Are you feeling overwhelmed by the sheer number of properties to consider? It’s easy to get distracted by glossy brochures, model homes, and flashy features, but the key to finding your dream home is in the details.

In the last part of our 12-Month Home Buying Plan, we covered the important steps to get your finances in order, secure loan pre-approval, and define your budget. Now, we’re diving into the exciting — and sometimes daunting — task of property research and site visits. This is where your dream home starts to take shape, and we’re here to guide you through each step of narrowing down your options, making sure you stay focused on the right properties.

By the end of this post, you’ll have actionable tips for assessing neighborhoods, visiting homes, and working with professionals to make this process smoother and more efficient. So, let’s get started on finding the home that fits your needs — and your future.

Section 1: Define Your Property Criteria

Before diving into property listings or attending open houses, take a moment to define exactly what you’re looking for in a home. This step sets the tone for a focused and productive search — saving you time, energy, and costly detours down the line.

Clarity is power. And in real estate, it’s your competitive edge.

Clarify Your “Must-Haves” vs. “Nice-to-Haves”

Start with a simple but powerful list. What are the non-negotiables in your future home? These are the essentials you can’t compromise on — whether it’s a minimum of three bedrooms for your growing family, parking for two cars, or a safe, pet-friendly outdoor space.

On the flip side, list your “nice-to-haves” — features you’d love, but could live without. Think built-in shelves, a walk-in closet, or a rooftop terrace. By distinguishing between the two, you’ll be able to filter listings more efficiently and make smarter decisions when faced with trade-offs.

Example must-haves vs. nice-to-haves:

| Must-Have | Nice-to-Have |

|---|---|

| At least 2 bathrooms | Bathtub in the master |

| Secure parking slot | Covered garage with storage |

| Access to public transport | Walking distance to a café |

Choose the Right Property Type for Your Lifestyle

Your ideal property type will depend on your current lifestyle, long-term goals, and budget. In the Philippines, common options include:

- Condominium: Great for professionals, couples, or investors who value location and convenience over land ownership.

- Townhouse: A popular choice for young families who want a balance of privacy, space, and affordability.

- Single-Detached House: Ideal for larger families or buyers prioritizing land ownership, outdoor space, and expansion potential.

- Duplex/Triplex: Perfect for extended families or buyers considering rental income opportunities.

Ask yourself: Will this home support your lifestyle in the next 5–10 years?

Decide on the Ideal Lot Size, Floor Area, and Layout

Square footage matters — but so does how that space is used. A 100 sqm unit with an open layout might feel more spacious than a 120 sqm home chopped into cramped rooms.

Here’s what to consider:

- Lot Size: For houses, will there be space for a garden, carport, or future extension?

- Floor Area: Is the space sufficient for all household members, current and future?

- Layout: Will the flow of the home work for your daily routine? Think about natural lighting, kitchen accessibility, storage, and work-from-home needs.

Don’t just chase numbers — chase livability.

Think Long-Term: Will This Property Still Work for You in 5–10 Years?

A home isn’t just a short-term shelter — it’s a base for your lifestyle and financial future.

Ask these future-facing questions:

- Are you planning to start or grow a family?

- Will you need more space to accommodate aging parents or children?

- Could remote work remain part of your career?

- Do you anticipate needing rental income from a portion of the property?

- Is the community poised for appreciation and development?

Thinking ahead will help you avoid outgrowing your home too soon — or worse, regretting your investment.

Pro Tip:

Create a personal “Home Criteria Worksheet” using Google Sheets or a checklist app. Rank each potential property against your must-haves and nice-to-haves. Consistency in evaluating options will keep emotions in check during site visits.

Section 2: Research Neighborhoods Thoroughly

Finding the right home is only half the equation — the other half is choosing the right neighborhood. Even a dream house can turn into a daily headache if it’s in the wrong location. In this phase, your job is to go beyond the glossy brochures and really get to know the communities you’re considering.

A home is more than four walls. It’s the street you walk on, the neighbors you meet, and the environment you live in every day.

Prioritize Safety First

Safety is non-negotiable. Before falling in love with any property, investigate:

- Crime Rates: Check online crime maps, local barangay reports, or ask the local police precinct for a record of incidents.

- Street Lighting: Drive or walk around the area at night. Well-lit streets are a good sign of a secure, maintained neighborhood.

- Community Reports: Join local Facebook groups or ask nearby residents about their experiences — they’ll give you the unfiltered truth.

A beautiful home means little if you don’t feel secure living there.

Check Accessibility to Essentials

Convenience matters. Whether you’re commuting daily or running weekend errands, location plays a major role in your quality of life.

Ask yourself:

- How far is the property from your workplace or business?

- Are there reliable schools, clinics, and hospitals within a 15–30 minute drive?

