A practical guide to studio condo investment in the Philippines for buyers, investors, and OFWs. | KeyStudio

TABLE OF CONTENTS

- The Studio Condo “Sweet Spot” Defined

- Studio Condo Pricing Realities in the Philippines

- Rent Is Revenue—But Only If It’s Real

- Vacancy Risk — The Most Ignored Variable

- Location as the Sweet Spot Multiplier

- Building-Level Factors That Make or Break Studio Performance

- Studio Size, Layout, and Livability Economics

- The Numbers That Actually Define the Sweet Spot

- Matching the Right Studio Strategy to the Right Investor

- Common Studio Condo Investment Mistakes

- Market Cycles, Timing, and Exit Liquidity

- Real-World Studio Scenarios

- A Practical Framework to Identify the Studio Sweet Spot

- Key Takeaways for Buyers, Investors, and Brokers

- Call to Action

Demand holds on the rental side for equally practical reasons. Studios match how city tenants actually live. Young professionals, hybrid workers, medical staff, students, and expatriates value proximity to work and transit more than extra space. As a result, studios re-lease faster and experience shorter vacancy periods than larger units. In the context of studio condo investment in the Philippines, performance is rarely about size—it is about pricing discipline, tenant behavior, and vacancy management.

This dominance explains why studios are everywhere. It does not explain which ones perform well. That distinction depends on something far more precise: whether price, rent, and vacancy are in balance. In Metro Manila, where commute time, transport access, and monthly amortization ceilings shape housing decisions, studio units have become the default entry point for urban buyers. This balance is easier to assess when you use a structured checklist instead of relying on intuition.

An infographic illustrating the primary tenant profiles that sustain studio condo demand in urban areas of the Philippines, highlighting factors such as job proximity, flexibility, and access.

Studio condos dominate the Philippine condo market because they solve three problems at once: affordability, location access, and rental demand. That alignment makes them the easiest units to sell, finance, and lease in dense urban centers.

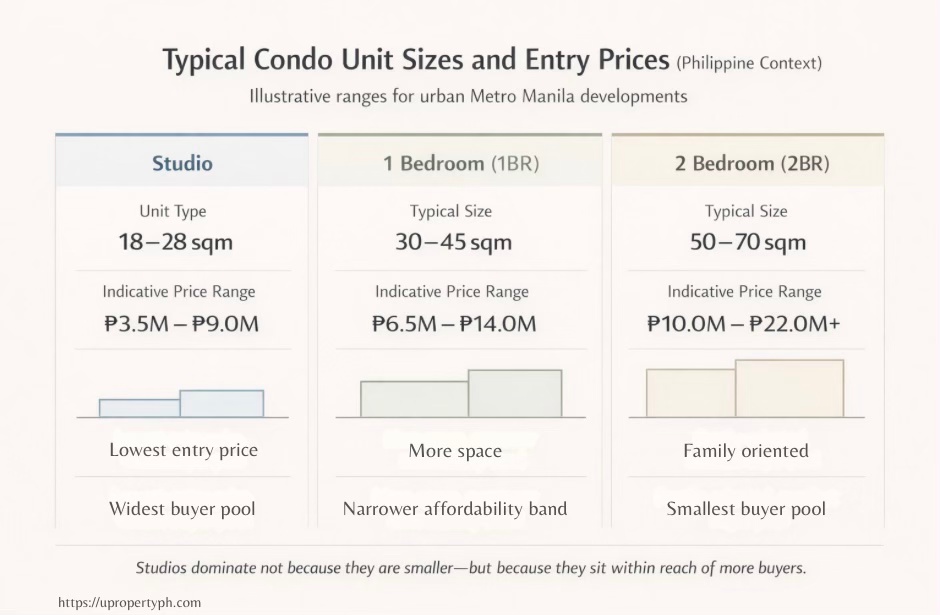

In local terms, a studio condo is a compact, open-plan unit with a separate toilet and bath, typically sized between 18 and 28 square meters. This size range allows developers to offer the lowest entry price in a project, accelerating sales and broadening the buyer pool. Studios move faster, carry lower financing risk, and stabilize project cash flow—reasons developers consistently prioritize them in new launches.

This size–price relationship explains why studios dominate pre-selling and early-stage launches.

To understand why some studios work while others quietly disappoint, you need a framework—not a feature list.

The Studio Condo “Sweet Spot” Defined

The Core Balance

The studio condo “sweet spot” is not about buying cheap, achieving the highest rent, or choosing the most popular location. It is about balance—specifically, the balance between purchase price, achievable rent, and vacancy risk. For most Philippine condo investors, this balance matters more than unit size, branding, or short-term rental potential.

Studios perform best when price, rent, and vacancy support each other—not when one compensates for the rest.

The Common Assumption

Most buyers fixate on one variable and assume the rest will automatically fall into place. That assumption is where problems begin.

Why Imbalance Fails

A studio priced too high may still command decent rent, but it leaves little room for error. A studio with strong rent potential but frequent vacancies becomes unreliable. A cheap studio with weak demand slowly bleeds income through prolonged vacancy and constant tenant turnover. None of these qualify as a sweet spot.

The sweet spot exists only when all three variables support each other. Price must be reasonable enough to allow rent to make sense. Rent must be realistic and repeatable, not dependent on perfect conditions. Vacancy must be minimal and predictable, not something you “manage” after the fact.

The Three-Way Tension

These three variables create a constant three-way tension. Affordability pressures developers to shrink unit sizes. Rent expectations push buyers to chase headline numbers. Occupancy, meanwhile, is controlled entirely by tenant behavior. Improving one variable almost always puts stress on the others. In the Philippine condo market, this balance matters more than architectural features or lifestyle branding. This is the same balance most investors struggle to evaluate consistently without a clear framework.

Where Buyers Misjudge Performance

This is where many buyers misjudge performance—by chasing rent alone. High rent feels like success, but rent only matters when the unit is occupied, consistently, at terms that justify the capital committed. A studio earning ₱25,000 a month sounds impressive until you factor in the price paid, furnishing costs, and two months of vacancy in a year.

The studio condo sweet spot is therefore not a maximum. It is a range. A narrow one. Find it, and performance becomes boring—in the best possible way. Miss it, and even a “hot” studio turns into a long-term lesson in why balance beats hype.

Once balance is clear conceptually, pricing is where most studio deals either hold—or quietly break.

Studio Condo Pricing Realities in the Philippines

Studio condo pricing in the Philippines follows a clear logic, yet many buyers ignore it and anchor on marketing headlines instead. To judge whether a studio is reasonably priced, three things matter: where it is located, what stage it is in, and what premium you are actually paying for.

Price Per Square Meter

Price per square meter remains the most reliable way to compare studio condo prices in Metro Manila objectively.

- Prime CBDs: BGC, Makati, and Ortigas, studios command the highest rates due to land scarcity, employment density, and genuine lifestyle access.

- Fringe Locations: Areas just outside CBD cores with strong transport links—price lower while still benefiting from spillover demand.

- Emerging Districts: They offer the lowest entry prices, but with thinner rental depth and less predictable exit liquidity.

This matters because Philippine buyers are typically constrained by bank and Pag-IBIG loan approval thresholds, not by headline price alone.

Typical Studio Condo Price per Square Meter by Location Tier

Illustrative ranges for urban residential markets

| Location Tier | Typical Areas (Examples) | Indicative Price per sqm | What the Premium Reflects |

|---|---|---|---|

| CBD | BGC, Makati CBD, Ortigas Center | ₱220,000 – ₱380,000 | Land scarcity, job density, walkability, established demand |

| Fringe | Mandaluyong, Pasig outskirts, QC near rail lines | ₱150,000 – ₱250,000 | Transport access, spillover demand, partial CBD connectivity |

| Emerging | North QC growth corridors, outer Taguig, provincial CBDs | ₱90,000 – ₱160,000 | Future access expectations, early-stage development, lower liquidity |

Studios priced materially above their location tier must justify the premium through access, demand depth, or building quality.

The ‘Near-CBD’ Pricing Trap

The common mistake is treating all “near-CBD” locations as equal. A studio priced like a CBD unit without CBD-level access, walkability, or tenant demand is already misaligned before rent is even considered.

