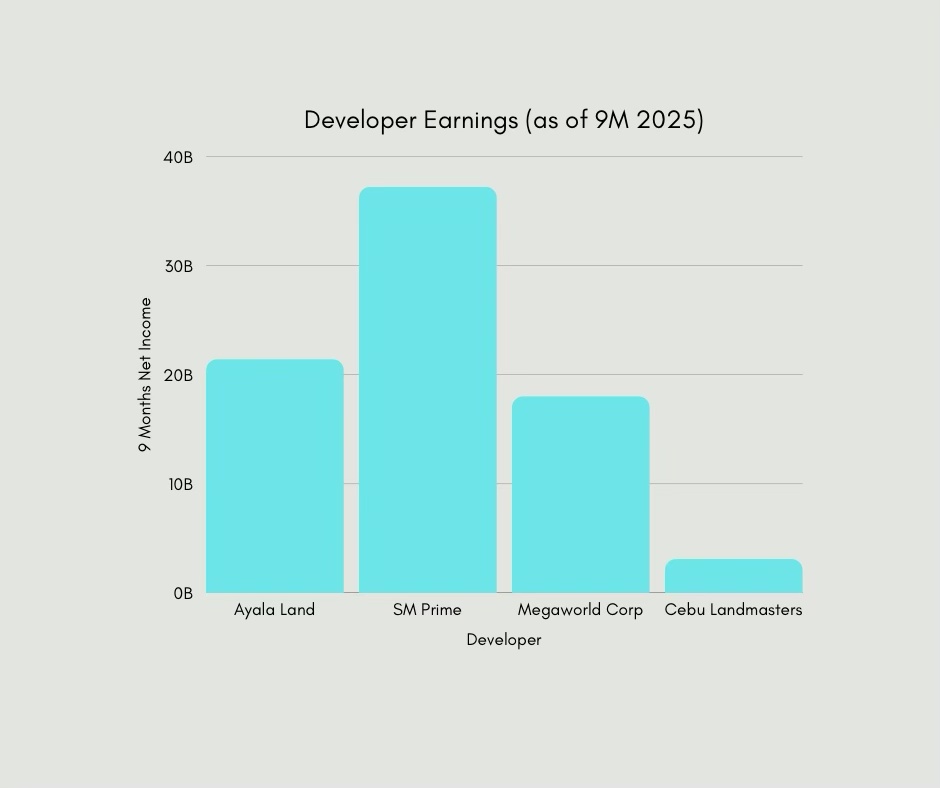

Ayala Land’s ₱21.4B nine-month net income

A clean demonstration of how decisive leasing is in this cycle. Residential momentum cooled under elevated mortgage rates, but malls, offices, and estates did the heavy lifting. ALI didn’t survive the quarter — it stabilized it.

SM Prime’s ₱37.2B earnings and a share buyback

Posting strong earnings is one thing. Buying back your own shares is another. SMPH essentially bet on its mall ecosystem with a confidence the market rarely questions. Reliable foot traffic, tight occupancy, and sticky tenants are doing exactly what they’re supposed to do: generate cashflows you can build a strategy on. Investors took note.

Metro Manila office vacancy sits near ~20%, but the story underneath is split

In reality, township-based Grade A offices in BGC, Vertis North, Arca South, and Filinvest track much tighter occupancy levels — many in the mid-80% to low-90% range — while older Makati and Ortigas towers pull the average downward.

BSP’s current rate environment continues to hammer affordability

Mortgage costs remain elevated. Developer borrowing costs remain elevated. And buyer decision-making remains, predictably, cautious. Presales aren’t collapsing — they’re flattening — but the burden of high rates is being felt across the board.

Growth downgrade expectations re-enter the conversation

Not enough to alarm the market, but enough to nudge developers into more conservative launch calendars going into 2026. When macro signals get foggier, capital gets more disciplined.

Cashflow assets are the winners.

Leverage-heavy plays are walking on a narrower ledge.

Everything else is commentary.

Disclaimer: Data and insights presented are for informational purposes only. Readers should verify details and consult professionals before making real estate or financial decisions.

Leasing Strength Reshapes Developer Strategy

(ALI, SMPH, REITs, Retail — The market’s stabilizer takes the lead)

Leasing didn’t just outperform this week. It dominated with quiet authority. In a cycle shaped by high rates and slower presales, the most stable income streams are doing the heavy lifting — and developers are adjusting their playbooks accordingly.

Ayala Land: steady income as the ballast

ALI’s results made one thing clear: recurring income from malls, hotels, offices, and estates is now the stabilizer keeping earnings predictable. Residential may be cooling, but leasing is compensating — and doing it with consistency. With hospitality recovering and mall spending staying resilient, this portfolio becomes the anchor for ALI’s short-term strategy.

