A policy shift just dropped—subtle on paper, seismic in impact. The Securities and Exchange Commission (SEC) has proposed sweeping reforms to the Philippine Real Estate Investment Trust (REIT) framework, and it’s not just a bureaucratic update. It reshapes how capital flows through the property market.

Within the past week, the SEC issued draft rules that:

- Expand what qualifies as income-generating real estate—now including logistics hubs, telco infrastructure, energy assets, data centers, and transport-linked developments.

- Loosen how REITs can structure and recycle assets through SPVs and indirect holdings.

- Strengthen transparency and investor protection, especially around leases, fees, and related-party transactions.

Most people will scroll past headlines like these. They shouldn’t.

If you own a condo, plan to buy one, invest through REITs, or build a property portfolio from abroad as an OFW, these reforms influence:

- future property valuations,

- rental yield benchmarks, and

- where institutional capital flows next.

This article breaks down what changed, why it matters, and how both large-scale developers and everyday property investors can reposition early—while the rules are still being finalized.

Table of Contents

- What Exactly Did the SEC Change in the REIT Rules?

- Where the Philippine REIT Market Stands Today

- Why These New Rules Matter to Investors

- How Developers and Landlords Can Capitalize on the New Rules

- What Does This Mean for Condo Owners and Small Investors?

- How REIT Reforms Align With the 99-Year Land Lease Law

- Step-by-Step: How to Start Investing in Philippine REITs

- Step 1 — Choose Your Entry Strategy

- Step 2 — Open and Fund a Brokerage Account

- Step 3 — Screen REITs by Sector and Asset Type

- Step 4 — Check the Right Metrics (Not Just Dividend Yield)

- Step 5 — Start Small and Build Over Time

- Step 6 — Pair REITs With Physical Assets (Hybrid Strategy)

- Step 7 — Rebalance Annually Based on Yield Spread

- FAQs and Common Misconceptions

- Final Takeaways: Position Yourself Before the Market Moves

What Exactly Did the SEC Change in the REIT Rules?

| Rule Category | Old Rules (Before Proposed Amendments) | New Rules (Proposed Amendments) | Why It Matters (Investor Impact) |

|---|---|---|---|

| Eligible Asset Types | Mostly traditional real estate: office towers, malls, hotels, commercial buildings | Expanded to include logistics hubs, warehouses, data centers, telecom infrastructure, energy-linked assets, long-term leases, transport-related real estate | REITs align with real economic drivers (infra, digital sectors) for more stable, diversified income streams |

| Asset Holding Structure | REIT must directly own income-generating properties | Allows indirect ownership through wholly owned unlisted SPVs (special purpose vehicles) | Easier portfolio structuring for faster expansion pipelines & more REIT listings |

| Reinvestment Period for Capital Raised | Must reinvest proceeds within 1 year | Extended to 2 years, with more flexible conditions | Sponsors can deploy capital strategically, not reactively for higher-quality acquisitions |

| Minimum Public Float / Ownership Requirements | Strict and inflexible public float requirements tied to listing | Conditional flexibility when injecting new assets into REITs (still regulated, requires disclosure) | Improves ability to add large assets without immediate dilution issues for more frequent expansions |

| Disclosure Requirements | Standard reporting for listed property firms | Stronger disclosure on leases, related-party deals, fee structures, and asset types | Greater transparency builds foreign and institutional investor confidence |

| Portfolio Concentration | Heavily office- and mall-centric due to narrow definitions | Enables portfolio diversification across infra, logistics, digital economy, sustainability assets | Lower vacancy risk + less cyclical performance |

| Investor Participation | Practical focus on institutional and high-capital domestic players | More accessible through emerging asset classes + lower correlation sectors | Retail investors and OFWs gain access to infrastructure-style income |

| Strategic Use Case for Developers | REITs primarily exit channels for mature commercial assets | REITs become ongoing capital recycling engines for long-term projects, not just one-time monetization | Developers can build-repeat-scale instead of sell-and-stop |

The SEC’s draft amendments mark the most significant overhaul of Philippine REIT regulations in years—widening what counts as real estate, changing how assets can be held, and tightening investor safeguards. These aren’t tweaks. They reshape how capital can move through the property ecosystem.