Project Stage

It further shapes pricing.

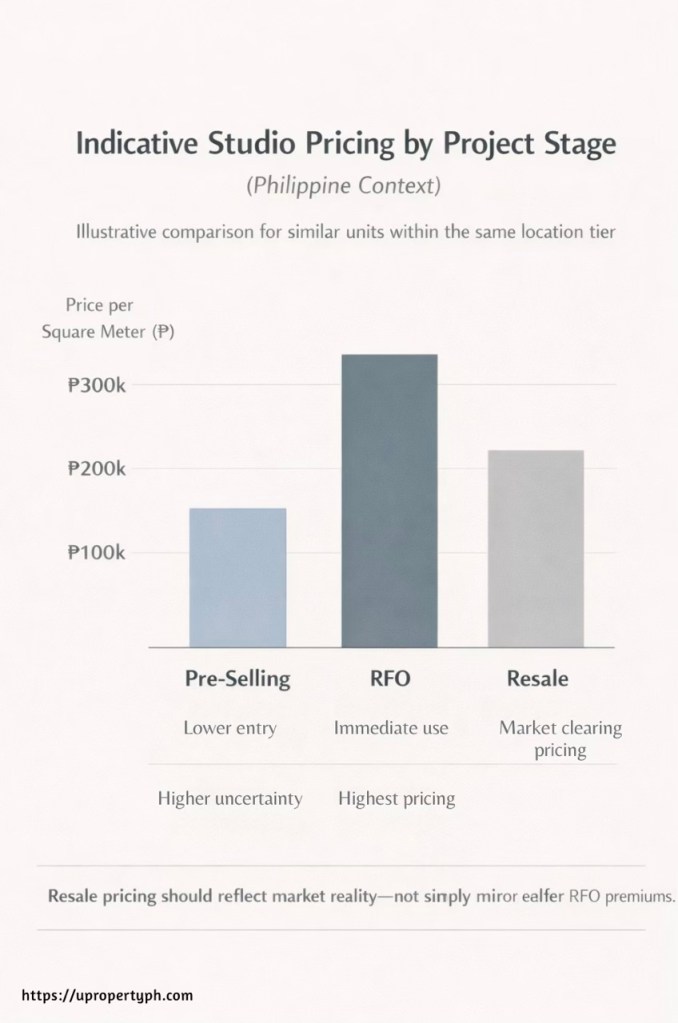

- Pre-selling Studios: Typically cheaper on a per-square-meter basis to compensate for construction risk and delayed use.

- RFO Units: Carry a premium for immediacy and reduced uncertainty. This distinction is especially relevant when comparing pre-selling vs RFO studio condos in the Philippines, where timing materially affects risk.

- Resale Units: Should logically sit between the two. When resale pricing matches or exceeds newer RFO inventory without offering superior location, layout, or building quality, the numbers stop making sense.

Resale pricing should reflect market reality—not simply mirror earlier RFO premiums

When Developer Premiums Make Sense

Developer premiums deserve careful scrutiny. Paying more is justified when it secures something tangible: an irreplaceable location, strong property management, established rental demand, or long-term relevance. Paying extra for branding, generic amenities, or speculative future upside rarely works for studio units. Studios are highly sensitive to pricing mistakes, and small miscalculations are felt quickly.

Signals of Overpricing

As a rule, price per square meter should not materially exceed nearby comparables without a clear, defensible reason. Projected rent must also cover ownership costs with enough margin to absorb normal friction. Studio buying decisions should be driven by data, not optimism.

Studio pricing works when it respects market forces. Ignore them, and even a well-marketed unit can struggle to perform.

Price sets the risk. Rent determines whether you can carry it.

Rent Is Revenue—But Only If It’s Real

Real revenue exists only when rent is repeatable, defensible, and expected, not when it is merely advertised. This gap is why advertised rents often differ from actual studio condo rental income in Metro Manila. In cities like Metro Manila, advertised rents often reflect asking behavior rather than executed leases.

Location-Driven Rent Differences

Average studio rents in the Philippines vary sharply by location. Prime CBD studios command the highest monthly rates because tenants are paying for proximity, not space. Fringe locations follow, supported by transport access and employment spillover. Emerging areas offer the lowest rents, but demand is thinner and leasing cycles are longer. The common mistake is assuming that small location trade-offs produce small rent differences. In reality, tenant willingness to pay drops quickly once convenience is compromised.

Typical Monthly Studio Rent by Location Tier (Philippine Context)

Illustrative long-term leasing ranges for urban residential markets

| Location Tier | Typical Areas (Examples) | Indicative Monthly Rent | What Drives the Rent Level |

|---|---|---|---|

| CBD | BGC, Makati CBD, Ortigas Center | ₱20,000 – ₱35,000 | Job density, walkability, time savings, lifestyle access |

| Fringe | Mandaluyong, Pasig outskirts, QC near rail lines | ₱14,000 – ₱25,000 | Transport access, spillover demand, commute logic |

| Emerging | North QC growth corridors, outer Taguig, provincial CBDs | ₱9,000 – ₱16,000 | Affordability ceilings, limited tenant depth, future access expectations |

Rent drops faster than price as convenience and access decline.

Furnished Versus Unfurnished Realities

Furnishing further distorts expectations.

- Furnished Studio: Typically achieve higher asking rents, but the premium is narrower than most buyers assume. Basic, durable furnishings improve leaseability; over-furnishing rarely produces proportional rent increases. Furniture depreciates, requires replacement, and adds turnover friction.

- Unfurnished Studios: Earns less per month but often attract longer-staying tenants and lower ongoing costs. The right choice depends on tenant profile, not presentation.

Short-Term Versus Long-Term Leasing

- Short-Term Rentals: Adds another layer of noise. Nightly rates look compelling when annualized, but income is volatile and operationally heavy. Occupancy fluctuates, management fees compound, and regulatory risk is unavoidable.

- Long-Term Leasing: Produces lower headline numbers but delivers stability. For studio units, consistency usually outperforms optimization.

Gross Rent Versus Net Rent

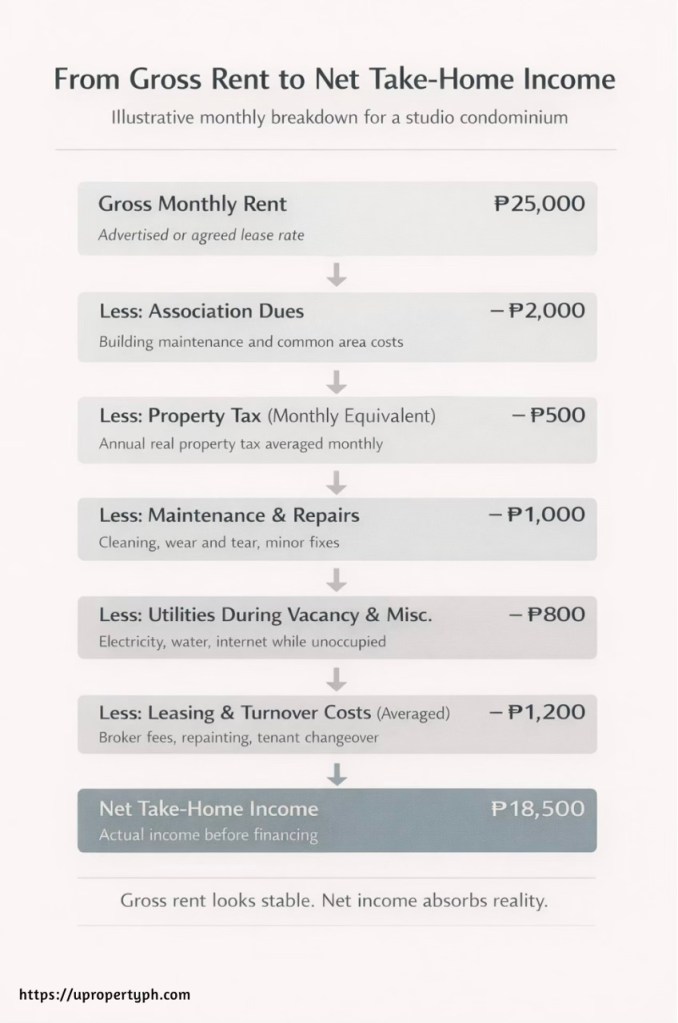

This is where gross rent and net rent diverge.

