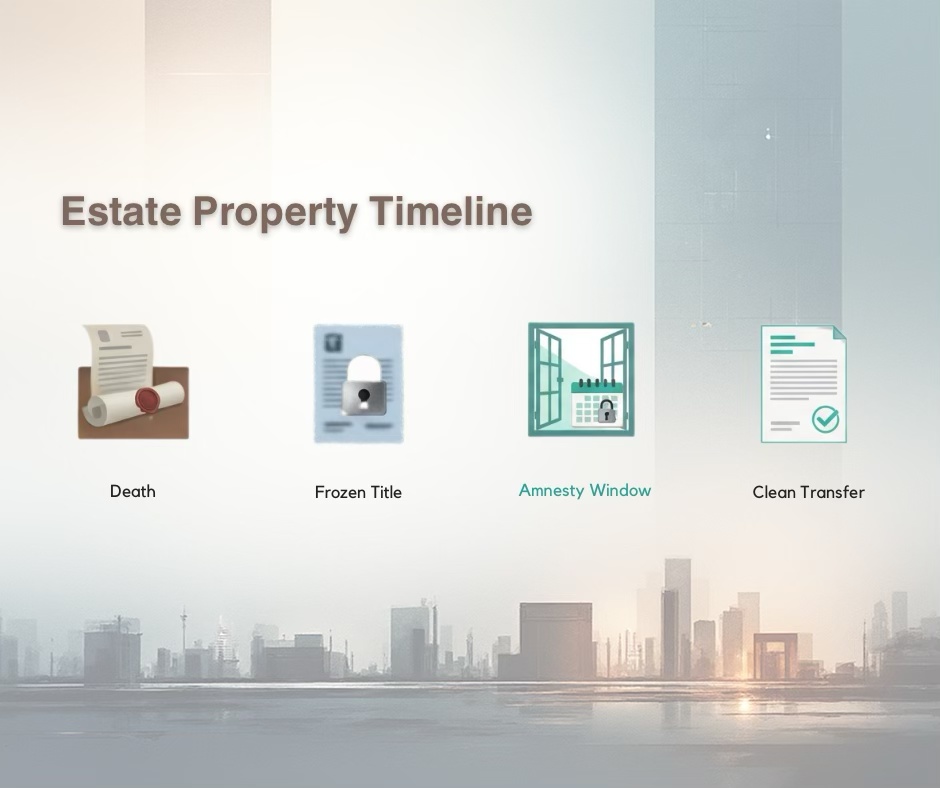

Most inherited properties stall at the “Frozen Title” stage. The estate tax amnesty creates the legal window to move forward.

A house sits quietly in Quezon City—fully paid, structurally sound, and rich with family history—yet for years, nothing meaningful happens to it. The property cannot be sold, leased, renovated, or transferred, not because the heirs lack interest, but because the original owner passed away and the estate tax was never settled. As a result, the title remains frozen, and the asset is effectively locked out of the market.

This situation is far more common than most people realize. In practice, this means billions of pesos’ worth of residential and provincial properties across the Philippines remain legally immobile at any given time.

Across the Philippines, thousands of inherited properties remain idle because of the unpaid estate taxes resulting in paralyzed ownership rights. Without a settled estate, titles cannot be transferred to heirs, buyers cannot proceed with confidence, and banks refuse to provide financing. What appears to be a valuable asset on paper slowly turns into a financial burden in reality.

Properties miss optimal selling windows during strong market cycles. Disagreements among heirs grow as time passes. Meanwhile, penalties and interest continue to grow in the background, turning what was once a manageable obligation into a far more expensive problem.

This is exactly the kind of situation the Estate Tax Amnesty was designed to address.

With Congress passing a bill seeking to extend the Estate Tax Amnesty until December 31, 2028, heirs and property owners are being offered a reset button. The extension preserves reduced tax rates, removes decades’ worth of penalties and surcharges, and gives heirs the opportunity to finally clean titles and unlock long-frozen value.

Handled properly, the amnesty allows inherited properties to re-enter the market with clean documentation, renewed liquidity, and real financial options. If ignored or delayed, it risks reverting to the old system—where estate taxes, penalties, and red tape once again make action prohibitively expensive.

This extension marks the moment when inherited property can finally stop being a legal complication and start functioning as a real, usable asset again.

TABLE OF CONTENTS

- What Is Estate Tax Amnesty in the Philippines?

- Estate Tax Amnesty Extension Bill: What Congress Approved and What Happens Next

- Who Benefits Most from the Estate Tax Amnesty Extension in the Philippines

- What Properties Are Covered Under the Philippine Estate Tax Amnesty

- How Much Money the Estate Tax Amnesty Can Save Heirs and Property Owners

- How the Estate Tax Amnesty Extension Impacts the Philippine Real Estate Market

- What the Estate Tax Amnesty Means for Property Buyers

- What the Estate Tax Amnesty Means for Heirs and Property Sellers

- Estate Tax Amnesty vs Regular Estate Settlement

- Step-by-Step Estate Tax Amnesty Process in the Philippines

- What the Estate Tax Amnesty Does NOT Fix

- Why Waiting Until 2028 to Settle Estate Tax Is a Bad Strategy

- When to Involve Professionals in Estate Tax Settlement

- Why the Estate Tax Amnesty Extension Matters Long-Term

- Ready to Move Forward? Get Clarity on Your Estate Property

What Is Estate Tax Amnesty in the Philippines?

Estate tax amnesty is the government’s way of saying this: settle past obligations at a discount, and we’ll let you move forward cleanly.

In practical terms, an estate tax amnesty allows heirs to pay a reduced estate tax rate on properties left behind by a deceased owner, while waiving penalties, surcharges, and accumulated interest that would normally apply. Once paid and processed through the Bureau of Internal Revenue, the estate is considered settled, and the legal transfer of property titles to heirs can finally proceed.

Without the amnesty, estate settlement is expensive, slow, and emotionally draining. With it, the process becomes financially survivable—and, more importantly, actionable. Estate tax amnesty does not eliminate the estate tax—it simply removes the financial penalties for delayed settlement.

Why Estate Taxes Stall Property Transfers in the Philippines

In the Philippine setting, estate tax effectively acts as a gatekeeper.

When a property owner passes away, ownership does not automatically transfer to heirs, even if everyone agrees on who inherits what. The title remains in the deceased person’s name until the estate tax is paid and the transfer is formally registered. As long as that step is incomplete, the property is stuck in legal limbo.

This creates a cascade of problems:

- The property cannot be sold because buyers require a clean, transferable title.