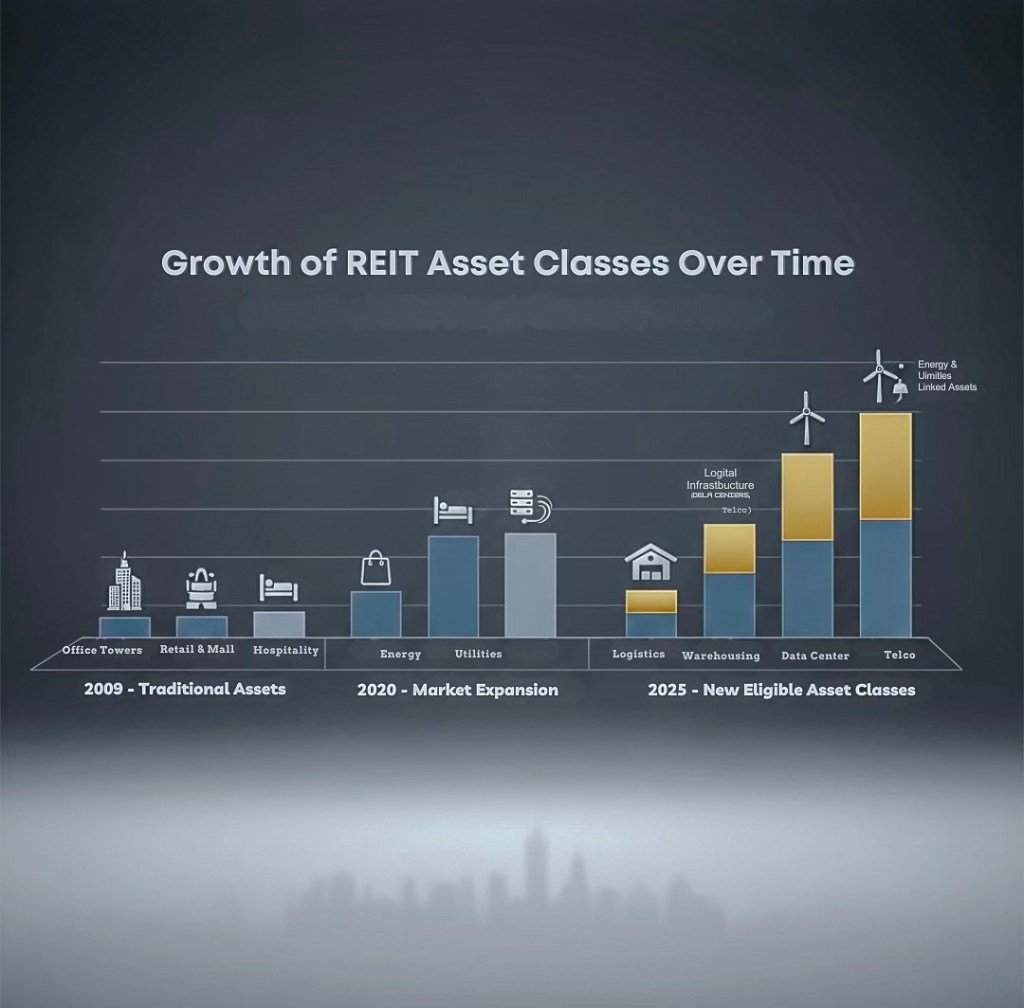

Expanded Asset Classes Beyond Traditional Buildings

REITs in the Philippines were historically anchored in familiar verticals: offices, malls, hotels, and serviced residential. Under the proposed reforms, the definition of “income-generating real estate” expands to include:

- Data centers and ICT infrastructure

- Logistics hubs, warehouses, and fulfillment facilities

- Transport-linked developments such as terminals or mobility facilities

- Selected energy and utilities-linked projects

- Long-term revenue-secure lease assets

Why this matters: REITs become less dependent on office demand and more aligned with economic fundamentals like connectivity, energy, and digital infrastructure—broadening where capital flows.

This turns REITs from “mall-and-office landlords” into platforms for infrastructure-adjacent growth.

More Flexible Asset-Holding Structures

The reforms allow REITs to hold assets directly or indirectly through unlisted special purpose vehicles (SPVs). This matters to developers more than it does to retail investors, but its downstream effects are significant.

Why this matters:

- Developers can reorganize assets into REIT portfolios without restructuring entire companies

- Smooth pipelines for future listings increase supply of investable assets

- More efficient asset transfers may accelerate expansion plans

Think of this as oiling the machinery behind how assets enter public markets.

“The reforms are designed to widen the scope of income-producing real estate and create a more flexible, transparent environment for long-term capital.”

Longer Reinvestment Windows + Float Adjustments

Previously, REITs needed to reinvest proceeds within one year. The draft rules extend this to two years, while also relaxing public float requirements when injecting new assets (subject to oversight).

Why this matters:

- Sponsors get time to deploy capital strategically—not reactively

- Acquisition pipelines become more deliberate, less rushed

- Retail investors may see steadier long-term portfolio expansion rather than sporadic jumps

This removes one of the biggest structural bottlenecks in the current REIT model.

Stronger Transparency & Investor Protection

The reforms introduce enhanced reporting standards covering:

- Lease terms and tenant disclosures

- Related-party transaction visibility

- Fees, lease profiles, and asset-type reporting

Why this matters:

High-yield assets mean nothing if investors can’t trust the numbers. Enhanced transparency increases market credibility, especially for foreign and institutional capital watching from the sidelines.

Where the Philippine REIT Market Stands Today

Philippine REITs are young by regional standards, but they’ve scaled faster than many expected. The first listing only happened in 2020 following delays after the 2009 REIT Act—but once regulatory kinks eased, capital flowed aggressively and the market quickly expanded across Metro Manila’s major CBDs.

Today, listed REITs span multiple sectors:

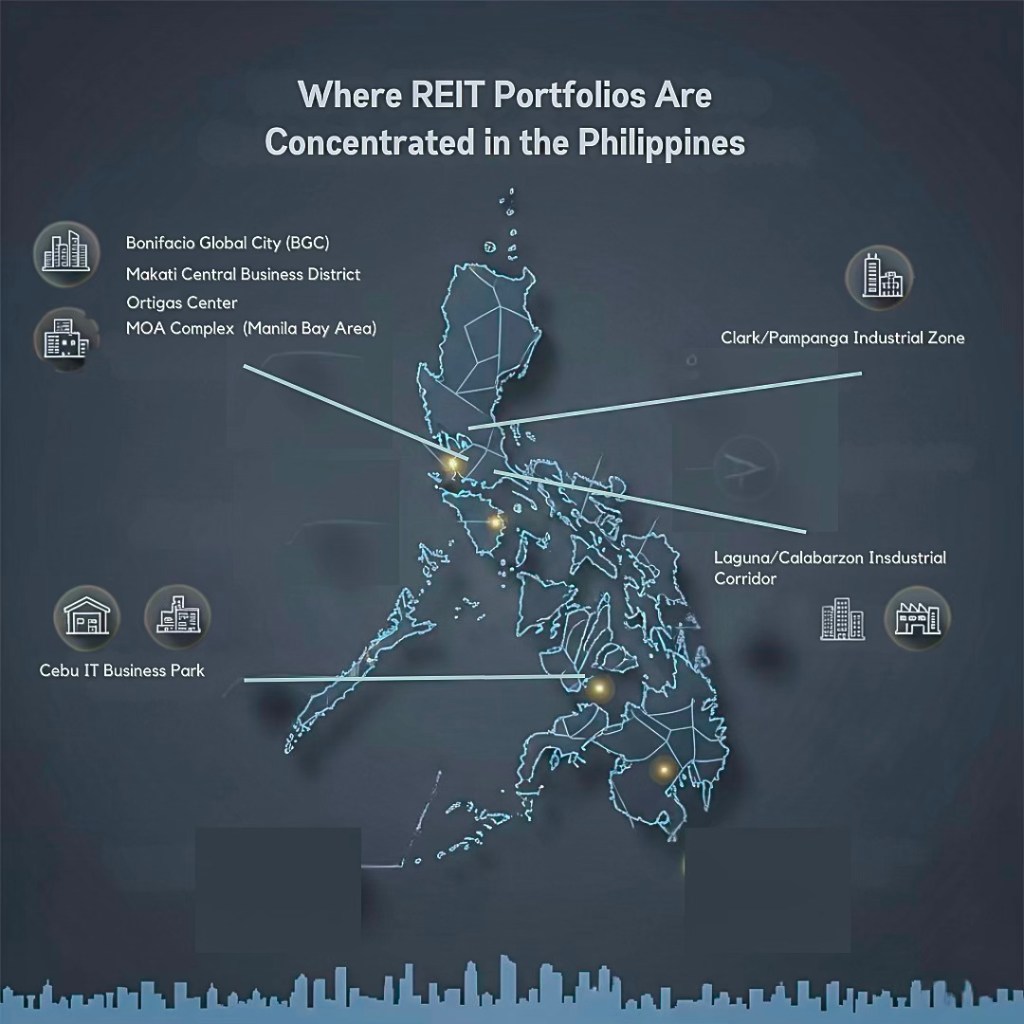

- Grade A office towers in BGC, Makati, and Ortigas

- Retail complexes and lifestyle malls in prime urban hubs

- Hotels, serviced apartments, and integrated developments

- Industrial parks and logistics sites serving the e-commerce economy

The landscape is maturing from “commercial trophy assets” to a broader platform that mirrors real economic activity—not just glossy metro skylines.