- Gross rent is what you quote.

- Net rent is what remains after association dues, property tax, maintenance, vacancy utilities, broker fees, and periodic refurbishing.

A studio that “earns” ₱25,000 a month on paper can look very different once these costs surface.

Gross rent looks stable. Net income absorbs reality.

Rent becomes revenue only when it reflects how tenants actually behave and what ownership actually costs. Anything else is projection, not performance.

Even realistic rent assumptions fail if vacancy is underestimated.

Vacancy Risk — The Most Ignored Variable

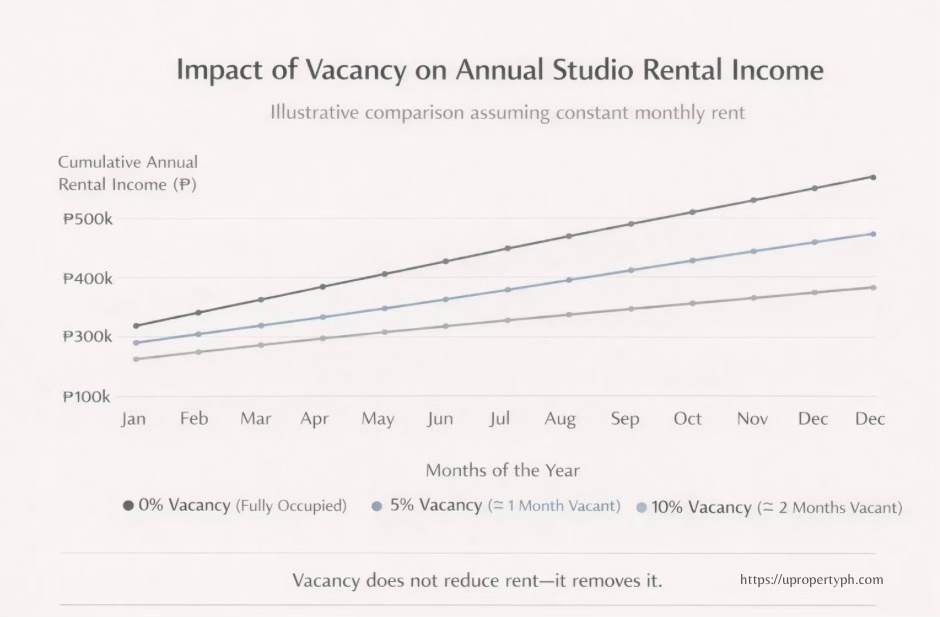

Vacancy is rarely discussed because it is inconvenient. Yet it is the variable that ultimately decides whether rent becomes income or remains a projection.

What Vacancy Really Costs

A vacancy rate is not an abstract percentage. In peso terms, it represents rent that never materializes. One vacant month in a year reduces income by 8.3 percent. Two months remove more than 16 percent. Unlike most expenses, vacancy compounds. While rent stops, association dues, utilities, and holding costs continue. In practice, condo vacancy risk in the Philippines affects small units faster and more visibly than larger formats. This pattern is common in Philippine condominiums, where lease gaps of one to two months per year are structurally normal rather than exceptional.

Vacancy does not reduce rent—it removes it.

Why High-Demand Areas Still Experience Vacancy

This is why vacancy exists even in “high-demand” locations. Demand does not mean uninterrupted occupancy. Tenants move for work, budget changes, or life transitions. Lease gaps are normal, including in prime districts. The common mistake is assuming that popularity eliminates downtime. It does not. At best, it shortens it—provided the unit is correctly priced and positioned.

Studio Oversupply and Competition

Oversupply magnifies the risk. Studio-heavy developments place identical units into direct competition for the same tenant pool. When multiple owners list at the same time, pricing compresses and vacancies lengthen. In these conditions, the unit that leases first is rarely the best one. It is usually the most competitively priced or the fastest to market.

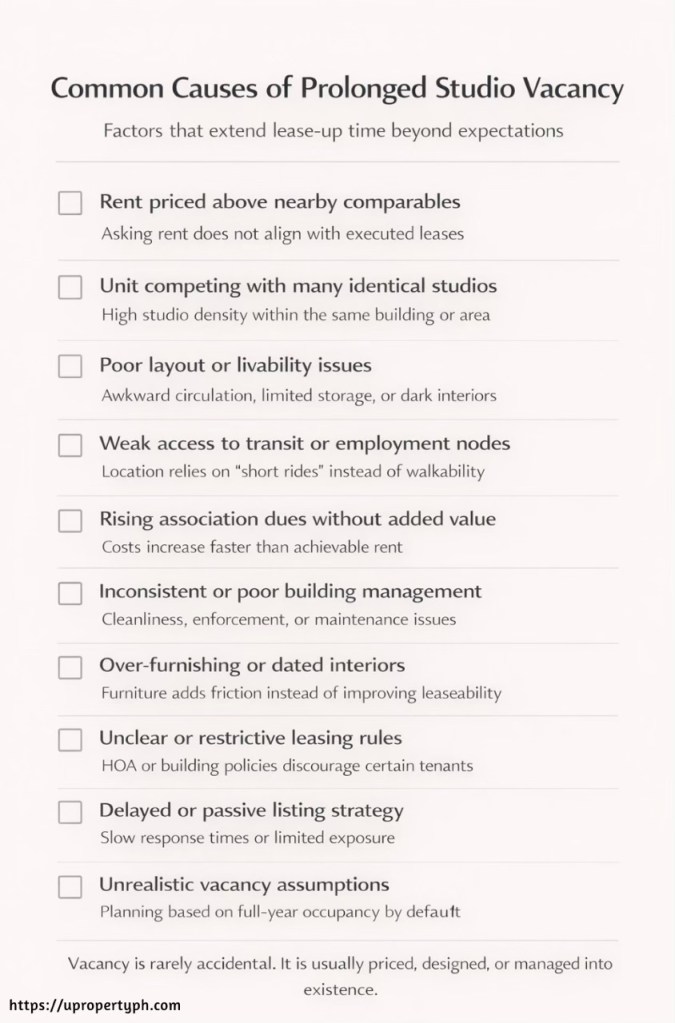

Most prolonged vacancies can be traced back to a small number of repeatable issues.

Turnover and Friction Costs

Turnover costs compound the damage. Each vacancy cycle typically requires repainting, cleaning, minor repairs, and occasional refurnishing. Broker fees further reduce take-home income. These costs are predictable, recurring, and often excluded from projections. Over time, they separate theoretical performance from actual results. Vacancy assumptions are one of the most commonly missed items in the Studio Condo Sweet Spot Checklist.

Vacancy is not a failure. It is a structural feature of rental property. The difference between resilient and fragile investments lies in whether vacancy is planned for—or discovered the hard way.

Vacancy is rarely random. More often, it traces back to location.

Location as the Sweet Spot Multiplier

Location does not just influence studio performance—it multiplies it. This is where outcomes diverge sharply, not because of hype, but because geography dictates how tenants behave, how quickly units lease, and how resilient demand remains over time.

The Three Location Tiers

At a high level, studio locations fall into three tiers: CBD, fringe, and emerging. CBDs concentrate employment, transit, and daily conveniences within walkable distance. Fringe areas sit just outside core districts but remain connected through rail lines or major corridors. Emerging locations trade proximity for price, betting on future access and development. Each tier can work, but they do not perform the same—and should never be priced as if they do.

Location tiers reflect demand depth and access—not just distance from the CBD.

Why Access Beats Proximity

CBD studios benefit from job density and time savings. Tenants pay for minutes, not meters. Fringe locations succeed when access is real and friction is low—direct rail links, reliable transport, and clear commuting logic. Emerging areas require patience and precision. Without a defined demand driver, lower prices alone rarely compensate for longer vacancy and thinner tenant pools.

Transit, Walkability, and Job Density

Transit access and walkability are decisive. A studio near a functioning rail station or within a genuinely walkable district consistently outperforms one that is “a short ride away.” Job density compounds this effect. The more offices, hospitals, schools, and commercial centers within reach, the broader the tenant base and the faster the lease-up.

