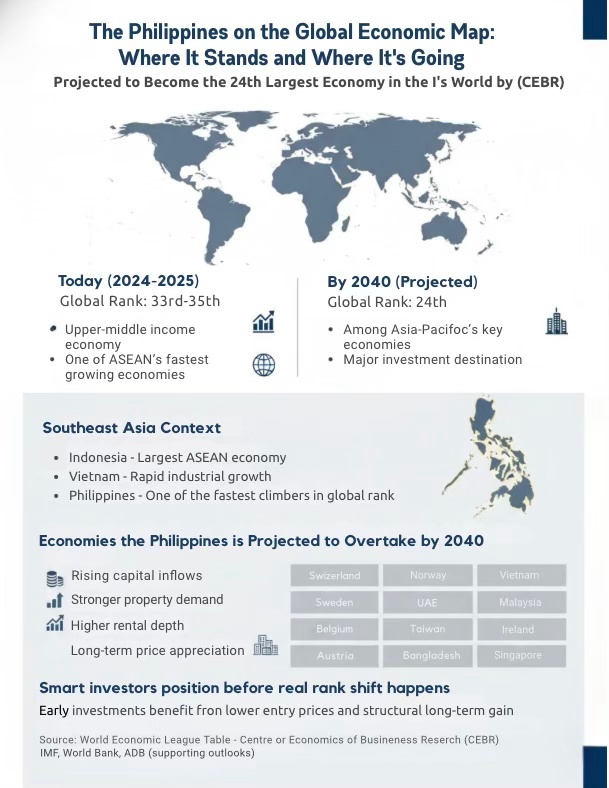

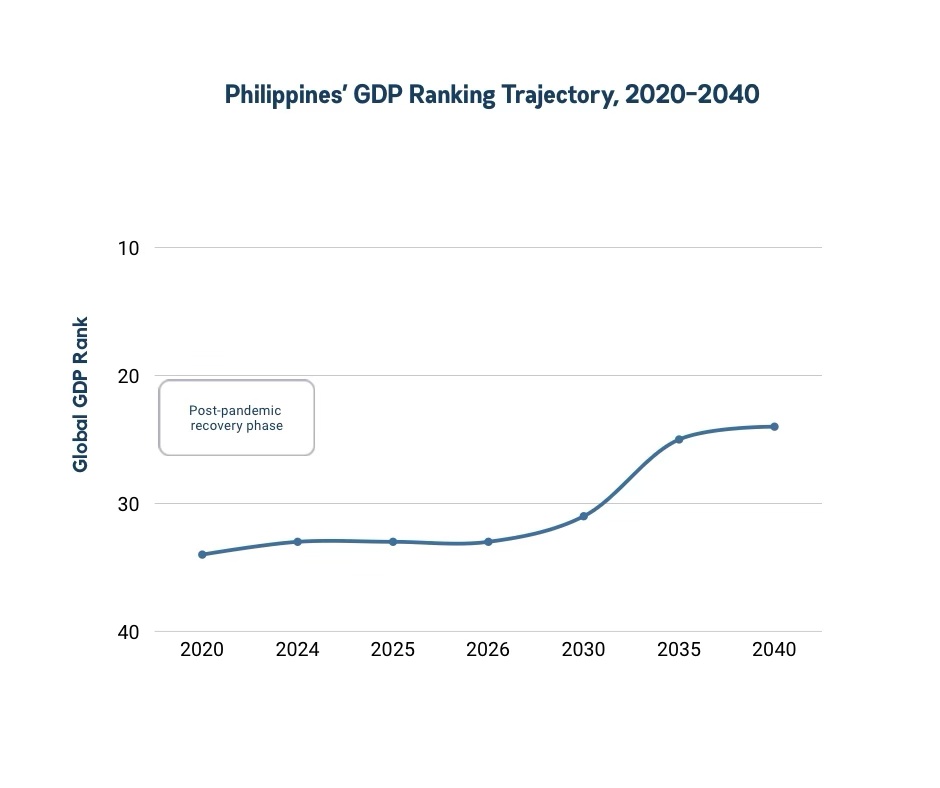

The Philippines is on track to join the ranks of the world’s economic heavyweights. According to the Center for Economics and Business Research (CEBR) World Economic League Table, the country is projected to become the 24th largest economy by 2040. This rise signals a shift in the country’s economic landscape, creating opportunities across industries, particularly in real estate.