We’re shifting from premium CBD assets to economy-driving infrastructure and logistics.

A Growth Market Still in Its Early Chapters

Despite expansion, the Philippines remains far behind markets like Singapore and Japan in scale, listings, and subsector variety. That gap is not a weakness—it’s runway.

Current dynamics suggest:

- More REITs entering the market over the next few years

- A shift from office-heavy portfolios toward logistics, tourism, and energy-linked assets

- Increasing involvement from conglomerates that previously held assets privately

Current dynamics suggest:

- More REITs entering the market over the next few years

- A shift from office-heavy portfolios toward logistics, tourism, and energy-linked assets

- Increasing involvement from conglomerates that previously held assets privately

Investors entering now are still early—this market hasn’t peaked; it’s forming

“We will define what the income-generating assets are. We will enumerate them in order to minimise issues — what is really an income-generating asset. For example, the electric towers attached to the ground — that’s income-generating. That can be a REIT-able asset.”

Francisco Ed Lim, SEC Chairperson

How Investors Have Used REITs So Far

For many investors—especially OFWs—REITs became a gateway into property without the friction of:

- Down payments

- Tenant turnover

- Repair expenses

- Vacancy risk

They serve as a passive-income counterpart to hands-on condo ownership.

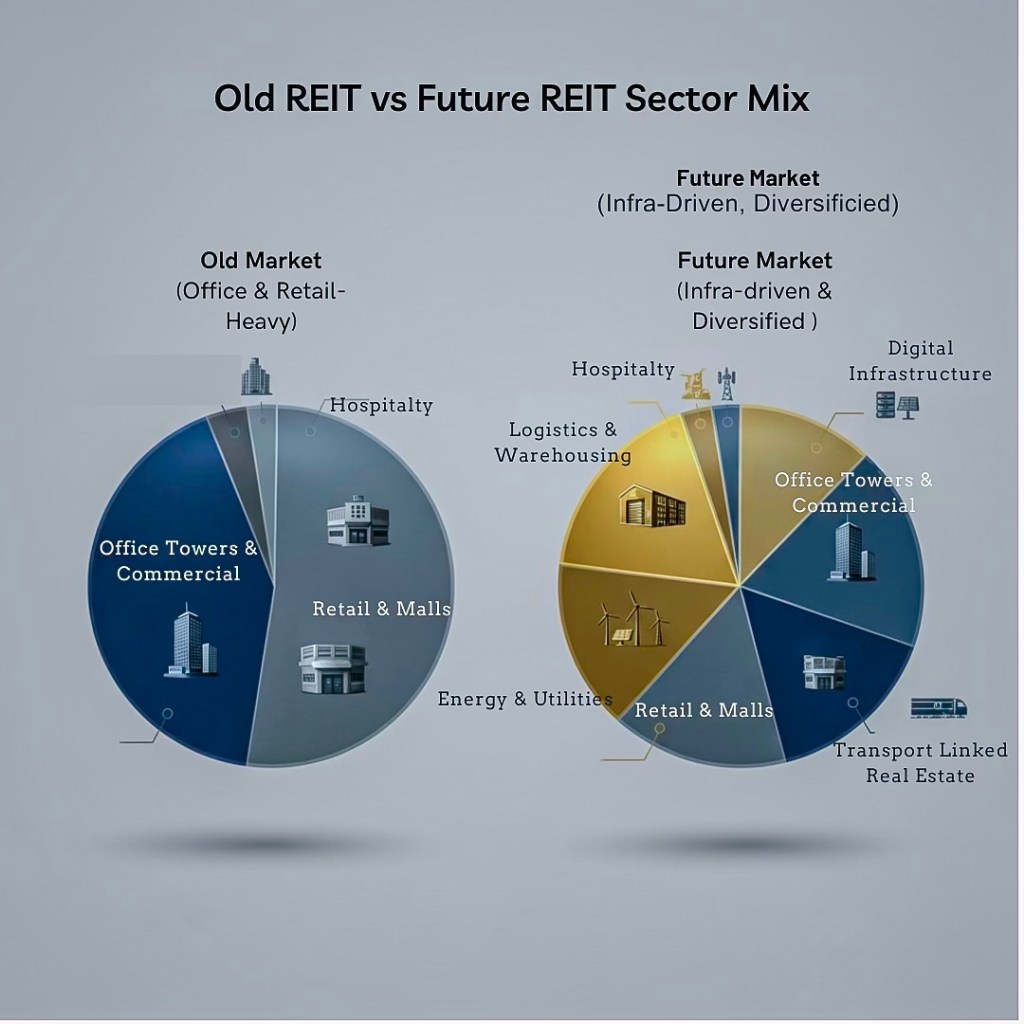

But until now, choices were limited. Most funds leaned heavily on office space, making diversification difficult. The new reforms change that trajectory.

REITs are evolving from office landlords into diversified real-asset portfolios. That opens new strategies for investors.

Why This Context Matters Before Discussing the New Rules

Rules don’t matter without understanding the baseline.

The reforms aren’t simply expanding technical definitions—they’re solving real structural limits:

- Too much reliance on office and retail demand

- Limited asset pipelines for expansion

- Regulatory friction that slowed capital recycling

This is the setup for why the overhaul matters: it unlocks growth in a market still early in development.

Why These New Rules Matter to Investors

This reform isn’t just regulatory housekeeping. It changes where money flows—and money flow dictates which assets appreciate, which sectors outperform, and where investors should position early.

REITs were previously limited to the same narrow asset types: offices, malls, hotels. That created concentration risk and made portfolios sensitive to business cycle swings. With the rule expansion, the investment universe widens into infrastructure, logistics, digital assets, and long-tenured leases—sectors driven by structural demand, not trend cycles.

In other words: less speculative, more essential.

When real estate aligns with infrastructure, returns become more durable.

New Sectors = More Defensive Income Streams

Adding logistics, energy-linked assets, and ICT infrastructure introduces cash flows tied to long-term contracts, not quarterly tenant turnover.

This matters if you’re:

- Tired of unit vacancies affecting ROI

- Stuck with office-heavy exposure

- Looking for inflation-resilient yield

- A first-time investor needing stability

Condo rentals rise with tourism and job growth. Infra-based assets rise with population, energy demand, and digital usage—even in slow markets.