- What’s the proximity to supermarkets, pharmacies, banks, or wet markets?

Use Google Maps to test commute times during rush hour — especially if you’re buying in a high-traffic city like Metro Manila or Cebu.

Investigate Transport Links, Traffic, and Flood Risks

Don’t wait until move-in day to find out your street floods easily or sits in a dead zone for public transport.

Here’s what to research:

- Public Transportation: Are jeepneys, buses, or train stations nearby and safe to access?

- Traffic Flow: Use apps like Waze to test rush-hour conditions.

- Flood Risks: Check the NOAH Flood Hazard Map or PHIVOLCS fault line data. Ask locals how bad the flooding gets during typhoons.

Tip: A well-priced home in a flood-prone zone could cost you more in the long run.

Explore Amenities and Lifestyle Perks

Your neighborhood should support your lifestyle — not limit it. Take a walk or drive around and ask:

- Are there parks or jogging trails for relaxation and recreation?

- Is there a nearby mall, market, or convenience store for quick errands?

- What about gyms, cafes, or coworking spaces for your work-life balance?

For families, check for nearby schools, playgrounds, and after-school centers.

Use Digital Tools and Local Intel

Combine online tools with grassroots research to paint a full picture:

- Google Maps: Check satellite view for green space, commercial density, and walkability.

- Facebook Groups: Join community pages for first-hand reviews, security concerns, and barangay alerts.

- Local Real Estate Sites: Browse listings by area to gauge price trends and development.

Nothing beats talking to locals — ask questions during site visits or open houses. Agents can show you houses; neighbors can tell you what it’s like to live there.

Download a Free Neighborhood Research Checklist

Pro Tip:

Build a “Neighborhood Scorecard” where you rate each location based on safety, accessibility, traffic, flood risk, and lifestyle. This gives you a data-backed way to compare and decide — not just rely on gut feel.

Section 3: Attend Open Houses and Book Private Viewings

Now comes the exciting part — stepping inside potential homes. But don’t let the scent of freshly baked cookies or staged furniture distract you. Whether you’re walking through an open house or scheduling a private viewing, this is where you put your research into action and start evaluating properties like a pro.

A polished home can hide a world of problems — your job is to look beyond the surface.

Learn to Read Between the Lines at Open Houses

Open houses are marketing events. Agents and sellers present properties in the best possible light — and that’s perfectly fair. Your task is to look for both what’s shown and what’s not shown.

Here’s how:

- Look closely at walls and ceilings for cracks, water stains, or signs of recent patchwork.

- Peek behind curtains and under rugs — they might be hiding flaws.

- Smell the air — musty odors could mean mold or poor ventilation.

- Observe the flow of space and natural light beyond just the decor.

Don’t be shy — open cabinets, check water pressure, and take your time. A few extra minutes now could save you months of regret later.

Bring a Checklist to Stay Objective

It’s easy to fall for a charming unit and overlook key dealbreakers. A checklist helps keep your feet on the ground.

Include questions like:

- Does the layout fit your daily routine?

- Are there enough electrical outlets?

- Is the neighborhood noise level acceptable?

- What’s the parking situation?

Score each property against your must-haves and nice-to-haves. This ensures a level playing field and makes comparisons much easier after a long day of viewings.

Document Everything: Photos, Videos, and Notes

Don’t rely on memory alone — especially if you’re viewing multiple properties in one weekend.

Bring your phone and:

- Take photos and videos of each room, including outdoor areas.

- Capture any flaws or red flags (peeling paint, warped doors, leaking faucets).

- Record short voice memos with your immediate impressions.

- Note the time of day and how it affects lighting and noise.

These will be invaluable when you review your top picks later and try to recall details that matter.

Ask the Right Questions

Don’t be afraid to ask direct, even awkward questions. You’re investing millions — clarity is a must.

Ask about:

- Homeowners’ Association (HOA) fees – What do they cover? Are there restrictions on pets, renovations, or renting?

- Renovation history – When was the roof, plumbing, or electrical system last upgraded?

- Legal status – Is the title clean? Are there liens, disputes, or pending taxes?

A professional seller or agent will appreciate your due diligence.

Book Private Viewings for Your Shortlist

If a home caught your eye at an open house — or via online listings — book a private viewing. This gives you time and space to assess the property without pressure or a crowd.

During private showings:

- Take your time walking through each room.

- Visit at different times of day to observe lighting, traffic, and noise.

- Bring a trusted companion for a second opinion — ideally someone who can spot issues you might miss.

Private viewings are your chance to go beyond first impressions and test if the property feels right long-term.

Pro Tip:

Create a shared Google Drive folder where you upload all your visit photos, notes, and checklists. Label each one by property name or address. This makes it easier to revisit, compare, and eventually choose your top contenders.