Studio Condo Performance Comparison by Location Tier (Philippine Context)

Long-term leasing behavior under normal market conditions

| Performance Indicator | CBD Studios | Fringe Studios | Provincial Studios |

|---|---|---|---|

| Typical Entry Price Level | Highest | Moderate | Lowest |

| Rent Stability | High | Moderate to high | Variable |

| Vacancy Risk | Low to moderate | Moderate | Higher and less predictable |

| Tenant Pool Depth | Broad and diverse | Narrower but consistent | Often concentrated |

| Lease-Up Speed | Fast | Moderate | Slow to moderate |

| Sensitivity to Oversupply | Moderate | High | Very high |

| Resale Liquidity | Strong | Moderate | Limited, price-sensitive |

| Typical Buyer Profile (Resale) | Investors, end-users, OFWs | Value-focused investors, first-time buyers | Local end-users, niche investors |

Studio performance varies less by price than by demand depth and liquidity.

Specialized Demand Nodes

University belts, hospital zones, and office clusters create recurring rental demand that is less sensitive to market cycles. Studios near these nodes benefit from predictable tenant turnover and shorter vacancy, provided pricing remains aligned with local budgets. In the Philippines, location performance is less about distance and more about daily friction—especially commute reliability.

Metro Manila vs Provincial Depth

Comparisons between Metro Manila studio condo investments and provincial markets often miss the point. The question is not which is cheaper, but which has depth of demand. Cities like Cebu City and Davao City offer viable studio investment pockets when employment centers, universities, and infrastructure are firmly in place. Where these anchors are weak or dispersed, lower entry prices are offset by longer leasing cycles. In these cities, studio condo demand is driven by employment density, not speculation.

Location multiplies both strength and weakness. When access, demand, and pricing align, studios lease faster and more consistently. When they do not, no amount of marketing can compensate. The sweet spot is rarely found in what sounds promising—it is found where tenants already choose to live.

Even in the right location, not all buildings perform the same.

Building-Level Factors That Make or Break Studio Performance

Two studios in the same location can perform very differently. The difference is rarely the unit itself. It is the building.

Studio Building Performance Scorecard (Philippine Context)

Qualitative indicators that influence rentability and vacancy

| Building Factor | Strong / Low Risk | Moderate | Weak / High Risk |

|---|---|---|---|

| Studio Density | Limited studios per floor; balanced unit mix | High studio count but spread across multiple towers | Studio-heavy floors or towers competing for the same tenants |

| Association Dues (Relative) | Dues aligned with rent levels and stable over time | Above-average dues with clear maintenance justification | Rising dues without visible value or service improvement |

| Property Management Quality | Consistent rule enforcement, clean common areas, responsive admin | Functional management with occasional lapses | Poor enforcement, cleanliness issues, unmanaged short-term rentals |

| Building Age & Design Relevance | Ageing well; functional layouts and maintained systems | Ageing with minor design or utility limitations | Obsolete layouts, poor ventilation, recurring system issues |

Buildings with two or more “Weak / High Risk” flags deserve deeper scrutiny—or elimination.

Studio Density and Saturation

Unit density is the first filter. Studio-heavy developments concentrate risk by placing many near-identical units into direct competition. When dozens—or hundreds—of studios target the same tenant pool, pricing power disappears quickly. Lease-ups slow, concessions appear, and vacancy stretches. Density is not inherently bad, but saturation without sufficient demand depth is. Smart buyers count studios per floor and per tower, not just amenities per brochure.

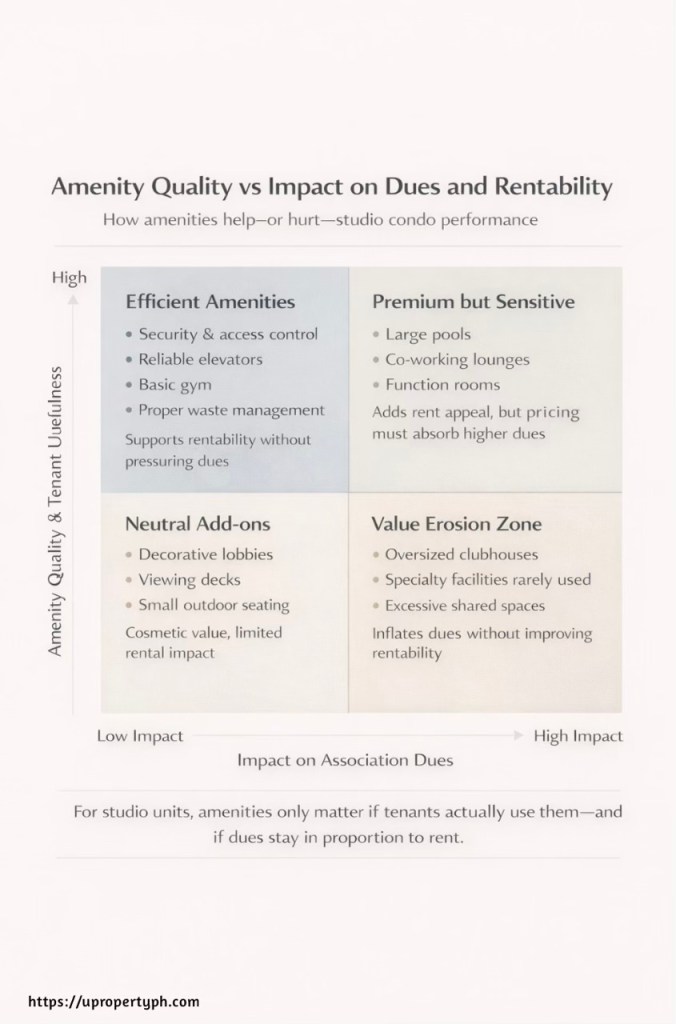

Amenities vs Dues

Amenities present a second trade-off. Quality amenities support rentability; excessive amenities inflate dues. Pools, gyms, lounges, and co-working spaces look attractive, but they carry long-term maintenance costs that tenants do not fully absorb through higher rent. Studios are especially sensitive to this imbalance. When dues rise faster than achievable rent, margins compress. Amenities should be evaluated for actual tenant use, not visual appeal. In many Philippine condo developments, rising association dues become visible within the first three to five years after turnover.

Property Management Quality

Property management quality is often underestimated and quickly felt. Effective management enforces rules, maintains common areas, controls noise and short-term rental abuse, and protects building standards. Poor management does the opposite. Studios suffer first because tenant turnover is higher and misuse shows faster. A well-managed building sustains rent and shortens vacancy. A poorly managed one erodes both, regardless of location.

For studio units, amenities only matter if tenants actually use them—and if dues stay in proportion to rent.

Age, Relevance, and Design Obsolescence

Age and design matter more than buyers expect. Older buildings are not automatically inferior, but design obsolescence is real. Inefficient layouts, poor ventilation, inadequate elevators, or outdated utilities affect tenant experience directly. Studios with tight floor areas cannot hide these flaws. As buildings age, relevance—not just condition—determines performance.

Studio investing rewards attention to building fundamentals. Brochures sell lifestyle. Buildings deliver outcomes. Buyers who understand this distinction avoid competition traps and protect long-term performance.

At the unit level, livability is where good buildings still separate winners from churn.

Studio Size, Layout, and Livability Economics

“Small” is not the problem. Inefficient is.