For investors, homeowners, and property developers, this projected growth translates into tangible market potential. Rising incomes, urbanization, and a young, expanding workforce will fuel demand for residential, commercial, and mixed-use properties in key cities. For first-time homebuyers and seasoned investors alike, understanding this economic trajectory is crucial for making strategic property decisions today that could yield significant returns by 2040.

The Philippines’ Economic Projection

The Philippines’ projected rise to the 24th largest economy in the world by 2040, as reported by the Center for Economics and Business Research (CEBR) World Economic League Table, is a testament to the country’s strong long-term growth potential. The CEBR ranking evaluates economies based on multiple macroeconomic factors, including GDP growth rates, population trends, labor force expansion, productivity gains, and investment flows. By 2040, the Philippines is expected to outperform many of its regional peers, positioning itself ahead of several established emerging markets.

This projection relies on several key assumptions.

Sustained GDP Growth

Averaging around 5–6% annually over the next two decades and fueled by infrastructure investments, a young and expanding workforce, and an increasing middle-class consumer base.

Urbanization Rate

More Filipinos moving to economic hubs such as Metro Manila, Cebu, Davao, and emerging growth cities like Iloilo and Clark.

Foreign Direct Investment (FDI)

Its inflows are projected to remain robust, supporting the expansion of the services sector, manufacturing, and logistics.

Government Reforms

Aimed at improving ease of doing business, tax structures, and digital economy readiness and are assumed to continue, creating a favorable business climate.

In the current global ranking, the Philippines ranks outside the top 30, trailing behind larger Southeast Asian economies such as Indonesia, Thailand, and Malaysia. By 2040, according to CEBR, the Philippines is set to surpass Thailand and other mid-tier emerging markets, cementing its place as a leading regional economy. This growth outlook places the Philippines on a similar path to countries like Mexico and South Korea during their periods of rapid expansion, highlighting the country’s potential to attract global investors and businesses.

For real estate stakeholders, this economic projection is a strong indicator of sustained demand across residential, commercial, and industrial property sectors. As GDP grows and disposable income rises, property prices, rental yields, and commercial occupancy rates are likely to follow, making strategic investments today a potentially high-return opportunity for 2040 and beyond.

Key Drivers of Economic Growth

The Philippines’ projected rise to becoming 24th largest economy by 2040 is underpinned by multiple structural drivers that combine demographic advantage, infrastructure expansion, sectoral diversification, and a favorable investment climate. Understanding these drivers is essential for investors, homebuyers, and real estate developers looking to capitalize on emerging opportunities.

1. Demographic Dividend and Urbanization

The Philippines continues to benefit from a young and expanding population, with the latest estimates placing the median age at around 26 years in 2026. This demographic advantage supports a large, dynamic workforce that fuels domestic consumption, entrepreneurship, and productivity growth. With a labor force projected to grow steadily over the next two decades, the country has the human capital needed to sustain long-term GDP expansion and support the rise of new economic hubs.

Urbanization remains a major driver of real estate demand. Key economic centers—Metro Manila, Cebu, Davao, Clark, and Iloilo—are seeing more internal migration, fueled by employment opportunities, lifestyle amenities, and improved transport connectivity. The expansion of business districts, tech parks, and industrial zones is further attracting residents seeking proximity to workplaces and modern conveniences.

2. Infrastructure Development

Infrastructure is a driving force behind the Philippines’ economic growth, with projects supporting urban connectivity and regional development. Following the “Build, Build, Build” initiative, the government has transitioned into the “Build, Better, Beyond” phase, focusing not only on completing existing projects but also on enhancing efficiency, sustainability, and integration with emerging economic zones.

Recent and ongoing projects include:

Metro Manila Subway

Set to revolutionize public transit by connecting key business districts and easing congestion in the capital.

North-South Commuter Railway (NSCR) Phase 2

Expanding connectivity between Bulacan and Calamba that will reduce travel times for commuters and increase demand for residential and com

Clark International Airport Expansion

Strengthen Clark as an international gateway and logistics hub that can attract businesses and residential growth in Pampanga and nearby areas.

Cebu-Cordova Link Expressway & Metro Cebu Expressway Projects

Improve intercity connectivity and can support commercial and industrial developments across Cebu.

These infrastructure investments not only enhance mobility and reduce logistical bottlenecks but also create high-potential property corridors for residential, commercial, and mixed-use developments. Proximity to modern transport hubs, expressways, and integrated transit systems has become a key driver of property appreciation and rental demand, making infrastructure-focused locations attractive for long-term investment.

