Table of Contents

- Overview of RA 4726

- Key Definitions You Must Understand

- How Condominium Ownership Works

- Foreign Ownership Rules

- Buying and Selling Under RA 4726

- Condo Governance, Fees, and Obligations

- Repairs, Redevelopment, and End-of-Life Rules

- Taxes and Transaction Costs

- Due Diligence Checklist for Buyers & Investors

- ROI, Rental Yields, and Investment Considerations

- Financing and Mortgage Notes

- Common Buyer Pitfalls and Red Flags

- Case Studies: How RA 4726 Works in Real Life

- Policy Updates and Proposed Amendments

- FAQs

- Key Takeaways

- Schedule a Consultation / CTA

Confusion strikes fast when you start exploring the condominium market in the Philippines. Suddenly you’re juggling terms like CCTs, Master Deeds, common areas, foreign ownership caps, and condominium corporations—yet almost no one explains the law that quietly controls all of them. That law is Republic Act No. 4726, the Condominium Act, and it dictates everything from the boundaries of your unit to the long-term future of your building.

Here’s what most buyers don’t realize:

RA 4726 affects every peso you spend, every rule you follow, every repair you approve, and every right you gain—or lose—as a condo owner.

It defines what your title actually covers, how your building must be governed, who gets to buy into it, how disputes are resolved, and even when the entire property can be demolished or redeveloped.

Misunderstand this law, and you walk blind into obligations you never intended to accept.

Understand it, and you build a powerful advantage—one that protects your money, strengthens your negotiating position, and shields your investment long after turnover.

Buyers frequently underestimate its impact. According to DHSUD case data, a significant share of condominium disputes stem from issues already addressed by RA 4726—from boundary definitions to renovation violations to unpaid dues and misuse of common areas. The tragedy is that most owners only learn the law after a dispute erupts.

This guide fixes that.

You’re getting a clear, practical, and fully updated explanation of RA 4726—how it works, where it applies, where it protects you, and how it shapes your returns whether you’re a first-time buyer, seasoned investor, OFW, foreign national, or real estate professional.

No legal fog. No technical jargon. Just the real rules that govern Philippine condo ownership—and how to use them to your advantage.

RA 4726 Explained — What the Condominium Act Actually Covers

Why the Law Was Created

Condominiums didn’t exist in Philippine law before the 1960s. Urban density was rising, but the legal framework only recognized traditional land ownership—one owner, one parcel, one structure. There was no mechanism for hundreds of families to legally share ownership of a single building while holding individual rights to separate units.

That gap stalled vertical development.

Developers couldn’t sell units separately.

Cities couldn’t expand upward.

And buyers had no secure way to own a space inside a shared structure.

RA 4726 changed everything.

Enacted in 1966, it introduced three groundbreaking concepts:

- Individual ownership of a defined unit inside a multi-storey building

- Collective, undivided ownership of common areas among all unit owners

- Creation of a condominium corporation to manage the building and enforce standards

It was a modernization move—one that enabled Makati, BGC, Ortigas, Cebu IT Park, and many of today’s prime business districts to exist at all.

In short, RA 4726 made vertical homeownership legal, enforceable, and scalable—and it remains the backbone of every condominium project in the country today.

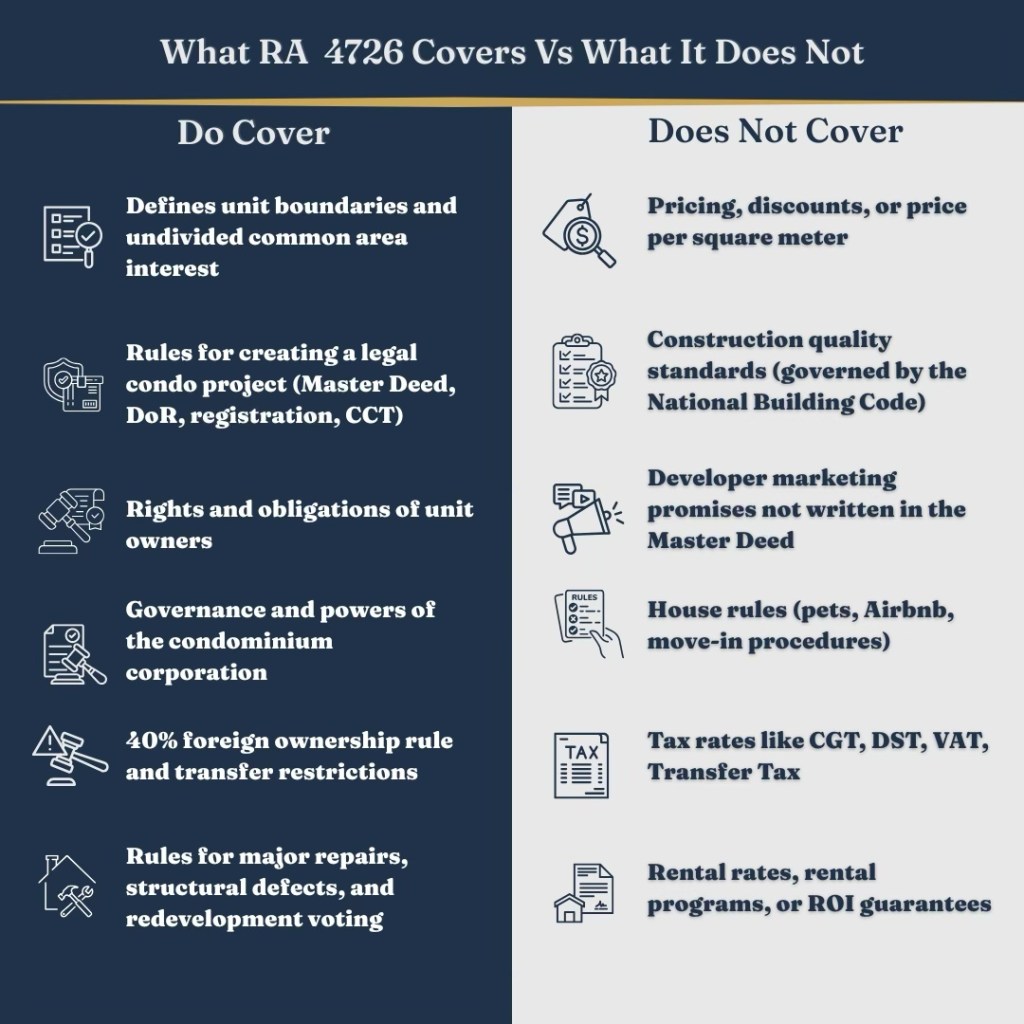

What RA 4726 Governs (In Simple Terms)

Despite its age, RA 4726 remains one of the most relevant real estate laws in the country because it tightly defines how condominium ownership works. In its simplest form, the law governs four major things:

1. What You Actually Own When You Buy a Condo

RA 4726 defines your ownership with precision:

You own:

- The inside surfaces of the unit

- Everything within those boundaries (fixtures, finishes, interiors)

- Your proportional, automatic share of the common areas

You do not own:

- Exterior walls

- Beams, columns, slabs, or the building’s structure

- Utility lines that serve more than one unit

- The land itself

Your “undivided interest” in the common areas is inseparable from your unit.

You can’t sell one without the other.

You can’t opt out of shared ownership or obligations.

2. How Condo Projects Are Created and Legally Registered

RA 4726 outlines the entire process:

Master Deed → Declaration of Restrictions → Registration → Annotation on Title → Issuance of CCTs

If any link in that chain is missing, the building is not legally a condominium project, no matter how impressive the showroom looks.

This is why serious buyers always ask for:

- The Master Deed

- The Declaration of Restrictions

- The License to Sell

- The project’s registration details

Because compliance = protection.

Non-compliance = long-term risk.

3. How Buildings Are Managed and Governed

Once units are sold and turned over, the condominium corporation takes over.

RA 4726 defines its powers clearly:

- Enforce rules

- Collect dues

- Maintain common areas

- Impose penalties

- File legal action

- Approve major repairs

- Vote on redevelopment

- Represent owners in negotiations

This corporation is not optional.

Membership is not optional.

Your voting power is tied to your unit’s percentage interest—not “one owner, one vote.”

The corporation’s governance quality often determines whether a condo ages gracefully… or collapses into disrepair.

4. Rights, Obligations, Transfers, and Ownership Limits

RA 4726 dictates:

- How ownership transfers

- What restrictions apply

- When foreigners may purchase (subject to the 40% rule)

- How liens work for unpaid dues

- Who pays for what (unit vs common area repairs)

- How the building can be renovated or demolished

- What rights each owner has inside their unit

These rules protect both the individual buyer and the entire community.

They prevent chaos, safeguard property values, and ensure the building remains safe and functional throughout its lifespan.

The Bottom Line

RA 4726 defines the entire ecosystem of condominium ownership—

from creation, to daily governance, to long-term redevelopment.

Everything you can or cannot do as a unit owner traces back to this law.

Master it, and you eliminate guesswork, avoid costly errors, and make smarter, more confident real estate decisions.

Key Definitions Every Buyer Should Know (Straight From the Law)

Legal terms become landmines the moment you enter the condominium market. One wrong assumption about “unit area,” “common areas,” or “condominium corporation powers” can lead to costly disputes—many of which buyers never see coming. RA 4726 solves this by defining exactly whatyou own, how you own it, and where your rights begin and end.

Master these definitions and you immediately rise above the average buyer. More importantly, you avoid the expensive mistakes that happen when people rely on marketing brochures instead of the law.

What Counts as a ‘Condominium’

Under RA 4726, a condominium is not a building type.

It is a form of ownership—a legal arrangement that allows:

- Individual ownership of a specific unit

- Collective, undivided ownership of shared spaces

- A registered Master Deed and Declaration of Restrictions governing the entire project

A building is not legally a condominium unless:

- The Master Deed is registered with the Register of Deeds

- The Declaration of Restrictions is filed

- The land title is annotated accordingly

- The project has a License to Sell (for preselling)

If these documents don’t exist—or aren’t registered—the project isn’t a condominium under Philippine law, no matter how it’s marketed.

Why this matters:

Your rights, restrictions, and even your ability to obtain a title depend on these documents being properly filed.

What a ‘Unit’ Legally Includes

Developers often promote “floor area” using marketing numbers that mix usable space with common-area allocations. RA 4726 cuts through the confusion by defining a unit in precise terms:

Your unit legally includes:

- The interior surfaces of floors, ceilings, and walls

- Everything within those boundaries

- Fixtures attached to the interior

Your unit does not include:

- Exterior walls

- Structural components (beams, slabs, columns)

- Pipes or utility lines that serve more than one unit

- Shafts, ducts, or risers

- The land beneath the building

Why this matters:

This definition determines:

- Who pays for repairs

- What renovations are allowed

- Where your insurance coverage starts and ends

- Whether a defect is your responsibility or the condo corporation’s

Boundary misunderstandings are one of the most common sources of disputes between owners and admins.

Common Areas and Your Undivided Interest

Common areas are the parts of the property owned collectively by all unit owners. RA 4726 makes your share in these areas inseparable from your unit—you cannot sell, mortgage, or transfer one without the other.