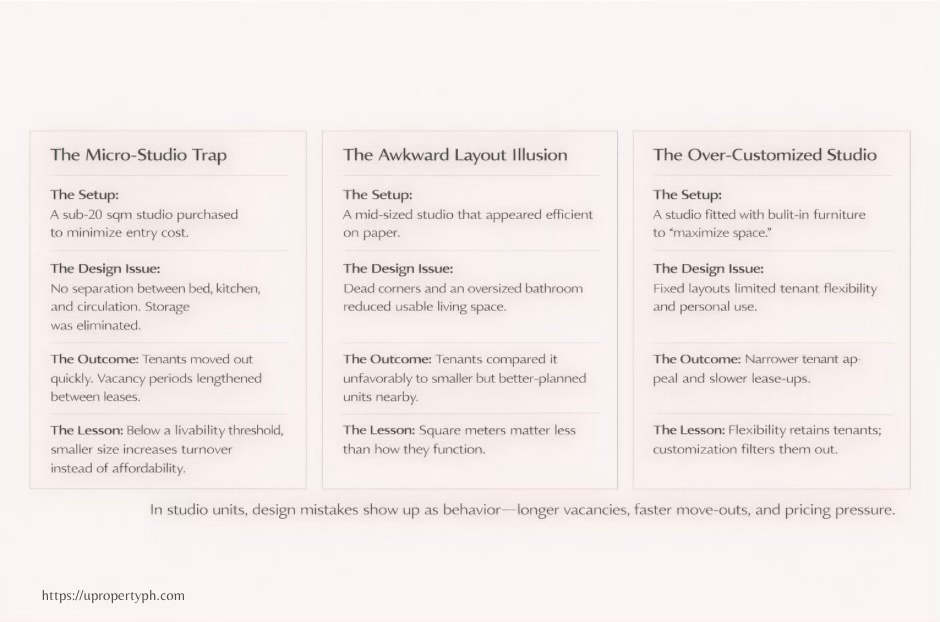

Studio performance is shaped less by square meters and more by how those square meters work. This is where many buyers misread value—assuming that a smaller unit automatically means lower risk or better affordability. In practice, micro-studios and livable studios behave very differently once tenants move in.

Micro Studios vs Livable Studios

Micro-studios prioritize price over usability. They hit lower entry points by compressing space to the minimum, often at the expense of circulation, storage, and comfort. Livable studios may be slightly larger, but they function better day to day. Tenants can place a bed without blocking movement, use the kitchen without compromise, and work or dine without constant reconfiguration. That difference directly affects how long tenants stay. This distinction is especially relevant in newer Philippine launches, where unit sizes have compressed to hit lower entry prices.

In studios, inefficiency is felt faster than in any other unit type.

Layout Efficiency and Storage

Layout efficiency matters more than size alone. Poor layouts waste space through awkward corridors, oversized bathrooms, or unusable corners. Efficient layouts do the opposite—clear sightlines, logical zoning, and flexible furniture placement. Storage is a quiet differentiator. Studios with built-in storage, proper closets, or even a small utility cabinet lease faster and turn over less frequently. Kitchen usability follows the same rule. A functional kitchenette supports daily living; a decorative one frustrates tenants and accelerates move-outs.

Light, Balcony, and Storage

Natural light and orientation amplify livability. Studios with windows positioned for daylight feel larger, ventilate better, and photograph more honestly. Balconies, even small ones, add perceived space and improve tenant satisfaction. Poor orientation—dark units, heat exposure, or blocked airflow—becomes immediately obvious in small units and shortens tenancy.

In studio units, design mistakes show up as behavior—longer vacancies, faster move-outs, and pricing pressure.

How Livability Reduces Vacancy

Livability ultimately shows up in vacancy duration. Tenants tolerate less in studios because they spend more time navigating limitations. Units that feel tight, dark, or awkward turn over faster. Units that feel workable—even modestly so—retain tenants longer. Longer stays reduce vacancy, limit turnover costs, and stabilize income.

Studio economics reward designs that respect how people actually live. Square meters set the price. Layout determines performance.

Once livability is validated, the numbers either confirm the decision—or stop it.

The Numbers That Actually Define the Sweet Spot

This is where intuition needs to give way to math. Not complex spreadsheets—just a few numbers that force clarity and prevent overconfidence. These figures don’t predict outcomes; they bound your risk. These metrics form the backbone of realistic studio condo ROI analysis in the Philippines and reflect how experienced Philippine investors evaluate studios before committing capital.

Price-to-Rent Ratio (Reality Check)

This ratio shows how many years of rent it takes to equal the purchase price—before expenses.

Lower ratios mean more room for vacancy, costs, and error.

In higher-demand locations, ratios naturally run higher—but they must still make sense for the rent the market can actually sustain.

Gross Yield vs Net Yield (What Actually Reaches You)

Gross yield shows what a property earns on paper.

Net yield shows what remains after dues, taxes, maintenance, vacancy, and leasing costs.

The wider the gap between gross and net yield, the more fragile the investment.

If these numbers only work under perfect assumptions, the sweet spot has already been missed.

Price-to-Rent Ratio

It answers a simple question: how many years of rent does it take to equal the purchase price? In practical terms, studios with lower ratios give you more breathing room. In prime areas, ratios naturally run higher; in fringe and emerging areas, they should compress to compensate for weaker demand. When a studio’s price-to-rent ratio looks stretched for its location, you are paying tomorrow’s optimism with today’s cash.

Gross Yield vs Net Yield

It is where expectations often break. Gross yield is calculated before costs; net yield is what remains after dues, taxes, maintenance, vacancy, and fees. The gap between the two matters more than the headline number. Studios with similar gross yields can perform very differently once expenses are accounted for. If the spread is wide, the investment is fragile.

Cash Flow vs Appreciation

It is a trade-off, not a bonus. Some studios are bought for monthly stability; others for long-term value growth. Problems arise when buyers expect both from the same unit without compromise. If appreciation is the primary goal, cash flow may be thin early on. If cash flow is the focus, price discipline becomes non-negotiable. The sweet spot respects this balance instead of denying it.

Break-Even Timelines

It brings everything together. This is not about exact dates; it’s about realism. Consider your down payment, closing costs, furnishing, and early vacancy. Then ask how long stable rental income needs to offset those outlays. Shorter break-even periods mean more flexibility. Longer ones demand stronger conviction—and patience.

Here’s how I frame it when evaluating a studio: if the numbers only work under perfect assumptions, they don’t work. The sweet spot sits where conservative estimates still hold.

Numbers don’t exist in a vacuum. They only matter in the context of your strategy.

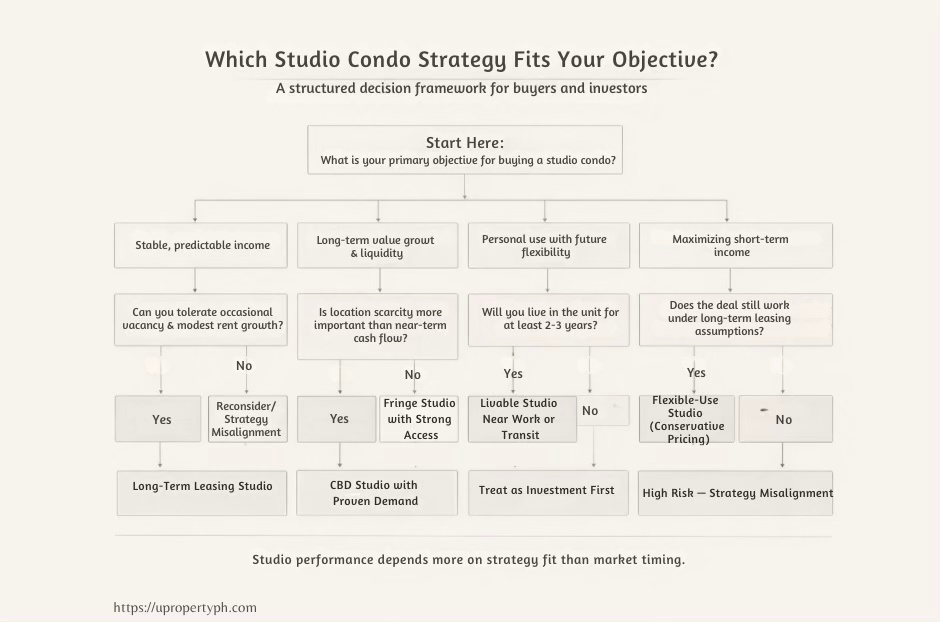

Matching the Right Studio Strategy to the Right Investor

There is no universally “good” studio investment. There is only a studio that fits your objective, your capital, and your tolerance for variability. Most mismatches happen when buyers follow someone else’s strategy instead of clarifying their own. This mismatch is common among Philippine buyers who enter the studio market through pre-selling offers or peer recommendations.