3. Sectoral Growth

The Philippine economy continues to diversify, with multiple sectors driving sustained growth and creating new opportunities for real estate investors.

Services Sector

Business process outsourcing (BPO), IT, fintech, and logistics, are the core engines of GDP and urban employment. In 2026, the country’s BPO industry employs over 1.5 million workers attracting high-value international contracts, while fintech adoption and digital services expand rapidly.

Manufacturing Sector

Manufacturing and export-oriented industries are experiencing renewed growth, supported by trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) and strategic initiatives in electronics, automotive, and processed food production.

Industrial demand is rising, driving warehouses, distribution centers, and industrial parks in logistics corridors near Metro Manila, Clark, Cebu, and Subic. E-commerce growth has also accelerated the need for last-mile delivery hubs, making industrial real estate increasingly lucrative.

4. Investment Climate

The Philippines’ investment climate has strengthened considerably in recent years, reinforcing its position as a preferred destination for both foreign and domestic capital. Foreign direct investment (FDI) continues to trend upward, driven by a growing consumer base, a digitally skilled workforce, and sustained structural reforms aimed at improving market accessibility and investor confidence.

Key drivers shaping today’s investment environment include:

- Liberalized foreign ownership rules, particularly in telecommunications, renewable energy, transport, and logistics

- Continued implementation of the CREATE Law, which lowered corporate income taxes and expanded fiscal incentives for strategic industries

- Strong integration into regional trade frameworks such as RCEP, deepening access to ASEAN and East Asian markets

- Rising participation from investors in Japan, South Korea, the US, and the EU, particularly in infrastructure, manufacturing, and technology

At the policy level, the government has intensified its push toward a digitally enabled and infrastructure-backed economy, prioritizing smart cities, renewable energy, and public-private partnerships (PPPs). These initiatives directly boost real estate demand as multinational firms, expatriates, and local enterprises seek Grade A offices, logistics facilities, mixed-use townships, and high-quality residential communities near growth corridors.

These sectors are expected to drive sustained property demand across Metro Manila, Clark, Cebu, and emerging growth corridors through 2040.

Implications for the Philippine Real Estate Market

Economic expansion, rising incomes, urban migration, and sectoral growth are driving increasing demand across residential, commercial, and industrial property sectors. For investors, homeowners, and developers, understanding these implications is essential for identifying high-potential opportunities.

1. Residential Demand

Residential demand in the Philippines continues to strengthen, fueled by the expansion of the middle class, sustained urbanization, and evolving lifestyle priorities. In 2026, the market is seeing strong demand across condominiums, townhouses, and well-planned affordable housing, particularly in urban and peri-urban growth corridors where employment and infrastructure investments converge.

Young professionals, millennials, and overseas Filipino workers (OFWs) are increasingly prioritizing location over property size—favoring properties within or near business districts, mass transit stations, and lifestyle hubs. This shift is driving higher absorption rates for developments that offer walkability, transit access, and integrated retail and leisure components.

Proximity to workplaces, schools, shopping centers, and healthcare facilities has become a non-negotiable criterion for many buyers, increasing demand for amenity-rich, master-planned communities over isolated standalone projects. Pre-selling developments in high-growth districts such as Vertis North, Bonifacio Global City (BGC), Cebu IT Park, and emerging Clark townshipscontinue to attract both end-users and investors, supported by flexible payment schemes, early pricing advantages, and strong post-completion appreciation potential.

2. Commercial and Mixed-Use Spaces

Commercial and mixed-use real estate in the Philippines has entered a more strategic and experience-driven phase, shaped by post-pandemic workplace shifts, digital commerce, and the demand for lifestyle-centric environments. While traditional office demand remains strong in prime CBDs, it is now complemented by more flexible workspaces, Grade A offices, and hybrid-use developments that support modern business models.

The growth of co-working spaces, innovation hubs, and satellite offices continues to cater to startups, BPO firms, tech companies, and multinational enterprises seeking agility, scalability, and proximity to talent. Notably, decentralization is accelerating, with firms expanding beyond Makati and Ortigas into BGC, Vertis North, Alabang, Cebu IT Park, and Clark, driving commercial demand in emerging business districts.