Common areas include:

- Lobbies, hallways, elevators

- Amenities: pool, gym, function rooms

- Structural elements: foundation, exterior walls, columns

- Mechanical systems: water tanks, generators, MEPF systems

- Open spaces and landscaped grounds

Your percentage interest is based on your unit size and appears in the Master Deed. It governs:

- Your voting power

- Your share of association dues

- Your obligation during special assessments

- Your proportional ownership of the land during redevelopment

This “undivided interest” is the backbone of condo ownership—and the reason every owner must contribute fairly to building upkeep.

The Condominium Corporation and Its Powers

Every legitimate condominium project has a condominium corporation—a legally registered, non-profit entity that manages the building. When you buy a unit, you automatically become a member. You cannot opt out, resign, or refuse participation.

Under RA 4726, the condominium corporation holds extensive powers, including:

- Collecting dues and assessments

- Maintaining and repairing common areas

- Enforcing rules and imposing penalties

- Representing owners in legal matters

- Voting on major decisions (repairs, improvements, redevelopment)

- Placing liens on units for unpaid obligations

- Amending rules with owner approval

Think of it as your building’s governing body—your mini-LGU inside the property. How competent (or incompetent) this corporation is will determine whether your building stays premium… or deteriorates fast.

Why this matters:

Buyers often blame developers for problems that legally fall under the condo corporation. Understanding this distinction helps you navigate disputes, renovations, dues, and voting rights with clarity.

Why These Definitions Matter More Than People Think

These aren’t just legal technicalities. They drive real-world consequences like:

- Who pays for a leaking pipe

- Whether you can renovate your bathroom

- Why your dues went up

- Whether Airbnb is allowed

- Who can buy in your building

- When the entire tower can be demolished or redeveloped

RA 4726 gives structure and predictability to condo ownership—but only if you know what the law actually says.

HOW Condo Ownership Works Under RA 4726

Condominium ownership looks deceptively simple—you buy a unit, get a CCT, move in. But under the hood is a legal machine designed to protect owners, ensure proper governance, and prevent chaos in shared living environments. RA 4726 dictates how a condominium is born, how rights are assigned, and where your ownership stops.

Understanding this framework isn’t optional. It’s the difference between a smooth ownership experience and a long list of expensive surprises.

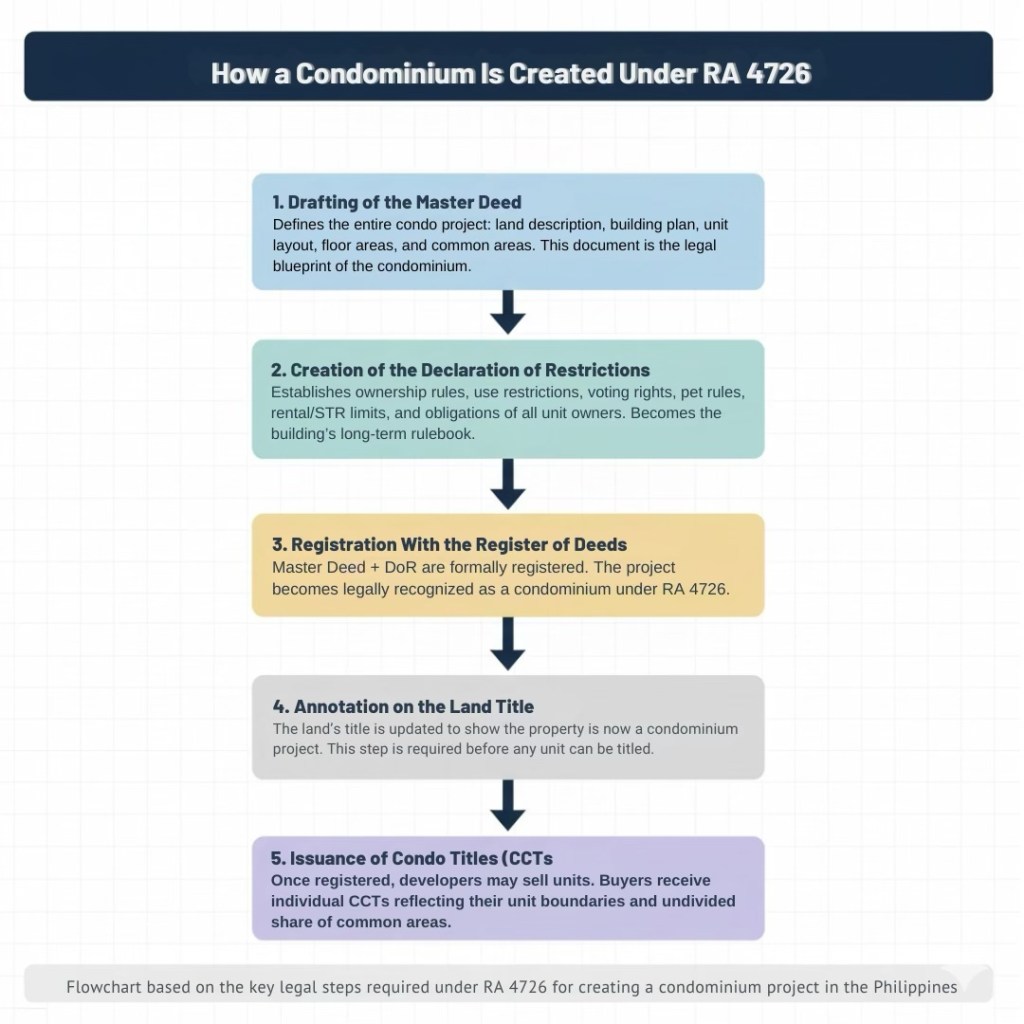

How a Condo Project Is Legally Created

Before a developer can sell even a single unit, the entire project must go through a specific legal sequence. If any step is skipped, the building is not a lawful condominium under RA 4726—and buyers risk serious title and ownership issues.

Here’s the required chain:

1. Master Deed (The Building’s Legal Blueprint)

This document describes the entire development, including:

- Total land area

- Number, type, and layout of units

- Common areas and amenity allocations

- Percentage interest of each unit

- Boundaries and definitions

If the building were a person, the Master Deed is its birth certificate—everything flows from it.

2. Declaration of Restrictions (The Building’s Constitution)

This document sets the binding rules for:

- Use (residential, commercial, mixed-use)

- Rental limitations

- Renovation restrictions

- Pets and noise regulations

- Voting rights

- Powers of the condominium corporation

Everything you’re allowed—or not allowed—to do inside your unit is anchored here.

If it’s not in the Master Deed or DoR, it’s not enforceable.

3. Registration With the Register of Deeds

This document sets the binding rules for:

The Master Deed and DoR must be registered to take legal effect.

This is the exact moment the project becomes a legal condominium under RA 4726.

Without registration, the project is not recognized—full stop.

4. Annotation on the Land Title

The land title is annotated to reflect the creation of a condominium project.

This makes it legally possible for the developer to issue CCTs later.

5. Issuance of Sellable Unit Titles

Only after all the above steps can the developer sell units and issue:

- Individual titles to buyers

- Each with an automatic share in the common areas

- Each with membership in the condominium corporation

If the paperwork isn’t complete, the titles are not valid—and buyers inherit a legal headache.

What Exactly You Own (and Don’t Own)

RA 4726 draws a strict line between your private unit and the shared property held collectively by all owners.

You own:

- The interior surfaces of your unit (walls, floors, ceilings)

- All fixtures within that interior boundary

- Your percentage interest in all common areas

- Your membership in the condominium corporation

You do not own:

- The building’s structural components

- Exterior walls

- Load-bearing walls, beams, or slabs

- Pipes, ducts, and risers serving multiple units

- Elevators, hallways, amenities

- The land

- Any space outside your interior boundaries

Why this distinction matters:

This is what determines:

- Who pays for a leaking pipe

- Whether you can knock down a wall

- Who handles electrical issues

- Who is liable for waterproofing or structural cracks

You control your unit—not the structure that supports it.

Rights and Limits Inside Your Unit

RA 4726 gives you broad freedom inside your unit, but that freedom isn’t absolute.

Your rights must coexist with the rights of every other owner and the safety of the building.

You own:

- The interior surfaces of your unit (walls, floors, ceilings)

- All fixtures within that interior boundary

- Your percentage interest in all common areas

- Your membership in the condominium corporation

Your Rights as a Unit Owner

You may:

- Renovate your unit (interior finishes only)

- Rent it out (unless prohibited in the Master Deed/house rules)

- Sell, mortgage, or transfer it

- Use the unit for its designated purpose

- Access all common areas and amenities

- Participate and vote in corporation meetings

You enjoy full control over what happens inside your walls—within the law.

Your Limits Under RA 4726

You may not:

- Alter structural elements (slabs, columns, beams)

- Modify utility lines that serve more than one unit

- Create noise or nuisance affecting others

- Convert a unit to a prohibited use (e.g., office in a purely residential building)

- Restrict access to emergency pathways

- Violate the Master Deed, DoR, or house rules

These limits exist for safety, fairness, and building integrity.

Examples That Make These Rules Clear

Scenario 1: Wall Removal

Want to remove a column to widen your living area?

Illegal.

Columns are structural. RA 4726 prohibits it.

Scenario 2: Bathroom Relocation

Relocating your toilet means altering shared plumbing.

Not allowed without corporation approval.

Scenario 3: Noise Complaints

You may own the space—but neighbors have the right to peaceful enjoyment.

RA 4726 allows enforcement and penalties.

Scenario 4: Airbnb Operation

It’s allowed only if the Master Deed and house rules allow it—not automatically.

Scenario 5: Leak From Above

If the leak comes from a common pipe, the corporation pays.

If it comes from your shower, you pay.

RA 4726 ensures that your freedom inside your unit never compromises the safety, rights, or comfort of others.

The Bottom Line

RA 4726 doesn’t just define ownership—it defines limits, obligations, and shared responsibilities.

It ensures:

- Safe living

- Fair contribution to costs

- Clear boundaries

- Predictable rules

- Sustainable building lifespan

When you understand this legal architecture, buying and owning a condo becomes a strategic advantage—not a gamble.

Foreign Ownership Rules — What’s Allowed and What Isn’t

Foreigners often see Philippine condominiums as the cleanest, safest entry point into local real estate—and they’re right. But the rules aren’t open-ended. Every foreign purchase sits on two foundations:

- RA 4726, the Condominium Act, and

- The 1987 Philippine Constitution, which limits foreign ownership of land.

Together, they create a system that allows foreigners to buy units—but only within very specific limits. Understanding these rules protects you from invalid sales, blocked transfers, and expensive legal headaches.

The 40% Rule Explained Clearly

The rule is brutally simple:

Foreign ownership in a condominium project cannot exceed 40% of the total saleable area or total units.

This is a constitutional limit, not a developer preference. It applies to:

- Foreign individuals

- Foreign corporations

- Philippine corporations that are more than 40% foreign-owned

What this looks like in practice:

- If a building has 1,000 units, only 400 may be foreign-owned.

- Once those slots are filled, the next foreign buyer cannot legally purchase—even if the unit is offered for resale.

- If you try to push through the sale, the Register of Deeds can refuse to transfer the title.

This limit is strict.

No workaround.

No “special exceptions.”

No “technical loophole.”

Developers who exceed this quota can face sanctions, and foreign buyers who purchase after the quota is filled may lose their right to title transfer.

How Developers Track Foreign Ownership

Developers are required to monitor foreign ownership levels from day one. With high-demand projects—especially in Makati, BGC, Cebu IT Park, and Ortigas—slots for foreigners fill extremely fast.