- The property cannot be mortgaged because banks will not lend against an unsettled estate.

- Any attempt to lease, subdivide, or develop the property carries legal risk.

Over time, unpaid estate taxes also grow more expensive. Regular estate settlement involves penalties and interest that compound year after year, often reaching amounts that heirs simply cannot afford. Many families delay action hoping for “better timing,” only to find the cost increasing while options disappear.

The result is a familiar pattern in Philippine real estate: valuable properties sitting unused for decades, not due to lack of demand, but due to unresolved estate obligations.

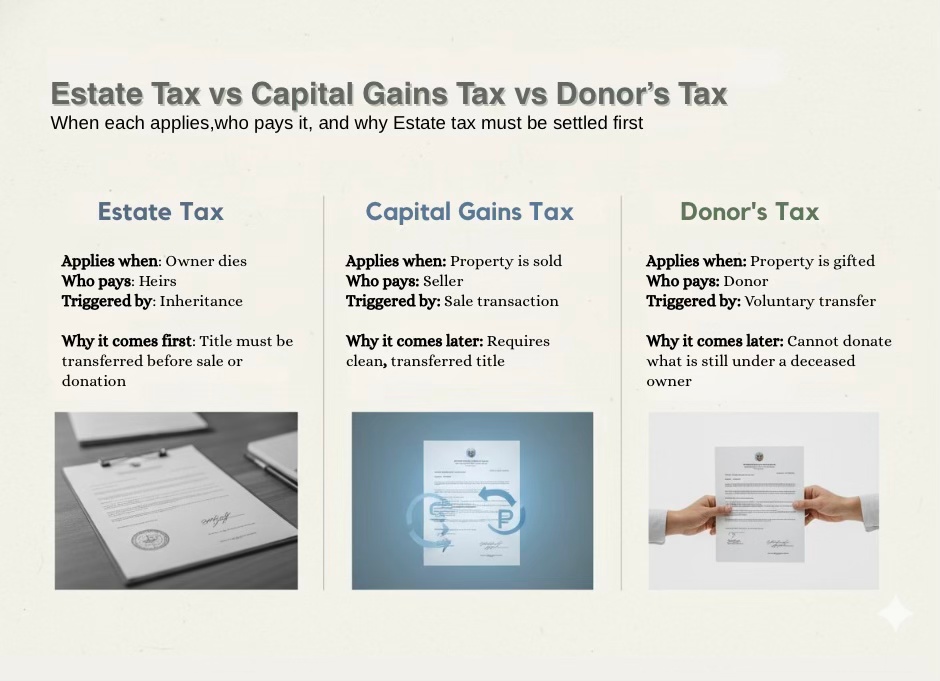

Estate Tax vs Other Property Transfer Taxes in the Philippines

One of the most common—and costly—misunderstandings among property owners is confusing estate tax with other real estate taxes. These are not interchangeable, and paying one does not cancel out the others.

Here’s the plain distinction:

- Estate Tax applies when a property owner dies. It is paid by the heirs before ownership can legally transfer from the deceased to them.

- Capital Gains Tax (CGT) applies when a property is sold. It is triggered by the act of selling, regardless of how the seller acquired the property.

- Donor’s Tax applies when property is given as a gift during the owner’s lifetime, rather than inherited after death.

Estate Tax vs Capital Gains Tax vs Donor’s Tax: When each applies, who pays it, and why estate tax must be settled first.

Estate tax comes first in inherited properties. Until it is settled, no valid sale, donation, or transfer can happen. This is why estate tax amnesty clears the first and most restrictive barrier, allowing all subsequent transactions to proceed legally.

At its core, estate tax amnesty is not about avoiding taxes. It is about restoring mobility to inherited property—so families can finally decide whether to keep, sell, develop, or pass on assets without being trapped by the past.

Estate Tax Amnesty Extension Bill: What Congress Approved and What Happens Next

Congress has taken a decisive step to keep inherited properties from remaining trapped in legal limbo.

The House of Representatives has approved a bill seeking to extend the Estate Tax Amnesty until December 31, 2028, effectively preserving the government’s most practical mechanism for helping families settle long-overdue estate obligations without punitive costs. This move recognizes a reality that a significant portion of Philippine real estate remains idle not because of market weakness, but because estate settlement has become financially and procedurally prohibitive under regular rules.

At its core, the bill keeps the same policy direction intact—reduced estate tax rates and the continued waiver of penalties, surcharges, and interest—while giving heirs additional time to act. For property owners who missed earlier deadlines, or those who only recently realized the consequences of unsettled estates, this extension reopens a window that many assumed had already closed for good.

New Estate Tax Amnesty Deadline: December 31, 2028

If enacted into law, the new deadline pushes the amnesty period four more years into the future, resetting the clock to December 31, 2028. That timeline matters more than it appears.

Estate settlement is rarely quick. Gathering documents, coordinating heirs (often across countries), resolving discrepancies in titles, and processing filings through multiple government offices takes time—sometimes years. The extended deadline acknowledges this complexity and gives families a realistic runway to complete the process properly rather than rushing into costly mistakes.

Just as important, the longer horizon allows property owners to plan strategically. Heirs can decide whether to settle now and sell later, settle and lease, or settle simply to preserve future flexibility. The extension restores choice, which is exactly what frozen titles take away.

How the 2028 Estate Tax Amnesty Deadline Compares to Previous Extensions

This is not the first estate tax amnesty, but it may be the most consequential.

Earlier amnesty windows were shorter and often underestimated. Many families delayed action, assuming extensions would always follow. When deadlines approached, government offices became congested, processing times ballooned, and last-minute filers found themselves racing against bottlenecks they could not control.

The proposed 2028 deadline appears designed to avoid repeating that cycle. By signaling early and clearly, Congress is encouraging proactive settlement rather than deadline-driven panic. Still, history offers a clear lesson: waiting until the final year almost always costs more—financially and emotionally—than acting earlier.

Legislative Status of the Estate Tax Amnesty Extension Bill

While approval by the House is a critical milestone, it is not the final step.

For the extension to become law, the bill must still pass through the remaining stages of the legislative process:

- Senate deliberation and approval, where provisions may be adopted as-is or amended

- Bicameral reconciliation, if House and Senate versions differ

- Presidential approval, which formally enacts the bill into law

- Issuance of Implementing Rules and Regulations (IRR), which operationalize the extension through the tax authorities

The estate tax amnesty extension must pass through all stages before implementation begins.