SM Prime: confidence backed by cashflow

A developer with the country’s largest mall footprint doesn’t execute a share buyback unless its rent-driven engine is firing at full strength. SMPH didn’t hide its confidence; it put capital behind it. That’s how you know leasing isn’t just “supporting” earnings — it’s shaping the storyline.

MREIT and other major REIT platforms posted improvement across their portfolios, especially in township-located assets where tenant stickiness is a built-in advantage. These micro-hubs thrive because they combine offices, residential towers, malls, and lifestyle components into one seamless ecosystem — the kind tenants rarely walk away from.

Retail holds the line — and then some

Even with softer consumption sentiment, mall occupancy remained stable across well-managed portfolios. Developers invested years into perfecting tenant mix, optimizing circulation, and enhancing foot traffic — and this week’s data shows just how well that strategy holds up in a high-rate environment. Retail isn’t just surviving. It’s outperforming expectations.

Why this shift is decisive

- Leasing stabilizes liquidity when buyers hesitate and mortgage rates bite.

- Diversified recurring income outperforms presale-dependent models, especially during macro uncertainty.

- Investor capital follows stability, and leasing income is the closest thing to certainty this quarter.

This isn’t temporary — it’s structural repositioning.

Strategic Implications

For Sellers

Rent-ready and tenanted units command stronger pricing power. Cashflow wins deals.

For Buyers

Prioritize township-adjacent units with real-life demand drivers — retail anchors, transport access, and corporate offices.

For Developers

Dial back aggressive condo pipelines and reallocate toward estate improvements, leasing assets, and long-horizon plays. A well-balanced portfolio is no longer optional.

For Investors

Follow the stability: REITs, mall-adjacent units, township office assets, and hospitality-driven locations.

A cycle led by leasing is a cycle led by discipline — and discipline is proving extremely profitable.

The Office Market Splits: Grade A vs. Legacy Corridors

One category on paper. Two completely different realities in practice.

Look only at YTD vacancy, and you’ll see ~20% Metro Manila office vacancy — a number that suggests broad weakness. Look beneath the surface, and you’ll find a market splitting cleanly into two contrasting profiles with different risks, different prospects, and different strategies.

Legacy corridors under strain

Aging Makati towers, older Ortigas buildings, and under-amenitized office stock continue to face tepid inquiries. Hybrid work patterns softened demand while BPO expansions grew selective. Landlords here negotiate from a defensive posture — they know tenants have alternatives, and those alternatives look better on every metric.

Township-based Grade A properties quietly absorbing

Meanwhile, integrated estates such as BGC, Uptown, McKinley, Vertis North, Filinvest Alabang, Arca South, and Cebu IT Park are playing a completely different game. Slight quarter-on-quarter improvements in occupancy — even in this macro climate — reveal how powerful integrated ecosystems are. Tenants choose these nodes because they solve multiple problems at once: accessibility, amenities, safety, talent attraction, lifestyle convenience.

This is the kind of advantage you can’t engineer in a standalone building.

Why the split matters

- Capital values will diverge depending on micro-market strength.

- Banks will stress-test older towers harder as refinancing cycles approach.

- Tenants will continue paying premiums for locations that boost retention and productivity.

The gap between winners and losers is widening — not narrowing.

Tactical Playbook

For Landlords

Reconfigure, retrofit, or repurpose weak-stock assets. Flex spaces, hybrid-ready layouts, micro-warehousing, cloud kitchens — choose revenue, not nostalgia.

For Tenants

If you’re in legacy corridors, negotiate like you mean it:

- free rent (1–2 months minimum)

- fit-out support

- step-up rent structures

- shorter lock-ins

You have leverage — use it.

For Developers

Slow down non-township office rollouts.

Strengthen estate infrastructure, improve mobility flows, and invest in public-space upgrades.

For Investors

Analyze submarkets, not cities.

“Office” is no longer a single thesis — it’s a portfolio of micro-climates with wildly different risk profiles.

The headline says “vacancy.”

The real story is polarization — and that story will shape valuations for years.

Macro Pressure: Rates, Growth Downgrades & Buyer Demand

BSP’s latest rate posture kept mortgage pricing pinned at elevated levels — firm enough to slow momentum but not dramatic enough to trigger panic. It created a market in limbo: buyers recalibrating budgets, developers recalculating feasibility, and banks holding a tighter line on underwriting. Layer in renewed growth downgrade signals, and you get a market that’s cautious, deliberate, and unwilling to stretch for anything priced without conviction. Developers felt the shift immediately — in inquiry volumes, in reservation conversions, and in financing conversations that suddenly require more documentation and tougher math.

Even without a shock, macro pressure moves through real estate like a slow, heavy tide.