Here’s how developers enforce compliance:

1. Passport Verification

Foreigners must present a passport or government ID.

Dual citizens with PH passports are counted as Filipino.

2. Nationality Tallying

Every reservation is immediately tagged as:

- Filipino buyer

- Foreign buyer

- Corporate buyer (with SEC documents checked for % foreign ownership)

3. Real-Time Ownership Ledger

Developers keep a running ledger showing:

- How many units have been sold

- Nationality of owners

- Slots left for foreign buyers

Many top developers automate this inside their CRM systems.

4. Title Transfer Compliance

Before issuing the Condominium Certificate of Title (CCT), the developer re-verifies nationality to ensure no breach.

5. Post-Turnover Monitoring

After turnover, the condominium corporation continues monitoring foreign ownership levels for:

- Resale transactions

- Intrafamily transfers

- Corporate acquisitions

If a resale to a foreigner would breach the 40% cap, the condominium corporation can refuse to endorse the transfer.

This is why foreign buyers must check foreign ownership availability before committing to a deal—especially in the resale market.

Can Foreigners Inherit or Transfer Units?

Yes—foreigners can acquire units through inheritance and can freely transfer ownership, but with critical rules attached.

1. Foreigners Can Inherit Condominium Units

Inheritance (testate or intestate) is allowed.

This is one of the few scenarios where a foreigner may exceed the 40% project quota without violating the Constitution.

However:

- The foreign heir may retain the unit.

- But if the project exceeds 40% due to multiple inheritances, the corporation may require the next sale to go to a Filipino.

- The foreign heir cannot buy another unit if the project is already capped.

Most condo corporations allow inherited units to remain with the foreign heir, but new foreign purchases will be blocked once the quota is full.

2. Foreigners Can Transfer or Sell Units Freely

A foreign owner may:

- Sell to a Filipino

- Sell to another foreigner (if slots are still available)

- Gift or transfer ownership within allowable limits

The one condition that never changes:

The transaction cannot cause foreign ownership to exceed 40%.

If a foreigner wants to sell to another foreigner and the quota is already maxed out, the transaction will be rejected.

The unit must be sold to a Filipino.

3. Foreign Corporations Face Stricter Requirements

A foreign-owned corporation (40%+ foreign equity) may buy units only for:

- Office operations

- Staff housing (if consistent with its purpose)

- Business-related use

Personal residential use is subject to strict interpretation and corporate purpose review.

Why These Rules Matter for Investors

Yes—foreigners can acquire units through inheritance and can freely transfer ownership, but with critical rules attached.

Foreign ownership limits influence:

- Liquidity (how easily you can resell)

- Demand and pricing (foreign-heavy markets appreciate faster)

- Market cycles (foreign quotas create artificial scarcity)

- Premiums in top cities (foreigners tend to choose prime CBD units)

Buildings that are close to the 40% cap often see:

- Faster price appreciation

- Higher demand

- Stronger rental markets

Buildings that hit the cap often see:

- Tight supply on foreign-resale units

- Reduced foreign buying pressure

- Higher resale premiums for units held by Filipinos

Understanding these dynamics is a profit advantage—not just a legal necessity.

Quick Answers Foreign Buyers Always Ask

Q: Can a foreigner buy multiple units?

A: Yes—no personal limit. The only limit is the project-wide 40%.

Q: Can foreigners buy parking slots?

A: Yes, if parking is sold as a separate CCT and the building hasn’t reached the quota. If parking is a mere accessory (no separate title), it follows the unit.

Q: Can a foreigner buy land by owning all units?

A: No. Even 100% unit ownership does not confer land ownership. The condominium corporation still owns the land, and it must be 60% Filipino-owned.

Q: Can a foreigner buy commercial condo units?

A: Yes—if within the 40% limit. The land ownership rule still applies.

The Bottom Line

Foreigners can absolutely invest in Philippine condominiums—but only within a rigid framework of constitutional and corporate control. RA 4726 ensures that foreigners can own units securely, but the Constitution ensures they can’t control the land beneath them.

The smartest foreign investors monitor:

- Quota availability

- Condo corporation policies

- House rules on rentals

- Developer transparency

- Resale restrictions

Understanding these rules protects your investment and prevents blocked sales, delayed title transfers, and legal disputes.

Buying and Selling Under RA 4726

Buying or selling a condominium in the Philippines isn’t as simple as exchanging cash for keys. RA 4726 controls the entire process—from how titles are transferred, to what documents must be cleared, to how dues and obligations follow the unit. Whether you’re purchasing preselling, ready-for-occupancy, or a resale, understanding these rules protects you from delays, blocked transfers, and costly mistakes.

This section breaks down the legal mechanics in a practical, buyer-friendly way.

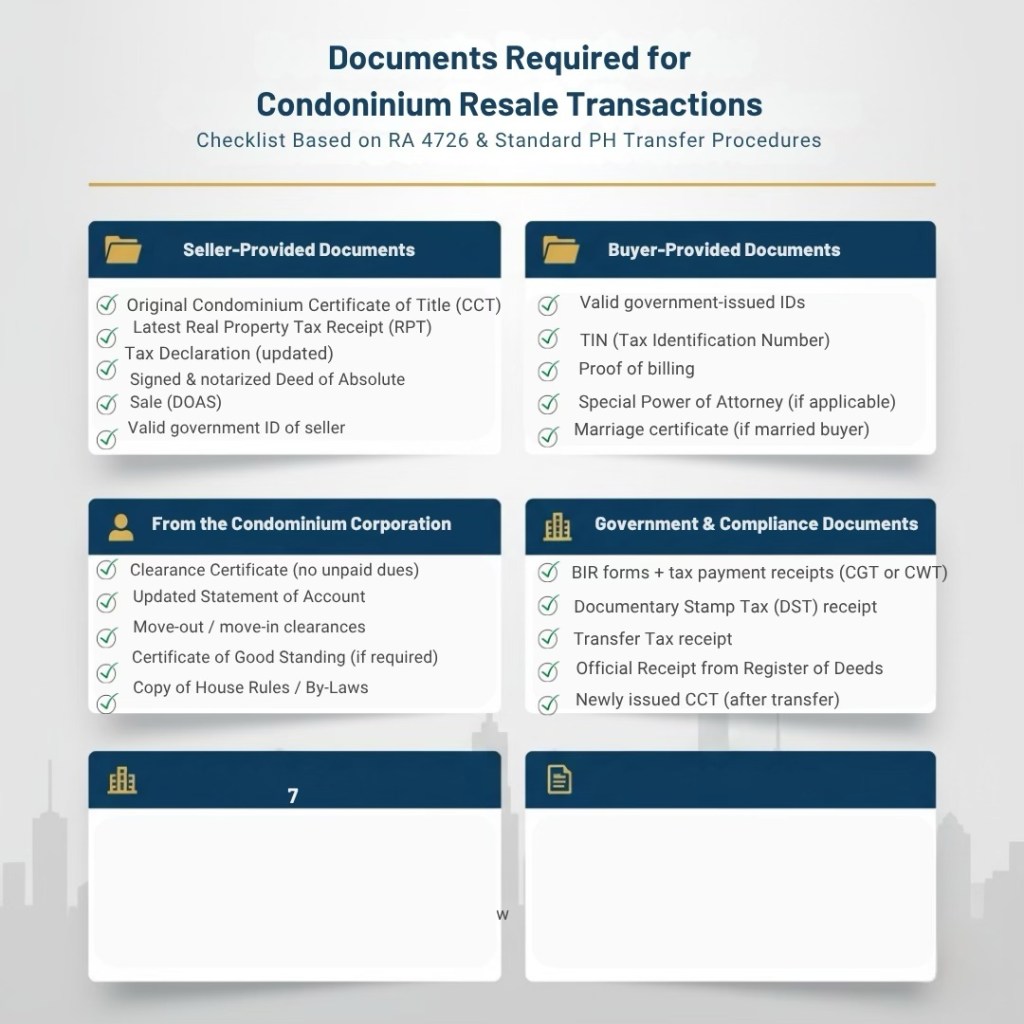

Transfer of Ownership: What the Law Requires

Every condominium transaction involves two inseparable components:

- The unit itself, and

- Your undivided interest in the common areas (your percentage share of hallways, amenities, structure, and land)

A proper transfer must include both—no exceptions.

RA 4726 requires the following:

1. A Legally Executed Deed of Sale or Assignment

This document must explicitly state the transfer of:

- The condominium unit (as described in the CCT)

- The seller’s proportional interest in the common areas

- The seller’s membership rights in the condominium corporation

If the Deed of Sale omits the undivided interest or the corporate membership, the transfer is incomplete—and may be rejected by the Register of Deeds.

2. Clearance from the Condominium Corporation

Before any transfer can proceed, the seller must secure:

- Statement of Account

- Dues Clearance Certificate

- Certification of No Pending Violations

The condo corporation is legally allowed to withhold clearance if:

- Dues are unpaid

- Special assessments are outstanding

- Violations remain unresolved

- Prior penalties were not settled

No clearance = no transfer.

The Register of Deeds will not process the title.

3. Taxes and Fees Must Be Fully Paid

All government-mandated taxes must be settled before the title can be transferred:

Buyer:

- Documentary Stamp Tax

- Transfer Tax

- Registration Fee

Seller:

- CGT (or CWT for developers)

- Unpaid real property tax

- Unpaid condo dues

Any missing tax certificate (e.g., missing CGT receipt) stalls the entire transaction

4. Title Transfer and Issuance of New CCT

Once all taxes and documents are complete:

- The Register of Deeds cancels the old CCT

- A new CCT is issued under the buyer’s name

- Ownership legally transfers at this point—not earlier

This ensures a clean chain of title and compliance with foreign ownership limits.

Special Rules for Resale Units

Resale units (secondary market) require more due diligence than preselling units because the condo corporation already governs the building and the unit has a history.

These rules matter even more for foreign buyers, because resale units often bump against the 40% foreign ownership cap.

1. Nationality Compliance Check

Before approving a resale, the condo corporation verifies:

- Whether the building is already at the 40% foreign ownership limit

If the quota is full:

- A foreign buyer cannot purchase

- The corporation may refuse endorsement

- The Register of Deeds may deny title transfer

Foreign buyers must verify foreign ownership availability before signing anything.

2. Review of Dues, Arrears, and Assessments

Buyers must request:

- Full dues history

- Special assessment records

- Pending repair charges

- Outstanding penalties

Important:

Under RA 4726, the condo corporation may place a lien on a unit for unpaid dues.

A lien follows the unit—not the seller.

This means you could unknowingly inherit someone else’s debt.

3. Inspection of Master Deed, House Rules, and By-Laws

Resale buyers must audit the building’s governing documents, especially:

- Rental restrictions

- Airbnb policies

- Pet rules

- Renovation rules

- Parking rules

- Approved unit uses

If your intended use conflicts with these documents, the corporation is legally empowered to block it.

4. Full Physical Unit Inspection

Resale units require:

- Plumbing checks

- Waterproofing tests

- Electrical inspection

- Mold assessment

- Verification of non-structural renovations

This prevents surprises like leaks, illegal alterations, or unresolved hidden defects.

Advanced buyer tip:

Request the building’s latest engineering and maintenance reports to assess overall building health.