Section 4: Consult with Real Estate Professionals

While property research and site visits are essential steps in the home-buying process, consulting with a licensed real estate professional can give you the competitive edge you need. A skilled broker not only opens doors to a wider range of listings but also provides expert guidance that ensures you’re making informed decisions every step of the way.

Real estate professionals can help you navigate the market, streamline your search, and negotiate deals with confidence.

Work with a Real Estate Broker for More Listings

A good real estate broker can expand your options significantly. While websites and open houses give you a glimpse of what’s available, brokers have access to exclusive listings — including properties that may not yet be publicly listed. They can also connect you with off-market deals or upcoming pre-sales, giving you a leg up on other buyers.

A licensed broker knows the ins and outs of the local market and can help you find properties that meet your criteria without the stress of endless searching.

Ask for a Comparative Market Analysis (CMA) for Fair Pricing

Understanding property value is crucial, and a Comparative Market Analysis (CMA) is one of the most reliable ways to assess fair pricing.

A CMA compares similar properties in the same area that have recently sold, are pending, or are currently on the market. By examining sale prices, property features, and market trends, your broker can provide you with a data-backed assessment of a property’s value.

This information will help you avoid overpaying and ensure you’re making an investment that aligns with the current market.

Discuss Market Trends and Developer Reputation

Your broker is your gateway to market insights and should help you understand what’s happening in the local real estate market. Discuss the current trends, including price movements, demand levels, and the economic outlook for the area. This will help you anticipate price shifts and make more informed decisions on when to buy.

Also, don’t overlook the reputation of the developer if you’re considering new constructions. A seasoned agent can provide valuable information about developer track records, project timelines, and the quality of previous builds — saving you from costly surprises down the road.

Leverage Your Agent’s Expertise to Negotiate Smarter

When it’s time to make an offer, don’t go it alone. Leverage your broker’s experience to ensure you’re getting the best deal possible. A seasoned agent knows how to assess property value, the motivations of the seller, and how to structure offers for optimal negotiation.

Your broker can also provide guidance on negotiating key terms like:

- Price reductions

- Repairs or renovations

- Closing costs and fees

An expert negotiator can be the difference between securing a deal at the right price and paying more than you should.

Pro Tip:

Building a strong relationship with your broker can pay off throughout the buying process and beyond. A trusted agent can offer continuous support, recommend reputable service providers (inspectors, lawyers, etc.), and even alert you to new opportunities as they arise.

Section 5: Narrow Down Your Top Options

After attending open houses, consulting with professionals, and carefully reviewing neighborhoods, it’s time to narrow down your choices. With so many factors to consider, this step can feel overwhelming, but it’s crucial to identify the properties that align best with your budget, priorities, and lifestyle needs.

By organizing your options and taking a more focused approach, you’ll be able to make an informed, confident decision.