Mixed-use developments have become the dominant urban development model, integrating residential, office, retail, hospitality, and open spaces into a single, cohesive environment. These projects benefit from multiple income streams and consistently outperform single-use assets due to their built-in foot traffic, convenience factor, and resilience across market cycles.

3. Industrial & Logistics Growth

Industrial and logistics real estate has become one of the fastest-growing and most resilient property segments in the Philippines, driven by the sustained expansion of e-commerce, regional trade, and supply chain reconfiguration across Asia. In 2026, demand for warehouses, distribution centers, cold storage facilities, and last-mile logistics hubs continues to outpace supply in key corridors.

Growth is particularly concentrated in Cavite, Laguna, Batangas, Clark, Subic, and Bulacan, where proximity to expressways, ports, and airports enables faster goods movement and lower operating costs. The maturation of logistics corridors such as CALABARZON and the Central Luzon logistics belt has turned these areas into strategic investment zones for industrial developers and institutional investors.

The rise of same-day delivery expectations, omnichannel retail, and regional manufacturing has directly pushed up industrial land values and rental rates, making logistics real estate a high-yield, low-vacancy asset class. For investors, long-term leases with logistics operators, third-party logistics (3PL) firms, and export-oriented manufacturers offer stable cash flow and strong capital appreciation, particularly for well-located and scalable industrial assets.

4. Investment Returns and ROI

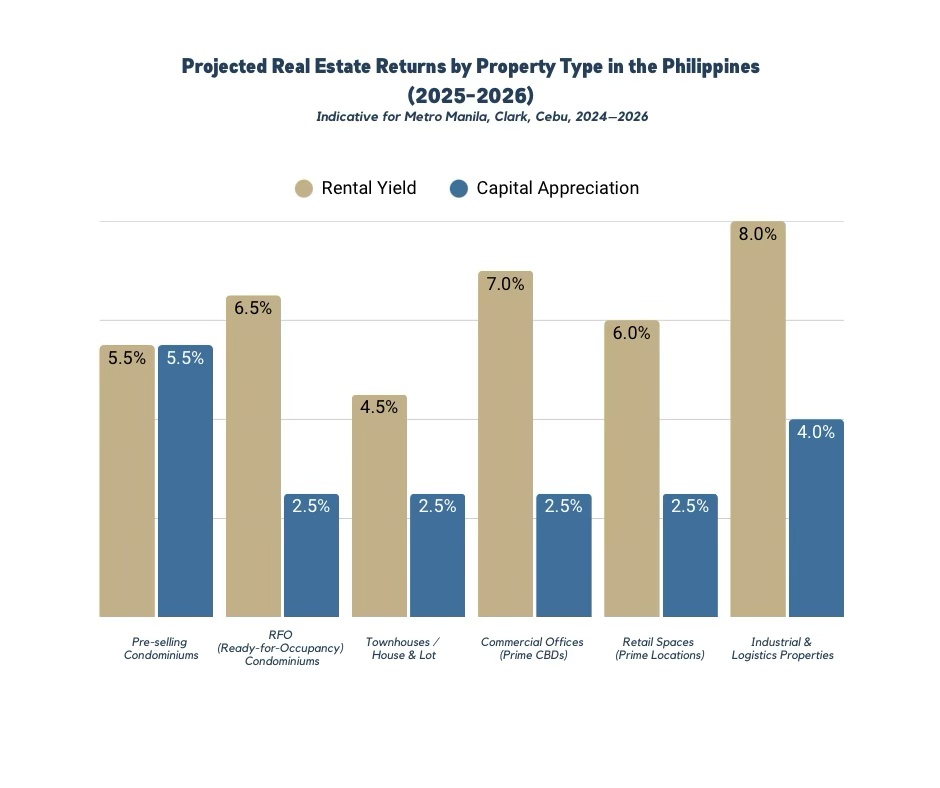

Philippine real estate continues to demonstrate strong long-term return fundamentals, supported by structural demand, limited prime land supply, and expanding urban economies. In the post-pandemic recovery period through 2025–2026, property values in key growth corridors such as BGC, Makati, Ortigas, Vertis North, Cebu IT Park, and Clark have shown renewed momentum, with residential capital appreciation generally tracking 6–9% annually in prime districts, while well-located commercial and industrial assets consistently outperform inflation.

Rental yields remain competitive by regional standards. Prime residential properties in central business districts typically generate 4–6% gross yields, while logistics, industrial, and Grade A commercial properties command 6–8% yields, particularly where long-term leases with institutional tenants are in place.