Contract Clauses That Protect You

Condominium contracts are notorious for dense language, but certain clauses are non-negotiable. These protect your rights during turnover, repair issues, or future disputes.

Here are the crucial ones every buyer should insist on:

1. Turnover and Acceptance Clause

This safeguards your right to:

- Conduct a punchlist inspection

- Reject substandard workmanship

- Require the developer to fix defects

Never accept a unit “as is” after turnover without a documented inspection.

2. Clear Unit Boundary Definitions

The contract must specify:

- What areas are legally yours

- What areas are common areas

- Which fixtures are unit-owned vs. shared

Ambiguous boundaries = future disputes, especially with leaks and structural issues.

3. Assignment of Developer Obligations

This clause should include:

- Structural warranty (typically 5 years)

- Workmanship warranty (1 year)

- Utility and system warranty

- Timelines for defect rectification

Without clarity, developers may shift all responsibility to the condo corporation—the moment turnover happens.

4. Restrictions and Use Clauses

This defines:

- If short-term rentals are allowed

- If pets are permitted

- If business use is allowed

- What renovations require approval

Buyers often discover these limits too late—after conflicts arise.

5. Resale and Lease Limitations

This clause governs:

- Right to sell to foreigners (subject to quota)

- Right to lease (short-term or long-term)

- Whether the condo corporation has right of first refusal

This protects you if you intend to become a landlord or investor.

6. Dispute Resolution Clause

This must clarify:

- Mandatory mediation or arbitration

- Recognized arbitration body

- Procedures for resolution

This keeps disputes out of court—saving you time and money.

The Bottom Line

RA 4726 creates a predictable, secure system for buying and selling condominium units—but only if you follow the rules. A condominium isn’t like a traditional property. Its transfer requires legal compliance, documentary precision, and strict coordination with the condo corporation.

Smart buyers and investors treat RA 4726 as an advantage—not a hurdle.

Governance, Fees, and Owner Obligations

Condominium ownership doesn’t end with buying a unit. Once you move in, you become part of a shared ecosystem—one governed by a structure that RA 4726 carefully designed to keep buildings livable, financially stable, and legally compliant. If you understand this system, condo living becomes predictable and empowered. If you don’t, every “simple issue” becomes a source of conflict, penalties, or sudden special assessments.

This section breaks down how governance works, why dues exist, and what rules every owner must follow—no exceptions.

How the Condo Corporation Functions

Every condominium project is run by a condominium corporation, a legally recognized, non-stock, nonprofit entity formed to manage the building. When you buy a unit, you automatically become a member. You cannot opt out, resign, or decline participation—membership is a legal consequence of owning a unit.

The corporation operates like a specialized LGU with corporate powers. Its job: protect the building, the community, and the shared investment.

1. Day-to-Day Building Management

The condominium corporation manages the essential operations that keep your building functional and safe:

- Security and CCTV monitoring

- Cleaning and housekeeping

- Elevator operations and maintenance

- Water pumps, generators, HVAC systems

- Pool, gym, and amenity upkeep

- Garbage and waste management

- Fire safety systems

If these operations are efficient, residents feel it instantly. If they aren’t, the entire building deteriorates quickly—and market value follows.

2. Enforcement of Rules and Restrictions

RA 4726 empowers the condominium corporation to enforce:

- House rules

- Renovation guidelines

- Noise and nuisance policies

- Parking regulations

- Pet policies

- Rental restrictions, including Airbnb bans

These rules aren’t optional. They derive from the Master Deed, Declaration of Restrictions, and approved By-Laws, all of which have the force of law within the building.

When enforced consistently, these rules maintain safety, order, and property value.

3. Legal and Financial Representation

The condominium corporation can:

- Sue or file cases to protect the building

- Enter into contracts (e.g., property management, security, repairs)

- Hire accountants, engineers, and auditors

- Secure insurance for common areas

- Represent owners in negotiations, inspections, and LGU compliance

This authority is critical—especially in emergencies, disputes, or structural concerns.

4. Meetings, Voting, and Collective Decisions

The corporation conducts:

- Annual General Meetings (AGMs)

- Special Meetings for urgent matters

- Voting for budgets, major projects, elections, or redevelopment

Voting power is based on percentage interest, not a one-owner-one-vote system. Larger units have larger shares—and therefore more voting influence.

Owners who never attend meetings often wonder why rules “change suddenly.” They didn’t. They were voted on.

Dues, Assessments, and Reserve Funds

Condo fees aren’t arbitrary. They are the financial foundation of the entire building. Without them, the condominium corporation cannot function, maintain amenities, or preserve property values.

Buyers who underestimate these costs often regret it later—especially when living in buildings with low reserves or high delinquency.

1. Monthly Association Dues

These dues cover the building’s operational expenses, such as:

- Security staff

- Cleaning services

- Electricity and water for common areas

- Amenity upkeep

- Administrative staff salaries

- Property management contracts

Rates vary by project quality, amenities, and developer standards.

Premium projects = higher dues = better maintenance and stronger long-term value.

2. Special Assessments

When regular dues aren’t enough for major repairs or upgrades, special assessments are imposed. These are one-time charges collected from all owners for:

- Elevator modernization

- Structural retrofitting

- Facade repainting or waterproofing

- Amenity upgrades

- Emergency repairs after storms or earthquakes

Smart buyers always ask:

“Has the building issued special assessments in the last 5 years? Why?”

Patterns reveal whether the building is well-managed or chronically underfunded.

3. Reserve (Sinking) Fund

This is the building’s long-term savings account.

It covers:

- Major system replacements (generators, pumps)

- Structural rehabilitation

- Large-scale waterproofing

- Fire safety system upgrades

- Future modernization

A low reserve fund is a red flag.

It guarantees future special assessments—and signals weak financial governance.

4. Financial Transparency and Audit Rights

RA 4726 gives owners the right to:

- Review audited financial statements

- Inspect budgets and expense allocations

- Request transparency on dues spending

- Question suspicious or unexplained expenses

A condominium corporation that refuses financial transparency is hiding something—usually mismanagement or heavy delinquency.

Penalties, Liens, and Enforcement

Condo living is collective living. RA 4726 gives the condominium corporation strong enforcement powers to protect the community and prevent abuse.

1. Penalties for Violations

The corporation may impose fines for:

- Late dues

- House rule violations

- Unauthorized renovations

- Noise and disturbance

- Airbnb operations in prohibited buildings

- Parking and pet violations

Penalties are not optional—they are enforceable under RA 4726.

2. Liens on Units for Unpaid Dues

This is the corporation’s strongest financial weapon.

If an owner refuses to pay dues or assessments, the corporation may:

- Record a lien on the unit

- Block title transfer

- Block leasing approvals

- Accumulate penalties and interest

- Deny move-out or clearance requests

A lien attaches to the unit, not the individual.

This means buyers of resale units may inherit unpaid dues unless they verify the Statement of Account.

3. Suspension of Privileges

The corporation may also restrict:

- Amenity access

- Non-essential services

- Gate passes or guest access

- Parking privileges

These are commonly used to encourage compliance without going to court.

4. Legal Action and Collection Remedies

For chronic violators, the corporation may:

- File civil cases

- Collect through garnishment

- Impose interest and penalties

- Recover legal costs

Well-run buildings rarely reach this point. Poorly run ones get here fast.

Why This Section Matters More Than Buyers Realize

A condo’s long-term value isn’t determined by the developer alone. It’s shaped by:

- How responsibly owners pay dues

- How transparent the corporation is

- How quickly repairs are done

- How strictly rules are enforced

- How healthy the reserve fund is

Strong governance protects your investment. Weak governance destroys it—no matter how beautiful the building looked during turnover.

Repairs, Major Renovations, and Redevelopment

Condominiums age just like any other structure—and when they do, the decisions around repairs, upgrades, or redevelopment become legally sensitive. RA 4726 outlines who decides what, how votes are taken, and what happens when the building reaches the end of its useful life. These rules matter because they directly affect your safety, your dues, and ultimately the long-term value of your unit.

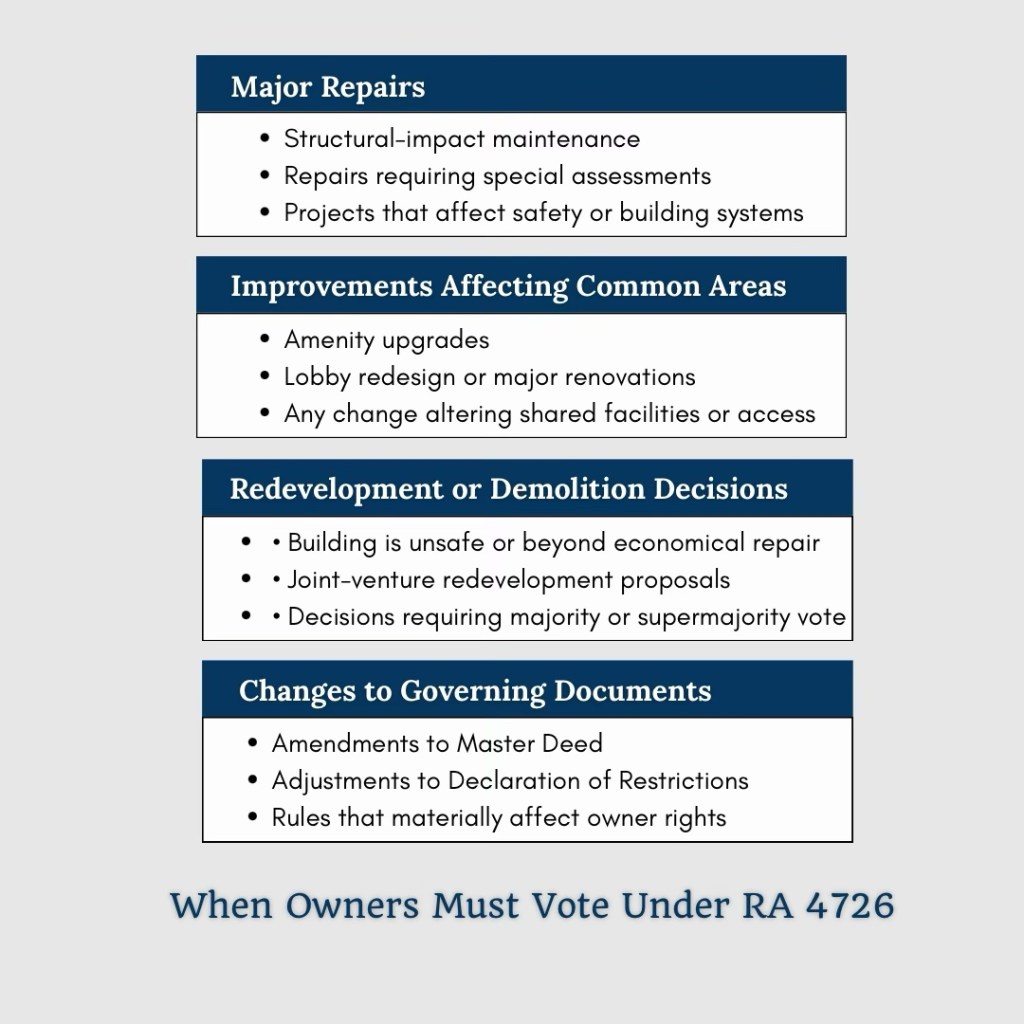

When Owners Must Vote

Strong governance protects your investment. Weak governance destroys it—no matter how beautiful the building looked during turnover.