How Macro Pressure Travels Through the Market

1. Higher mortgage spreads → lower affordability → slower presales

Buyers are more selective. Monthly amortization becomes the anchor they refuse to break, no matter how tempting the introductory promo. In a high-rate cycle, emotion loses to mathematics.

2. Slower presales → weaker near-term cash conversion → cautious launch calendars

Developers don’t like uncertainty — it distorts planning cycles. When presales soften, project launches become more measured, more phased, and more targeted. Launch cadences slow down not because developers can’t build, but because they won’t risk inventory sitting too long.

3. Higher developer borrowing costs → tighter liquidity → heavier reliance on leasing

This is where the shift becomes structural. Expensive capital means developers lean harder on predictable income streams from malls, offices, estates, and hospitality. Leasing becomes the safety net. The market’s center of gravity quietly moves away from aggressive pre-selling and toward operating assets that buffer cashflows.

What This Creates

A market where sentiment is cautious but very much alive.

Buyers haven’t disappeared; they’ve simply become disciplined. They will not overextend under tight rate conditions, and they will gravitate to high-certainty locations, strong developers, and units with clear end-use or rental logic.

Developers, meanwhile, are shifting out of “growth mode” and into “resilience mode.”

Fewer speculative launches. More estate enhancement. More leasing reinforcement. More attention to cashflow timelines. The winners in this climate are the players who prepared early, not those who hope rates suddenly cooperate.

Signals Worth Watching

These upcoming signals will tell you exactly where pricing and supply are headed:

1. December mortgage repricing windows

If banks adjust spreads upward, affordability tightens further. If they hold steady or soften, presale momentum may get a soft lift.

2. Q4–Q1 launch cadence adjustments

Watch the big developers. If Ayala Land, SM Prime, DMCI, or Federal Land trim launch plans, the rest of the market will follow.

3. Developer promos and payment structures

More stretched-downpayment terms, deferred schemes, or subsidized bank rates indicate presale pressure under the surface.

4. Regional demand patterns in Cebu, Mandaue, Davao

These are the pressure points that will define the first quarter of 2026.

The Big Shift: Pricing Power Moves Toward the Well-Capitalized

This phase of the cycle quietly redistributes leverage.

Developers with strong balance sheets and robust leasing income can wait out the tightening.

Buyers with cash (or strong financing positions) gain negotiating power.

Investors with dry powder can find opportunities others can’t touch.

This is where discipline pays, and where overleveraged plays get exposed. The power doesn’t shift loudly — but it shifts permanently.

Secondary Signals to Watch

These signals aren’t swinging the market yet, but they’re the subtle tremors you monitor when you want to stay three steps ahead. Each one carries the potential to grow from background noise into a genuine market mover — the kind that shifts pricing, strategy, and sentiment when no one’s paying attention.

REIT performance shows steady improvement

Occupancy gains across multiple REIT platforms are boosting confidence among yield-focused investors. As more portfolios firm up, you’ll see greater interest in dividend-driven plays, especially from buyers who want income while waiting out high interest rates. This strengthens the narrative that operating income assets are the safest place to park capital right now.

Cebu Landmasters continues to outperform in key VisMin corridors

CLI’s resilience across Cebu, Mandaue, and Davao reinforces one consistent message: regional demand isn’t just holding — it’s leading. Absorption in mid-income and horizontal projects is outpacing several NCR submarkets, hinting at a geographic rebalancing of growth that bigger developers cannot ignore.

Retail remains surprisingly stable in major malls

Despite consumer fatigue and tightened household budgets, mall occupancy stayed strong in well-managed portfolios. The tenant mix is doing the heavy lifting — essentials, F&B, services, and curated lifestyle brands continue to pull steady foot traffic. Retail strength is more than a feel-good story; it’s a core stabilizer for the developers who depend on it.

Infrastructure probe continues to unfold

The flood-control corruption investigation hasn’t hit project timelines for major developers, but it’s a governance concern worth tracking. If the probe widens — especially into broader construction networks — it could tighten regulatory processes, delay approvals, or affect contractor credibility. Not urgent yet, but not ignorable either.

Secondary today; potentially pivotal tomorrow.

The signals may be subtle, but smart players treat them as early indicators — the first whispers of where the next wave of capital, demand, and developer focus will flow.

Quick Wins by Segment

Every segment has a move to make this month — small shifts that deliver outsized results in a high-rate, leasing-led cycle. These are the tactical plays that work right now.

Homebuyers

Treat your budget like a precision instrument. Build a rate buffer into every affordability calculation, then use that discipline as leverage. Developers are far more flexible behind the scenes than their brochures suggest — push for closing incentives, extended payment terms, or minor upgrades that lift livability without lifting your cost. In a tight financing climate, knowledge is your bargaining power.