Only after the IRR is released will the extension be fully enforceable at the implementation level, particularly within the Bureau of Internal Revenue and local registries. Until then, the policy direction is clear—but execution remains pending. Until the implementing rules are issued, heirs and property owners should focus on preparation rather than execution

For heirs, buyers, and property professionals, this stage is about awareness rather than complacency. The intent is for the extension to move forward. The smart move now is preparation—so that once the law is finalized, action can begin immediately rather than from a standing start.

The next section can unpack who benefits the most from this extension—and why certain groups stand to gain far more than others.

Who Benefits Most from the Estate Tax Amnesty Extension in the Philippines

The estate tax amnesty extension does not have equal impact across the board. It benefits certain groups more than others depending on their property’s situation.

Families with Inherited Houses or Ancestral Land

For families holding inherited houses or ancestral land, the extension offers long-overdue relief from a problem that often spans generations. Many of these properties were never transferred after the original owner’s death, either because heirs were unaware of the requirement or because the accumulated estate taxes became too expensive to settle under regular rules.

The amnesty allows these families to finally legalize ownership at a fraction of the historical cost, clearing titles without the burden of decades’ worth of penalties and interest. More importantly, it restores control. Once the estate is settled, families can choose to keep the property, redevelop it, lease it for income, or sell it at market value—options that were previously off the table.

OFWs and Overseas Heirs with Inherited Property

For OFWs and heirs living overseas, estate settlement is often delayed not by unwillingness, but by distance and complexity. Coordinating documents, communicating with co-heirs, and navigating Philippine tax and registry systems from abroad can be overwhelming, especially when deadlines feel uncertain.

The extended amnesty window gives overseas heirs time and predictability. It allows them to plan visits, appoint representatives, consolidate documents, and align decisions with family members at home. For many OFWs, this extension turns estate settlement from an urgent crisis into a manageable, scheduled process—one that protects family assets instead of slowly eroding them.

Sellers of Long-Held Family and Inherited Properties

Some families know they will eventually sell inherited property but have been stuck waiting for “the right time” to settle the estate. The right time never arrived and the costs kept increasing.

The amnesty dramatically lowers the financial barrier to estate settlement, allowing sellers to unlock properties that have been held idle for years or even decades. Once titles are cleaned, these assets can finally enter the open market, where pricing is stronger, buyer demand is real, and negotiations are no longer derailed by legal uncertainty.

Buyers Looking for Secondary-Market Property Opportunities

Buyers—especially those focused on the secondary market—are indirect but significant beneficiaries of the extension. As more heirs settle estates and clean titles, previously untouchable properties become viable purchase options.

This expanded supply often includes well-located homes, older subdivisions, and family-held properties that never reached the open market. Buyers gain access to assets that were once locked behind legal barriers, often with more room for negotiation during the settlement phase. The amnesty reduces transaction risk, shortens closing timelines, and makes due diligence clearer—advantages that matter to both end-users and investors.

Real Estate Brokers and Property InvestorS

For real estate brokers and investors, the extension creates a healthier transaction environment. Clean titles mean fewer stalled deals, fewer collapsed negotiations, and less time spent untangling preventable legal issues.

Investors benefit from earlier entry points—working with heirs while estates are being settled rather than after values peak. Brokers, on the other hand, gain the ability to guide families through a clear, compliant process, adding real advisory value instead of merely listing properties.

In practical terms, the extension shifts estate-related transactions from being high-risk exceptions to manageable, repeatable deal types.

This extension reduces taxes, reshapes who can move, who can decide, and who can finally extract value from inherited real estate—and those who recognize their position early stand to gain the most. If you fall into any of these groups, the next question is not whether the amnesty matters—but whether your specific property qualifies.

What Properties Are Covered Under the Philippine Estate Tax Amnesty

One of the biggest reasons families delay estate settlement is uncertainty. Many heirs assume their property is either too complicated, too old, or too unusual to qualify for amnesty, so they postpone action indefinitely.

The guiding principle is simple: if the property formed part of a deceased person’s estate and the estate tax remains unpaid, it is generally within the coverage of the amnesty, regardless of property type or location. Eligibility under the amnesty does not automatically mean an easy settlement—process complexity still depends on documentation and coordination.

Residential Properties Covered Under the Estate Tax Amnesty

Residential properties are the most common assets covered under the amnesty. This includes inherited houses, townhouses, and condominium units, whether located in Metro Manila or in the provinces.

Even properties that have remained in the deceased owner’s name for decades are not automatically disqualified. As long as ownership can be traced and documented, heirs may still avail of the amnesty to settle the estate tax and proceed with title transfer. This is particularly relevant for family homes that were never sold, leased, or transferred after the owner’s passing, often because the legal process felt overwhelming or prohibitively expensive.

Agricultural and Provincial Land Under the Estate Tax Amnesty

Agricultural land and provincial properties are equally covered, despite a common belief that only urban or residential assets qualify. Many ancestral lands in the provinces remain untitled or under the original owner’s name simply because no transaction ever forced settlement.

The amnesty applies to these properties as well, provided they are part of the decedent’s estate. In fact, provincial and agricultural lands often benefit the most from the extension, since penalties and interest tend to accumulate quietly over long periods while land values gradually rise. Settling under the amnesty allows families to preserve, consolidate, or eventually monetize these holdings without absorbing the full historical tax burden.

Commercial and Mixed-Use Properties Covered by the Amnesty

Commercial buildings, rental properties, and mixed-use developments inherited by heirs also fall within the scope of the amnesty. This includes small apartment buildings, shophouses, office units, and income-generating properties that continued operating informally after the owner’s death.

While these assets may have generated income over the years, the underlying titles often remained unsettled. The amnesty allows heirs to regularize ownership, strengthen leasing arrangements, and position the property for sale or redevelopment with far less legal risk.

Inherited Properties with Multiple Heirs

Properties owned by multiple heirs are not excluded from coverage. In fact, the amnesty was designed with these situations in mind.

Whether the estate involves siblings, extended relatives, or heirs based in different locations, the presence of multiple heirs does not automatically disqualify the property. What matters is that the estate tax is settled collectively, following proper documentation and allocation. While coordination among heirs can be complex, the amnesty reduces the financial friction that often stalls these discussions in the first place.

Common Misconceptions About Estate Tax Amnesty Coverage

Properties owned by multiple heirs are not excluded from coverage. In fact, the amnesty was designed with these situations in mind.

Several misconceptions continue to prevent families from acting, even when their properties are clearly eligible:

- “The property is too old to qualify.” Age does not remove eligibility; unpaid estate tax is the determining factor.