Matching Studio Condo Strategies to Investor Profiles (Philippine Context)

Strategic alignment based on objectives, constraints, and risk tolerance

| Investor Profile | Primary Objective | Suitable Studio Strategy | Location Bias | Risk Sensitivity |

|---|---|---|---|---|

| First-Time Investor | Learn the market with limited downside | Conservatively priced, livable studio for long-term leasing | Fringe areas with real transit access | High sensitivity to vacancy and surprises |

| OFW Investor | Stable, low-touch income from abroad | Well-managed studio with predictable tenant demand | Established CBD or proven fringe locations | High sensitivity to operational friction |

| End-User / Rent Hedge Buyer | Lock in housing costs and flexibility | Livable studio with strong daily-use fundamentals | CBD or walkable employment nodes | Moderate sensitivity to cash flow volatility |

| Yield-Focused Investor | Maximize income relative to capital deployed | Disciplined pricing with realistic rent assumptions | Fringe or emerging areas with verified demand | High sensitivity to pricing and vacancy |

| Appreciation-Oriented Buyer | Long-term value growth and liquidity | Scarce-location studio with long relevance runway | Prime CBDs or irreplaceable nodes | Lower sensitivity to short-term cash flow |

Most studio underperformance comes from strategy mismatch, not market conditions.

First-Time Investors

Those with limited capital benefit most from simplicity and margin for error. The priority is controlled pricing, predictable demand, and low operational friction. Fringe locations with real transit access, livable layouts, and conservative rent assumptions usually outperform flashy launches. The goal is not to maximize returns early; it is to stay invested without surprises while learning how the numbers behave.

OFW Investors

Those seeking passive income need resilience more than optimization. Distance amplifies friction. Studios that lease quickly, attract long-term tenants, and operate well without constant intervention are the right fit. This usually points to established locations, competent property management, and straightforward long-term leasing. Slightly lower rent is acceptable if it buys stability and fewer decisions from abroad.

End-users

Those hedging against rent inflation approach studios differently. The logic here is defensive. Buying a studio locks in housing costs in areas where rent tends to rise faster than income. Location, livability, and building quality matter more than yield metrics. The right studio functions as both shelter and option value—it can be rented out later if plans change.

Yield-Focused vs Appreciation-Driven Buyers

They must choose their bias early. Yield-focused buyers need strict price discipline, realistic rent, and short vacancy cycles. Appreciation-driven buyers accept thinner cash flow in exchange for location scarcity and long-term relevance. Problems arise when buyers expect strong yield and strong appreciation from the same studio without compromise. The sweet spot exists, but it is narrow.

When I assess fit, I start with one question: What does this studio need to do for you over the next five years? Income, flexibility, protection, or growth. Once that is clear, many options eliminate themselves.

Studios perform best when strategy and buyer are aligned. When they are not, even a well-located unit feels like a constant adjustment.

The right studio strategy depends less on the market—and more on your objective.

Most studio mistakes happen when strategy is skipped—or borrowed.

Common Studio Condo Investment Mistakes

Most studio condo mistakes are not reckless. They are reasonable decisions made with incomplete thinking. Patterns repeat because the same assumptions keep circulating. These mistakes are common among first-time condo buyers in the Philippines entering the studio market.

Studio underperformance is usually structural—not accidental.

Buying Cheap Without Demand

This validation is the most common trap. A low price feels safe, especially for first-time buyers. But price alone does not create demand. Studios in weak locations or poorly connected areas struggle to lease, regardless of how affordable they are. Cheap units often carry the highest vacancy risk, which quietly erodes any perceived savings.

Overpaying for Branding

Overpaying for branding and marketing hype comes next. Developer reputation, glossy renderings, and lifestyle promises influence pricing far more than performance. Paying a premium only makes sense when it secures something defensible: location, management quality, or proven tenant demand. Branding without fundamentals fades quickly once the building is lived in.

Ignoring Vacancy

Ignoring vacancy assumptions is where projections break. Many buyers assume full-year occupancy by default. In reality, lease gaps happen, even in prime areas. Failure to account for vacancy turns acceptable numbers into disappointing outcomes. Vacancy is not an exception; it is a baseline condition that must be planned for.

Over-Reliance on Short-Term Rentals

This is a newer but growing risk. Short-term income looks attractive when annualized, but it depends on sustained occupancy, constant management, and regulatory stability. When any of these shift, income volatility rises sharply. Studios that only work as short-term rentals are fragile by design.

The pattern is consistent: focusing on what looks good at the point of purchase, and underestimating what matters after turnover. Avoiding these mistakes does not require sophistication—only discipline.

Studio mistakes rarely fail immediately—they fail quietly through pricing pressure and vacancy.

Even disciplined decisions are shaped by timing.

Market Cycles, Timing, and Exit Liquidity

Studios are sensitive to timing. What looks attractive at launch can behave very differently after turnover, and long-term performance depends on understanding where the unit sits in the cycle—and who will buy it from you later.

Studios don’t underperform after turnover—they begin revealing how they actually work.

Launch vs Post-Turnover Reality

Launch-phase excitement versus post-turnover reality is the first gap to manage. Pre-selling periods are driven by scarcity narratives and flexible payment terms. Turnover introduces competition: dozens of similar units list at once, rents reset to market reality, and buyer optimism meets actual tenant behavior. Stabilization comes later, once inventory clears and pricing normalizes. Investors who plan only for launch conditions are often surprised after keys are released.

Interest Rate Sensitivity

This matters because studio buyers are highly payment-conscious. Smaller ticket sizes attract borrowers who are more exposed to rate changes. When rates rise, demand softens quickly; when rates ease, studios rebound faster than larger units. This volatility affects both leasing assumptions and resale liquidity. Timing entry and exit around rate cycles is not speculation—it is risk management. In the Philippines, studio demand responds quickly to interest rate shifts because buyers are highly payment-sensitive.

Who Actually Buys Studios

Resale liquidity depends on who the next buyer is. Studios are typically bought by first-time investors, end-users hedging rent, or small landlords—not institutions. That means resale demand is broad but price-sensitive. Units that are competitively priced, in proven locations, and easy to understand move first. Studios that rely on aggressive narratives or niche strategies stall. Understanding this dynamic is critical for anyone planning a studio condo resale in the Philippines.

Exit Liquidity of Studio Condos by Buyer Type (Philippine Context)

Who buys studios, how price-sensitive they are, and how quickly deals close

| Buyer Type | Primary Motivation | Pricing Sensitivity | Typical Time-to-Sell | Liquidity Reliability |

|---|---|---|---|---|

| First-Time Investors | Affordable entry and learning experience | High — small price differences affect decisions | Moderate (weeks to a few months) | Moderate, improves with competitive pricing |

| End-Users (Rent Hedge Buyers) | Lock in housing costs and location access | Moderate — value-driven rather than return-driven | Faster when location and livability align | High in established locations |

| Yield-Focused Investors | Income relative to capital deployed | Very high — numbers must work immediately | Slow if pricing is optimistic | Low unless priced conservatively |

| Appreciation-Oriented Buyers | Long-term value growth and scarcity | Lower — selective but patient | Slower but steadier in prime areas | High only in scarce locations |

| Short-Term Rental Operators | Cash flow optimization | High — dependent on regulatory and platform conditions | Unpredictable | Low when regulations tighten |

Exit liquidity is strongest when pricing aligns with the next buyer’s reality—not the original seller’s expectations.

When to Hold, Rent, or Exit

Knowing when to hold, rent, or exit is the final discipline. Hold when occupancy is stable and market supply is digesting. Rent when pricing is rational and demand is steady. Consider exiting when resale prices reflect peak optimism rather than stabilized performance, or when better-aligned opportunities emerge. There is no universal timing—only alignment with your objective.

Studios reward patience during stabilization and decisiveness at inflection points. Exit liquidity is not guaranteed by popularity; it is earned through timing, pricing, and clarity of use.

Here’s how all of this looks when theory meets actual units.

Real-World Studio Scenarios

Abstract rules only become useful when you see how they play out. Below are three common studio scenarios I encounter repeatedly—not as edge cases, but as patterns. None are extreme. All are realistic.