Diversification Beyond CBD Offices

Before the reforms, choosing between Philippine REITs often meant choosing which office landlord to back. Now investors can diversify not just by location, but by economic driver.

Sample diversification paths:

- Urban consumption: malls, retail REITs

- Digital infrastructure: data centers, fiber networks

- Supply chain growth: logistics hubs, dry ports

- Tourism rebound: hotels + hospitality portfolios

Each has different cycles, risks, and catalysts.

Diversification isn’t a buzzword here—it’s insulation.

Potential Impact on Dividend Behavior

Philippine REITs are known for strong yields relative to bonds and savings accounts. With new asset classes, yield patterns may shift:

- Longer leases = smoother payout cycles

- Regulated/utility-type assets = lower volatility but competitive yields

- Fewer distressed-fire-sale acquisitions = steadier growth pacing

This is an evolution from income with volatility to income with resilience.

For many OFW and retiree investors, that shift matters more than headline percentages.

Lower Entry Barriers Than Physical Real Estate

Many investors want exposure to high-growth infrastructure corridors but can’t buy:

- An entire logistics facility

- Fiber network nodes

- Airport-linked land

- Data-center-zoned property

Many investors want exposure to high-growth infrastructure corridors but can’t buy:

- An entire logistics facility

- Fiber network nodes

- Airport-linked land

- Data-center-zoned property

REITs turn those assets into tradable shares.

Now a ₱5,000 beginner portfolio can participate in asset classes normally reserved for conglomerates.

This reform democratizes infrastructure investing, not just real estate.

Why This Should Change Your Strategy Now

Markets price in reform momentum before reforms take effect. Investors who wait for final implementation typically enter at higher valuations.

Early positioning lets you:

- Accumulate REIT positions before sector pipelines expand

- Reallocate away from overexposed office portfolios

- Align condo purchases with infra + logistics growth corridors

- Benchmark rental yields vs. REIT dividend yields to price smarter

Failing to adapt doesn’t just miss upside—it risks falling behind new yield benchmarks.

How Developers and Landlords Can Capitalize on the New Rules

These reforms don’t just expand REIT eligibility—they open new exits, new funding cycles, and new asset strategies. Developers who adapt early can recycle capital faster, build pipelines around infrastructure demand, and monetize portfolios that previously couldn’t qualify for listing.

Landlords with smaller holdings also gain leverage: valuation benchmarks shift, rental positioning changes, and assets can now be structured toward institutional-grade performance.

This is where the rules convert into opportunity.

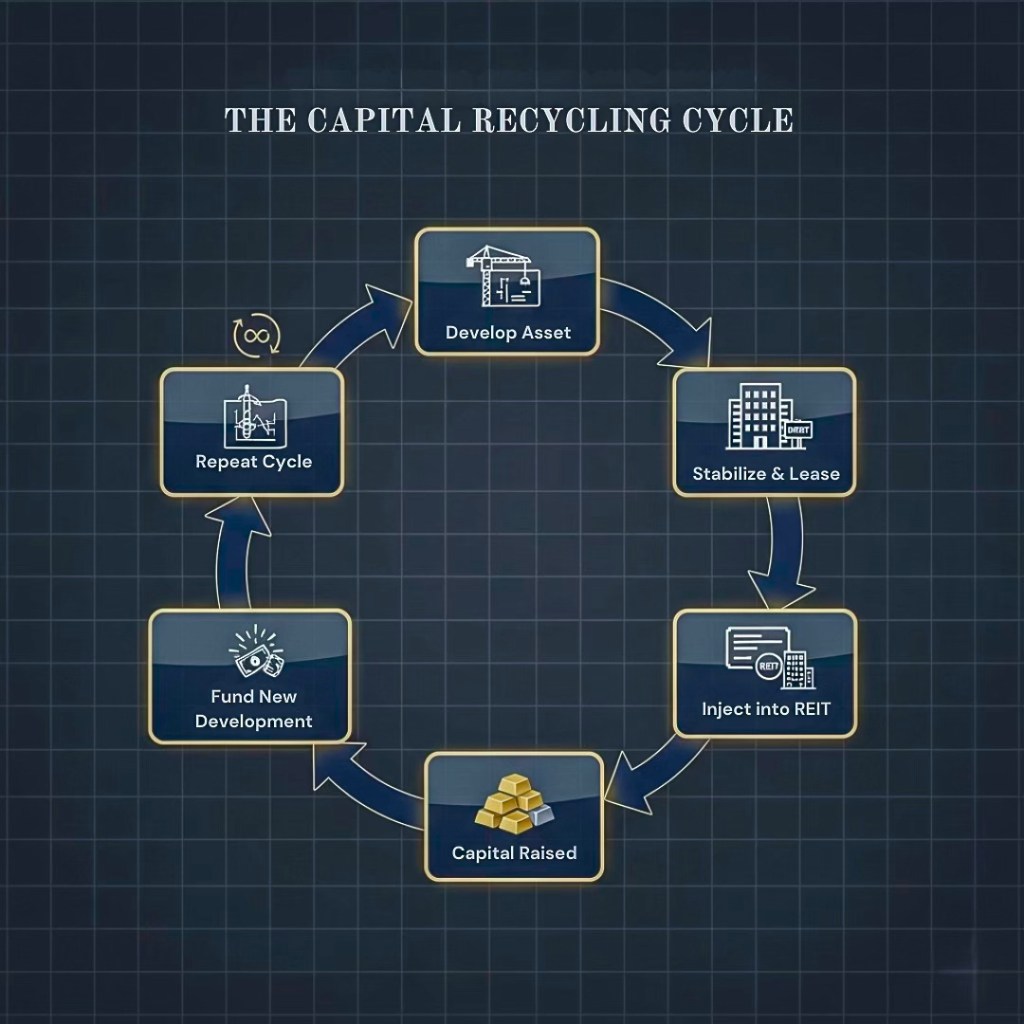

Capital Recycling: Build → Stabilize → List → Repeat

REITs turn real estate into a continuous growth engine instead of a one-time sale. With SPV flexibility and a longer reinvestment window, developers can:

- Hold assets just long enough to stabilize

- Inject them into REITs under clearer eligibility rules

- Use proceeds to fund the next development cycle

It’s not just about liquidity—it’s about velocity.

It’s not just about liquidity—it’s about velocity.

This favors developers in growth corridors like Bulacan, Pampanga, South NCR, Clark, Laguna, and Cebu, where logistics and infra projects create build-list-recycle flywheels.