- “The title is messy, so it won’t be covered.” Title issues may require additional steps, but they do not automatically disqualify the property from amnesty.

- “Only residential properties are included.” Agricultural, commercial, and mixed-use properties are also covered.

- “Multiple heirs make it ineligible.” Complexity affects process, not eligibility.

If you can answer “yes” to all four, the estate tax amnesty likely applies.

Understanding coverage often helps heirs realize their property qualifies, where the conversation shifts from if they can act to how and when.

How Much Money the Estate Tax Amnesty Can Save Heirs and Property Owners

For most heirs, the decision to act—or to delay—comes down to cost. The extension matters because it dramatically lowers the total cash required to unlock an inherited property, often by seven figures, even for modest assets.

Estate Tax Rates: Amnesty vs Regular Estate Settlement

Under current Philippine tax rules, the estate tax rate is a flat 6% of the net estate value. On paper, that rate applies whether or not an amnesty exists. The difference is not the base rate. The difference is everything that piles on top of it.

In a regular estate settlement, unpaid estate tax triggers:

- A 25% surcharge

- Annual interest on the unpaid tax (compounded over time)

- Additional penalties for late filing and non-compliance

Over a decade—or worse, multiple decades—these add-ons routinely exceed the original tax due.

Under the estate tax amnesty, these extras are stripped away. Heirs pay the basic estate tax, and penalties, surcharges, and interest are waived, provided the settlement is completed within the amnesty period and in compliance with its requirements.

Penalties, Interest, and Surcharges in Regular Estate Settlement

The most damaging part of regular estate settlement is not the tax itself, but time.

Consider what typically happens:

- The owner passes away.

- No immediate action is taken.

- Years go by.

- The property appreciates.

- The unpaid tax quietly accrues penalties and interest.

By the time heirs finally inquire, the bill feels overwhelming because the delay multiplied the cost. The amnesty freezes the damage and resets the obligation to its most basic form.

Estate Tax Cost Comparison: With Amnesty vs Without Amnesty

📍 The following figures are illustrative and may vary depending on property valuation, timing, and compliance requirements.

Example 1: Family House and Lot

- Estimated property value: ₱5,000,000

- Base estate tax (6%): ₱300,000

Without Amnesty (after years of delay):

- Base tax: ₱300,000

- Surcharges + interest (illustrative): ₱250,000–₱400,000

- Total payable: ₱550,000–₱700,000+

That difference alone can determine whether a family moves forward or stays stuck.

Example 2: Small Commercial or Rental Property

- Estimated value: ₱12,000,000

- Base estate tax (6%): ₱720,000

Without amnesty, total liabilities can easily push past ₱1.2M–₱1.5M, depending on how long the estate remained unsettled. Under the amnesty, the obligation stays close to the original ₱720,000—often the only scenario where settlement is financially realistic.

Scenario:

- Net Estate Value: ₱12,000,000

- Unsettled Period: 5–10 years (typical for inherited family properties)

| Item | With Estate Tax Amnesty | Without Amnesty (Regular Settlement) |

|---|---|---|

| Estate Tax Rate | 6% of net estate | 6% of net estate |

| Base Estate Tax | ₱720,000 | ₱720,000 |

| Late Filing Surcharge (25%) | Waived | ₱180,000 |

| Interest on Unpaid Tax (12%/annum) | Waived | ₱430,000 – ₱860,000 |

| Compromise / Administrative Penalties | Waived | ₱30,000 – ₱60,000 |

| Estimated Total Tax Payable | ₱720,000 | ₱1,360,000 – ₱1,820,000 |

| Cost Certainty | High (fixed once computed) | Low (increases with delay) |

| Ability to Transfer Title | Immediately after compliance | Only after full settlement |

| Impact on Sale or Financing | Enables clean transfer and bankability | Often blocks or delays transactions |

Figures shown are illustrative and based on current Philippine tax rules, including the 6% estate tax rate under the TRAIN Law (RA 10963) and standard BIR penalties and interest for late estate settlement. Actual liabilities may vary depending on property valuation, length of delay, filing history, and BIR assessment. This table is for general guidance only and does not constitute legal or tax advice.

Illustrative comparison based on standard BIR interest rates and penalties. Actual liabilities may vary.

Liquidity Unlocked in Dormant Assets

The savings do more than reduce tax bills. They unlock liquidity.

Once an estate is settled:

- Properties can be sold at full market value.

- Rental income becomes legally secure.

- Bank financing becomes possible.

- Family members can finally divide or consolidate assets properly.

In many cases, heirs use proceeds from a sale or refinancing to pay the estate tax itself—something that is impossible when the title remains frozen. The amnesty turns inherited property from a static, untouchable asset into a usable financial resource.

This is why the extension matters. It does not merely reduce taxes—it restores financial viability to properties that would otherwise remain locked, undervalued, or abandoned. Once the numbers are clear, the question usually shifts from “Can we afford to settle?” to “Why didn’t we do this sooner?”

How the Estate Tax Amnesty Extension Impacts the Philippine Real Estate Market

The estate tax amnesty extension does more than help individual families. At scale, it reshapes the behavior of the secondary market, quietly influencing supply, pricing, and transaction velocity across the country. For investors and market observers, this is one of the most underappreciated policy drivers in Philippine real estate today.

Increased Supply of Clean-Titled Properties in the Secondary Market

One of the chronic constraints in the Philippine real estate market—especially in established areas—is the shortage of clean-titled, ready-to-sell properties. Many homes and lots technically exist but never reach the open market because the titles are still under deceased owners’ names.

As more heirs take advantage of the amnesty, these properties re-enter circulation. Houses that have been “off-market” for decades suddenly become legally sellable. Ancestral lots are subdivided, consolidated, or sold. Small apartment buildings finally get regularized.

How estate tax amnesty translates into real market liquidity.

This steadily expands legitimate supply, particularly in neighborhoods where new developments are limited by land scarcity.

Faster and More Predictable Secondary-Market Transactions

Estate-involved deals are among the slowest and riskiest in the market. Buyers hesitate, banks delay or decline financing, and closings stretch from months into years—or collapse entirely. As amnesty-driven settlements increase, the market sees fewer stalled transactions and more standardized deal flows.

For buyers and investors, this means:

- Shorter due-diligence cycles

- Higher confidence in title transfer

- Fewer last-minute deal failures

For brokers and developers acquiring secondary assets, it means lower friction and higher turnover, which directly affects market liquidity. Over time, this also improves bank confidence in secondary-market collateral.