RA 4726 mandates owner approval when decisions affect the structure, safety, cost obligations, or future use of the building.

Here are the scenarios that legally require owner voting:

1. Major Structural Repairs

These are repairs affecting the building’s integrity or long-term safety, such as:

- Structural retrofitting

- Column or beam reinforcement

- Roof replacement

- Large-scale waterproofing

- Elevators reaching end-of-life

These projects require significant funding and typically involve engineers, contractors, and extended timelines—making owner approval necessary.

2. Improvements That Increase Costs for All Owners

Examples include:

- Lobby redesign or upgrade

- Adding new amenities (e.g., co-working spaces, additional function rooms)

- Technology upgrades (CCTV overhaul, digital access systems)

- Modernizing fire safety systems

Because these changes impact all owners financially, RA 4726 requires collective consent.

3. Alteration or Reallocation of Common Areas

Common areas are co-owned by all unit owners.

No single party—not even the board or developer—can alter or repurpose these areas without the required vote.

Examples:

- Converting part of a hallway into storage

- Turning an open deck into commercial space

- Reconfiguring amenity layouts

4. Redevelopment or Demolition Is Proposed

This is the most serious decision a condominium can face. RA 4726 requires a majority vote (based on percentage interest) unless the By-Laws prescribe a higher threshold.

This includes:

- Full building demolition

- Joint venture redevelopment

- Large-scale building reconstruction

- Temporary or permanent relocation of owners

Redevelopment votes define the future of the entire property—and the compensation owners will receive.

What Happens in Structural Defects

Structural defects are not “cosmetic problems.” They trigger legal obligations, emergency action, and strict timelines. RA 4726 interacts with the National Building Code, civil law, and DHSUD regulationsto determine responsibility.

Here’s what happens when structural defects appear:

1. Developer Responsibility (During Warranty Period)

Developers are responsible for:

- Structural defects (up to 5 years by law)

- Workmanship defects (typically 1 year)

- Hidden or latent defects

They must repair at their cost—no passing the burden to the condo corporation or owners.

2. Condo Corporation Responsibility (Post-Warranty)

Once warranties expire, the burden shifts to the corporation. Their responsibilities include:

- Commissioning structural assessments

- Hiring independent engineers

- Allocating emergency funds

- Recommending building-level interventions

- Imposing special assessments if necessary

Structural issues rarely affect just one unit—they become a collective financial responsibility.

3. Emergency Closures and Safety Measures

If the building poses risks:

- Amenities may be closed

- Certain floors may be restricted

- Units may be temporarily vacated

- Emergency repairs may be mandated

Safety overrides everything—including convenience.

4. Government Intervention (LGU + DHSUD)

Authorities may:

- Issue notices of violation

- Order mandatory repairs

- Require retrofitting

- Conduct independent structural reviews

- Suspend occupancy in extreme cases

If a building becomes unsafe, the law demands immediate corrective action.

End-of-Life Redevelopment Rules

Few buyers consider what happens when a condo tower reaches the end of its lifespan, but RA 4726 provides a framework for exactly that scenario. Condominiums do not last forever; concrete, piping, and electrical systems degrade. The average economic life of a building in the Philippines is often 40–50 years, depending on maintenance.

End-of-life scenarios under the law include:

1. When the Building Is No Longer Safe or Economically Viable

Redevelopment is triggered when:

- Repair costs exceed redevelopment value

- Structural integrity is compromised

- Utility systems fail on a building-wide level

- Modernization requires full replacement

- Safety standards can no longer be met by patch repairs

The condo corporation must call for a vote.

2. Required Owner Vote for Redevelopment or Demolition

RA 4726 requires approval from a majority of unit owners (based on total interest) unless the By-Laws set a higher threshold.

Redevelopment includes:

- Full demolition

- Joint venture redevelopment with a new developer

- Major reconstruction

- Retrofits that fundamentally alter the building’s structure

These decisions affect everyone’s property rights—and must reflect the majority’s will.

3. Compensation and Land Value Sharing

Even if the building is demolished, owners still retain valuable rights because they own:

- Their undivided interest in the land, and

- Their share in the condominium corporation

Depending on the redevelopment agreement, owners may receive:

- Lump-sum payouts

- Equivalent units in the future project

- Cash + new unit hybrids

- Appreciated value of land shares

In prime areas—Makati CBD, BGC, Ortigas, Cebu IT Park—redevelopment deals can create massive upside for owners.

4. Transition and Vacating Procedures

Once redevelopment is approved:

- Units must be vacated

- Water, electricity, and building systems are decommissioned

- Titles may be recalled and replaced under the agreement

- Owners follow compensation or reallocation procedures

A competent condominium board ensures transparency and protects every owner’s interest during this high-stakes process.

Why This Section Is Critical for Buyers and Investors

Because buildings age, these rules are not optional—they’re inevitable. Smart investors evaluate condos not just by amenities or developer reputation but by:

- Reserve fund strength

- Governance quality

- Building maintenance practices

- Structural history

- Future redevelopment potential

- Location’s long-term land value

A well-managed building ages gracefully.

A poorly managed one deteriorates fast—and drags your investment down with it.

Taxes and Transaction Costs for Condominiums

Taxes catch more buyers off guard than any other part of a condominium transaction. The numbers are real, the deadlines are strict, and missing even one requirement can stall your title transfer for months. RA 4726 doesn’t set tax rates, but it activates these taxes the moment ownership changes hands—making them unavoidable for both buyers and sellers.

This is the section that separates well-prepared investors from those who walk blindly into surprise expenses.

Buyer’s Mandatory Costs

Buying a condo means paying government taxes, transfer fees, and building-related charges before the Register of Deeds will issue your title.

Here’s what every buyer must prepare for:

1. Documentary Stamp Tax (DST)

Rate: 1.5% of the higher of the following:

- Selling price

- BIR zonal value

- Fair market value (Tax Declaration)

DST applies to every transfer—preselling, resale, donation, even foreclosure.

2. Transfer Tax (Local Government Tax)

Rate varies by location:

- NCR: up to 0.75%

- Outside NCR: typically 0.5%–0.75%

This tax is paid at the City Treasurer’s Office before the new title can be processed.

3. Registration Fee (Register of Deeds)

This fee covers the issuance of your new Condominium Certificate of Title (CCT).

Cost depends on the property value, but typical ranges are:

- ₱8,000 to ₱30,000+

4. Condo Corporation Fees

These are not government taxes but are mandatory for move-in clearance.

Expect:

- Move-in charges

- Membership or activation fees

- CCT annotation fees

- Advance association dues (usually 1–3 months)

Buildings use this to maintain operations and confirm your membership.

5. Notarial Fees

Typically:

- ₱1,000 – ₱10,000 depending on the contract and complexity.

Notarial fees legitimize your Deed of Sale or Assignment and are required before any BIR filing.

Seller’s Mandatory Costs

The seller pays the taxes triggered by the sale itself. Missing these means the buyer cannot transfer the title—even if the unit is already fully paid.

1. Capital Gains Tax (CGT)

Rate: 6% of the higher of:

- Selling price

- Zonal value

CGT applies when the seller is an individual selling a condo treated as a capital asset.

CGT does not apply when:

- The seller is a developer

- The property is considered inventory

2. Creditable Withholding Tax (CWT)

CWT replaces CGT for:

- Developers

- Corporations

- Businesses selling units as part of ordinary business

Rates vary from 1.5% to 6% depending on the type of seller and property classification.

3. Broker’s Fees/Agent’s Commission

Standard rates:

- 3% to 5% for regular condos

- Higher for luxury units

This isn’t a legal requirement but is standard real estate practice.

4. Unpaid Dues and Assessments

The seller must present:

- Clearance Certificate from the Condo Corporation

- Zero balance statement

- Proof that no penalties or special assessments remain unpaid

A unit cannot be transferred without this clearance.

Buyers should never accept excuses—delinquent dues stick to the unit, not the seller.

5. Documentation or Developer Fees (Preselling)

Preselling transactions typically include:

- Documentation fees

- Processing charges

- Admin costs

Usual range: ₱20,000 to ₱50,000+, depending on developer and project value.

VAT, CGT, DST, Transfer Tax—When They Apply

The biggest confusion among buyers and sellers comes from not knowing which tax applies to which scenario. Here’s the simplest way to understand it:

1. Value-Added Tax (VAT)

VAT applies only under specific conditions:

VAT is charged when:

- The seller is a VAT-registered entity (usually developers or brokers earning above ₱3 million annually), and

- The selling price exceeds the VAT threshold set by the BIR (adjusted yearly).

- Most developers charge 12% VAT for units above the threshold.

VAT does not apply when:

- The seller is an individual selling their personal property

- The sale is below the threshold for VAT exemption

- The property is not part of a trade or business

VAT often applies in preselling; rarely in pure resales.

2. Capital Gains Tax (CGT)

CGT applies when:

- The seller is an individual

- The property is treated as a capital asset

CGT is 6% based on the zonal value or selling price—whichever is higher.

CGT does not apply to:

- Developers (corporate sellers)

- Businesses treating property as inventory

In those cases, Creditable Withholding Tax applies instead.

3. Documentary Stamp Tax (DST)

DST applies to all real property transfers, whether the unit is:

- Preselling

- RFO

- Resale

- Foreclosures

- Donations

- Inheritance

Rate: 1.5% of the higher value.

DST is unavoidable unless the transfer is exempt under specific BIR rulings.

4. Local Transfer Tax

Paid to the LGU after DST and CGT/CWT are settled.

Transfer Tax applies when:

The property is located within NCR or local municipalities

The title changes hands

Rate:

Provinces: 0.5%–0.75%

NCR: up to 0.75%

Why These Taxes Matter to Buyers & Investors

Sample Computation for a ₱6,000,000 Condo

Scenario:

Buyer purchases a ₱6,000,000 condominium unit (assume zonal value is equal to selling price).

🔵 Buyer’s Costs

1. Documentary Stamp Tax (DST)

1.5% × ₱6,000,000 = ₱90,000

2. Local Transfer Tax

Assuming NCR rate of 0.75%

0.75% × ₱6,000,000 = ₱45,000

3. Registration Fee (Register of Deeds)

Estimated using typical sliding scale:

₱8,000 – ₱12,000

(Use ₱10,000 for this example)

4. Miscellaneous Condo Fees

Move-in fee + Membership fee + Advance dues

Estimate: ₱15,000 – ₱30,000

(Use ₱20,000 for sample)

➡️ Total Estimated Buyer Costs:

- ₱90,000 (DST)

- ₱45,000 (Transfer Tax)

- ₱10,000 (CCT Registration Fee)

- ₱20,000 (Move-in / Misc.)

= ₱165,000 total estimated buyer acquisition cost

🔴 Seller’s Costs

1. Capital Gains Tax (CGT)

6% × ₱6,000,000 = ₱360,000

2. Broker’s Commission

Assuming 5% professional fee:

5% × ₱6,000,000 = ₱300,000

3. Notarial / Documentation Costs

Estimated range: ₱5,000 – ₱10,000

(Use ₱7,500 for this example)

➡️ Total Estimated Seller Costs:

- ₱360,000 (CGT)

- ₱300,000 (Broker Commission)

- ₱7,500 (Notarial)

= ₱667,500 total estimated seller costs

Because taxes directly affect:

- Your true acquisition cost

- Your net yield

- Your exit strategy

- Your timeline for turnover

Buyers who fail to understand taxes often underestimate real costs by 6%–12%.