Design and Leasing Strategies Will Evolve

A market moving toward long-tenure, infrastructure-aligned assets forces a higher standard of asset planning:

| Design Lever | REIT-Aligned Advantage |

|---|---|

| Longer WALE (≥6–10 years) | Smoother dividend cycles |

| ESG / Green certifications | Higher institutional demand |

| Anchor tenants w/ national presence | Lower vacancy risk |

| Proximity to rail, air, ports | Aligns with logistics flows |

This affects even condo developers:

- Properties near subway lines, airports, and business hubs gain stronger exit value

- Short-stay/hospitality models may feed into hotel REIT structures over time

- Build-to-rent portfolios may evolve beyond retail buyers

Each has different cycles, risks, and catalysts.

Diversification isn’t a buzzword here—it’s insulation.

Opportunities for Mid-Sized Developers & Portfolio Landlords

You don’t need to be Ayala, Filinvest, or Megaworld to benefit.

Smaller developers can:

- Package stabilized assets for sale to REITs or REIT-aligned funds

- Partner with larger players for acquisition pipelines

- Position rental buildings as “REIT-ready” assets through compliance, certification, and long-term tenancy strategy

For landlords with 10–50 units in Makati, Ortigas, Cebu IT Park, or Bay Area:

- Track REIT yields to price rentals more strategically

- Structure leases with longer guaranteed revenue to improve exit valuations

- Position buildings as feeder assets into future hotel, BPO, or logistics transactions

Your rental building is no longer just yielding income—it can become a financial instrument.

The Competitive Advantage Goes to Those Who Move Early

Once reforms finalize, asset prices adjust to reflect REIT eligibility. Early movers can secure:

- Lower land cost relative to future yield

- Higher valuation multiple upon stabilization

- First-mover advantage in underserved asset classes (cold chain, data, energy)

Waiting means entering after the market reprices.

What Does This Mean for Condo Owners and Small Investors?

At first glance, REIT reforms look like a win for billion-peso portfolios. But they hit the everyday condo owner, landlord, and first-time investor just as hard—because they change how rental performance, yield expectations, and property valuations will be benchmarked moving forward.

If you own a unit in Makati, BGC, Ortigas, Cebu IT Park, or Bay Area, these reforms aren’t background noise. They redefine your competitive landscape.

REIT Benchmarks Will Influence Condo Pricing and Yields

When investors choose between a condo and a REIT, they’re comparing:

- rental yield vs dividend yield

- appreciation potential vs liquidity

- hands-on management vs passive cash flow

If REITs start offering more stable, infrastructure-linked income streams, condo investments need stronger fundamentals to compete—not just location or amenities.

What this means for you:

- A studio in a prime CBD must justify higher risk with higher cash-on-cash returns

- Mid-tier condos in saturated markets may underperform against REIT dividend benchmarks

- Units near transport infrastructure may see premium pricing due to long-term demand drivers

REITs set the yield benchmark; condos must outperform it to stay compelling.

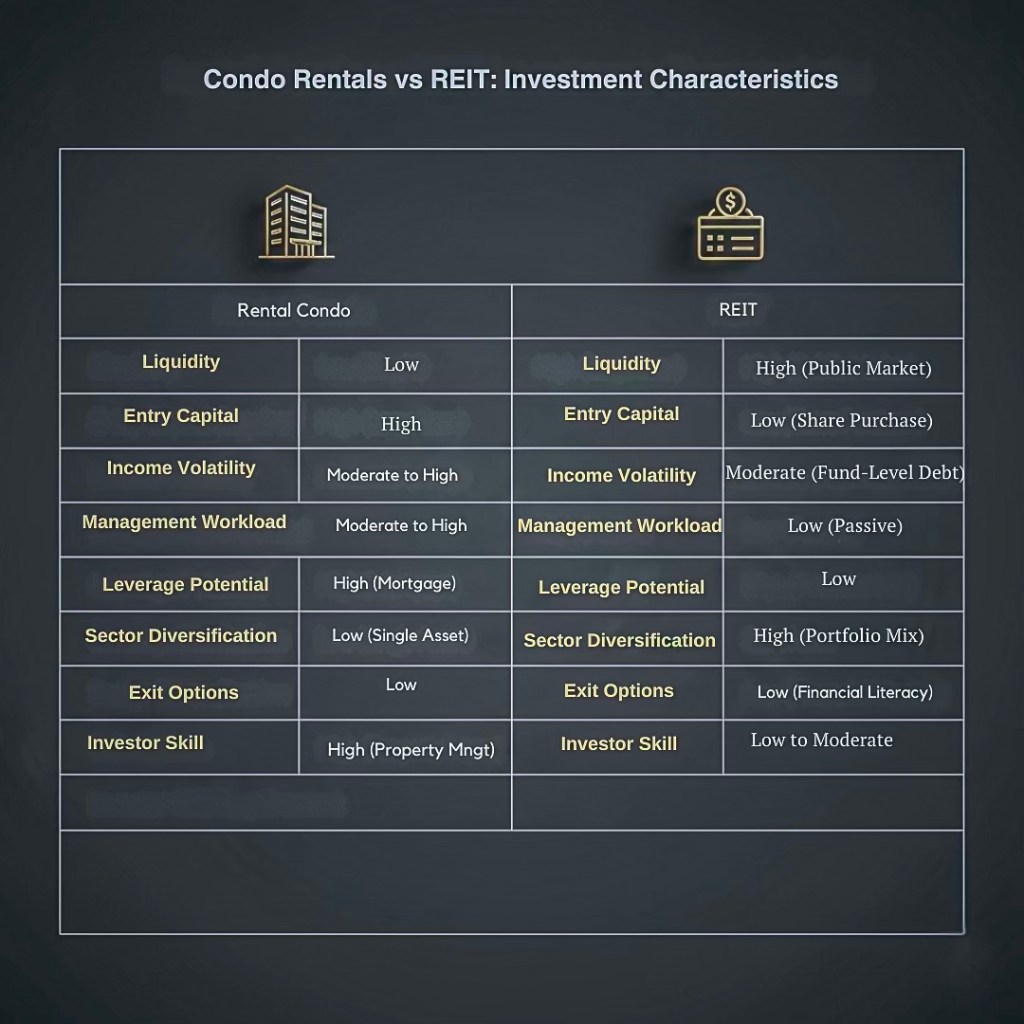

Condos vs REITs Are No Longer Either-Or—They Serve Different Roles

Owning a condo gives you control, leverage, and resale potential. REITs offer diversification, liquidity, and passive income.