Looking forward, the convergence of economic expansion, urban densification, infrastructure completion, and sectoral growth strongly supports an upward trajectory for real estate returns. Investors are increasingly shifting toward pre-selling developments in growth corridors, mixed-use townships, and logistics-linked industrial assets, which offer a compelling balance of capital appreciation and income stability.

Strategic acquisitions made in this phase of the cycle—especially in locations aligned with transport infrastructure, business districts, and population growth—position investors to benefit from sustained property appreciation and resilient rental demand through 2040 and beyond, turning an economic projection into durable, wealth-building assets.

This convergence of rising residential demand, thriving commercial hubs, industrial expansion, and strong ROI potential makes the Philippine real estate market one of the most compelling investment destinations in Asia. Investors who understand these dynamics can strategically position themselves to maximize returns over the next two decades.

Industrial and pre-selling assets currently deliver the strongest combined income and growth potential in the Philippine market, reflecting the economy’s structural transformation.

Urbanization and Lifestyle Trends

The Philippines’ economic rise is reshaping urban landscapes and influencing how Filipinos live, work, and invest. Urban migration, lifestyle-focused developments, smart city initiatives, and evolving buyer preferences are creating a dynamic real estate environment, offering opportunities for both investors and homebuyers.

Migration to Urban Centers

Urban migration is reshaping the Philippine real estate landscape strategically and more decentralized than in previous decades. While Metro Manila, Cebu, and Davao remain dominant for talent and capital, secondary growth hubs such as Clark, Iloilo, Bacolod, Cagayan de Oro, and General Santos absorb a growing share of population inflows, driven by infrastructure connectivity, business process decentralization, and regional economic expansion.

The post-pandemic normalization of hybrid work, coupled with aggressive regional development policies, reduced overconcentration in traditional CBDs and accelerated demand in transit-oriented developments, integrated townships, and master-planned communities outside the historical core. Buyers prioritize access to mass transport, healthcare, schools, and lifestyle centers over sheer proximity to legacy business districts.

Lifestyle Districts and Emerging Neighborhoods

Lifestyle-oriented districts defined the format of modern urban development in the Philippines, shifting away from isolated CBDs toward integrated, experience-driven communities. Established hubs such as Bonifacio Global City (BGC), Makati CBD, and Cebu IT Park continue to mature, but the real momentum is now expanding into Vertis North, Bridgetowne, Arca South, Clark Global City, Nuvali, and Iloilo Business Park, where large-scale master planning is shaping the next generation of urban centers.

What differentiates these emerging neighborhoods is their deliberate focus on placemaking: walkable street grids, curated retail and dining corridors, expansive green spaces, cultural venues, and seamless transport connectivity. These are designed ecosystems that support productivity, wellness, and social engagement in one address.

Smart City Initiatives and Sustainable Living

Smart city development in the Philippines has moved beyond conceptual planning into measurable, investable reality. Flagship projects such as New Clark City, Clark Global City, and the Iloilo Smart City initiatives, alongside digitally upgraded districts within Metro Manila, are now actively deploying AI-assisted traffic systems, fiber-first connectivity, smart grids, and data-driven urban management platforms. These are not cosmetic upgrades—they are structural improvements that redefine how cities operate, scale, and attract capital.

Developers are increasingly embedding sustainability by design, not only as a marketing layer but as a regulatory, financial, and demand-driven necessity. High-performance façades, energy-efficient HVAC systems, rainwater harvesting, waste-to-energy solutions, and LEED or BERDE certifications are becoming standard in premium and even mid-market projects. Buyers and tenants now actively screen for environmental performance, operating cost efficiency, and climate resilience.

Preferences of Millennials, Gen Z, and OFWs

Millennials, Gen Z, and overseas Filipino workers are now the dominant demand drivers of the Philippine residential market, and their buying behavior has become markedly more sophisticated. Urban professionals increasingly prioritize location intelligence over unit size, favoring properties that minimize commute time, integrate with transit systems, and sit within walkable, mixed-use districts. High-speed connectivity, smart-home features, and digital property management are no longer premium add-ons—they are baseline expectations.

Gen Z buyers, now entering the market earlier than previous generations, demonstrate a strong preference for flexible layouts, co-living formats, and community-oriented developments, reflecting a lifestyle that blends work, social interaction, and wellness. Sustainability credentials and brand reputation of developers also materially influence their purchase decisions, especially in competitive urban markets.