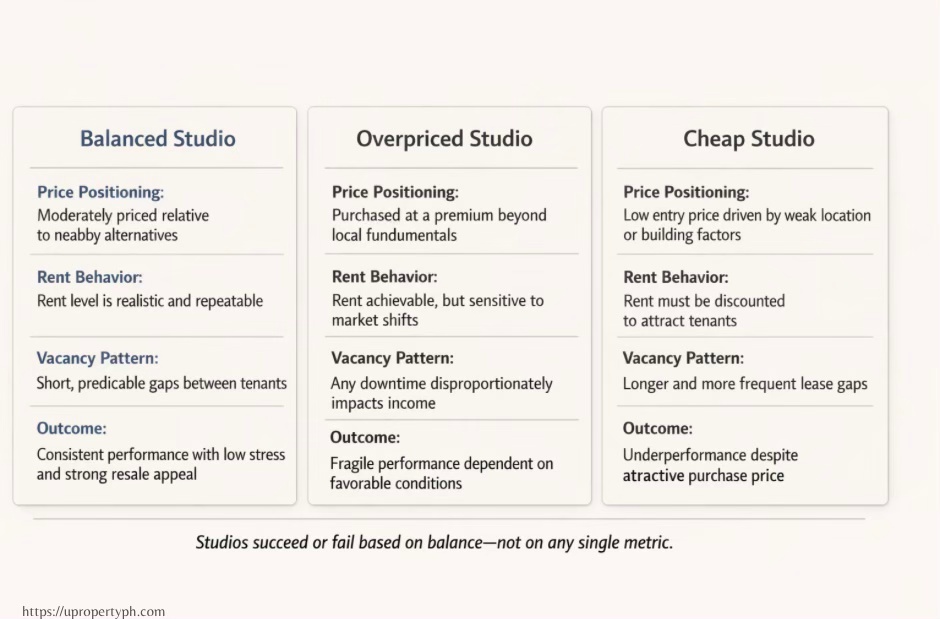

Studios succeed or fail based on balance—not on any single metric.

Balanced Studio

This studio is not the cheapest in the building and not the highest-renting on the listings page. It is sensibly priced for its location, has a livable layout, and sits in a building with steady demand. Rent levels are realistic, vacancy is short, and tenant turnover is manageable. Nothing about the unit is exciting—and that is precisely why it works. Performance is consistent, cash flow is predictable, and resale remains straightforward because the unit appeals to a wide buyer base.

Balanced Studio — Compounding Outcome

| Factor | Yearly Assumption | Compounding Effect |

|---|---|---|

| Purchase Price Discipline | Priced close to market comparables | Limits downside risk |

| Achievable Rent Level | Sustainable and repeatable | Rent holds across cycles |

| Average Annual Vacancy | Short, predictable gaps | Minimal income disruption |

| Net Income Stability | Consistent year to year | Easier planning and flexibility |

| 5–10 Year Outcome | Small advantages compound steadily | Stable long-term performance |

Overpriced Studio

On paper, this unit looks strong. Rent is above average, finishes are polished, and the location sounds premium. The issue is entry price. Too much capital was committed upfront, leaving little room for vacancy, negotiation, or market shifts. A few weeks of downtime or a small rent adjustment has an outsized impact. The unit is not failing—but it is fragile. Performance depends on conditions staying favorable.

Overpriced Studio — Compounding Outcome

| Factor | Yearly Assumption | Compounding Effect |

|---|---|---|

| Purchase Price Discipline | Entered above local fundamentals | Limited margin for error |

| Achievable Rent Level | Rent achievable but fragile | Sensitive to market shifts |

| Average Annual Vacancy | Minor gaps create outsized impact | Income volatility increases |

| Net Income Stability | Easily disrupted | Performance depends on conditions |

| 5–10 Year Outcome | Small frictions accumulate | Gradual underperformance |

Cheap Studio

This unit attracts buyers because of its price. Unfortunately, tenants are harder to convince. Location friction, building issues, or layout limitations slow lease-ups. Rent must be discounted to compete, and vacancy stretches between tenants. Over time, turnover costs and missed months quietly erase the initial savings. Cheap entry does not compensate for weak demand.

Cheap Studio — Compounding Outcome

| Factor | Yearly Assumption | Compounding Effect |

|---|---|---|

| Purchase Price Discipline | Low entry driven by weak demand | Price does not create liquidity |

| Achievable Rent Level | Discounted to compete | Lower income baseline |

| Average Annual Vacancy | Longer and recurring gaps | Missed income compounds |

| Net Income Stability | Irregular and unpredictable | Planning becomes difficult |

| 5–10 Year Outcome | Early savings eroded | Long-term underperformance |

Why Balance Wins Long-Term

Across these scenarios, the pattern is consistent. Studios that balance price, rent, and vacancy outperform those that optimize only one variable. Balanced units absorb market noise, lease through slow periods, and remain sellable without narrative gymnastics. They do not rely on perfect timing or ideal tenants. They simply work.

This is the practical takeaway: studios succeed not by maximizing any single metric, but by minimizing regret. Balance is what keeps performance intact when conditions change.

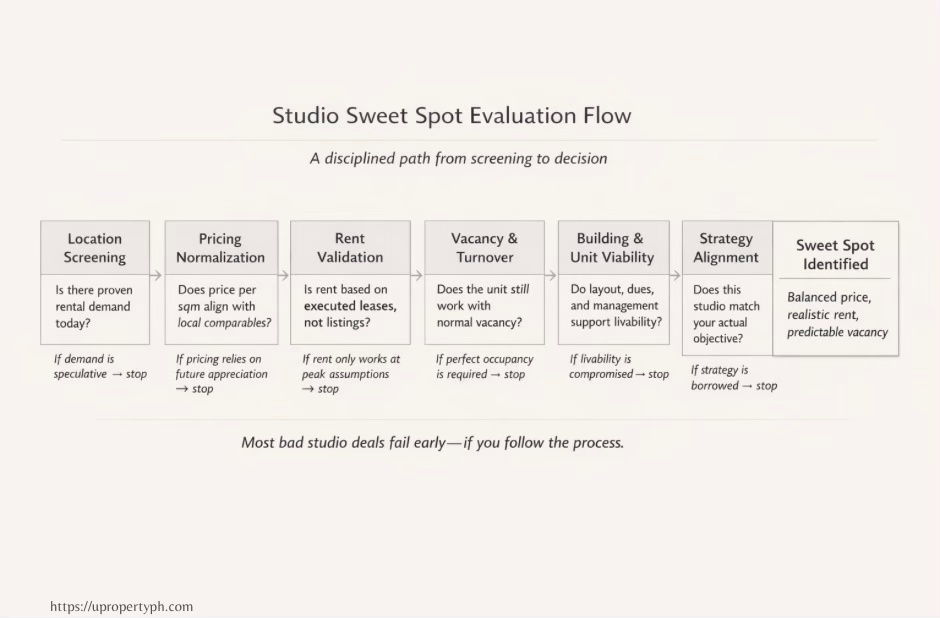

The goal now is repeatability—not intuition.

A Practical Framework to Identify the Studio Sweet Spot

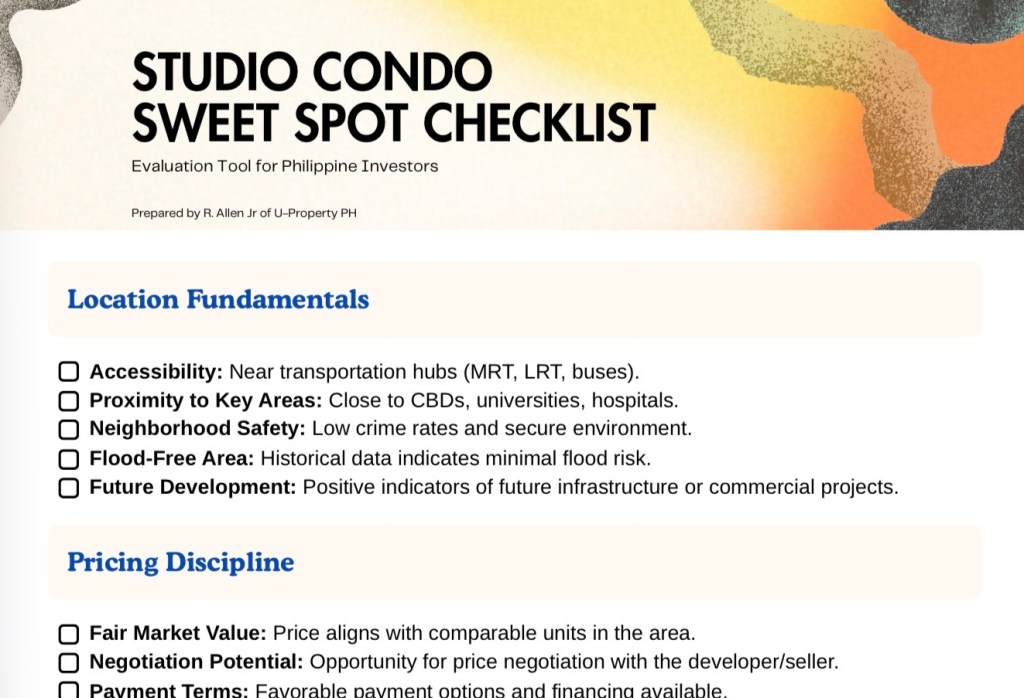

The sweet spot is not discovered by instinct. It is identified through a repeatable process that forces discipline and removes emotion from the decision. This checklist-style approach reflects how professional real estate due diligence in the Philippines is actually done and it mirrors how real estate due diligence is typically conducted for small residential investments in the Philippines.