Investors who miscalculate taxes destroy their ROI before even collecting rent.

And sellers who ignore compliance delay the buyer’s transfer by months—damaging credibility and potentially inviting penalties.

Knowing these taxes gives you:

- Leverage during negotiation

- Faster processing

- Cleaner transactions

- Lower long-term cost

Smart investors calculate taxes before signing anything.

Buyer vs Seller Taxes + Typical Cost Range

| Tax / Fee | Who Pays | Description | Typical Cost Range (Philippines) |

|---|---|---|---|

| Documentary Stamp Tax (DST) | Buyer | National tax required for every real property transfer. Computed on the higher of selling price, zonal value, or market value. | 1.5% of the property value |

| Local Transfer Tax | Buyer | LGU-imposed tax needed before title transfer. Paid to the city/municipality. | 0.50% – 0.75% of property value (NCR max 0.75%) |

| Registration Fee (Register of Deeds) | Buyer | Fee for issuing the new Condominium Certificate of Title (CCT). | ₱8,000 – ₱25,000+ depending on value (sliding scale) |

| Move-in / Membership Fees | Buyer | Required by most condo corporations before occupancy. Includes advance dues and membership setup. | ₱5,000 – ₱50,000+ depending on building class |

| Notarial Fee (Buyer Side) | Buyer | For notarizing the Deed of Absolute Sale (DOAS). | ₱1,000 – ₱10,000 depending on value and location |

| Capital Gains Tax (CGT) | Seller | National tax for individuals selling a capital asset. Based on the higher of zonal value or selling price. | 6% of the property value |

| Creditable Withholding Tax (CWT) | Seller | Applies when the property is considered inventory or part of business operations. | 1.5% – 6% depending on classification |

| Broker’s Commission | Seller | Professional fee for licensed brokers or agents handling the sale. | 3% – 5% of selling price (varies for luxury units) |

| Unpaid Association Dues or Assessments | Seller | Must be cleared before title transfer; condo corp will not issue clearance with arrears. | Varies; typically ₱50 – ₱150 per sqm/month for dues |

| Notarial Fee (Seller Side) | Seller | Notarizing seller documents (authority to sell, affidavits, etc.) | ₱500 – ₱5,000 |

Due Diligence Checklist for Buyers and Investors

Buying a condominium without due diligence is like signing a contract blindfolded. The building may look impressive, the price may seem fair, and the agent may promise the world—but RA 4726 is very clear: the responsibility to verify documents, financial health, and legal compliance falls on the buyer.

This checklist is built for one purpose: to protect you from hidden liabilities, title issues, structural risks, and costly future repairs. Whether you’re buying preselling, RFO, or secondary market units, these steps separate smart investors from distressed ones.

📥 Download the “Ultimate RA 4726 Buyer Checklist”

Your smartest advantage before buying any condo in the Philippines

Buying a condo without understanding RA 4726 is risky.

This guide gives you the exact due diligence checklist top brokers, lawyers, and serious investors use to avoid bad buildings, hidden defects, illegal documentation, and overpriced units.

When you download this guide, you’ll get:

✔ A complete legal compliance checklist

✔ Financial health indicators of condo corporations

✔ Structural and engineering warning signs

✔ Red flags that signal you should walk away

✔ Unit inspection essentials for resales

✔ Rental rules, STR rules, foreign ownership rules

✔ Tax and cost breakdown cheat sheet

✔ A final go/no-go decision checklist

Take control of your condo purchase before problems take control of you.

Perfect for first-time buyers, OFWs, investors, and anyone planning to buy in 2025.

👉 Get Your Free PDF Now

Enter your name and email to instantly download the guide and receive:

- Exclusive buyer tips

- Market insights

- New listings based on your criteria

Documents to Request (Legal)

These documents confirm that the condominium project is legally recognized under RA 4726 and that the unit you’re buying has clean, transferable ownership.

1. Master Deed and Declaration of Restrictions (MD + DoR)

The Master Deed defines the entire project; the DoR defines the rules you’ll live under—forever.

Check for:

- Allowed uses (residential, mixed-use, leasing rules, STR restrictions)

- Boundaries and definitions of your unit

- Common areas and your percentage interest

- Voting rights and governance structure

If the developer or admin cannot produce these, walk away.

The project may not even be a legally recognized condominium.

2. Condominium Certificate of Title (CCT)

This is your proof of ownership. Inspect the CCT carefully.

Verify:

- Authenticity (with RD seal and dry stamp)

- Unit number, floor area, project name

- Name of the registered owner (must match seller)

- Liens, encumbrances, or annotations

Red flag: “PENDING CASE” or unsatisfied liens.

3. Tax Declaration (City Assessor’s Office)

The tax declaration should match the CCT details.

Check:

- Updated real property tax payments

- Correct classification (residential/commercial)

- Avoid discrepancies in floor area or unit listing

A missing or mismatched tax declaration warns of compliance issues.

4. Latest Statement of Account and Clearance Certificate

Issued by the Condominium Corporation.

Confirm:

- Zero unpaid dues

- No penalties or violations

- No special assessments pending

Without clearance, the title transfer will be blocked.

5. HLURB/DHSUD Certificates, License to Sell, and Permits

For preselling:

- License to Sell

- Certificate of Registration

- Building Permits

For RFO units:

- Occupancy Permit

These ensure the project is legal, safe, and authorized for sale.

6. Contract to Sell (CTS) and Deed of Absolute Sale (DOAS)

Review key clauses:

- Turnover conditions

- Unit specifications

- Penalties and dispute resolution

- Use restrictions

- Assignment of rights and obligations

Ensure it explicitly states your undivided interest in the common areas—a cornerstone of RA 4726.

Documents to Request (Financial)

A condo’s physical appearance hides nothing compared to what its financial statements reveal.

A beautiful lobby means little if the building is drowning in debt or running on a depleted reserve fund.

1. Audited Financial Statements of the Condominium Corporation

Request the latest two to three years of audited statements.

Check for:

- Liquidity

- Spending patterns

- Debt levels

- Transparency

A financially weak building leads to sudden special assessments—and declining property values.

2. Reserve Fund (Sinking Fund) Balance

You want a corporation that:

- Actively saves for long-term repairs

- Has adequate funds for major replacements

- Avoids relying on emergency assessments

If the reserve fund is near zero, the building is at risk.

3. Schedule of Monthly Dues and Special Assessments

Ask for:

- Current association dues

- Pending increases

- Recent special assessments

- Planned future assessments

This helps you project real ownership costs.

4. Delinquency Rate of Unit Owners

A high delinquency rate means:

- Cash-flow problems for the condo corporation

- Delayed repairs

- Potential increase in dues

- Poor governance and management

Serious investors always check this number.

5. Insurance Policies

Verify coverage for:

- Fire

- Earthquake

- Comprehensive building damage

Under-insured properties expose all unit owners to financial risk.