Pricing Pressure in Legacy and Older Neighborhoods

Legacy neighborhoods—older subdivisions, inner-city districts, and long-established provincial town centers, stand to feel the effects most clearly.

These areas often contain valuable but underutilized properties held by families for generations. When estate settlement costs drop, more owners are willing to sell or redevelop, increasing competition among listings. This can create pricing pressure, not necessarily downward across the board, but toward more realistic, market-aligned values.

At the same time, buyers gain access to locations that were previously inaccessible due to title issues. The result is a healthier price discovery process, where values are driven less by artificial scarcity and more by actual demand.

Why This Matters for Quezon City, Metro Manila, and Key Provinces

In Quezon City and Metro Manila, the extension is especially significant. These areas have large stocks of aging residential properties in prime locations, many of which remain untitled at the heir level. As estates are settled, these assets become candidates for resale, renovation, or redevelopment—adding depth to markets that are already land-constrained.

In key provinces, the impact is different but equally important. Estate settlement allows families to consolidate agricultural land, monetize inherited lots near growth corridors, or finally transact properties that have sat idle simply because paperwork was never resolved. This supports local liquidity and encourages more formal participation in the property market outside major urban centers.

The common thread is normalization. The amnesty helps move properties from legal gray zones into the formal economy, where they can be priced, financed, insured, and developed properly.

For investors watching from the sidelines, this extension is not noise. It is a slow-burn catalyst—one that expands opportunity not through speculation, but through the steady release of long-trapped supply into a market that already knows how to absorb it.

What the Estate Tax Amnesty Means for Property Buyers

For buyers, estate-involved properties have always been a double-edged sword. The upside is often clear—better locations, motivated sellers, and pricing flexibility—but the risks can feel disproportionate when titles are unsettled and timelines uncertain. The estate tax amnesty extension materially changes that risk profile, making these transactions more predictable, negotiable, and defensible when handled correctly.

Reduced Risk in Estate-Involved Property Transactions

The single biggest buyer risk in estate properties is not the structure or the location—it is the title risk. An unsettled estate means ownership cannot legally transfer, regardless of how much money changes hands.

As heirs settle estate taxes under the amnesty, that uncertaintyis significantly reduced. Buyers gain clearer visibility on when titles can be transferred, banks become more willing to finance, and transaction timelines become more realistic.

This does not mean estate properties become risk-free, but it does mean that one of the largest barriers is actively being removed during the amnesty window.

Better Negotiation Leverage During the Estate Tax Amnesty Period

Many heirs settling estates are motivated by deadlines, coordination fatigue among co-heirs, or the desire to finally monetize long-held assets.

Buyers who engage during this phase often find:

- More openness to flexible pricing

- Willingness to structure staggered payments or extended timelines

- Reduced competition, especially for properties not yet publicly listed

Buyers who can accommodate estate settlement timelines—while protecting themselves contractually—are often rewarded with better terms than those waiting for fully polished, market-ready listings.

Due Diligence Still Required When Buying Estate Properties

The amnesty simplifies tax settlement, not due diligence. Buyers must remain disciplined.

Even when an estate is being settled, buyers should verify:

- That estate tax filings are actually submitted, not merely promised

- That all legal heirs are identified and consenting

- That no adverse claims, liens, or annotations exist on the title

- That the transfer process aligns with the sale timeline

If any item is unclear or missing, pause the transaction.

Skipping these checks under the assumption that “the amnesty fixes everything” is how buyers inherit other people’s problems.

Red Flags Buyers Should Not Ignore in Estate Property Deals

Certain warning signs should immediately slow down or halt a transaction, regardless of how attractive the price looks:

- Unclear heir representation, where one party claims authority without written consent from others

- Promises of future settlement without documented filings or receipts

- Pressure to release full payment before estate settlement is completed

- Inconsistent property details, such as mismatched lot areas or outdated tax declarations

These issues are not cured by tax amnesty alone and often require additional legal resolution.

For buyers willing to do the work, the amnesty period is not a riskier time to buy—it is often a smarter one. The advantage belongs to those who combine patience with process, and curiosity with caution.

What the Estate Tax Amnesty Means for Heirs and Property Sellers

For heirs and family sellers, the estate tax amnesty extension shifts the conversation from whether anything can be done to what should be done first. The policy removes a major financial barrier, but still requires clear decisions, coordination, and timing. Those who approach the process deliberately extract value. Those who drift often repeat the same mistakes that kept the property frozen in the first place. Estate settlement is not a tax task—it is a strategic asset decision.

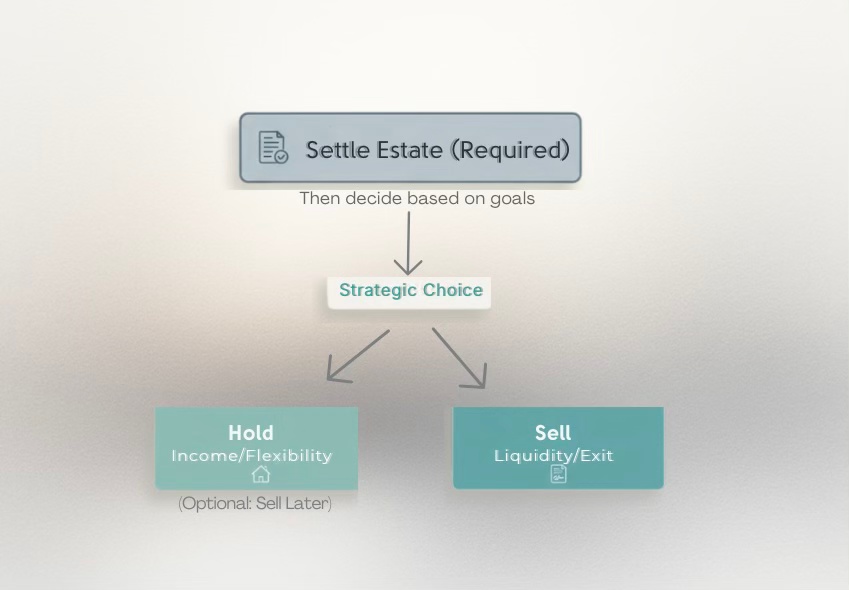

When to Settle Estate Tax First—and When Selling Makes Sense

As a rule, estate settlement comes before strategy, not after it.