OFWs

Get financing pre-approval early; it’s the difference between securing a good unit and watching it disappear. Prioritize developers with strong leasing ecosystems and township footprints — they protect your long-distance investment and offer built-in rentability if you plan to lease the unit out. Stability first, appreciation second.

Investors

Rotate capital toward stabilized, cashflow-ready assets. Rent-ready units, REIT-aligned properties, and township condos with proven occupancy outperform speculative presales every time in a high-rate cycle. Trim exposure to units dependent on future appreciation or aggressive resale assumptions. Cashflow is king; timing is the throne.

Developers

Pull back on high-volume condo launches and shift toward measured, phased releases. Strengthen leasing assets, upgrade estate amenities, and enhance tenant experience — they’re the lifeline when presales get sluggish. In this environment, the developers who win are the ones who optimize for resilience, not velocity.

Brokers

Lead with clarity. Buyers don’t freeze because the unit isn’t attractive — they freeze because the financing is confusing. Bring mortgage projections, rate comparisons, rentability angles, and micro-market insights to the conversation. You’re no longer just a messenger; you’re the decision-making engine your clients depend on.

Commercial Landlords

Segment your portfolio ruthlessly. High-performing township offices deserve long-term renewals locked in now, before expansion cycles return. Weak-stock assets in legacy CBDs need aggressive repositioning: flexible leases, hybrid layouts, or amenity upgrades. Retain the strong, reinvent the vulnerable.

Commercial Tenants

If you’re in a legacy corridor, negotiate like you’re holding the winning card — because you are. Free rent, fit-out support, step-up rents, shorter lock-ins: these are all on the table. If you’re aiming for a township location, secure it early. The best spaces in integrated estates do not stay vacant for long. Cost savings now, competitive advantage later.

30-Day Strategy Checklist

The next 30 days won’t reward guesswork. They will reward precision, discipline, and timing. The signals are clear, the risks are defined, and the opportunities favor players who know how to move with intention — not speed.

Base Case (55%) — The Probable Path

Leasing stays solid, presales remain flat, and the high-rate environment holds its grip. Demand doesn’t vanish, but it stays selective and price-sensitive. Developers keep launches measured. Buyers maintain caution. Investors focus on stability and income.

What this means:

Expect steady activity in township markets, steady rents, and cautious developer sentiment. Stability, not acceleration.

Downside Case (30%) — The Pressure Scenario

Growth downgrade concerns intensify, consumer confidence weakens, and developers respond with deeper discounts, extended payment terms, and slower launch calendars.

What this means:

You’ll see more aggressive presale incentives, softened pricing in overbuilt micro-markets, and tighter bank underwriting. Cashflow-heavy players outperform; leverage-heavy ones feel the squeeze.

Upside Case (15%) — The Relief Scenario

Rate softening or stronger liquidity signals arrive earlier than expected, giving buyers more breathing room. Demand stabilizes in select NCR submarkets, and premium township units see renewed traction.

What this means:

Not a boom — a selective rebound, especially in vertical communities with strong leasing ecosystems and walkable amenities.

Priority Actions (Do These Now)

1. Recalculate affordability with a 150–250 bps buffer

Protect your budget from unexpected rate swings. Buyers and brokers should anchor every conversation to real, updated amortization numbers — not outdated assumptions.

2. Developers: finalize promo structures for December & Q1 2026

Flexible downpayment schemes, stretched payment timelines, and selective bank-rate partnerships will drive conversions in a tight market. Prepare them now before competition floods the field.

3. Investors: screen REITs by occupancy resilience and covenants, not headline yields

Yields can mislead; occupancy and debt health do not. Prioritize REITs with strong tenants, integrated-estate exposure, and disciplined leverage.

4. Brokers: prepare mortgage cheat-sheets for every listing

Financing clarity is the difference between hesitation and conversion. Bring ready-made comparisons: bank spreads, Pag-IBIG options, fixed vs. variable scenarios. Make the math easy.

5. Landlords: secure early renewals to stabilize 2026 NOI

Lock in strong tenants now — before market uncertainty heightens. Offer realistic incentives where needed, especially in corridors facing oversupply.

The Bottom Line

This month rewards precision — not speed.

Leverage the signals, watch the rate environment closely, and make moves that protect cashflow, not speculation.

Disclaimer: This weekly market brief is based on publicly available data, reputable news sources, and industry reports as of the publication date. While every effort has been made to ensure accuracy, the analysis and insights presented are for informational purposes only and should not be construed as financial, investment, or legal advice. Market conditions may change without notice. Readers are encouraged to conduct their own due diligence or consult qualified professionals before making property or financial decisions.

Not sure how these trends affect your next move?

Send me your budget and preferred location, and I’ll build a 7-Point Real Estate Scenario that shows your risks, opportunities, and best timing.

Leave a comment