OFWs, meanwhile, continue to anchor the investment segment but with sharper financial discipline. Rather than buying purely for asset accumulation, they increasingly target rental-grade properties in BGC, Vertis North, Cebu IT Park, and Clark that offer yield visibility, professional property management, and exit liquidity. Pre-selling units with phased payment structures and income-ready turnarounds are especially attractive to this segment.

By combining urban migration patterns, lifestyle-focused districts, smart city developments, and generational preferences, the Philippine real estate market is evolving to meet modern demand. For investors, these trends offer clear guidance on where and what type of properties to prioritize for long-term growth and sustained rental income.

Why Lifestyle Districts Outperform Traditional Developments

Integrated lifestyle districts outperform traditional developments by combining accessibility, employment, education, and amenities within a single urban ecosystem.

Risks and Considerations

While the Philippines’ projected rise presents significant real estate opportunities, investors and homebuyers must carefully evaluate potential risks. Understanding economic, environmental, regulatory, and market dynamics is critical for making informed property investment decisions and safeguarding long-term returns.

Inflation, Interest Rates, and Currency Volatility

Macroeconomic conditions remain one of the most decisive variables to real estate performance in the Philippines.

Inflation

While inflation has moderated from its post-pandemic peaks, it still influences construction costs, pricing, and household purchasing power. Developers have become more disciplined in project phasing and unit sizing, while buyers are increasingly sensitive to value-per-square-meter rather than headline prices alone.

Interest rates

Interest rates remaining higher than the ultra-low environment of the early 2020s, made investors and end-users change their approach to leverage. Mortgage affordability now plays a central role in purchasing decisions, pushing greater demand toward flexible payment schemes, longer fixing periods, and developer-assisted financing programs. For investors, yield compression is no longer tolerated; deals must now clear a higher return threshold to justify capital deployment.

Currency Volatility

Currency volatility adds another layer of complexity, particularly for OFWs and foreign buyers. Peso movements directly affect acquisition costs, repatriated returns, and cross-border portfolio allocation. As a result, more investors are structuring purchases as natural hedges—pairing peso-denominated rental income with foreign-currency savings or targeting assets in prime districts with historically resilient pricing.

Environmental and Climate Risks

Smart city development in the Philippines has moved beyond conceptual planning into measurable, investable reality. Flagship projects such as New Clark City, Clark Global City, and the Iloilo Smart City initiatives, alongside digitally upgraded districts within Metro Manila, are now actively deploying AI-assisted traffic systems, fiber-first connectivity, smart grids, and data-driven urban management platforms. These are not cosmetic upgrades—they are structural improvements that redefine how cities operate, scale, and attract capital.

Developers are increasingly embedding sustainability by design, not only as a marketing layer but as a regulatory, financial, and demand-driven necessity. High-performance façades, energy-efficient HVAC systems, rainwater harvesting, waste-to-energy solutions, and LEED or BERDE certifications are becoming standard in premium and even mid-market projects. Buyers and tenants now actively screen for environmental performance, operating cost efficiency, and climate resilience.

Regulatory and Taxation Issues

The real estate market is shaped by a dynamic regulatory and taxation landscape that directly affects investment returns. Key considerations include capital gains tax, documentary stamp tax, transfer fees, zoning regulations, and foreign ownership restrictions, all of which evolve under both national reforms and local government ordinances.

Recent policy shifts have streamlined property transactions, expanded incentives for strategic investments, and enhanced compliance transparency. For example, updates to the CREATE lawand local real estate ordinances now offer more predictable tax frameworks for residential, commercial, and industrial developments, while certain economic zones provide tax holidays and special incentives for developers and investors.

Foreign buyers and OFWs must carefully consider restrictions on land ownership and condominium acquisitions, as well as the compliance requirements for cross-border investments. Staying informed about these regulations—and leveraging professional support from licensed brokers, legal counsel, and established developers—remains essential to reduce risk, optimize financing, and maximize long-term ROI.

Market Saturation and Timing Considerations

Even in a high-growth market, overconcentration of developments in prime districts can lead to temporary market saturation. When multiple residential, commercial, or mixed-use projects launch simultaneously, absorption rates may slow, rental yields can compress, and short-term capital appreciation may be muted.