Settling the estate tax early restores control. Once the title is transferable, heirs can decide whether to hold the property for long-term use, lease it for income, or sell it outright. In contrast, attempting to sell before settlement often leads to discounted prices, collapsed negotiations, or deals that drag on indefinitely.

Estate settlement is mandatory. What you do next is a strategic choice.

There are, however, situations where planning a sale alongside settlement makes sense—particularly when the property will clearly be sold and proceeds will be used to fund the tax payment. In these cases, the sequence matters: settlement steps must be clearly defined, documented, and aligned with the sale timeline. Vague promises to “fix the title later” almost always backfire.

Coordinating with Siblings and Co-Heirs During Estate Settlement

Multiple heirs are normal and coordination is where most estate processes stall.

The amnesty reduces financial pressure, but it does not resolve disagreements. Families that succeed are those that establish early clarity on:

- Who represents the estate administratively

- How costs are shared or advanced

- Whether the goal is preservation, income, or exit

Delays often arise not from legal complexity, but from indecision and miscommunication. Clear documentation and written agreements among heirs prevent disputes from resurfacing midway through the process, when reversing course becomes expensive.

Estate Settlement Timing Strategies Before 2028

While the 2028 deadline may feel distant, estate settlement is not a last-minute exercise.

Smart timing follows three principles:

- Start early, even if the sale or transfer happens later

- Allow buffer time for document retrieval, corrections, and agency backlogs

- Avoid deadline clustering, when government offices become congested and errors increase

Families that settle early gain flexibility. They can wait for better market conditions, explore redevelopment, or simply hold the asset without legal pressure. Those who wait until the final year often lose bargaining power and flexibility simultaneously.

Common Mistakes Heirs Make Even During the Amnesty Period

The extension reduces costs, but it does not protect heirs from poor decisions. The most common mistakes remain strikingly consistent:

- Treating the amnesty as a reason to delay rather than act

- Relying on verbal assurances instead of documented filings

- Allowing unresolved family disagreements to derail progress

- Assuming settlement automatically means market readiness

For heirs and sellers, the extension is a rare moment of leverage. It rewards decisiveness, coordination, and early planning. The families that benefit most are not those with the best properties, but those who finally choose to move forward—deliberately and on their own terms.

Estate Tax Amnesty vs Regular Estate Settlement

For many families, confusion between estate tax amnesty and regular estate settlement is what causes years of inaction. The distinction matters, because the financial, procedural, and emotional cost of choosing the wrong path can be significant. A clear comparison removes hesitation and allows heirs to decide based on facts, not assumptions.

Side-by-Side Comparison: Estate Tax Amnesty vs Regular Settlement

At a high level, both processes aim to accomplish the same thing: the legal transfer of property from a deceased owner to the rightful heirs. The difference lies in how much it costs, how long it takes, and how punishing the process becomes after delays.

Under the estate tax amnesty, the government prioritizes resolution and compliance. Under regular settlement, the system prioritizes enforcement and penalties. Regular settlement is not “safer”—it is simply more expensive when delayed.

| Factor | Estate Tax Amnesty | Regular Estate Settlement |

|---|---|---|

| Estate Tax Rate | 6% of net estate | 6% of net estate |

| Penalties & Interest | Waived | Accumulate over time |

| Total Cost | Predictable, lower | Often significantly higher |

| Processing Complexity | Simplified | More complex |

| Best For | Delayed estates | Recently opened estates |

Cost, Timeline, and Complexity: Amnesty vs Regular Settlement

From a cost perspective, the amnesty is almost always the more practical option for delayed estates. While both paths apply the same base estate tax rate, regular settlement layers on penalties, surcharges, and interest that grow with time. For estates left unsettled for years, these additions often exceed the original tax due.

In terms of timeline, amnesty-driven settlements tend to move faster because computations are simpler and disputes over penalties are removed. Regular settlements require more detailed reconciliation, more approvals, and often more back-and-forth with tax authorities.

When the Estate Tax Amnesty Is the Best Option

The estate tax amnesty is clearly the better route when:

- The estate has been unsettled for several years

- Penalties and interest have already accumulated

- Heirs need a predictable, manageable tax figure

- The property must be sold, transferred, or financed soon

In these cases, the amnesty is not just cheaper—it is often the only financially viable way forward.

When Regular Estate Settlement Still Applies

Regular settlement may still apply in limited scenarios:

- Estates settled promptly after death, before penalties accrue

- Cases where amnesty coverage does not apply due to timing or eligibility constraints

- Situations requiring court-supervised settlement due to disputes

Even then, the cost-benefit analysis should be done carefully. Many families assume regular settlement is “cleaner” or “more proper,” only to discover later that it carries unnecessary financial weight.

The decision is practical. For most heirs dealing with long-unsettled property, the estate tax amnesty restores fairness and feasibility to the process.

Step-by-Step Estate Tax Amnesty Process in the Philippines

One reason estate settlement feels intimidating is because of fear of the unknown. The amnesty helps precisely because it standardizes the process. Once you understand the steps, the path forward becomes procedural rather than overwhelming.

What follows is a realistic, ground-level view of how estate settlement under the amnesty actually works in the Philippines.

Documents Required for Estate Tax Amnesty Filing

While requirements vary slightly depending on the property and family structure, most estate settlements under the amnesty require the following core documents:

- Death certificate of the property owner

- Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT)

- Tax Declaration for land and/or improvements

- Deed of Extrajudicial Settlement or court order (if applicable)

- Valid IDs and Tax Identification Numbers (TINs) of all heirs

- Proof of property valuation (zonal value, assessed value, or appraisal)

Incomplete or inconsistent documentation is the single most common cause of delays.

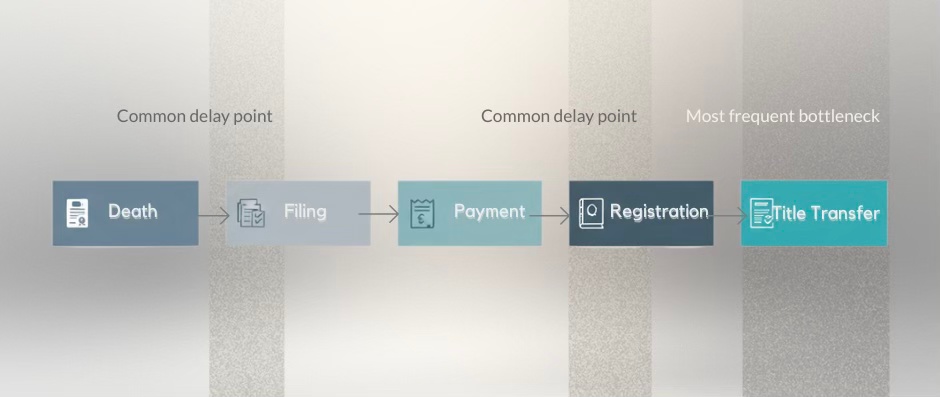

Government Agencies Involved in Estate Tax Settlement

Estate settlement is not handled by a single office. It moves through several agencies, each with a specific function:

Bureau of Internal Revenue (BIR)

Responsible for accepting the estate tax return, computing tax due under the amnesty, and issuing proof of payment and clearance.