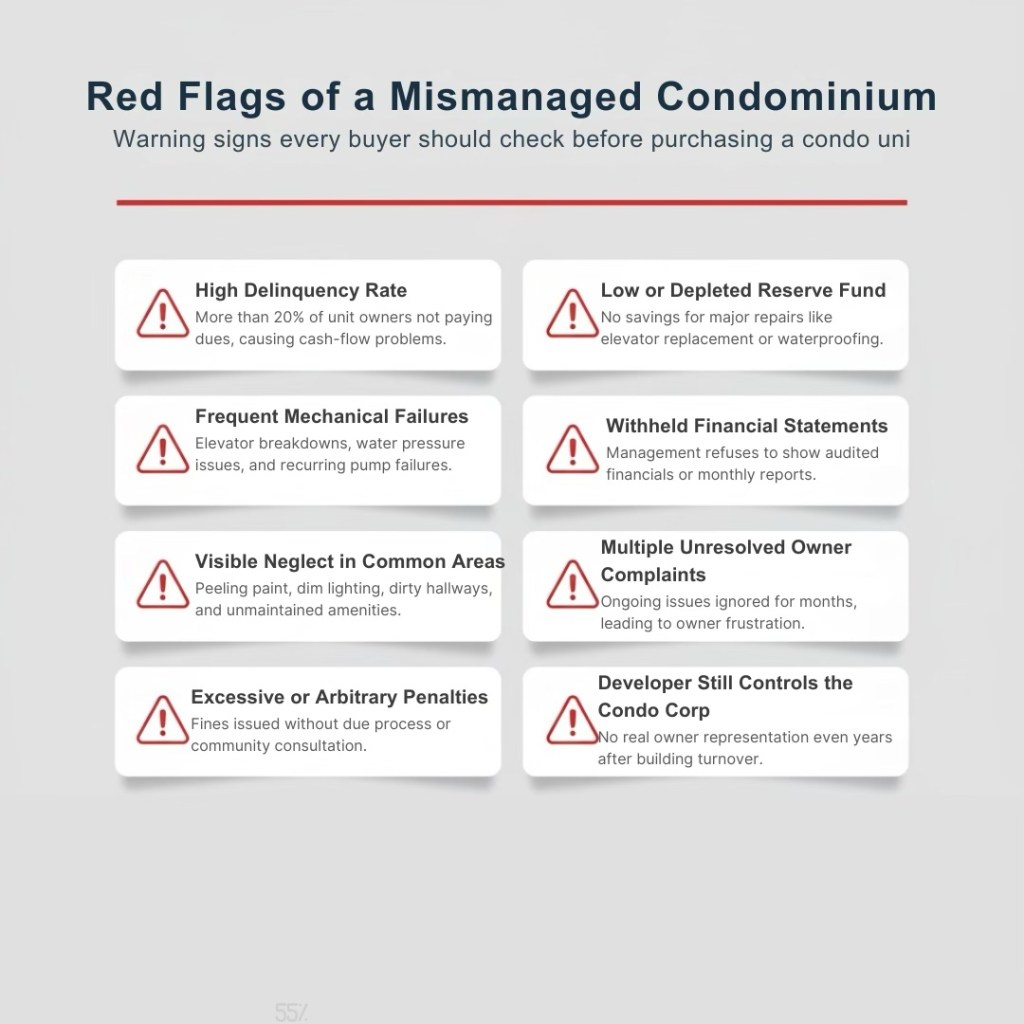

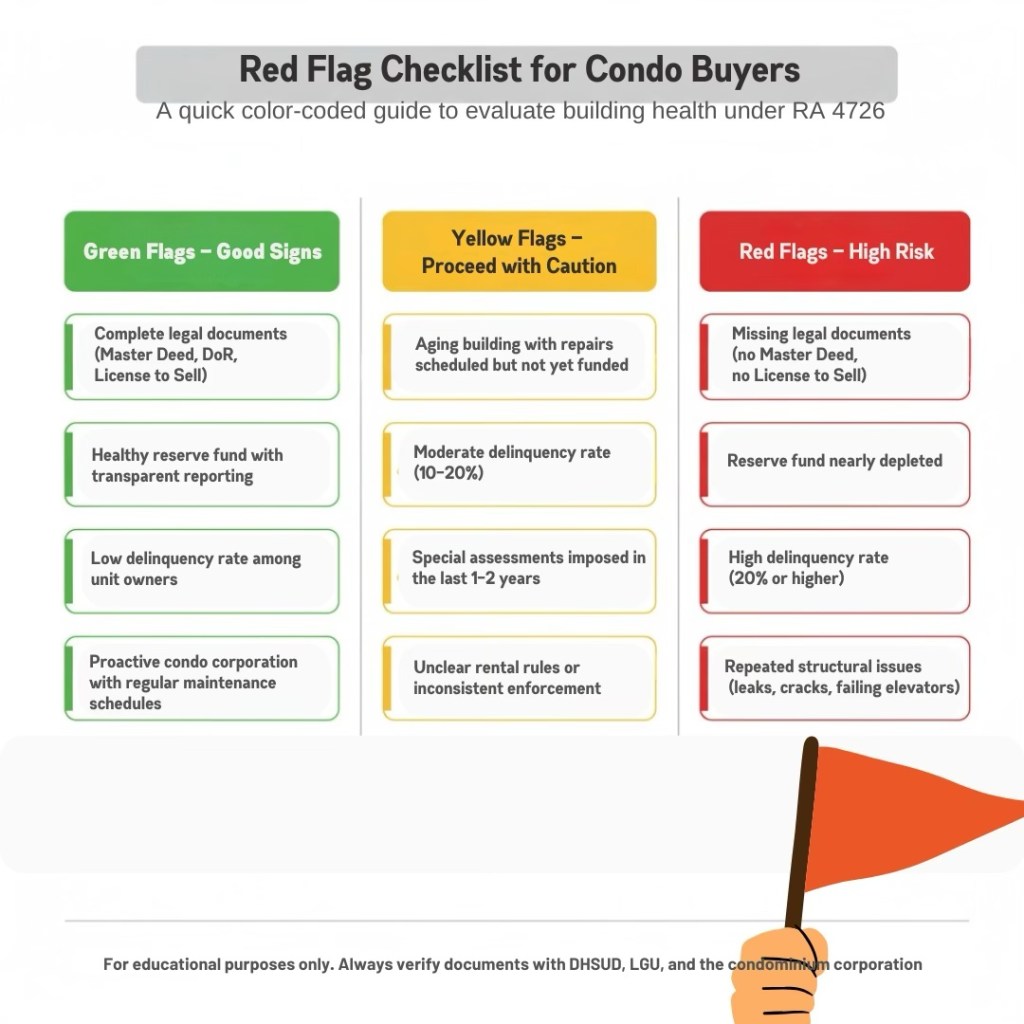

Red Flags That Should Make You Walk Away

These warning signs indicate legal risk, financial instability, or long-term problems that will drain your money and peace of mind.

1. No Master Deed, No Declaration of Restrictions, or No License to Sell

This means:

- The project is not legally a condominium

- Titles may not be issued

- Developer compliance is questionable

Immediate walk-away.

2. Outstanding Liens or Heavy Encumbrances on the CCT

Liens for unpaid dues, mortgages, or legal judgments are deal killers unless fully settled before transfer.

3. Very Low or Depleted Reserve Fund

A near-empty sinking fund means you’re buying into a disaster waiting to happen—future assessments will be painful.

4. High Delinquency Rate (>20% of owners not paying dues)

This typically signals:

- Poor management

- Potential financial collapse

- Rising dues

- Declining maintenance quality

Buildings like this age rapidly.

5. Inconsistent or Withheld Financial Reports

If the admin refuses to show financial statements, something is being hidden.

6. Structural Issues or Repeated Major Repairs

Signs of deeper problems include:

- Frequent leaks

- Cracks in walls or ceilings

- Water pressure issues

- Elevator breakdowns

- Recurring electrical failures

These lead to spiraling costs.

7. Strange or Excessive Rules in the By-Laws

Examples:

- Blanket bans on rentals

- Excessive renovation restrictions

- High penalties for minor violations

- Mandatory vendor/service use

These limit your rights and resale potential.

8. Developer Still Controlling the Condo Corporation Years After Turnover

This usually indicates:

- Weak owner representation

- Biased decision-making

- Restricted access to financial records

The best buildings are owner-led.The best buildings are owner-led.

9. Title Issues: Wrong Area, Missing Floor Plan, Mismatched Details

Fixing title errors can take months—and stall bank loans or resale plans.

10. Building Feels Neglected

Sometimes the simplest checks reveal the truth:

- Dirty hallways

- Understaffed security

- Unmaintained amenities

- Poor lighting

- Peeling paint

When the visual cues are bad, the financials are usually worse.

This checklist is your strongest protection when entering a condominium purchase. A unit’s price per square meter may look good, but if the building is unstable—legally or financially—your investment’s long-term value collapses.

ROI, Rental Yields, and Investment Implications Under RA 4726

Condominium investing in the Philippines revolves around three pillars: rental income, capital appreciation, and operational flexibility (such as allowing rentals or short-term stays). RA 4726 doesn’t dictate market prices, but it directly shapes the conditions that influence how much you earn—and how fast your investment grows.

Understanding these mechanics gives you a massive advantage. Investors who read this section already outperform the market; those who ignore it often chase yields that crumble under dues, restrictions, and legal blind spots.

Typical Yields in Major PH Markets

Rental yields in the Philippines vary dramatically depending on location, developer reputation, unit size, and building age. While numbers shift year to year, the market consistently reveals clear patterns:

1. Metro Manila: Prime CBDs (4% – 6% Gross Yields)

Bonifacio Global City (BGC)

4.5% – 6%

Strong demand from expats, finance professionals, and multinational firms

Studio units outperform due to rapid turnover and high occupancy

Premium amenities contribute to stable pricing but higher dues

Makati CBD (Ayala Center, Legazpi, Salcedo)

4% – 6%

Corporate housing demand remains resilient

Older premium buildings offer higher net yields after lower acquisition costs

Ortigas Center / Pasig (Ortigas CBD, Kapitolyo, Bridgetowne)

4% – 5%

Growing corporate hubs stabilize occupancy; modern builds attract young professionals

2. Quezon City (Vertis North, Katipunan, Eastwood): 3.8% – 5%

- High demand from students, BPO workers, and hospitals

- New mixed-use developments like Vertis North improving long-term yields

3. Cebu City (IT Park, Lahug, Mandani Bay): 4.5% – 6%

- Explosive BPO growth sustains strong rental demand

- Cebu IT Park remains a national hotspot for studio rental yields

4. Davao City (Downtown & Lanang): 3.5% – 4.5%

- More conservative market but stable for long-term holds

5. Older Buildings (10–20 Years Old): 6% – 8% Potential Gross Yields

- Lower entry price = higher initial yield

- But:

- Higher association dues

- Larger repair risks

- Higher vacancy risk

- More unpredictable special assessments

Investor Rule:

Gross yield is irrelevant. Net yield determines actual profit—and RA 4726 directly affects your net yield through governance, dues, repairs, and restrictions.

How RA 4726 Affects Capital Appreciation

RA 4726 plays a subtle but powerful role in determining how much your condo appreciates. The law governs the structural, financial, and operational systems that influence long-term property value.

Here’s how:

1. Strong Governance Boosts Appreciation

Buildings with transparent condo corporations and healthy reserve funds maintain:

- Better maintenance

- Stronger curb appeal

- Lower tenant turnover

- Higher resale value

Well-governed condominiums age gracefully—and financially outperform poorly managed ones.

2. Clear Legal Boundaries Reduce Buyer Risk

RA 4726 makes titles, boundaries, and ownership rights predictable. When units are easy to transfer and legally clean, demand stays strong, pushing prices upward.

3. Foreign Ownership Caps Sustain Demand

The 40% rule creates controlled scarcity.

When foreign ownership slots run out, foreign buyers shift demand to nearby projects, boosting appreciation in competitive areas like Makati, BGC, Ortigas, Cebu IT Park, and QC Vertis North.

4. RA 4726 Stabilizes Common Areas and Amenities

Legal protection of common areas ensures:

- Amenities cannot be arbitrarily removed or repurposed

- Owners cannot privatize or monopolize shared spaces

- Improvements require collective approval

These safeguards protect long-term desirability—especially in amenity-driven markets.

5. Redevelopment Rules Preserve Land Value

Older buildings in prime areas often reach redevelopment discussions.

Because owners maintain undivided interest in the land, they can benefit from:

- Joint venture redevelopment

- Developer buyouts

- Allocation of new units in future towers

This potential upside makes older condos in prime locations a hidden gem for investors with a long-term horizon.

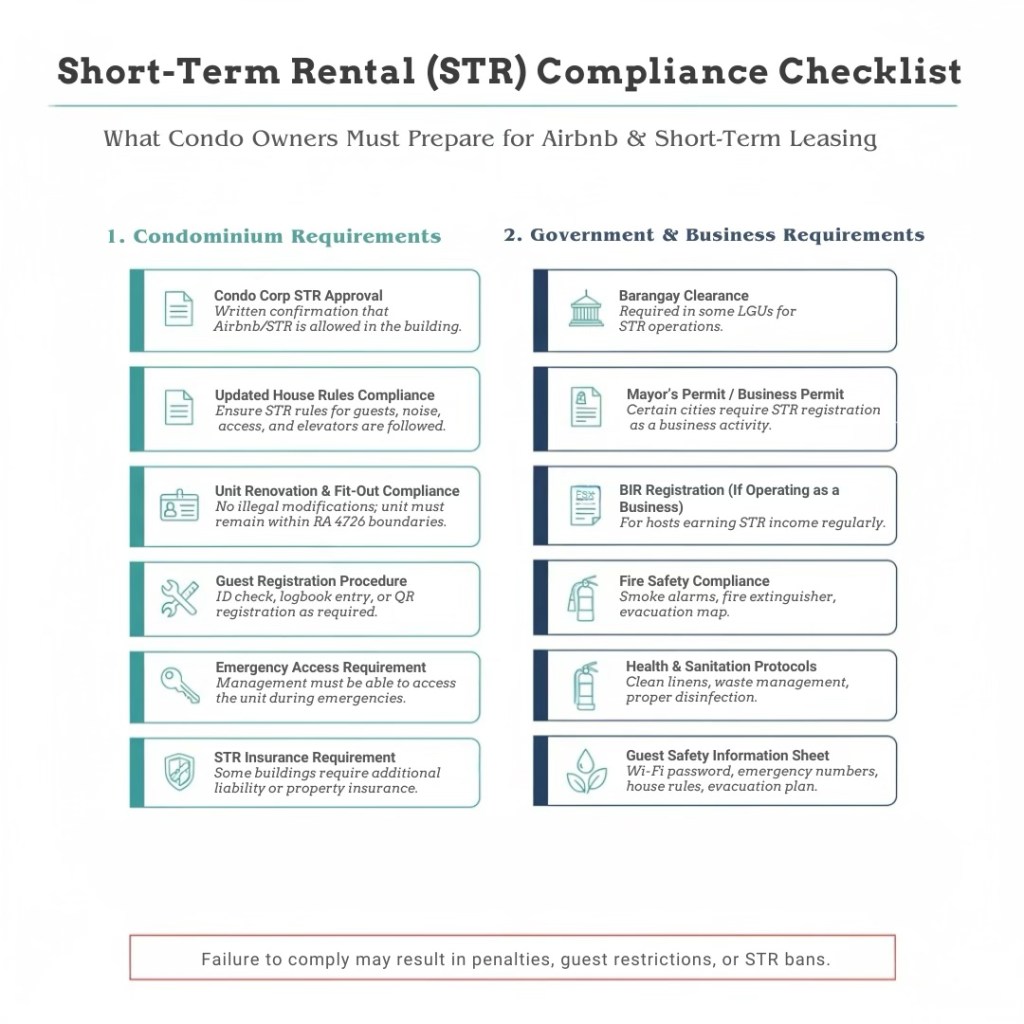

Airbnb/Short-Term Rental Limitations

Short-term rentals can push yields significantly higher—sometimes 8% to 12%, especially in CBDs close to business districts, hospitals, and transport hubs. But RA 4726 intersects with house rules and city regulations in ways that investors must understand before entering the STR market.