Here’s how they stack strategically:

| Metric | Condo Investment | REIT Investment |

|---|---|---|

| Capital Required | High (downpayment + closing costs) | Low (₱3K–₱10K to start) |

| Liquidity | Low | High |

| Income Pattern | Tenant-dependent | Contract-driven dividends |

| Risk Type | Location-specific | Sector diversified |

| Ownership Type | Hard asset | Tradable financial instrument |

Neither is better. They play different roles:

- Condos → capital growth + leverage

- REITs → income stability + diversification

A modern Philippine portfolio needs both.

Studio Owners Can Use This as a Positioning Advantage

Your studio unit isn’t competing with other units—it’s competing with other asset classes.

Position studios as:

- Entry-level assets for first-time investors before scaling into REIT + condo hybrids

- High-yield rentals in transit-oriented or CBD-adjacent zones

- Units that align with infrastructure-driven demand (MRT-7, subway, NAIA redevelopment, Clark airport corridor)

Demand follows movement. Movement follows infrastructure.

REIT Growth Strengthens Rental Demand in Strategic Areas

As capital flows into logistics, transport, and digital infrastructure, expect spillover demand from workers, operators, support services, and foreign firms.

This helps condo landlords in:

- BGC → corporate HQ + tech hubs

- Makati → financial core + long-stay expats

- Ortigas → BPO consolidation + mid-market demand

- Clark + Pampanga → industrial + logistics

- Cebu IT Park → tech + FDI inflows

Your unit performs better when it’s located near supply chain nodes—not just malls.

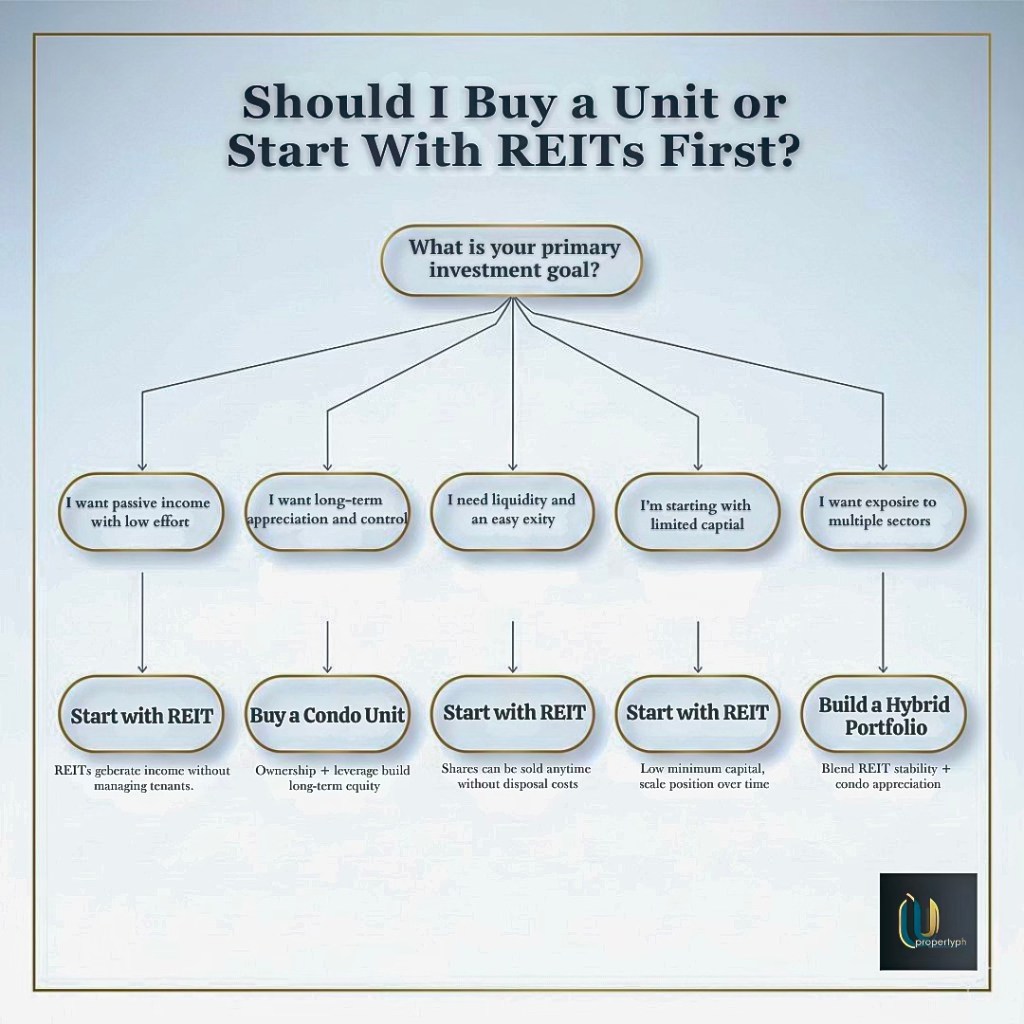

The Smart Play: Pair Physical Units With REIT Exposure

The best strategy for small investors isn’t just owning a unit or buying REIT shares—it’s sequencing both:

Suggested strategy path

1️⃣ Start with REITs for passive, low-capital entry

2️⃣ Accumulate cash + experience benchmarking yields

3️⃣ Acquire a strategically located condo once yield > REIT benchmark

4️⃣ Rebalance portfolio using REIT dividends + rental income

This gives you liquidity and ownership—and positions you against economic cycles, not just market hype.

Condos build wealth. REITs stabilize it.