Local Government Unit (LGU)

Handles transfer taxes, updated tax declarations, and local clearances at the city or municipal level.

Registry of Deeds (RD)

Registers the transfer of title from the deceased owner to the heirs once all taxes and clearances are complete.

Understanding that delays can happen at any of these stages helps set realistic expectations.

Estate Tax Amnesty Processing Timeline in the Philippines

Under ideal conditions, an estate settlement might move quickly. In practice, timelines vary widely.

A realistic range under the amnesty looks like this:

- Document preparation: 1–3 months

- BIR filing and payment: 1–2 months

- LGU clearances and tax declaration updates: 2–4 weeks

- Registry of Deeds processing: 1–3 months

In total, three to six months is a reasonable expectation for a straightforward case. More complex estates—multiple heirs, missing documents, or older titles—can take longer.

Common Causes of Delay in Estate Tax Settlement

Delays are rarely random. They almost always stem from the same pressure points:

- Missing or inconsistent property records

- Disagreements or incomplete consent among heirs

- Valuation discrepancies between BIR and LGU records

- Backlogs at the Registry of Deeds, especially near deadlines

Estate settlement progresses through defined stages—each must be completed before the next can begin.

The amnesty makes the estate settlement manageable. Once the steps are visible and the timeline is understood, fear gives way to planning, and planning is what finally turns inherited property from a frozen obligation into a controllable asset.

What the Estate Tax Amnesty Does NOT Fix

The estate tax amnesty is powerful—but it is not magical. Treating it as a cure-all is how families walk straight into their next problem. The amnesty clears tax liabilities, not structural, legal, or relational issues that existed long before the tax bill arrived.

Understanding its limits is what separates smooth settlements from expensive second rounds of cleanup.

Title Defects Unrelated to Estate Tax

The amnesty settles tax obligations, not title defects.

If a property title has errors—misspelled names, incorrect technical descriptions, missing annotations, or inconsistencies between the title and tax declaration—those issues remain. Likewise, problems such as overlapping titles, prior encumbrances, or unresolved annotations are not erased by paying estate tax.

In short, the amnesty allows the transfer to move forward only if the title itself is transferable.

Heir Disputes and Competing Claims

Taxes are administrative. Family dynamics are not.

The amnesty does not resolve:

- Disagreements among siblings

- Claims from undisclosed or late-appearing heirs

- Conflicts over partition, valuation, or sale proceeds

If heirs are not aligned, the process slows—or stops—regardless of how favorable the tax terms are. In some cases, court intervention is still required, and no amnesty can shortcut that reality.

Boundary and Survey Issues

Many older properties—especially in provincial areas—suffer from outdated or inaccurate surveys. Boundary overlaps, mismatched lot areas, or missing survey plans are common, and they become visible only when a transfer is attempted.

The amnesty does not fix:

- Boundary disputes with neighbors

- Encroachments or right-of-way issues

- Errors between survey plans and registered titles

These must be corrected separately, often through resurvey, technical descriptions, or legal proceedings.

Why the Amnesty Is Not a Magic Eraser

The danger lies in false confidence.

Paying estate tax under the amnesty does not automatically make a property market-ready. It makes it eligible to move forward—nothing more. Skipping verification steps or assuming all problems disappear after payment often leads to failed sales, buyer withdrawals, or delayed registrations.

The amnesty is a reset button for taxes, not a blanket pardon for every issue tied to a property’s history.

The estate tax amnesty clears tax liabilities—but it does not erase legal or technical issues.

This reality check is not meant to discourage action. It is meant to protect it. Families who combine the amnesty with proper verification and professional guidance do not just settle estates—they prevent the next generation from inheriting the same unresolved problems all over again. This is why verification must come before monetization.

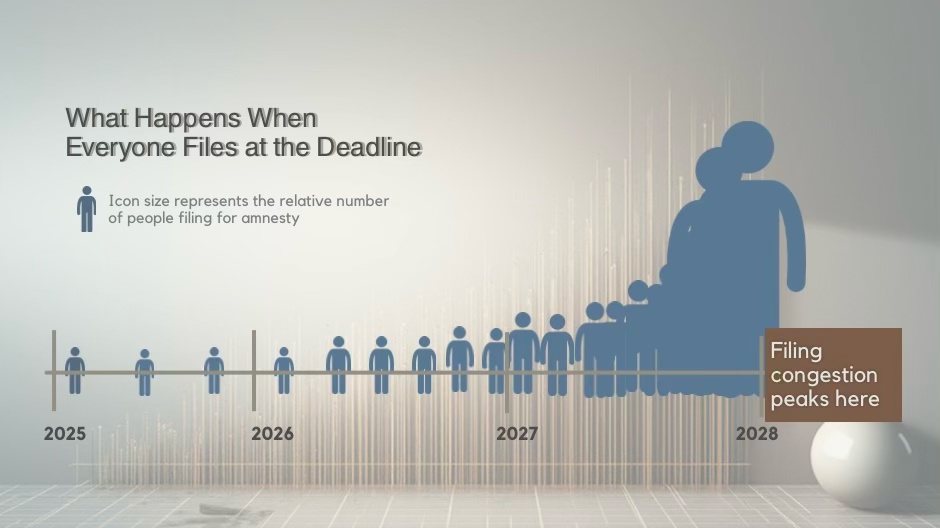

Why Waiting Until 2028 to Settle Estate Tax Is a Bad Strategy

A 2028 deadline sounds generous. That perception is precisely what gets families into trouble.

Estate tax amnesties do not fail because people lack time; they fail because people wait until time runs out. The pattern is predictable, and history has already shown how costly that mindset can be.

Lessons from Previous Deadline Rushes

In prior amnesty periods, the same story repeated itself. Early on, processing moved smoothly. Requirements were clear. Officers had time to review documents properly. Then deadlines approached—and everything slowed.