1. RA 4726 Allows (But Does Not Guarantee) Short-Term Rentals

Legally, the unit owner can rent out their unit unless:

- The Master Deed prohibits it

- The Condo Corporation imposes restrictions

- LGU ordinances require additional compliance

RA 4726 does not automatically give you the right to run an Airbnb business—it simply gives the condominium corporation the authority to regulate it.

2. Buildings Can Restrict or Ban Airbnb

Condominium corporations may choose to:

- Allow it

- Allow it with limitations

- Restrict it to certain floors

- Ban it entirely

Buildings that lean towards long-term family residency often ban STRs due to safety concerns, foot traffic, and amenity misuse.

3. Cities May Impose Local Regulations

Some LGUs require:

- Business permits

- Tourism registration

- Health and safety compliance

- Condo corporation approvals

Failing to comply exposes owners to penalties.

4. Higher Wear and Tear = Higher Costs

Short-term rental units typically face:

- Higher cleaning costs

- Faster furniture turnover

- More frequent repairs

- Higher risks of neighbor complaints

These reduce net yield unless priced properly.

5. Insurance Requirements

Many condo corporations require:

- Additional insurance coverage

- Security deposits

- Guest registers and ID checks

This protects the building but adds operational complexity for STR investors.

Short-term rentals can be extremely profitable—but only in buildings and cities that explicitly allow them. RA 4726 gives condo corporations the power to regulate or restrict this business model, so smart investors verify the rules before buying.

Investor Takeaway: RA 4726 Favors the Prepared

RA 4726 doesn’t restrict investors—it rewards informed ones.

If you understand:

- foreign ownership caps,

- governance rules,

- STR limitations,

- repair obligations, and

- redevelopment potential…

You can outperform most condo investors who only look at price per square meter.

Mortgage and Financing Notes

Financing a condominium in the Philippines looks straightforward—submit documents, wait for approval, get the keys. In reality, banks follow strict internal rules tied to RA 4726, project accreditation requirements, borrower risk scoring, and building conditions. One missing document or an unaccredited project can collapse your loan even if your income is strong.

Understanding these rules helps you secure better rates, avoid delays, and choose units that banks are actually willing to finance.

Bank Requirements for Condo Buyers

Banks assess both you and the project before approving a loan. Even if your income is strong, a condo in a non-accredited or high-risk building will be rejected instantly.

Here are the standard borrower requirements:

1. Income and Employment Documents

Banks look for stable, verifiable cashflow.

Expect to submit:

- Certificate of Employment (COE) with compensation

- Latest payslips (1–3 months)

- Latest ITR / Form 2316

- For self-employed: DTI/SEC docs + Audited FS

Banks analyze income stability, not just salary amount. Irregular or unverifiable income signals risk.

2. Identification and Proof of Residence

- Government-issued IDs

- Proof of billing

- Marriage certificate (if applicable)

Banks verify your identity, marital status, and capacity to enter a long-term mortgage.

3. Credit Standing and Liabilities Check

Banks review:

- Credit history

- Existing loans

- Credit card payment history

- Any outstanding obligations

A clean credit history increases approval chances and lowers interest rates.

4. Unit Documentation

Banks require proof that the unit is legally recognized and transferable under RA 4726.

They will request:

- CCT (or developer’s master title for preselling)

- Contract to Sell

- Master Deed & DoR references

- Unit specs and developer-issued computation

If the developer fails to provide any of these, the loan stops immediately.

5. Proof of Equity Payment

Most developers require 10%–30% equity before endorsing your application.

Banks want proof of:

- Official receipts

- Payment schedules

- Updated statements

Incomplete equity payments stall loan approval.

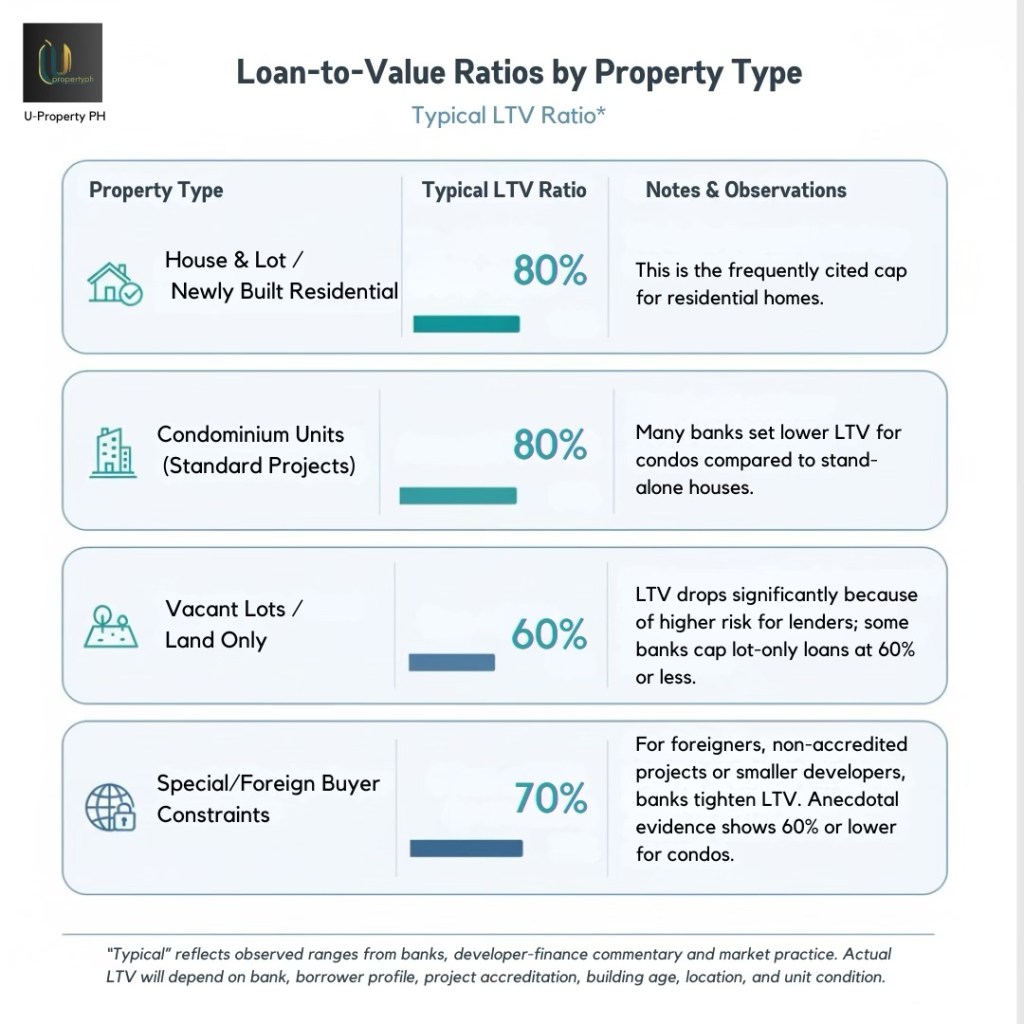

Loan-to-Value and Project Accreditation

Banks are extremely cautious when financing condos, especially in older or under-maintained buildings. They evaluate the loan-to-value ratio (LTV) and project accreditation before approving any mortgage.

1. Loan-to-Value Ratio (LTV)

LTV determines how much the bank is willing to finance.

Typical LTV for condos:

- Up to 80% for prime, accredited projects

- 70% or lower for older buildings

- 50% or lower for units in buildings with structural issues, legal risk, or poor financials

This means you may need a bigger down payment than expected if the project isn’t in top condition.

2. Project Accreditation Criteria

Banks evaluate the building as rigorously as the borrower. A project must show:

- Clean Master Deed & clear developer title

- No ongoing legal cases

- Proper registration with DHSUD

- Stable condo corporation and low delinquency rate

- Good physical condition and maintenance

- Updated permits and occupancy certificates

If the project fails accreditation:

- The loan application is automatically denied

- Buyer is forced into in-house financing (higher interest)

- Developers may withhold turnover until full payment

A weak building ruins even the strongest financial profile.

3. Unit Condition Matters (Especially for Resale)

For resale units, banks require an appraisal. They check:

- Water pressure

- Electrical system age

- Structural cracks

- Waterproofing quality

- Elevator reliability

- Common area cleanliness

- Building maintenance history

If the building is deteriorating or mismanaged, the appraised value drops—and so does your loanable amount.

4. Developer Reputation Affects Lending Ease

Banks prefer developers with:

- Strong delivery track records

- Transparent documents

- Low complaint ratios

- Proven financial stability

Top-tier developers (Ayala, Rockwell, Megaworld, DMCI, Robinsons, Federal Land) usually get higher LTVs and faster approvals.

Emerging or lesser-known developers face more scrutiny and lower loanable values.

Financing Rules for Foreigners

Foreigners are allowed to own up to 40% of a condominium project—but financing is where the rules tighten dramatically.

1. Most Philippine Banks Do NOT Offer Home Loans to Foreigners

The vast majority of Philippine banks only finance:

- Filipino citizens

- Dual citizens

- Filipino residents married to foreigners

Pure foreign buyers usually need:

- Cash payment

- In-house financing

- Offshore bank loans

- Corporate financing (if buying through a Philippine corporation)

2. Exceptions: A Few Banks Consider Foreigners

Some banks may lend to foreigners under specific conditions, such as:

- Long-term residency in the Philippines

- Stable Philippine-based income

- Married to a Filipino citizen

- Strong local credit footprint

- Can provide extensive financial documentation

But approval is difficult and uncommon.

3. Foreign Corporations Face Tougher Requirements

A foreign-owned corporation (40%+ foreign equity) must show:

- SEC registration

- Proof of business operations in the Philippines

- Corporate financial statements

- Board resolutions authorizing the purchase

Banks scrutinize corporate buyers heavily due to risk and compliance controls.

4. In-House Financing Is the Most Viable Path for Foreigners

Developers typically offer:

- 5 to 10-year payment terms

- Higher interest rates

- Lower documentation requirements

This is why many foreign buyers prefer preselling projects—they can lock in flexible payment structures without relying on bank approval.

5. Cash Buyers Gain Negotiating Power

Because foreigners often purchase in cash, they can:

- Negotiate better discounts

- Close deals faster

- Compete effectively in high-demand buildings

Cash purchases also bypass foreign lending restrictions entirely.

Investor Advantage: Understand the Financing Matrix Before Buying

RA 4726 governs ownership, but financing determines the real cost of your investment.

Smart investors analyze these factors before entering a deal:

- Project accreditation status

- Building age and financial health

- Developer credibility

- LTV ratios for similar units

- Restrictions for foreigners