Strategic timing remains critical for investors seeking maximum returns. Targeting pre-selling units, emerging neighborhoods, or underdeveloped growth corridors—such as Clark, Iloilo Business Park, Subic, and select CALABARZON hubs—provides a first-mover advantage. Early investments in these areas benefit from lower entry prices, higher rental demand, and long-term appreciation as infrastructure, business activity, and urban migration converge.

By assessing economic, environmental, regulatory, and market factors, investors can make informed decisions, mitigate risks, and position themselves to capture the Philippines’ real estate growth over the next two decades.

A practical risk checklist every Philippine real estate investor should evaluate before buying.

Strategic Actionable Advice for Investors

With the Philippines projected to become the 24th largest economy by 2040, strategic investment decisions today can yield substantial returns over the next two decades. Savvy investors must focus on location, financing, timing, and expert guidance to maximize capital appreciation and rental yields.

Where to Buy Property for Capital Appreciation

Location remains the most critical factor for long-term property growth. Investors should target emerging economic hubs and high-demand urban districts, including:

Metro Manila

BGC, Makati CBD, Ortigas, and Vertis North for prime residential and mixed-use properties.

Cebu

Cebu IT Park, Mactan, and South Road properties benefiting from business expansion and urbanization.

Davao

Ecoland and Lanang districts, driven by economic growth and rising middle-class demand.

Clark and Subic

Strategic industrial and residential areas benefiting from infrastructure and logistics expansion.

Properties near transport hubs, business centers, and lifestyle amenities typically see stronger appreciation and higher rental demand. Pre-selling and off-plan developments in these areas can offer early entry advantages and discounted rates, further boosting potential ROI.

Financing Options: Mortgages and Pre-Selling Advantages

Understanding financing is crucial for maximizing investment potential. Mortgages allow buyers to leverage capital while taking advantage of historically low interest rates, making high-value properties accessible.

Pre-selling properties offer additional advantages:

- Lower initial cash outlay and flexible payment terms.

- Potential for capital appreciation before project completion.

- Priority selection of units in prime locations.

Combining mortgage financing with pre-selling opportunities can create a high-leverage strategy for both residential and commercial investments, especially in fast-growing urban districts.

How to Leverage Economic Growth for Long-Term Wealth

Investors can capitalize on the Philippines’ economic rise by focusing on high-demand property types aligned with demographic and sectoral trends:

Residential

Condominiums, townhouses, and amenity-rich developments near economic hubs.

Commercial

Office spaces and mixed-use developments benefiting from BPO, IT, and fintech expansion.

Industrial

Warehouses and logistics facilities tied to e-commerce and export growth.

Strategically diversifying investments across these sectors allows investors to capture both rental income and long-term capital appreciation, aligning property portfolios with the economic trajectory.

Partnering with Brokers and Advisors

Partnering with licensed brokers, financial advisors, and legal consultants ensures compliance with local regulations, access to exclusive properties, and informed investment decisions.

Experienced professionals can provide guidance on:

- Market timing and property selection.

- Negotiation strategies and contract review.

- Financing solutions and pre-selling opportunities.

- Risk assessment and portfolio diversification.

Investors who collaborate with trusted advisors can maximize returns while mitigating risks, especially in high-growth areas poised for rapid appreciation.

By focusing on prime locations, leveraging financing strategies, aligning with economic trends, and partnering with expert advisors, investors can position themselves to capture the full potential of the Philippine real estate market. Strategic action today sets the foundation for long-term wealth creation and high-yield property investments by 2040.

A strategic roadmap for building property wealth aligned with the Philippines’ economic rise.

Conclusion

The Philippines’ projected rise to become the 24th largest economy by 2040 presents a once-in-a-generation opportunity for real estate investors, homebuyers, and developers. Economic growth drives higher incomes, urban migration, and sectoral expansion—all of which directly translate into strong property demand, capital appreciation, and rental income. Simply put: economic rise equals real estate gains.

The time to act is now. Strategic decisions made today—whether acquiring pre-selling condominiums, investing in mixed-use developments, or securing industrial properties—can position you to maximize returns over the next two decades. With proper planning, financing, and guidance, investors can leverage the Philippines’ growth trajectory to build long-term wealth and diversify their portfolios.

Take control of your investment journey: schedule a consultation with a licensed real estate advisor, explore prime pre-selling properties, or subscribe to our market updates to stay informed about the latest opportunities.

By acting now, you can capitalize on the Philippines’ economic rise and secure your position in the country’s most promising real estate markets, turning projections into real, tangible wealth.

Leave a comment