Evaluate Studio Deals With Clarity—Not Hype

Download the Studio Condo Sweet Spot Checklist—a one-page framework that helps you assess price, rent, and vacancy balance before you commit.

This is the same logic used to filter out marginal studio deals early—before optimism takes over.

Most studio mistakes don’t happen because buyers rush.

They happen because decisions are made without a structured filter.

This checklist gives you a clear, repeatable way to pressure-test any studio—pre-selling, RFO, or resale—using conservative, real-world assumptions.

No formulas. No projections. Just disciplined evaluation.

Inside the one-page checklist:

- A location reality check grounded in actual tenant behavior

- Pricing discipline rules to spot unjustified premiums early

- Rent validation prompts that separate listings from executed leases

- Vacancy and turnover assumptions most buyers ignore

- A final decision gate that makes walking away easier

Get the checklist sent to your email.

Used by buyers and investors who prefer boring, repeatable performance over speculative upside.

No spam. No sales blasts.

Only practical insights on studio pricing, rent behavior, and vacancy risk in the Philippine market.

Most bad studio deals fail early—if you follow the process.

Step-by-Step Evaluation Process

Start with location fundamentals. Confirm access to employment centers, transport, and daily conveniences. Next, normalize pricing using price per square meter against nearby comparables. Then pressure-test rent using current listings, not projections. Finally, assume vacancy and basic turnover costs before deciding whether the numbers still make sense. If the deal only works under ideal conditions, it does not work.

Red Flags to Walk Away From

Walk away when pricing is justified by future promises instead of current demand. Walk away when comparable rents are scarce or inconsistent. Walk away when vacancy assumptions are brushed aside as “temporary.” And walk away when the building shows signs of poor management, excessive studio saturation, or rising dues without corresponding value.

Data Every Buyer Should Request

Before committing, ask for recent leasing ranges—not asking prices, but executed rents. Review association dues history and any planned increases. Check studio density per floor and per tower. Confirm property management track record and house rules, especially on short-term rentals. Data reduces guesswork. Guesswork inflates risk.

Questions Brokers Must Answer Clearly

A competent broker should explain who the typical tenant is, how long studios usually take to lease, and where pricing sits relative to nearby alternatives. They should be able to articulate downside scenarios, not just upside narratives. If answers rely on optimism rather than evidence, pause.

The full version of this framework is summarized in a one-page checklist you can reference before committing. This framework is deliberately simple. It does not aim to find the “best” studio—only one that works under normal conditions. That is the essence of the sweet spot.

If you remember nothing else, remember this.

Key Takeaways for Buyers, Investors, and Brokers

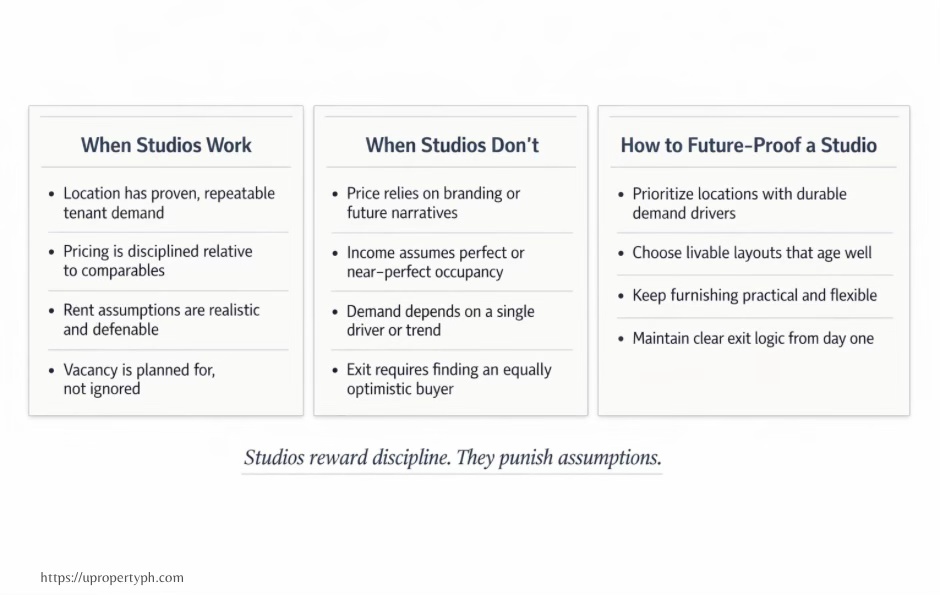

This guide reduces studio investing to what actually matters. Not hype. Not exceptions. Just conditions.

Studios reward discipline. They punish assumptions.

When Studio Condos Make Sense

Studios work when location fundamentals are real, pricing is disciplined, and demand is repeatable. They make sense for buyers who value liquidity, manageable ticket sizes, and faster lease-up. They also work when the unit’s layout is livable, the building is well-managed, and vacancy assumptions are conservative. In these conditions, studios deliver steady, boring performance—the kind that compounds quietly.

When They Don’t

Studios struggle when price runs ahead of demand, when supply overwhelms the tenant pool, or when income depends on perfect occupancy. They also underperform when buyers rely on branding, short-term rental narratives, or future infrastructure promises to justify today’s numbers. If a studio only works under ideal scenarios, it is not aligned with reality.

How to Future-Proof a Studio Investment

Future-proofing is less about prediction and more about resilience. Prioritize locations with durable demand drivers, buildings with competent management, and layouts that age well. Keep furnishing practical, pricing realistic, and exit options clear. Studios that can function under normal conditions remain viable when markets shift.

For brokers, the takeaway is responsibility. Studios are easy to sell and easy to misrepresent. Long-term credibility is built by helping buyers avoid marginal deals, not by pushing every available unit.

For buyers and investors, the takeaway is clarity. Studio condos are not inherently good or bad. They are precise instruments. Used correctly, they perform. Used casually, they disappoint.

If you prefer to apply this process without guesswork, the next step is straightforward.

The next step depends on how you prefer to decide—independently or with support.

Call to Action

If you’re evaluating a studio condo investment in the Philippines and want clarity before committing, the next step is straightforward. This is the same framework I use when reviewing studio units for buyers who want them to still make sense years after turnover. This approach reflects how studio condos are evaluated in real Philippine transactions, not in marketing decks.

If you want a second set of eyes on a specific studio you’re considering—pricing, rent assumptions, vacancy risk, and building fundamentals—I offer studio investment evaluation consultations with KeyStudio, designed to pressure-test deals before money changes hands. No sales script. Just an objective assessment based on how studios actually perform.

If you prefer to evaluate independently, download the Studio Condo Sweet Spot Checklist—a one-page tool that mirrors the exact decision process outlined in this guide.

For ongoing insights, you can also subscribe for investment-focused updates—practical observations on pricing shifts, rental behavior, and studio performance trends across Metro Manila and key growth areas. No noise. Just what changes decisions.

Smart studio investing is not about moving fast. It’s about moving informed. Start with the tool or conversation that fits how you make decisions. Most readers who reach this point use the checklist to confirm—not to decide.

Leave a comment