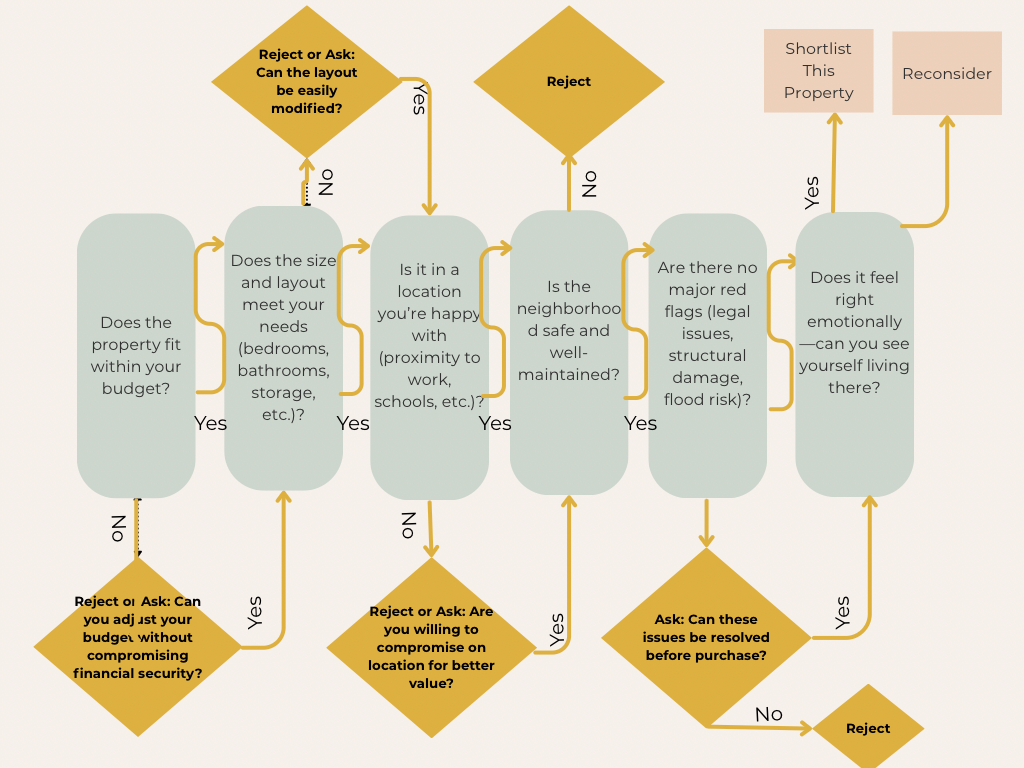

Rank Properties Based on Budget, Priorities, and Emotional Fit

Start by ranking each property according to your budget and the priorities you’ve identified in earlier stages. This is where your research pays off — you now have a clearer picture of your ideal home’s location, features, and price range.

Consider these categories when ranking:

- Affordability: Is the asking price within your budget? Factor in not just the cost of the property, but also taxes, closing costs, and potential repairs.

- Essential Features: Does it have the number of bedrooms, parking, outdoor space, or home office you need?

- Emotional Fit: Does this home feel right when you walk through it? It’s easy to get caught up in the data, but trust your gut — this is where you’ll be spending years.

Revisit Your Top 3–5 Properties for a More Critical Look

Your top contenders should be narrowed down to 3–5 properties that check all the key boxes. Now, it’s time to visit them again — but this time, with a more critical eye.

Here’s what to focus on during your second visit:

- Day vs. Night Comparison: Visit at a different time of day to assess changes in lighting, noise, and traffic.

- Maintenance Needs: Look for any maintenance issues that might have been missed in the first visit, such as cracks, signs of leaks, or appliances that may need upgrading.

- Neighbourhood Ambience: Pay attention to the neighborhood’s vibe during different times — are there disturbances, traffic buildup, or disruptions you didn’t notice before?

This step helps ensure that you aren’t blinded by first impressions or staging, giving you a more practical view of what you’re getting into.

Assess Practical Concerns: Commute, Noise, and Neighbors

When narrowing down your options, always consider the practical aspects that will affect your daily life. A home that checks all the boxes on paper may not be as perfect as it seems in reality.

Consider:

- Commute Times: Use your phone’s navigation apps to simulate the morning commuteand assess travel time to work, school, or other key destinations.

- Noise Levels: Visit during the day and at night. Check for nearby construction, highways, or loud neighbors.

- Natural Light: Does the home get enough natural light? Consider the direction it faces and how sunlight enters at different times of day.

- Neighbors: Walk or drive around the block to see who lives nearby. Are they friendly, quiet, and respectful of their space?

These practical elements may seem minor now, but they play a huge role in your long-term happiness.

Create a Side-by-Side Comparison Matrix

By this stage, you should have enough information to make an apples-to-apples comparison of your options. A comparison matrix is an effective way to visually organize the pros and cons of each property.

We recommend creating a side-by-side table that includes the following columns:

- Property Name/Address

- Price

- Size (lot and floor area)

- Number of Bedrooms/Bathrooms

- Features (parking, outdoor space, etc.)

- Neighborhood Evaluation (safety, commute, amenities)

- Condition/Repairs Needed

- Your Rating (1-5 scale)

This simple tool will allow you to compare multiple properties quickly and objectively.

Pro Tip:

If you’d like to make the process even easier, we can design a downloadable PDF or Google Sheet version of the comparison matrix for you. This makes it easy for you to fill in their own data as you go through the decision-making process.

Conclusion: Ready to Find Your Dream Home?

By now, you’ve equipped yourself with the tools and insights needed to successfully navigate the property research phase of your home-buying journey. From defining your property criteria to attending open houses and consulting with real estate professionals, every step brings you closer to finding a home that truly fits your needs.

But remember, this process doesn’t happen overnight. It requires time, effort, and a clear understanding of what works best for you and your future. Trust the steps outlined here, stay patient, and don’t hesitate to reach out to experts when you need guidance.

Take the Next Step: Start Your Home Search Today

Ready to dive into the next phase of your home-buying journey? The right property is out there, and with the right tools, you can find it with confidence.

At U-Property PH, we’re here to guide you every step of the way. Whether you’re looking for expert advice, the latest property listings, or the best real estate professionals in the area — we’ve got you covered.

Contact us today to get personalized help with narrowing down your options, scheduling private viewings, or connecting with top-tier real estate professionals.

Don’t wait — your dream home is waiting for you!

Leave a reply to Your 12-Months Home Buying Plan – Months 7 to 9: Shortlisting Properties and Securing the Right Price – U-Property PH Cancel reply