Last-minute filers encountered:

- Overloaded BIR offices

- Longer review times and stricter scrutiny

- Higher error rates in filings due to pressure

- Missed deadlines caused by factors outside their control

As deadlines approach, more people compete for the same processing capacity.

Many families who intended to “just start later” ended up losing the amnesty entirely, not because they failed to act, but because they acted too late.

Government Processing Bottlenecks Are Real

No matter how favorable the policy, estate settlement still runs through human systems.

As deadlines near, the Bureau of Internal Revenue, local government units, and the Registry of Deeds face surges in volume. Processing times can stretch, appointments become scarce and simple corrections take weeks instead of days.

Waiting until the final stretch means surrendering control to queues, backlogs, and calendar risk.

Why Early Movers Win

Heirs who act early gain advantages that have nothing to do with tax rates.

They gain time to:

- Correct documentation errors without panic

- Resolve heir coordination issues calmly

- Choose optimal moments to sell or lease

- Negotiate from strength, not desperation

Early movers treat the amnesty as a planning tool, not an emergency exit. As a result, they preserve flexibility while others scramble.

Flexibility Disappears When Deadlines Loom

As deadlines approach, options shrink.

Buyers become cautious, brokers become selective, banks slow approvals and families compromise on pricing just to meet timelines. What could have been a strategic sale or thoughtful retention turns into a rushed decision driven by fear of missing the window.

Waiting recreates the pressure the amnesty was designed to remove.

The smartest use of an extended deadline is not postponement. It is early action with long-term optionality. Those who move first decide on their own terms. Those who wait until the clock is loud rarely do.

When to Involve Professionals in Estate Tax Settlement

Estate settlement looks deceptively simple on paper. In practice, it is a multi-layered process where small mistakes compound quickly, often surfacing only when a sale is already in motion. The right professionals do not just speed things up—they prevent value leakage.

The Role of Brokers in Estate-Led Sales

A competent real estate broker does more than market a property. In estate-led transactions, the broker acts as a transaction strategist.

Brokers help heirs:

- Assess whether a property should be settled first, sold later, or structured concurrently

- Price assets realistically given title status, timelines, and buyer risk tolerance

- Coordinate buyer expectations with estate settlement milestones

- Prevent deals from collapsing due to misaligned assumptions

In short, brokers translate legal progress into market-ready outcomes. Without that bridge, even clean titles struggle to convert into successful transactions.

When Legal and Tax Professionals Are Essential

There are moments when professional support shifts from optional to non-negotiable.

Common DIY pitfalls include:

- Filing incorrect estate tax returns that require amendments

- Overlooking title defects that block registration

- Accepting buyer payments before legal transfer is possible

- Triggering disputes among heirs due to unclear documentation

Attempting to navigate these scenarios without proper guidance often leads to stalled filings, rejected registrations, or disputes that surface after money has already changed hands.

The Real Cost of DIY Mistakes

The most expensive errors are rarely upfront. They appear later, when reversing them costs far more than doing things right the first time.

They gain time to:

- Correct documentation errors without panic

- Resolve heir coordination issues calmly

- Choose optimal moments to sell or lease

- Negotiate from strength, not desperation

Most estate properties can be handled by a broker. Specialists step in only when complexity demands it.

These mistakes do not just delay outcomes—they destroy leverage. By the time they surface, families are often forced to settle on unfavorable terms simply to move forward.

Involving professionals early, removes friction, protects value, and ensures that when a property finally moves, it does so cleanly, legally, and on the family’s terms.

Why the Estate Tax Amnesty Extension Matters Long-Term

Beyond its immediate tax relief, the estate tax amnesty extension sends a clear policy signal about where Philippine real estate is heading. This is not merely a concession to past non-compliance. It is a structural nudge toward liquidity, transparency, and market normalization—outcomes the property sector has struggled to achieve for decades.

A Clear Signal of Pro-Liquidity Policy

By extending the amnesty, lawmakers are acknowledging a hard truth: capital locked in inherited property is capital that cannot circulate, develop, or support economic activity. The extension reinforces a pro-liquidity stance—one that prioritizes movement over stagnation and compliance over punishment.

This direction matters. When property can move, it can be financed. When it can be financed, it can be improved, repurposed, or redeployed. Over time, that translates into healthier transaction volumes and more resilient local markets.

Resetting Intergenerational Wealth Transfer

Unsettled estates are one of the quietest destroyers of family wealth in the Philippines. They trap assets in legal limbo, create friction among heirs, and erode value through neglect and penalties.

The extension gives families a chance to reset the handoff between generations. Properly settled estates allow heirs to inherit usable assets rather than inherited problems. This is not just about fairness—it is about continuity. Families that act now spare the next generation from repeating the same cycle of delay and loss.

Normalizing the Secondary Market

A mature real estate market depends on a functioning secondary market. New developments attract attention, but resale properties provide depth, price stability, and accessibility.

By enabling more clean-titled properties to enter circulation, the amnesty helps normalize secondary-market activity. Transactions become more standardized. Pricing becomes more transparent. Buyers gain confidence. Over time, this reduces reliance on speculative new supply and strengthens the resale ecosystem that supports long-term market health.

If This Truly Is the Last Extension

Every amnesty carries an unspoken warning: do not assume another one will follow.

If this extension proves to be the final window, the consequences of inaction will be sharper. Estates left unsettled will revert to full penalties and interest, recreating the same financial barriers that froze properties in the first place. The difference is that those who acted will move forward unburdened, while those who waited will face a harder reset.

In that sense, the extension is both an opportunity and a line in the sand. It rewards decisiveness and penalizes complacency—not through punishment, but through the quiet advantages that early movers accumulate over time.

Policy opens the door—but action determines who walks through it.

Ready to Move Forward? Get Clarity on Your Estate Property

Inherited property should not stay frozen because of uncertainty, hesitation, or outdated assumptions. Whether you are holding a family home, coordinating with co-heirs, or evaluating an estate-involved purchase, clarity is the most valuable asset you can secure right now.

If you are unsure whether your property qualifies under the estate tax amnesty—or if you want to understand the smartest way to structure a sale, settlement, or purchase—now is the time to get it reviewed properly.

Two smart next steps:

Not sure if your inherited property qualifies?

Get a clear, professional estate property assessment—fast, confidential, and decision-focused.

Planning to sell or buy an estate-involved property?

Let’s review the title, timeline, and risks carefully—before mistakes cost you millions or derail the transaction.

This is not about rushing into action. It is about making informed decisions while leverage is on your side. The amnesty creates opportunity—but only for those who choose to use it deliberately.

Leave a comment