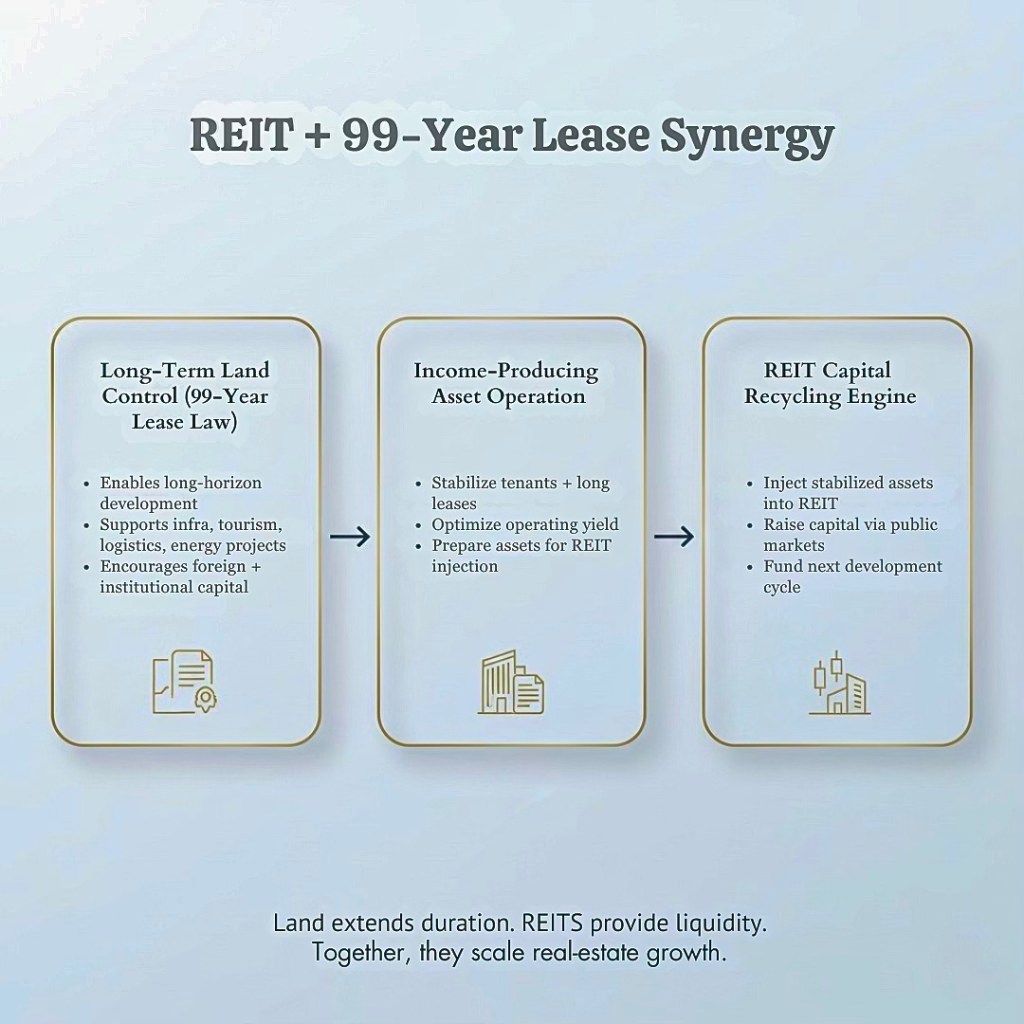

How REIT Reforms Align With the 99-Year Land Lease Law

These reforms aren’t isolated policy changes. The expansion of REIT asset classes and the passage of the 99-year lease law form a synchronized strategy: make Philippine real estate easier to own, easier to operate, and easier to scale for both local and foreign capital.

REITs address how income-producing real estate enters capital markets.

Long-term leases address how land-based projects stay viable for decades.

Put together, they lower friction for large-scale developments—from logistics corridors to data centers to tourism estates—by letting developers secure land long-term and exit through publicly listed vehicles.

One reform opens the door to capital. The other keeps capital in the country longer.

Why Long-Term Leases Matter to Investment Projects

Before RA 12252, foreign lease horizons were effectively capped at 75 years. That worked for condos and short-cycle commercial plays, but not for:

- Data and hyperscale computing facilities

- Manufacturing plants and industrial parks

- Airport-linked mixed-use districts

- Resorts and long-gestation tourism assets

- Renewable energy sites and power infrastructure

These projects require long-horizon capital and clear exit pathways. The combination of extended lease terms + REIT eligibility gives them both.

Develop for decades, earn cash flow, list the portfolio later.

The Pairing Unlocks Institutional-Scale Deals

Consider the development model that now becomes possible:

📌 Long-term land lease (up to 99 years) → Build income-producing infra → Inject into REIT → Recapitalize → Scale new sites

That creates:

- Lower upfront land cost for foreign/institutional players

- Faster capital recycling for developers

- Liquid investment products for the public market

- More supply of non-residential income assets

This is the country becoming investable at scale—not just purchasable at retail.

Where the Impact Will Likely Be Felt First

This shift matters most in high-growth corridors with logistics and tourism potential, not just central business districts:

📍 Clark, Pampanga / Tarlac — Airport logistics + industrial parks

📍 Cebu & Mactan — Tech hubs + hospitality pipelines

📍 Bulacan / North NCR Corridor — Rail, airports, tollway-linked nodes

📍 Subic & Cagayan North Ports — Trade & special economic zones

📍 Laguna / Batangas — Manufacturing + supply chain hubs

These aren’t mall-driven markets—they’re infrastructure economies.

What This Means for Investors and Condo Owners

For investors, this isn’t just about buying REIT shares—it’s about understanding which locations will see long-term institutional money.

Practical implications:

- Properties near infra corridors may appreciate faster as REIT funds expand into non-CBD assets

- Condo investors should benchmark rental yields against logistics- or infra-linked REIT dividends

- OFW investors can enter the market earlier via REITs before buying physical property in strategic areas

- Developers should design projects with REIT exit criteria from day one: long leases, strong tenants, infra proximity

You’ll make the most money where REITs and long-term leases overlap.

The Bigger Picture: Global Competitiveness

Other ASEAN markets already use REIT frameworks + long-horizon land control to attract foreign capital—Singapore, Thailand, Vietnam.

The Philippines is finally positioning itself to play in the same league.

This isn’t liberalization for the sake of politics—it’s structural modernization to:

- Increase capital market depth

- Reduce dependency on pre-selling models

- Bring large-scale projects into public investment channels

- Turn real estate into a capital market asset class, not just property ownership

This is the transition from land play → capital markets play.

Step-by-Step: How to Start Investing in Philippine REITs

Whether you’re a first-time investor, an OFW looking for passive income, or a condo owner diversifying beyond physical units, REITs provide a way to earn from income-generating real estate without managing tenants or handling repairs.

Here’s a streamlined path to get started—optimized for Philippine investors but applicable even if you’re overseas.

Step 1 — Choose Your Entry Strategy

Before opening an account, decide what role REITs play in your portfolio:

What’s your goal?

| Goal | Strategy | Example |

|---|---|---|

| Passive quarterly income | High-yield REIT picks | Office + retail portfolios |

| Long-term growth | Infra + logistics plays | Data centers, telco assets |

| Hedge against vacancy risk | Mix REITs + condo | Dual-stream income |

| Start investing with low capital | REIT-first strategy | Small monthly DCA buys |

Don’t just “buy REITs”—decide what job they perform in your portfolio.

Step 2 — Open and Fund a Brokerage Account

To trade REITs, you need a PSE-accredited broker.

Local investors

- BDO Securities

- BPI Trade

- COL Financial

- FirstMetroSec

OFW investors

- Brokers with remote KYC and global access

- Fund via Philippine bank remittance or digital wallets

What to prepare:

- Valid ID

- Proof of address

- TIN

- Funding method (bank, Instapay, SWIFT, remittance)

REITs trade like stocks—buy shares, receive dividends.

Step 3 — Screen REITs by Sector and Asset Type

Don’t pick based on brand name. Pick based on what economic driver you believe in.

Example filters:

| Sector Focus | Good For | Risk Level |

|---|---|---|

| Office-heavy | Yield + blue-chip tenants | Higher vacancy risk |

| Malls + retail | Consumer spending | Cyclical |

| Hotels + tourism | Reopening + foreign demand | Seasonal |

| Industrial + logistics | E-commerce + supply chain | Rising sector |

| Infra + energy | Long-term stability | Policy-sensitive |

This section should encourage intentionality—not blind buying.

Step 4 — Check the Right Metrics (Not Just Dividend Yield)

High yield ≠ good investment.

Key metrics to review:

- Dividend yield (trailing 12mo + forward)

- Occupancy rate & WALE (weighted average lease expiry)

- Portfolio tenant mix

- Gearing/leverage ratios

- Pipeline for new asset injection

- Diversification across regions + se

If you’re used to condos, think of these like:

- WALE → tenant contract length

- Gearing → mortgage leverage

- Dividend yield → rental income NET of vacancy

A 7% dividend with weak tenants is worse than 5% from long-term contracts.

Step 5 — Start Small and Build Over Time

Instead of timing the market, accumulate gradually.

Smart approaches:

- Monthly cost-averaging

- Buy-on-dip strategy around rate shifts

- Add positions when new asset pipelines are announced

This helps mitigate timing risk and builds habit.

Step 6 — Pair REITs With Physical Assets (Hybrid Strategy)

A high-performing portfolio doesn’t choose between rentals and REITs—it blends both roles:

- Condos → appreciation + leverage

- REITs → steady, liquid dividends

- Infra assets → long-term macro exposure

If you already own units:

Use REIT yields as competitive benchmarks for setting rental prices and evaluating new purchases.

If you’re starting from zero:

Start with REITs to build passive income and move to RFO units once returns outpace dividend benchmarks.

Step 7 — Rebalance Annually Based on Yield Spread

One year from now, review performance:

- Did your condo outperform REITs after expenses?

- Did logistics REITs gain vs office-heavy portfolios?

- Did interest-rate cycles affect dividends?

Move capital where returns are strongest—not where emotions are.

Portfolios should evolve with the market, not stay loyal to assets.

Unlock the REIT Investment Starter Pack

A practical checklist to help you choose the right REIT, benchmark dividend performance, avoid common mistakes, and start investing with clarity—not trial-and-error.

- Step-by-step beginner roadmap

- Sector breakdowns (logistics, digital infra, retail, office)

- Red-flag screening checklist

- Portfolio strategy templates

- Designed for PH investors, OFWs, and first-time buyers

Perfect if you’re choosing between rental property, REITs, or a hybrid portfolio.

Enter your email below to download the guide instantly

FAQs and Common Misconceptions

These reforms come with hype—and confusion. Here are the questions investors actually ask, answered in clear, strategic terms.

💬 “Are REITs only for big-time or institutional investors?”

No. REITs trade on the Philippine Stock Exchange like regular stocks. You can start with just a few thousand pesos and scale from there.

The difference isn’t capital—it’s discipline.

If you’re new and still building savings, REITs are the easiest entry point into income-producing real estate without buying a unit.

Start with REITs now, buy physical property once your yield benchmarks have a baseline.

💬 “Will REITs make condo investments less attractive?”

Only for units that can’t justify higher risk.

Condos compete by offering:

- control

- leverage

- long-term capital appreciation

- lifestyle or rental positioning

REITs compete by offering:

- stability

- passive income

- liquidity

- lower volatility

Smart investors hold both—but choose which one leads based on life stage and capital.

If your unit is in a slow-moving market? The REIT might outperform. If you’re in BGC steps from a transit line? The unit may win.

💬 “Which performs better: REIT dividends or condo rental income?”

It depends on:

- vacancy rates

- leverage cost

- taxes + repair costs

- market cycle

- sector exposure

Use this rule of thumb:

If your condo net yield isn’t beating top REIT dividend yields, your capital allocation needs re-evaluation.

Condos must outperform REITs after expenses, not just on paper.

💬 “Do I need experience in the stock market to invest in REITs?”

No—you only need:

- A brokerage account

- Funds

- A strategy based on sector, not hype

If you’re new, start with low-volatility sectors like logistics and infra rather than office-heavy plays.

This removes timing anxiety.

💬 “What happens if interest rates remain high?”

REIT yields may temporarily soften, but long-term income streams remain tied to:

- lease contracts

- inflation-linked escalations

- sector performance (e.g., tech + logistics demand)

High-rate environments are actually ideal accumulation phases before valuations compress on recovery.

💬 “Is it risky to invest now while rules aren’t final yet?”

The market prices in reform momentum before final implementation. Early entry typically captures upside, not late entry.

Waiting until rules finalize means:

- entering at potentially higher prices

- losing early-position accumulation time

Still—invest based on sector quality, not just “reform hype.”

💬 “Can smaller landlords benefit even if they never list in a REIT?”

Absolutely. REITs influence:

- demand concentration

- pricing power

- cap-rate benchmarks

- investor expectations

Move capital where returns are strongest—not where emotions are.

Portfolios should evolve with the market, not stay loyal to assets.

Final Takeaways: Position Yourself Before the Market Moves

The Philippine property market is entering a new phase—where buildings aren’t just owned, they’re financialized. REIT reforms expand what counts as income-producing real estate. The 99-year lease law extends how long major projects can operate. Together, they pull the country closer to Singapore- and Japan-style capital markets.

This isn’t a trend. It’s a shift in how wealth will be built in Philippine real estate for the next decade.

If you’re investing in condos, REITs, land, or integrated developments, your question isn’t:

“Should I invest?”

“Where does my capital deliver the strongest returns in this new ecosystem?”

Because capital will flow to:

- transit-linked corridors

- logistics + digital economy nodes

- yield-stable infra assets

- prime urban rentals that outperform REIT benchmarks

Those who adapt early win. Those who hold outdated portfolios get left behind.

Your Next Strategic Move

Before opening an account, decide what role REITs play in your portfolio:

What’s your goal?

| Goal | Strategy |

|---|---|

| If you’re a condo owner: | Compare your net yield vs REIT yields and reposition your rental strategy. |

| If you’re a first-time investor: | Start with REITs, then layer into physical assets once yield benchmarks are clear. |

| If you’re a developer or portfolio landlord: | Design assets with REIT exit standards—long WALE, infra proximity, institutional leasing. |

| If you’re OFW or abroad: | REIT-first strategy |

Use REITs as your entry point, then target acquisition in high-growth corridors when timing is optimal.

Don’t build investments around sentiment—build them around capital flow.

Leave a comment